One of the biggest obstacles every land investor has to wrestle with is finding the market value of vacant land.

It might seem like a strange challenge for a typical real estate investor. But trust me—if you’ve ever tried to find comparable sales or figure out the value of raw land, you know how difficult it can be.

Figuring out the value of land is a big challenge, especially for land flippers. After all, the valuation number we come up with impacts everything else in the deal, and in many cases, most of the data we need to determine this value simply doesn’t exist.

In this guide, I'll break down the key factors and methods for accurately valuing land so you won’t risk overpaying or undervaluing its potential.

How Real Estate Appraisals Work

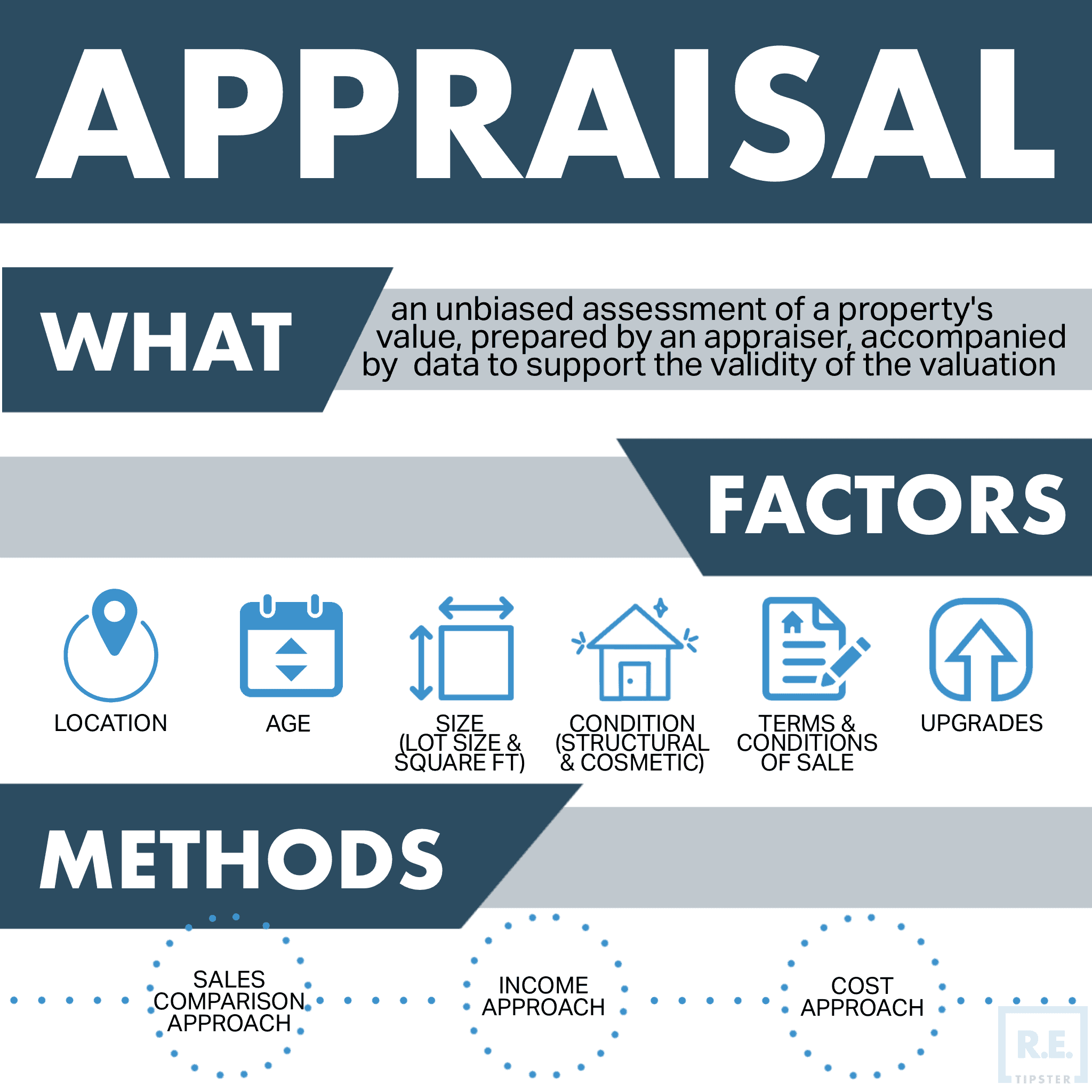

Before we get into the details of valuing land, let’s start with the basics of how real estate appraisals work. An appraisal is the process real estate professionals use to determine the value of real estate, including land.

In most real estate transactions, especially when financing is involved, buyers and lenders hire a professional appraiser to confirm the property’s value. The appraiser will create a detailed valuation report using one or more of the following methods, as described in the infographic below. These are widely considered to be the most reliable methods of determining a property's market value. In most cases, an appraiser will use at least two (if not all three) of these methods to reach their final assessment.

Here's a quick overview of how each approach works:

The Income Approach

The income approach asks the question:

“How much do similar properties earn in this market?”

This method aims to estimate the ongoing income (like rent or lease revenue) that the property is expected to generate. To do this, a licensed appraiser will examine the market rent and compare similar properties in the area, considering factors like size, location, condition, amenities, and more.

The Cost Approach

The cost approach asks the question:

“How much would it cost to rebuild the exact same structure from scratch?”

In this method, the appraiser calculates the cost of constructing an identical structure at current prices, subtracts depreciation, and adds the value of the land to determine the property’s value.

While this method is straightforward, it makes some big assumptions—like the cost of materials and the idea that the property won’t sell for more than what it would cost to rebuild. Although the cost approach is useful, it’s rarely enough on its own to determine a property's value.

RELATED: How to Calculate Land Value for Taxes and Depreciation

