REtipster features products and services we find useful. If you buy something through the links below, we may receive a referral fee, which helps support our work. Learn more.

Note: You can get a $50 discount if you use coupon code RETIPSTER during the checkout process (as noted in the video above).

Have you ever wondered what a parcel of vacant land is worth?

I'm not talking about what the seller or their listing agent has it listed for, but what it's ACTUALLY worth.

If you have ever dealt with vacant land in the real estate profession, you probably know what a dilemma this can be.

And sometimes, it can be a BIG problem because the conclusions you draw about a property's value will affect everything else in the process, such as:

- How much you can offer for the property.

- How much you can list and sell it for.

- How quickly the property ends up selling.

- How much profit you'll make on the deal.

- What kinds of properties you can pursue in the first place.

- How much financing (if any) you can get for the property.

- If you add improvements, how much of a depreciation write-off you'll be able to get.

The way you determine any property's market value is a crucial part of how every deal comes together. If you get this wrong, everything else can fall apart.

So how can you come up with a solid, educated, and reasonably accurate valuation for vacant land?

How can you NOT lose sleep at night, wondering if you made a huge mistake overpaying for a property?

Land Valuation Is a Complex Issue

Finding the value of a vacant lot may seem straightforward, but the issue is anything but simple.

Unlike most types of real estate (houses, multi-family properties, commercial retail, farmland, industrial, you name it), vacant land is a VERY challenging type of real estate to value, because:

- These properties aren't producing any income, which means the Income Approach can't be used.

- These properties don't have any improvements, which means the Cost Approach doesn't work either.

- It's usually a rough experience to find similar properties in the same market that have sold in the past 12 months. As a result, the Sales Comparison Approach (the only relevant valuation approach) is very tricky to work with.

In most cases, we have inadequate information at our fingertips, which makes the process extraordinarily difficult.

Heck, most professional appraisers don't even know how to value land this with any real accuracy. So how are WE supposed to figure it out?

