For land investing, anyone using a calculated offer range strategy in their mailings rather than a fixed offer price that would be willing to share some best practices or tips?

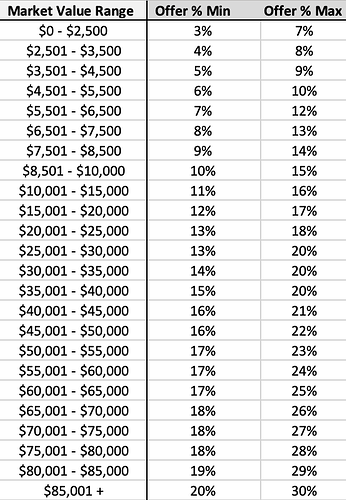

@robc I’ll drop this little tidbit here from the course since it seems relevant to what you’re asking.

Depending on what I determine a property’s market value to be, I’ll adjust my offers up or down as a percentage of what I think it’s worth.

As this sliding scale implies, I’m willing to offer a higher percentage of market value as the market value increases. If the seller appears to be highly motivated or apathetic about their property, then my offer will be on the lower end of the range I’ve set for myself. If I think they’ll need a higher offer, then I’ll lean towards the higher end (but I rarely exceed it).

Now, keep in mind, I’m more on the conservative side of most land investors I know. I know plenty of people in more competitive markets who will offer upwards of 40% - 50% on some properties, but that’s not something I’m willing to do unless it’s a unique situation and I’m VERY confident about it’s value and that the property will sell quickly.

This offer-to-value range isn’t a set of rules you need to live by (feel free to create something similar for yourself with different numbers based on the market where you’re working… if it’s a high-demand market where properties sell quickly, it could easily make sense to offer more).

Nevertheless, the idea is, if I ever have any doubt about what my offer price should be, this gives me some clear instructions on what to do (and I keep my number on the lower end of the spectrum if I’m not very confident about the property’s value).

In some markets with more competition or a higher demand for vacant land, it may make sense to go higher (or maybe even lower) than what this scale suggests.

@robc I have thought about the same thing. Since every property is different, a specific dollar amount restricts potential opportunities. I see an advantage to putting an offer range in a letter, rather than an exact dollar amount or blind offer.

The letter would state something like: Based on my review of your property’s information in the County’s database and the market trends in this area, I am willing to offer you between $3,466 and $6,932. If an offer within this price range interests you, please reach out to me or complete the form on our website to provide additional property information. With additional information, we will determine our exact offer amount for you.

This gives the letter’s recipient an understanding of about how much you’d be willing to offer. You will likely get a lot more calls (opportunities) than if you were to offer an exact amount, yet it still eliminates all of the callers expecting more than your offer range. It seems like a good middle ground between neutral postcards and blind offers.

@tylerd Thats exactly what I was thinking. I have no problem returning calls and having conversations. Most people avoid that. I guess you would have to play with the bracketing depending upon the area, comps etc.

@tylerd it would be interesting to see where the conversations go when offering a range like this. It seems like most people would just fixate on the higher number and assume that’s what they’re going to get.

And what if you eventually find out that you need to offer even less than the lowest amount?

Seems like there’s a good reason to give it a try, but I wonder if it might backfire in some cases.

@charlotteirwin Yeah I agree, those are good points. I haven’t done this myself, and I’d be curious to know if anyone out there in the forum has played with this strategy.

Actually, all I have done so far is neutral letters, and I get a lot of calls from people wanting market value. The “range method” eliminates these calls, at least. The range would be something like 20-40% of market value.

Regarding your comment about needing to offer even less than the lowest amount… what if the opposite is the case? What if the higher end of the range still has a really good return? That land owner may not have called if they only received a blind offer equal to 20% of the estimated MV. I think the letter would require language similar to a blind offer, stating nothing is firm until after we complete a detailed review of the property.

@tylerd said:

Regarding your comment about needing to offer even less than the lowest amount… what if the opposite is the case? What if the higher end of the range still has a really good return? That land owner may not have called if they only received a blind offer equal to 20% of the estimated MV. I think the letter would require language similar to a blind offer, stating nothing is firm until after we complete a detailed review of the property.

Totally valid point. I suppose either perspective is pure speculation, and both could be accurate, depending on who the seller is and where they’re coming from.

I guess the only way to know for sure would be to send out 50,000 mailers to get a good read on the situation. ![]() You go first!

You go first!

@retipsterseth I did use your offer calculator/ due diligence spread sheet for a while when I started. I do have a bit of a sliding scale, but in today’s deals I wouldn’t be buying very many with your numbers!

@jawollbrink the percentages could definitely be adjusted, depending on the market and the appetite of the investor… but like I said, I’m pretty stubborn with low offers. Sometimes it’s to my detriment (I walk away from a lot of okay opportunities), but I’m also at the stage where I can afford to wait around for the more exciting ones.

I don’t recall which states you’re working in these days, but you’re more than welcome to share what your sliding scale looks like. Mine is by no means the gold standard. It wouldn’t hurt to get some more perspectives on what offer ranges are working others out there. The more the merrier!

Interesting thread. I’ve only done neutral letters so far with some success but have had to weed out a ton of people wanting top dollar.

One thing I’ve always wondered about doing blind offer mailings ( or range offer) - Is there a way to have the letters your sending automatically put the amount? In other words, is there some real estate program or app that one can somehow plug in the “assessed property” values by plugging in the list or something like this, where the app can take that info and based on your input range, populate the letter for each property you’re mailing and auto put in that range?

As opposed to you having to look at each property, calculate the blind offer or range offer yourself , based on what you see the property is valued out, and manually typing that into each letter ( since obviously each property on your list will have varying values) ? Sorry the question is so long and I hope I’m being clear, but this is something that kept me from doing blind offers because I wasn’t aware of some smart, quick, “auto pilot” way to do it other than just individually looking at each property and transposing your range offer onto the letter, which in my mind would take up way too much time.

@robere I may not be understanding your question 100%, but the closest thing I know of that would get you there would be PRYCD. If you haven’t seen this review, it may help you understand why I bring this up.

Price Boss may also help toward this end. You can see that review in this blog post.

Neither one is exactly push-button easy (it still requires a lot of oversight on your end), but they can save you a lot of time, as long as you understand the logic you’re putting into your blind offer pricing process.