The Sales Comparison Approach

The sales comparison approach asks the question:

“How much did similar properties in the area sell for?”

This approach involves looking at the recent sales figures of similar properties in the area, also known as “comps.”

Appraisers will focus only on properties that have actually been sold, because these provide solid numbers that reflect real purchase prices. They gather this comparable land sales data from sources like public records, real estate agents, and other appraisers.

The assumption behind this approach is that a buyer won’t pay more for a property than what others have recently paid for similar ones in the same area.

The Problem With Land Valuation

These valuation approaches work well for houses, apartments, and commercial buildings, but vacant land is completely different. Unlike other types of real estate, vacant land does not have structures or physical improvements to evaluate.

This means the data needed to determine the value of undeveloped land isn’t available, which makes these approaches ineffective.

- The Income Approach rarely applies to land because it’s uncommon for a vacant lot to generate regular income unless it’s leased for farming, hunting, or something similar.

- The Cost Approach also doesn’t work since there are no improvements or structures to factor in.

- The Sales Comparison Approach could be useful, but only if there are enough recent sales of similar lots to compare. Typically, there are far fewer comps for land than for houses or developed properties. Even when comps exist, they’re much harder to compare since no two vacant lots are precisely the same. This makes it much more difficult to determine an accurate value, turning it into an imperfect science.

It's a frustrating challenge for land investors because we need to understand a property's market value. This number affects everything—from the offer price to property taxes, holding costs, closing costs, and the profit margin when you sell.

If we can’t pin down a property’s market value, we’re left with some uncertainty, which is never ideal, especially when investing significant money into a property we cannot afford to be wrong about!

RELATED: The Truth About Land Investing: 21 Warning Signs to Look for When Buying Vacant Land

How to Determine Land Value

Unfortunately, there is no “magic bullet” for valuing land.

As any real estate appraiser can tell you, it's virtually impossible to reach the point of 100% certainty about any property's market value. Especially for unimproved land.

Here's the good news: you can usually get a pretty good idea of what a property is worth, even if it's just raw land.