Finding and Using Comps

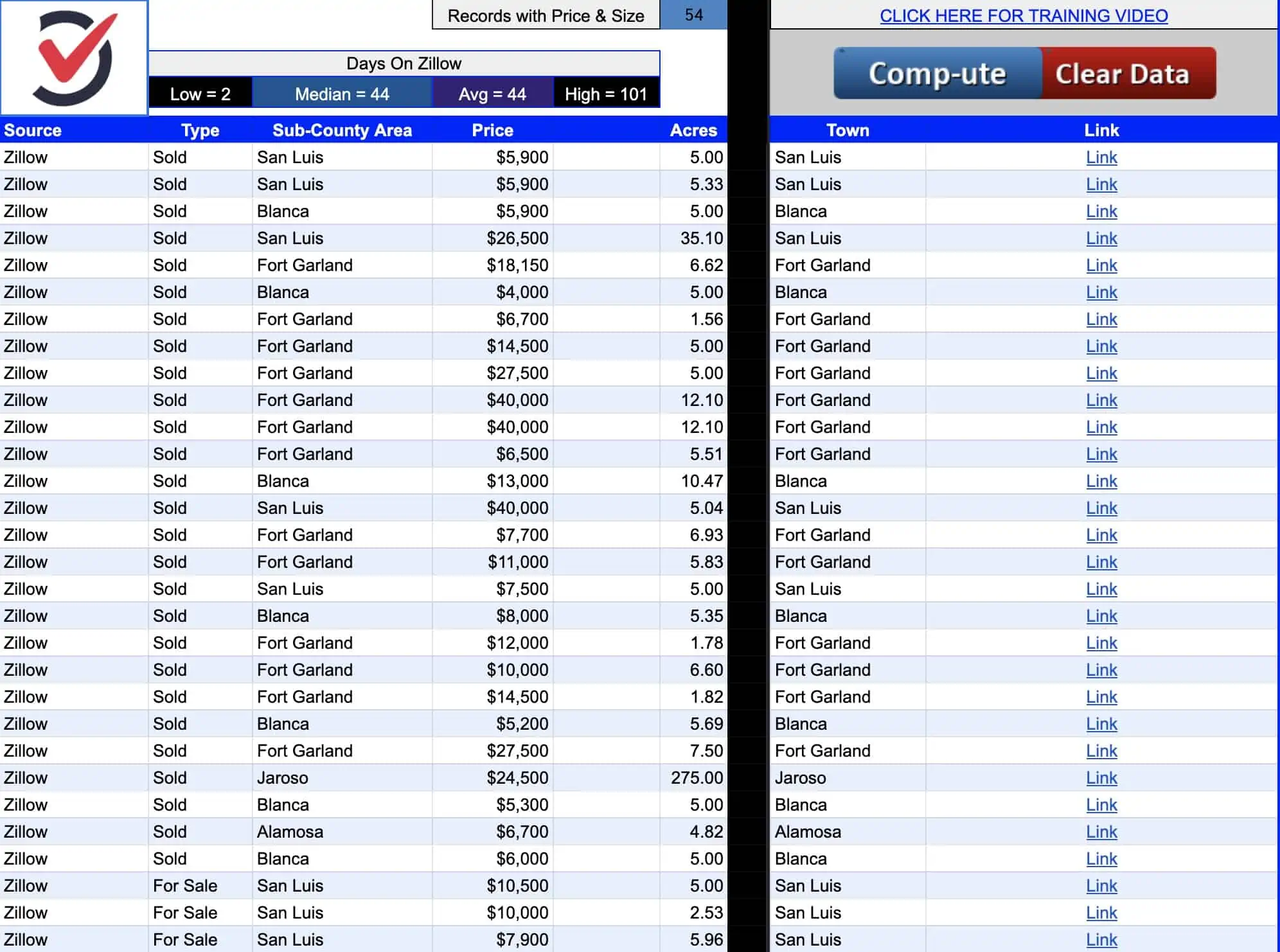

Back when I got started in the land business, websites like Zillow and Realtor.com had practically ZERO sold comps for vacant lots in each market. Luckily, over the past few years, these websites have gotten a lot better at providing this kind of data in the markets where comps are available.

Of course, having more comps available doesn't automatically fix the problem, but it does give us a lot more information to work with.

When there aren't sufficient comps in a given market, there will usually be a lot more “For Sale” listings that can be used. While these numbers aren't nearly as reliable for valuing land (because a listing price is just the seller's opinion of value and hardly an objective truth), these listings can give us an idea of what people think their properties are worth. We can then compare these numbers to what properties are actually selling for on a per-acre basis, and figure out how much variation there is between the two.

Between the sold and for sale comps we have available, it has gotten much more feasible to look at the information in each market. From there, we can draw some better conclusions about what properties are actually worth and how those numbers fluctuate based on property sizes, and which towns and subdivisions they're in.

What Can Price Boss Do?

He showed me how it worked, and he said I could play around with it for free (mainly, so I could tell YOU about it). After using it for a few days, I saw how it could be a MAJOR help to other folks in the land business.

While I can't claim to be a Price Boss expert, I have had a chance to run through several valuations and get a good feel for what it can do.

It's an amazing example of how Google Sheets and formulas can work together to perform some remarkably useful calculations.

Granted, the quality of information this calculator puts out is only as good as the data you put into it (in much the same way as any calculator or spreadsheet works). The more relevant data you input on the front end, the more accurate and reliable your results will be.

What I Like About Price Boss

There's a lot to like about Price Boss. These are some of the things I appreciate the most about it.

The web scraping tools for Zillow, Lands of America, and Realtor.com are a MAJOR value. This kind of thing would take a long, LONG time to do manually, and the Google sheets do a beautiful job of finding and sorting the relevant data into a usable format while allowing you to find and remove the data that shouldn't be included.

