Vacant Land is one of the most overlooked and misunderstood real estate investments in the world.

Most real estate investors completely fail to recognize the superior benefits of owning land in its raw form.

The simplicity and stability that come with owning the right piece of land, purchased at the right price, can far outweigh the myriad of problems that are certain to come up with any other type of real estate.

While I firmly believe that vacant land is one of the best places you can put your money, there is another side of the story that should be carefully considered.

As an experienced land investor, I've learned (sometimes the hard way) that several things need to be evaluated before purchasing a parcel of vacant land.

Land Can Be Deceptively Complicated

Vacant land may seem like a simple type of real estate, but there can be A LOT of potential problems lurking beneath any piece of land. I wouldn't necessarily say all these issues are common, but the fact is, any one of them could become a huge liability if you don't discover them before you buy.

Don't get me wrong, land is a rock-solid investment. It's just a matter of knowing what to watch out for in your due diligence process and under what circumstances you should re-adjust your offer price or walk from the deal altogether.

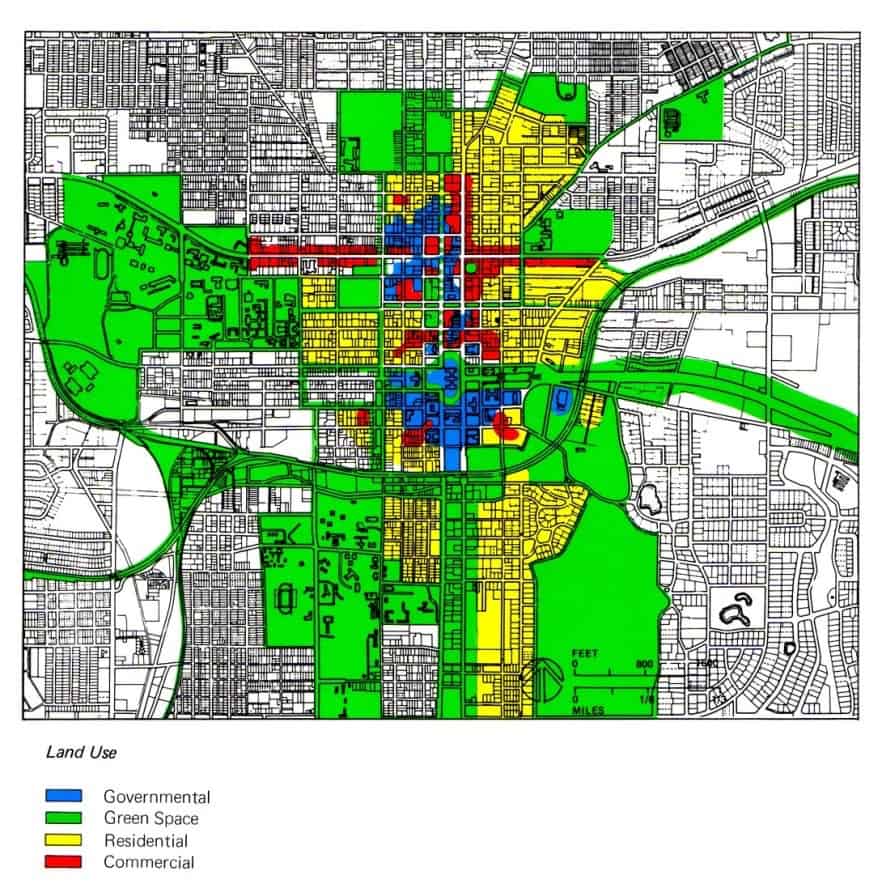

1. Zoning

Once you know the zoning classification (e.g., residential, commercial, industrial, agricultural, etc.), ask them to give examples of what types of property uses would be allowed under this zoning type. They may even give you some ideas you hadn’t previously thought of.

Once you understand the most ideal use for the land you're looking at, you can quickly determine whether it will fit your needs (or the needs of those you intend to sell the property to in the future).

RELATED: 8 Land Investing Myths Debunked

2. Topography

The property's topography is one of the first things I look at when evaluating a vacant lot. Many places have irregular elevations, cliffs, mountains, valleys, and ravines. In many cases, the topography of the will can have a major impact on the usability of a property.

For the same reasons you can’t build a house on a 90-degree cliff, you should do preliminary research to find out where your property is located and the land's topographic contour lines.

One of the easiest ways to do this is with Land id, which can show these same contour lines throughout the country.

If you're looking for a free way to do this, Google Earth and the topography maps from Earth Point can be useful, too. With Google Earth, you can search for your property (using the address or coordinates) and zoom in using your mouse buttons and the control/command and shift keys on your keyboard. This will allow you to tilt the earth to see where all the hills and valleys are in your area, along with the topo map overlay from Earth Point.

As you can see, this combination of software can give you a crucial perspective on what type of property you're considering. And if you want even more clarity on your property's parcel lines, check out Parlay as another helpful resource.

RELATED: What Is a Topographic Survey?

3. Property Taxes

If you intend to hold onto a property for any length of time, beware of a super high tax bill relative to the property's actual value. Some properties have ridiculously high taxes in proportion to the property’s actual value (for example, if a $10,000 property has an annual tax bill of $2,000, THIS IS TOO HIGH). In my experience, I've found that a reasonable annual tax bill usually falls in the range of 1% – 4% of the property’s full market value.

Whatever the situation, make sure you're aware of this cost because it will be your obligation to pay it for as long as you own the property.

4. Public Utilities

If a property doesn't have access to one or more of these common public utilities (water, sewer, electric, gas, phone), the property may not be an ideal candidate for building a dwelling.