While there's no one-size-fits-all approach to determining value, there are several reliable ways to get a good estimate before spending any money.

When considering buying a piece of land, I ask myself:

“What will matter most to the person who eventually buys this property from me?”

To answer this question, we need to think through a few more things.

Asking the Right Questions to Value Land

When I'm seriously evaluating a potential land investment, I start by looking at several different factors and asking myself a series of questions:

1. How is the property zoned?

Make sure you understand what you (or your future buyer) will be allowed to do with the property in accordance with the local planning and zoning department.

What can this land be used for? Can someone use it to build a house, office building, factory, etc.? Is it best suited for farming, hunting, mining, etc.?

What is the highest and best use for this property?

In many cases, a property may be useful for more than one purpose, which is another important thing to consider. There are countless ways to use vacant land, some of which we cited in our blog post, 50 Surprisingly Creative Uses for Vacant Land.

2. How much inventory is available on the market?

Is this a one-of-a-kind property, or are there hundreds of similar properties on the market right now?

If you own land with an incredible location (or view, access, resources, etc.) unlike any other area, those unique attributes are probably worth something! But if your property is one of hundreds like it listed for sale, it may be harder to sell at a premium price.

To find the best, blue-ocean markets for land investing, you might want to head to our guide on Finding the Best Markets for Land Investing.

3. What are the asking prices for similar properties listed nearby?

Let's put ourselves in the shoes of the property owner for a moment.

If you put this property on the market today, what other similar properties would you have to compete against in the area?

If you could buy this property at the exact price you want, could you turn around and sell it at a higher price without making any changes?

And here's the key—could you sell it for a profit while pricing it below similar properties in the area? This is the secret sauce of land flipping. It's a crucial factor in deciding how much to offer for a piece of vacant land.

4. How desirable is the property?

Think of this as the “common sense” approach.

What was your first impression the first time you saw this parcel of land? Did anything about it look interesting, desirable, appealing, or attractive? Was there anything sexy about it? Is it likely to catch anyone else's interest? Are you looking at a gorgeous, wooded, mountainside lot—or is it a dry, barren, hostile wasteland?

Be honest with yourself when answering these questions.

If you go through the effort of creating a great property listing, how beautiful could you make this property look? Can you give buyers an offer that they can’t refuse?

5. What are the holding costs?

Let’s say you buy this parcel of land and cannot re-sell it immediately.

What if you have to hold onto it for six months? Or twelve months? How about two years? Even longer?

This question is important because the longer you own a property, the more expenses pile up. We call these “holding costs.”

Can you afford to pay property taxes, association fees, and other costs for a long time if you have to? More importantly, is it worth it?

The good news is that empty land usually doesn't cost much, but keep an eye out for unusually high property taxes or homeowners association (HOA) fees. If you spot these, you'll want to consider that extra risk when deciding how much to offer or whether to make an offer at all.

6. Does the property have road access?

When you're dealing with vacant land, this one is a biggie. Road access has huge implications for what a property is worth.

It’s crucial to make sure the land can be reached legally, either by road or through an easement. After all, what good is a piece of land if you can't get to it? This isn't just important for you; it's crucial for any future buyer, too.

If you can't legally get to your property (and trust me, this happens more often than you'd think) it might as well be on the moon!

If you're feeling lucky and want to gamble on a landlocked property, make sure you're getting it for pennies on the dollar.

7. What is the property’s size, shape, and dimensions?

Picture what someone might want to do with this land someday.

Is it big enough? Does the parcel have a strange shape? Oddly shaped plots, especially in rural areas, can be a real headache when reading and following legal descriptions.

Is there anything nearby that might make people think twice about buying? Like, say, a cliff? Sloped land can be tricky, too. If your property is on a slope, consider reading our guide on Navigating the Ups and Downs of Hillside Construction.

Take a mental note of any red flags that you run into. These can be serious issues that will influence the property's value.

