Hey friends, I could use some advice from this thoughtful, handsome, and hyper-intelligent group. After some reflection, I realize that I am able to act on some of my long term financial goals but I am not sure if my plan will have the impact I need or expect.

I have spent the last few years flipping land and saving all of the profits in hopes for some financial security for my wife and I. We are in a somewhat unique situation because due to health conditions, my wife works part time and will most likely not work past 50 (we are in our late 30’s now).

We live modestly and have stayed in our 1 bedroom condo to keep costs low while we save to invest in assets such as long term SFR rentals and build my land biz for a 2nd income stream.

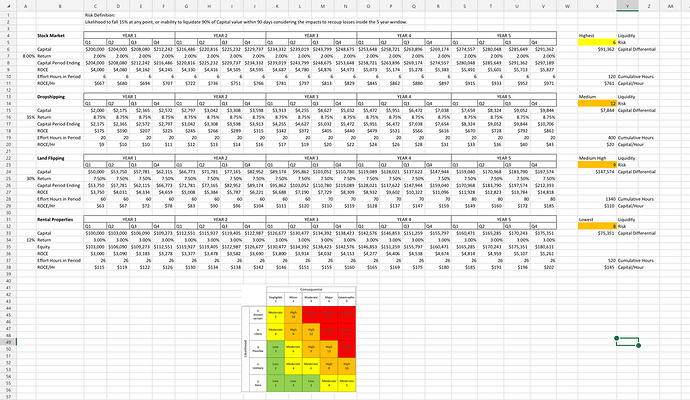

I now find myself wanting to make some moves for quality of life and future financial health. These include buying rental homes or other income producing assets, reducing my workload with the land biz by focusing on higher value deals with lower volume, and upgrading to a bigger home ($250k).

My financial snapshot is something like this:

- $70k equity in current home ($120k value)

- $50k cash for down payment of SFR rental

- $60k salary

- $30k income from land biz

- $50k student loan debt at 4% fixed

Currently my plan is to buy a turnkey a year, continue with my land biz and lessen the workload, and hopefully be able to upgrade my personal home.

I am currently on a few wait lists for turnkeys that still produce ok cash flow at the $150k mark.

I have done my research in the turnkey world but still feel naive about the situation because all though I have read a ton about the benefits of leverage/hedging inflation/renters paying off your mortgage at 20% in, the return is small compared to what I am used to. And they do charge a premium.

My end goal is to own 10 rental homes to bolster my retirement funds and increase my current income somewhat. I also don’t need a 3rd job, so the turnkey world is appealing to me.

Right now, SFR’s are crazy high and slated to go higher (I don’t really see any info saying otherwise). So I do not see a huge downside about investing a significant portion of my funds into it, but again my knowledge is limited in real world SFR investing and I am looking for advise.

Do you think it is a smart move to invest in turnkeys if you can find one with good numbers now? Should I hold out on upgrading my home and try to get into 2 rentals by leveraging my equity? Or is there a creative way to have it all?

Regarding my student loan debt, I am reluctant to pay it off because I currently make way more than 4% reinvesting my land profits back into the land biz and just hate the idea of not making a return on my cash (even though the debt is costing me).

I get that this is an impossible question to answer outright. But I am sure there are some experienced investors out there saying I bet you could do this and that…or don’t buy now. Or invest my saved funds into my land biz and wait for the crazy market to chill out and inventory to come back.

Thanks for making it through my story and I cannot wait to hear you to tell me to invest all of my money in Bitcoin.