REtipster features products and services we find useful. If you buy something through the links below, we may receive a referral fee, which helps support our work. Learn more.

For most of us, the risk of losing everything in a flood is NOT something we lose sleep worrying about at night.

Flooding disasters tend to be highly infrequent, once-in-a-lifetime events that happen to other people, right?

It's an understandable bias, because statistically speaking, the average person will never have to deal with it. But what if YOU are part of that dreaded statistic?

Like most natural disasters, a flood can wipe out everything you own in seconds. So if there is ANY risk that your property is in a flood zone, is it worth rolling the dice on this?

Why Do Flood Zones Matter?

Flooding may or may not end up hitting you where you live. But regardless of how concerned you are about it, there are at least a few solid reasons to check whether your property is situated in (or anywhere near) a flood zone.

Simply understanding your situation is half the battle won:

Flood Zones = Risk

When a property is located in a confirmed floodplain, it can seriously affect the cost of property ownership, even if it doesn't flood. What's more, if you're buying land in a flood zone using some financing (such as from a bank or a credit union), they may require you to pay for flood insurance.

RELATED: How to Identify (and Avoid) Wetlands

Do I Need Flood Insurance?

If your property is in a confirmed flood zone and you are borrowing money to buy the property, the short answer is yes.

Even if the risk is relatively small, a property at risk of flooding puts the lender's collateral at stake. Most lenders will require their borrowers to pay for flood insurance to mitigate that risk.

Even if you buy a property free and clear and don't purchase flood insurance, it will most likely be a problem for the next owner. When most buyers find out they need flood insurance (and, more importantly, how much it can cost them), it can be a deal-breaker for them when they otherwise would've been happy to buy your property. A property with an elevated flood risk can create a serious obstacle in the selling process.

Keep in mind that the added cost of flood insurance isn't always huge; it depends on the type of flood zone a property is located in.

In some cases, flood insurance can get very expensive. I've seen flood insurance quotes that add several thousand dollars to the annual holding cost of some properties! When flood insurance is required, it's almost like a second property tax bill the owner has to pay each year.

If flood insurance is something you (or any future owner) will have to pay on an ongoing basis, you should know about the issue BEFORE it's your problem. However, if you do need flood insurance, you can do a Google search for “flood insurance agents near me” and make a few phone calls. This will give you a better idea of the cost of flood insurance for your specific situation.

Is My Property in a Flood Zone?

Luckily, there are a some fast and FREE ways to determine if your property is in a flood zone as well. The video below explains how it works:

To get started, search for your property address on FEMA.gov to access the area's nearest, most relevant flood map. If you're dealing with a vacant lot that doesn't have a registered address, find the nearest property with an address and search for that one.

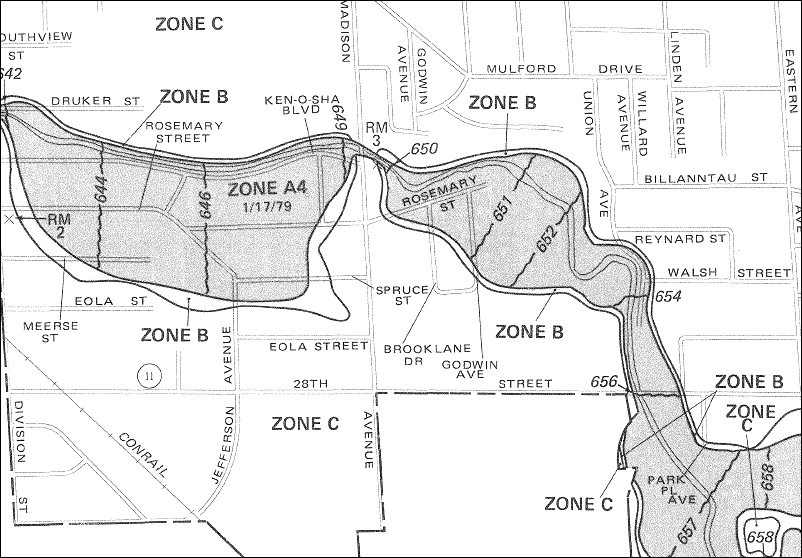

Here's an example of what these flood maps look like:

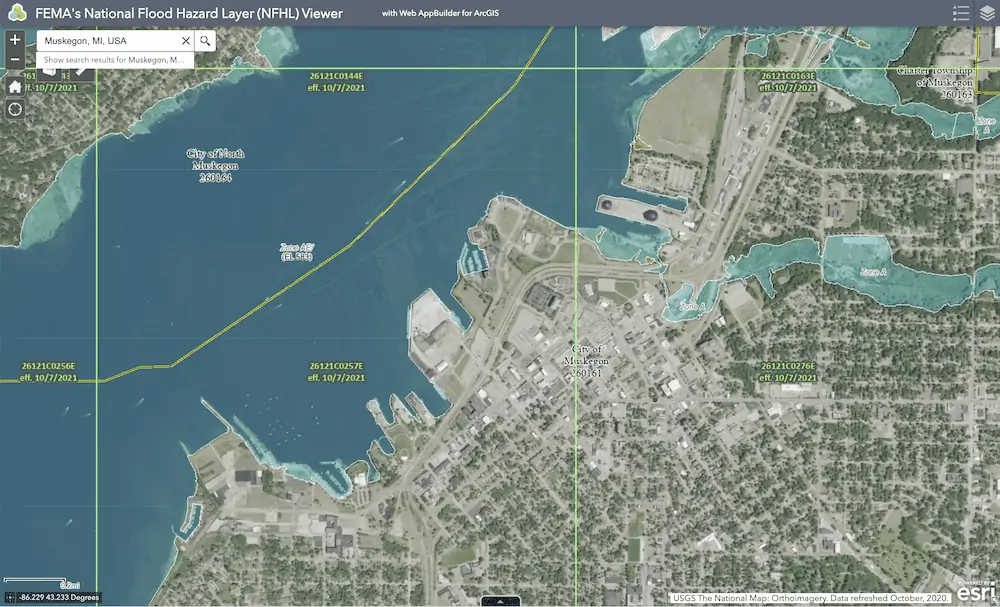

Another way to search on the FEMA website is through the National Flood Hazard Layer (NFHL) Viewer, which will give you an interactive map.

You can also use the Obie Risk Map and search for your property there. In some ways, I prefer this website over the FEMA maps because it has a more user-friendly look and feel.

Just search for the address of your property, and you'll see a map that looks something like this:

As you can see, this site will give you a good idea as to whether your property lies within a high, moderate, or low-risk area. Keep in mind that this information is advisory only and not the final determination of whether you're going to need flood insurance.

If you discover your property is anywhere in or near a flood zone, you can also click the “Get Instant Quote” button on the same page, where you can get a ballpark estimate on how much flood insurance is going to cost.

There are all kinds of things that can create headaches for property owners. Considering how quick and easy it is to verify this aspect of property on the front end, there's no reason not to take a few minutes and research before the problem officially falls in your lap.

RELATED: The Truth About Land Investing: 21 Warning Signs to Look For BEFORE Buying Vacant Land

Understanding FEMA Flood Zone Types

| FEMA Flood Zone | Risk Level | Meaning/Description |

|---|---|---|

| Zone A | High | Areas with a 1% annual chance of flooding (also known as the 100-year flood). No detailed flood elevations provided. |

| Zone AE | High | Areas with a 1% annual chance of flooding; detailed Base Flood Elevations (BFEs) provided. |

| Zone AH | High | Areas with a 1% annual chance of shallow flooding (ponding) with average depths between 1 and 3 feet. BFEs provided. |

| Zone AO | High | Areas with a 1% annual chance of shallow flooding (sheet flow), average depths of 1 to 3 feet. Depth provided. |

| Zone AR | High | Temporary flood risk due to levee restoration projects underway. |

| Zone A99 | High | Areas with a 1% annual chance of flooding that will be protected by a levee or flood protection system currently under construction. |

| Zone V | High | Coastal areas with a 1% annual chance of flooding, additional hazards from storm-induced waves. No BFEs provided. |

| Zone VE | High | Coastal areas with a 1% annual chance of flooding, including wave hazards; detailed BFEs provided. |

| Zone X (shaded) | Moderate | Areas with a 0.2% annual chance of flooding (also called 500-year flood); moderate flood hazard. |

| Zone X (unshaded) | Low | Areas outside the 0.2% annual chance floodplain; minimal flood hazard. |

| Zone D | Undetermined | Areas with possible flood risks, but no flood hazard analysis has been conducted. |

To boil it all down, here's a more succinct overview of how to make sense of each flood zone:

- High-Risk Zones (Special Flood Hazard Areas – SFHA): A, AE, AH, AO, AR, A99, V, VE. These zones typically require flood insurance if the property has a federally-backed mortgage.

- Moderate-Risk Zones: Shaded Zone X. Flood insurance is not federally required but recommended.

- Low-Risk Zones: Unshaded Zone X. Flood insurance is optional but encouraged.

- Undetermined Risk: Zone D. Flood risks are unclear; flood insurance is available, but rates vary.

My Property Is In a Flood Zone! Now What?

Don't panic. If you've concluded that your property is within the boundaries of a flood zone, the first step is to contact a qualified agent and verify whether your assumptions are correct. They should be able to confirm or deny whether this is an issue, and, if so, how much it will cost you to insure over it.

In some cases, you could also go through the motions of getting your property removed from a flood zone. If a flood zone determination was made decades ago without careful analysis of the elevations and characteristics of your specific property, there could be a solid case for getting the flood zone classification changed on your property.

If you want to pursue this option, you can contact DJ McClure at NationalFloodExperts.com to see if there might be a case for this on your property. His email address is info@nationalfloodexperts.com.

The cost of flood insurance can vary widely depending on the flood zone determination and the specifics of your property, so it will be up to you to determine whether the benefit of fixing the flood zone issue is worth the cost.