RELATED: 4 Easy Tricks to Find the Size, Shape, Dimensions, and Location of Your Property

8. What’s nearby? How close is this property to the local conveniences and amenities?

Think about what's near the property. Can the owner walk to a grocery store, or is it a long drive just to grab some milk? When you're trying to sell this property later, will you be able to brag about its location?

This one is closely related to the property's desirability and its highest and best use. If the property's most obvious use is to build a single-family house, park a mobile home, or hold any kind of residence, then this metric becomes even more important to consider.

On the other hand, if the most obvious use is hunting land or a peaceful getaway, then its proximity to local conveniences could be even less desirable.

9. What do the adjoining properties look like?

The properties next door can make or break your land's value and how easy it is to sell.

Think about it: Would you rather live or work next to Glacier National Park or a meth lab?

Most folks care a lot about who's living nearby, what they see when they look out their window, and what sounds and smells are generated around their property.

Determine how the surrounding area might affect the desirability of your property. If you spot any obvious problems with the neighboring properties – things you can't change – think hard about how that might impact what your land is worth.

10. Is the property in a flood zone?

Nobody wants their land underwater.

When properties are situated in a flood zone, the cost of flood insurance can be sky-high. This added cost of property ownership can dampen any plans to build or improve the property.

To get an idea of whether a property is situated within a flood zone, check out the FEMA website or the Obie Risk Map and do a property search to see if your property is located within a flood zone.

11. Are there wetlands on the property?

Wetlands can significantly impact a property's value, often in ways you might not expect.

In most of the U.S., federal and state laws put strict limits on how you can use land with wetlands. Since wetland areas are off-limits for development, this limits the property’s uses and thereby, seriously impacts the property’s market value.

So, how do you figure out the true value? Start by identifying any wetlands before you buy. This knowledge is crucial for accurately understanding what a vacant lot is worth.

The gold standard? Get a wetlands consultant or government agents to check it out in person. But let's be real—that's not always practical, especially if you need to move fast.

Good news, though! You can do some detective work right from your computer. Tools like the Wetlands Mapper and the NRCS Web Soil Survey can give you a pretty good idea of what you're dealing with. Here's how to use them:

You can also check out our guide on How to Identify (and Avoid) Wetlands.

12. How about perc tests and sewer access?

Wastewater handling is another important consideration when valuing vacant land. It can make or break a property's worth.

If you’re planning to build any type of dwelling, there must be a place for wastewater. Properties with easy sewer connections will greatly simplify this issue, but perc tests are crucial for land without sewer access.

A perc test measures soil drainage to determine if a septic system can be installed. If it passes the perc test, the property will maintain development potential and value. If it fails, this will dramatically reduce the value by limiting its use.

Bottom Line: Wastewater solutions significantly impact land value. They can determine whether a property is a prime opportunity or a challenging investment. Always include this factor in your valuation process.

RELATED: How Does a “Perc Test” Work (and How Much Does It Really Matter)?

Land Valuation Hacks

In most areas, vacant land appraisal data is scarce, but alternative methods can still be used to estimate the property's value.

Here are a couple of tricks I use regularly:

Research Public Listing Websites

As mentioned in the video above, you can also use Redfin to determine approximate market values in the same way but with better options for data analysis. Here’s a complete guide on How Redfin Can Help You Find the Value of Vacant Land.

This approach is far from perfect (for obvious reasons). However, it does do one thing quite well: it will inform you of your competition and what they are hoping to get out of their property. In other words, if you were to list your subject property for sale in this market today, what other listings would you have to compete against?

Take a minute and do the math. If you know what price your property must be listed for to look like the best deal on the market, you can compare its potential land investment value to what is currently available. Because if you offer the best deal and advertise it well, it will sell first.

To supercharge using either Zillow or Redfin to find land values, you can also use tools like PRYCD and Price Boss. These will streamline the process by handling much of the manual research for you. These two different software options handle the process a bit differently, but they can both help save you a ton of time if you understand how to work within their limitations.

