I am trying to close on a property in California and have a purchase agreement signed. I am buying the property for less than $10,000 but still want title insurance. I called a title company and they quoted me around $2,500 for all the fees including title insurance and escrow services. I have been calling around other places as well and haven’t heard back yet. Was just wondering if this was normal?

@sempervirens Seems high but everything in California is expensive. Haha. I live on the coast in California. Do you have a signed purchase agreement they are quoting you on? Or is this a ballpark quote they are giving you? I’d wait to get some of the other quotes back and compare them.

@sempervirens can they give you a breakdown of what those costs are attributable to? It might help isolate why the cost is coming out so high?

For example, if the title insurance policy is higher than normal for some reason, it may be because of the title insurance underwriter they’re using. Sometimes this can be cleared up by just going with a different underwriter (or a different closing agent altogether).

I agree with all posters - seems high. @retipsterseth is right (as usual - grin). Ask them to give you a break out of costs. Some items they might mention:

(all cost for TX)

- Escrow fee: typically $400 to $900 (both sides)

- Doc prep fee (doing the deed) $75 to $250

- Title insurance (in TX based on the purhacse price), but min = $328

https://www.tdi.texas.gov/title/Titlerates2019.html - Courier / mail (if doing a mail out closing) $25 to $100 depending on # of parties

- Recording (set by county clerk) $20 to $50

- eRecording fee $5 to $25

- Tax certitications $25 to $100

So on the pruchase, I usually factor in $2k on the HIGH side and usual expect $800 to $1,200.

Check out this thread as well:

https://retipster.com/forum/topic/1144/what-are-your-typical-closing-costs?_=1627185194369

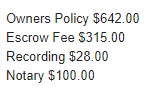

Here is a fee breakdown from a less expensive title company that we found. It seems more in line with what Karl is typically seeing.

We will start factoring in $2k in fees on our deals just to be safe, unless we know it will be cheaper otherwise.

Thanks for the help!

@sempervirens do you mind sharing the title company you used in CA? I need one for a property we’re getting under contract.

You can probably go online and get a quote from any of the big boys. They will post title insurance and escrow minimums and add most of the junk fees too. There are big price differences in what title policy you buy. An ALTA policy gives you better protection but costs more than a CLTA policy and there are other forms that are even less expensive. Endorsements could be $10 or $100 a pop depending. Ask a good title officer what they think you might need in a base policy and endorsements on a $10k deal. Check Old Republic, First American and Fidelity and you will get a good idea quickly.

How much money do you want to spend to protect your investment? 25% seems too stiff.

@landdreamer We tried a couple and found the Inter County title in Placerville was the least expensive.