The fact that Price Boss allows users to do this with absolute precision by hand-picking which comps do and don't belong in the calculation is a big deal. By contrast, tools like PRYCD use artificial intelligence to do all of this work behind the scenes. This kind of automation makes PRYCD feel like an easier tool to use, but the downside is that users don't have the kind of precision that Price Boss is designed to have.

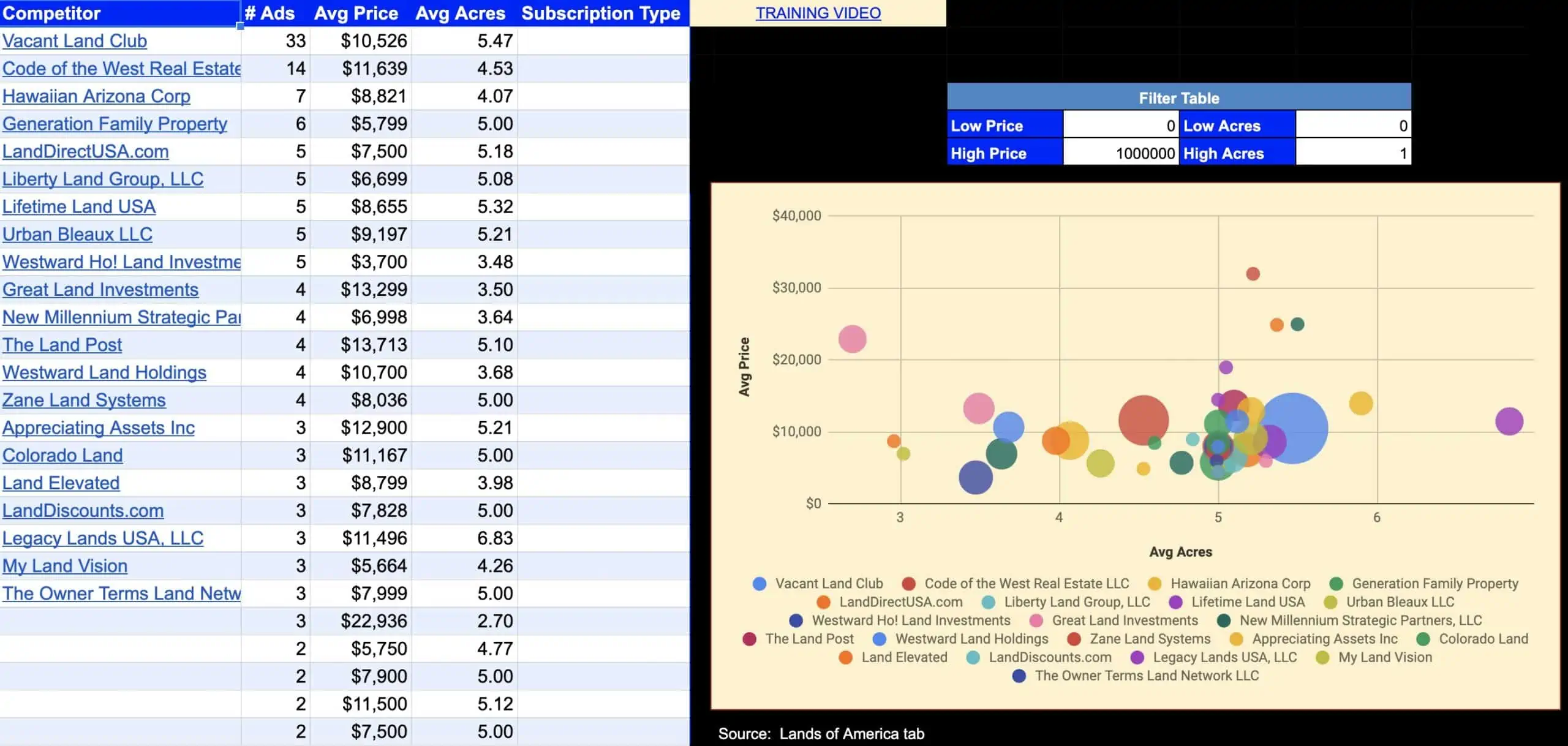

The scatter graph on the Offer Analysis sheet is handy for visualizing property values and understanding where the clusters are based on size and price. The ability to view the graph on an individual subdivision basis is even more helpful, especially if you have plenty of comps available in the subdivision or town where your subject property is located.