If you’re unsure which is better for your needs, check out our comprehensive PRYCD review or our deep dive into Price Boss.

A Chrome extension called Pebble Pricer can also help with this process. In this video, I'll show you how it works.

Download the Pebble Pricer Chrome extension and give it a try!

Contact Local Real Estate Agents

Looking at market data online is great, but here's a pro tip: pick up the phone and chat with some local real estate agents. A good agent specializing in vacant land is worth their weight in gold.

When I find an agent who knows their stuff about selling empty lots in the area, I ask them something like this:

“Let's say I owned this property free and clear and wanted to list it with you today. What price would have it sold within 30 days?”

This kind of statement tells the agent a couple of things:

- I'm looking for a realistic idea of what it will take to sell this property quickly. I'm serious about getting it sold and I want some honest answers.

- If the agent knows their stuff and is helpful, they might land a new client—me! This encourages them to give me their time and some solid advice.

RELATED: How Land Investors Can Leverage the Power of Real Estate Agents

While chatting with these agents, I'm all ears about their suggested prices. If their numbers don't add up, it's better to know now than after I've bought the property.

Here's a little bonus: I might want one of these agents to list the property for me. So, reaching out like this isn't just about getting information—it's also about making connections that could come in handy later.

This method isn't perfect, but it does help give a general idea of what the property might sell for.

Here's a heads-up: Don't put all your eggs in one agent's basket. There are plenty of agents out there who don't know much about empty land. That's why I always talk to at least two or three before making a final decision.

Hidden Aspects That Influence Land Value

Sometimes, a property's true value isn't obvious at first glance.

The location might not be prime, or the limited uses might not be ideal, but the real goldmine could be what's growing on the land or hidden beneath it—think timber or minerals.

It's easy to miss these hidden treasures when you're just looking at what's on the surface. But some land can be rich in natural resources, and the average investor might walk right past it. This is where you can spot opportunities others miss.

Timber

Keep an eye out for any value that can be yielded by harvesting timber. If you notice that a property is situated in a densely wooded area, this may be worth investigating further.

A professional forestry consultant can help you understand what timber on a piece of land is worth. You can also start by reading up on our Guide to the Harvesting of Trees for land investors.

Also, depending on several factors, removing trees has the potential to either enhance or detract from a property's value and usefulness.

Sometimes, clearing the land (or just the right spots) can make a property ready for building, boosting its value. But don't grab that chainsaw just yet! In other cases, those thick woods might be perfect for wildlife, making the land a dream spot for outdoor enthusiasts.

Mineral and Surface Rights

Another potential value point is the property's mineral rights. These aren't always automatically transferred to a new owner when you buy property, which usually only come with surface rights.

Surface rights are exactly as they sound. They are your rights to own and use the land’s surface and whatever is on it. Surface rights let you develop your land according to local zoning and planning legislation, depending on its type.

Mineral rights, on the other hand, apply to anything that exists beneath the surface. This includes coal, natural gas, oil, or any other commodity that can be mined.

If your land is situated in an area with these energy resources and you own the mineral rights to your land, you can sell them or lease them to an interested party. Both options have pros and cons; you can make money by collecting royalty or working interest. It will be up to you to decide which one you prefer.

RELATED: What Every Land Investor Should Know About Mineral Rights

A Real Estate Appraiser's Perspective

I reached out to Ryan Lundquist (founder of the Sacramento Appraisal Blog and a certified appraiser in the State of California) to get his input on how he would approach the task of valuing land.

When it comes to real estate valuations, this guy's word carries a lot of weight because he is working in this world every day. As a professional appraiser, he understands how to approach this process using the conventional standards that are well-established in the real estate industry.

Here is a summary of a Q&A interview we put together on this topic…

What are the most important factors in determining the value of a vacant land property?

It’s honestly not easy to determine a ballpark value for a piece of land because there are so many factors to consider (as we'll get to below). Plus, since I hold a state license to appraise property, I have to actually support the values I give – whether I'm giving a verbal “ballpark” value or a full, written appraisal. I am essentially liable for any value I give, so that is why it can be challenging when people call me and say, “I don’t need a full appraisal, but just a quick value.” I get what people are asking, but since I actually have to support the value I give, it is more involved on my end.

Let's talk about location, zoning, and topography. Why are these things important? What about these three factors would cause a property's value to go up or down?

Everyone knows real estate is about location. A site next to a toxic dump, for example, probably isn't going to fetch high dollars, but a vacant lot in an upscale neighborhood is going to be worth much more.

That beings said, not all vacant lots are created equal and this is where zoning comes in to play. Zoning helps tell us what the site can be used for legally. This means if a vacant lot was zoned for residential housing and it could be split into four buildable lots, that might carry much more weight than a lot that isn't buildable at all (for whatever reason). On the other hand, if zoning would only permit a property for industrial use, it’s worth considering whether that use can be fully realized in the current market. In other words, is it a good market to improve an industrial lot?

Lastly, the topography is crucial. Two separate lots might have the same exact size on paper, but if one of them is on a steep incline and has very little buildable space, the lot that is actually useable could be worth much more.

RELATED: What Is a Topographic Survey?

In your opinion, is vacant land a difficult type of real estate to value? If so, why?

It sometimes feels difficult because there are definitely fewer comps. Sparse data always makes for more challenging valuations. Since the bulk of my work involves lots that have already been improved, that is definitely part of why it takes me longer.