The Realtor Analysis sheet is a brilliant addition to the software. It's a great way to use available data to discover new insights about who the most active land specialized agents are in the market.

The Competitor Analysis sheet is a great way to find who the biggest players are in the market. It also offers new opportunities to spot holes and underserved areas in the areas where you're working.

What I Don't Like About Price Boss

In its current state, there are a couple of problems or limitations I see with Price Boss.

The tool isn't idiot-proof. The average user will need to spend some time watching the tutorial videos (which are provided) to make sense of it. You also need to be smart about how you're using it and where you're getting the data from. It requires intelligent thought and consideration to import the right comps and make sense of the information it gives you.

Tutorials and customer support are available if/when you have questions or get stuck on something. Still, the onus is on the user to actually use those resources when needed.

Relevant comps aren't always available. This problem has certainly improved over the last several years. But there are still plenty of instances where you won't be able to find enough of them (or in some cases, any) for evaluating a single property because some properties are literally one-of-a-kind.

This isn't Price Boss' fault, it's just the reality of the situation and when you can't find enough relevant comps, you will be left to “guesstimate” values to some extent.

You can certainly narrow the range of possible values, even when the comps aren't great, but it will be difficult to find much certainty in these cases.

There are occasional glitches and bugs. As I was using Price Boss, there were a few instances where Google Sheets weren't communicating right with each other and the software just didn't work the way it was supposed to. I communicated this to Howard and he fixed it for me… but it made the software feel like more of a “work in progress” than a complete, finished piece of software. I also found some aspects of it confusing (e.g., it took me a while to grasp “strong de-dupe” vs “weak de-dupe”, and why neither one did a complete job of removing duplicates).

The software still has plenty of areas where it can improve, but if the user goes into it with proper expectations and a willingness to play with it until it works, it's still an insanely useful calculator and pricing tool.

Price Boss Pricing

Price Boss is currently available as a monthly subscription.

To sign up, there is a $200 fee for the Analysis Pack (which includes the Realtor Analysis and Competitor Analysis sheets), followed by recurring payments of $37/mo.

If you sign up with the coupon code RETIPSTER at checkout, you can get a $50 discount on this setup fee and earn a small commission to help support REtipster as well.

There is a free trial with the Pro version. Give it a whirl before you pay for it so you can actually know how to use it before you lay out the money.

What's the Bottom Line?

Ultimately, I think Price Boss gives users the ability to come up with much more accurate, reliable, data-driven pricing and valuations based on the size and subdivision/city split. This is WAY more dynamic than just offering $____ (insert your favorite shoot-from-the-hip number) per acre for everything in a given county, regardless of size or location.

There are always huge variations in what identical-sized vacant lots will sell for, even within the same county, and if you just send out a flat number-per-acre on a county-wide basis, you're going to lose a lot of deals.

Of course, you can still do it this way, and you'll probably still get deals. After all, this is how most people have sent blind offers for years, and it works. But there's a good chance you'll get a lot more deals if you improve this part of your process.

While it does require a bit of learning and flexibility on behalf of the user, this really is a valuable calculator for the tiny niche of land investing.

It offers a great deal of help in dealing with a very real problem that all land investors have. Every other land valuation method I've seen to date (talking to realtors, looking at dozens of comps on Zillow manually, even getting an appraiser's opinion) only gets you part of the way there at best.

In many cases, I think Price Boss could honestly do a better job than most appraisers would do because (as most appraisers will tell you), appraisers typically have marginal data and no solid basis for how they come up with values for most parcels of land.

I wouldn't say Price Boss gives you 100% certainty either. But it can get you a heck of a lot closer, with the ability to utilize a lot more information in an organized fashion than all the other methods will.