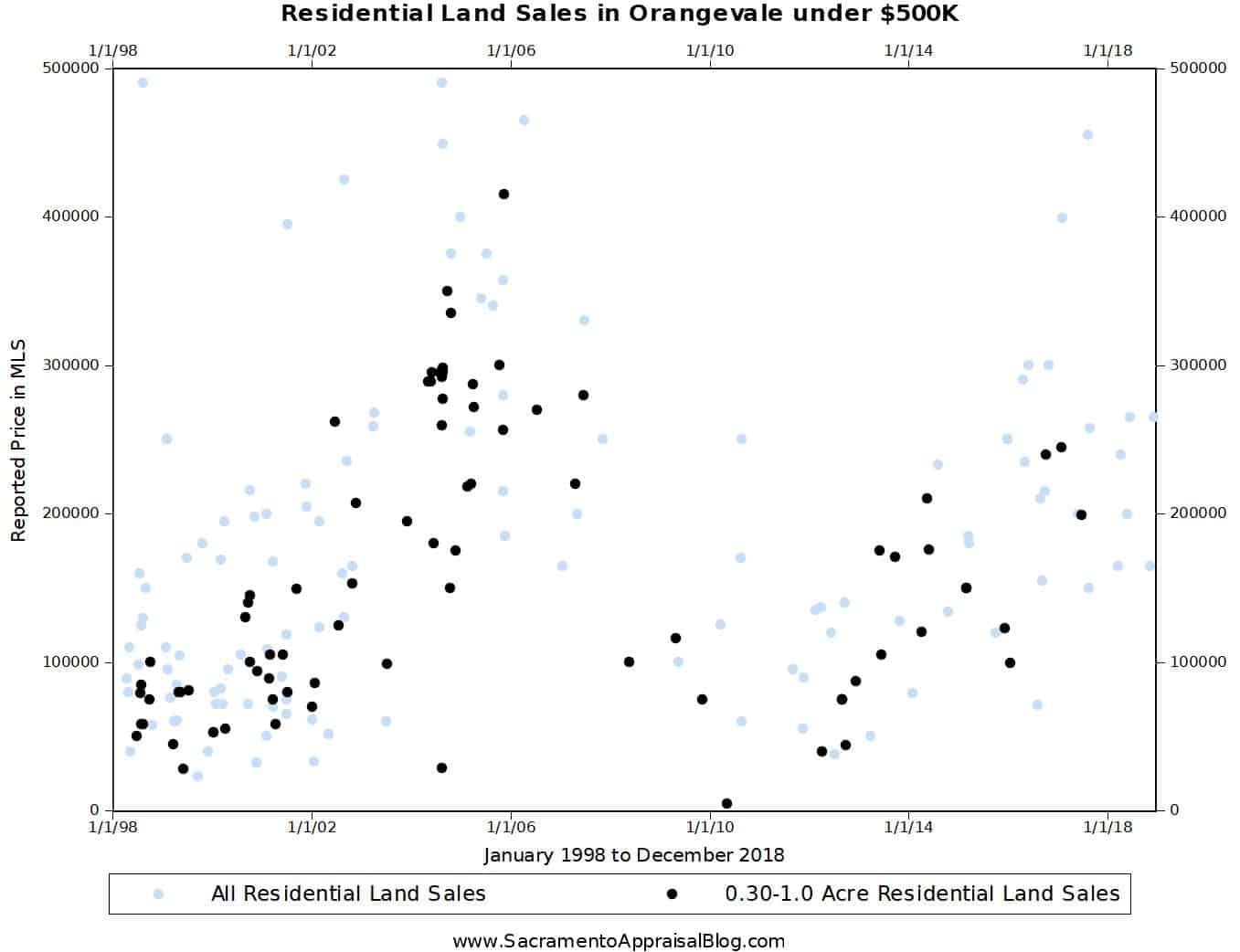

(Note: When the data is available, this is the kind of visual context that Ryan likes to provide for his clients)

When an appraiser nails down the value of a vacant parcel of land, how much deviation (or “lack of reliability”) do you think there is on this number and why?

It honestly depends on the appraiser and how good the report is. There is no real “standard” end-all answer to this question. The reader of an appraisal report will have to sniff out whether it seems legitimate or not. Does the report tell a compelling story of value so that the value makes reasonable sense?

How much weight and importance would you give to the following factors?

The property's assessed value:

I suppose it really depends on how good the assessment is. Some areas may be better than others. However, one important consideration is that assessments in my area at least are based on when the property was purchased instead of the current market value. This means an assessment for a piece of land purchased 15 years ago might show a profoundly lower value than what the current market is willing to pay. Personally, I pay almost no attention to the assessment for this reason.

The listed prices of similar lots in the area:

I think the list price for similar properties can say something about value, though sometimes listings are out-of-sync with the market. I do pay attention to them (as well as pending and withdrawn transactions), but it’s always important to judge each one on its own – and determine whether it says something about the market or not. I do want to know how much interest similar properties have had from buyers when exposed to the open market and [it also helps to know] how many days they spent on the market too. It can be telling if listings aren’t selling at a certain level or if they’re fetching a lot of interest at a certain price.

The amount of inventory (of similar properties) on the market:

This is important because when there is more inventory in a market, it tends to water down the price (due to the increased competition). This is basic economics. When there is more supply than demand, prices will inevitably come down.

For the typical land investor who is trying to nail down a “ballpark value” of a vacant lot (WITHOUT ordering an appraisal), are there any common valuation mistakes or dangerous misconceptions they should watch out for?

I would say to make sure you are comparing apples to apples. One lot might look very competitive on paper, but when driving by or at least viewing it on Google “Street View”, differences can become apparent. I would also recommend talking with the city to ensure the land use and zoning are understood. I say this because sometimes information provided in Tax Records may not be accurate. The definitive word should come from the planning department instead of published records that may not have been updated in years.

Land Valuation is an Art, Not a Science

Believe me, I would LOVE to give you a crystal-clear approach to valuing land that will always work, every time. But it's just not that simple.

And if anyone tries to tell you otherwise, I'd be highly suspicious of whatever they're trying to sell you!

The fact is, even an appraiser's opinion should be taken with a grain of salt. When we're talking about real estate (or any other product or service, for that matter), the final rule is this:

It's worth whatever someone is willing to pay for it.

The data (when available) can give us a halfway decent idea of this, but that isn't something you should bet your life on. The value is mostly contingent on finding the right buyer, for the right property, at the right time. Extracting the most value from any piece of real estate is an art, not a science.

Photo by Elizabeth Gottwald

When determining land value, the best you can do is perform a reasonable amount of research. Take the time you need to carefully consider the items listed above. Dig up whatever data you can find with online tools for estimating land value, such as DataTree or PropStream, look at other locally listed properties on Zillow and use the best, most unbiased judgment you can manage.

At the end of the day, if you're making low enough offers, you should be able to protect yourself from most of the risks of land investing.

Due to the difficulty of getting perfect valuations, you should be giving yourself a healthy buffer to help offset any judgment errors you might be making along the way. This is how I've been doing it for years, and even though I haven't always done it perfectly, I've never gotten in over my head, and that's something most real estate investors can't say for themselves.

Ready to Take Your Land Investing to the Next Level?

Understanding land value is just the beginning. To truly succeed as a land investor, you need the right tools, resources, and strategies.

Join our Land Investing Masterclass today and learn from industry experts who have been where you are and know what it takes to succeed. Plus, get access to exclusive tips and insights that will help you find, buy, and sell land more profitably.

Click below to learn more and secure your spot!

FAQs on Land Value

Does land always appreciate in value?

No, land does not always appreciate in value. Generally, land appreciates due to its limited supply along with the demand for new development in the area. As populations grow, demand for land typically increases, further driving prices up over time. However, if demand decreases—due to factors like economic downturns or shifts in population—land values can decline.

Other factors that can influence the growth or decline of land value include economic fluctuations, infrastructure, and the overall desirability of a location.

A common example of declining property values is that of Detroit, Michigan. Detroit's population has dropped from a peak of 1.85 million in the 1950s to around 639,000 as of the 2020 census. This population loss has resulted in around 17% of the city's 138 square miles being vacant land. This led to a significant taxable revenue loss, prompting the city to declare bankruptcy in 2013.

Is land value the same as its market value?

Land value and market value are related but not identical.

Land value refers specifically to the value of the land itself, without any structures or improvements.

Market value, on the other hand, represents the price the land could fetch in the current market, considering factors like demand, location, and any improvements or potential for development. Market value includes the land value but also takes into account external influences, such as buyer interest, market trends, and economic conditions.

How do environmental factors affect land value?

Environmental factors can significantly impact land value, either positively or negatively. For instance, land with scenic views, proximity to water bodies, or abundant natural resources can see increased value due to its desirability for residential, recreational, or conservation purposes.

On the other hand, land in flood zones, areas with contaminated soil, or regions prone to natural disasters like wildfires or earthquakes may decrease value due to the associated risks and higher costs for insurance and development. Additionally, environmental regulations, such as restrictions on building near wetlands or preserving endangered species habitats, can limit the land's usability and thus reduce its value.

When dealing with commercial and industrial properties, it's essential to conduct a thorough environmental assessment or order an environmental report before purchasing land to understand these potential impacts.

How to calculate land value vs house value?

Calculating land value differs from calculating house value because land doesn’t have physical improvements to evaluate, and it typically does not generate any recurring income in the way that a rental property would.

Some studies suggest that the building’s value generally accounts for 80% to 90% of the total property value, while the land value accounts for the remaining 10% to 20%. This ratio can vary depending on the location and market conditions. For example, in high-demand urban areas, land value may represent a larger percentage of the total property value due to the scarcity and desirability of land.

To calculate the land value separately, you can subtract the estimated building value from the total property value. For instance, if a property is valued at $500,000 and the building’s value is estimated at $400,000, the land value would be $100,000. Conversely, to calculate the house value, you would assess both the land and building value together, factoring in elements like the building’s condition, amenities, and market trends.