Think about it, would you want to build a house where you can't flush the toilet, get access to clean water, or have electricity or gas to power your appliances?

Granted, some alternatives can be sought if the owner is willing to pay the price (septic systems, well water, solar energy, propane tanks, etc.), but if these obstacles exist, you'll want to know about them before you buy.

If a property isn't an ideal fit for a building, it could lose a massive portion of its value, especially if the best use is to place a structure on it. Since most people buy land with the intent of building on it, you will definitely want to know about anything that could get in the way of this objective.

5. Building Setback Requirements

Once you understand the dimensions of the parcel you're evaluating, call the local planning department and ask them what the designated building setbacks are for the property (building setback requirements are very common and are imposed as a way of giving order and consistency to the buildings in any given area).

When you consider these setbacks and regulations (relative to the parcel size), ask yourself,

“Is there still enough room to build something worthwhile here, or is this property useless?”

I've come across several properties that were too small to build anything because of the size of the property relative n to the required setbacks. Similar to the utility issue mentioned above, if a property isn't buildable or has severely limited uses, it will lose a massive portion of its value.

6. Usage Restrictions

Most of the vacant land you'll encounter will have SOME kind of usage restrictions in place (there's a reason you'll never see a 100-acre pig farm next to a 100-story skyscraper or a massive shopping mall next to a landfill… it just doesn't make sense).

Every municipality in America has a plan (even if it's a vague one) for how they want different sections of their land to be used, regardless of who owns it. As such, you should always expect your property to come with some reasonable limitations on what it can be used for.

If the property is part of a Home Owner's Association (HOA), it will most likely have even more restrictions in place to help maintain the “quality” and formality of the neighborhood. The idea is to keep any bizarre behavior OUT of the neighborhood (e.g. – cars in the front yard, lawns nobody takes care of, houses that look out of place, etc).

Usage restrictions aren't necessarily bad; they usually exist for a reason and make sense on some level. They're designed to help maintain order and support the value of each property in the subdivision. On the same coin… if you aren't aware of these restrictions before you purchase, they can also create some conflict with the plans you had in mind for the property.

This isn't common for most land investors (because most people have no intention of using their property for purposes that don't jive with their surroundings). Even so, you should always ensure you understand the rules before buying a parcel of vacant land. This will help you avoid owning a property that requires maintenance you don't want to do or that can't be used for your intended purpose.

7. Flood Zone

In some parts of the country, parcels of land are vacant because they are literally underwater. In other areas, properties near bodies of water may be at high risk of flooding.

In either case, if a property is located in a flood zone – you'll want to know about this BEFORE you buy because when a property is in a flood zone, it can be extremely expensive to insure.

Land located near a body of water can be extremely valuable, but this proximity can also create several potential issues, so be sure you understand the ramifications of your particular location.

Do you want to check if your property is in a flood zone? You can do this by visiting FEMA.gov, using the NFHL Viewer, or the Obie Risk Map, and following the instructions in the video above.

8. Perc Test or Sewer System

If you're planning to build a dwelling of any kind on your parcel of land, there is one issue that may seem insignificant at first glance, but it has the potential to make or break a land deal. It's called a “Perc Test,” and if you're dropping some serious coin on land in a rural area, this is an issue you'll want to be sure about before you sink your money into it.

A Perc Test (also known as the “Perk Test” and more formally known as a “Percolation Test“) is a soil evaluation that tests the rate at which water drains through the soil. If a property doesn't have easy access to the local sewer system, a perc test is required to determine whether a septic system (the alternative to a sewer) can be installed on the property.

If a property doesn't pass this test, you could have a very difficult time building any type of dwelling on the property, so unless you're able to tap into the municipal sewer system (which will negate this issue altogether), be sure to give the county health department a call and ask them what is required to install a septic system (or connect to the local sewer) in your area.

9. Road Access

Believe it or not, there are thousands of properties all over the country that have no road access. Other privately owned properties surround them. Since there is no way to access the property without trespassing over someone else's land, the property is legally inaccessible. These properties might as well be on another planet because nobody can legally get to them!

This issue can be overcome if you can obtain a legal easement to the property from one of the surrounding neighbors so you can travel through their property to your own. In most cases, a neighbor shouldn’t be expected to do this for free; you’ll have to give them a reason to help you (usually in the form of money).

This isn’t an impossible issue to overcome, but you’ll want to be aware of it before you purchase.

Landlocked properties aren't always a deal-breaker (sometimes they can be a great opportunity if you're able to resolve the easement issue), but you'll want to be aware of the problem ahead of time so you can adjust your offer WAY lower to account for the limited usability (or walk away from the deal altogether).

10. Physical Access

Some properties may not have road access but physical access through a common area or government-owned land. Even without the convenience of a road, accessing your land without trespassing over someone else's property will offer an important benefit.

For obvious reasons, a property with any physical access is preferable to a completely inaccessible property.

Examining the GIS parcel lines and satellite maps can often identify physical access. Simple foot trails or ATV paths to and from a property from a public road can be a good indication of established physical access that has been used consistently for a length of time.

11. Size, Shape, Dimensions and Location

I've seen several properties that are virtually useless due to their size and shape. On one occasion, I came across a parcel of land 5 feet wide and 900 feet long. I've also seen properties that were 10 feet by 10 feet.

Use your common sense if you see a parcel of land with an odd shape. You'll probably want to pass on it if you can't think of any legitimate uses for a property with its given dimensions.

You can find the size, shape, location, and dimensions quickly if your county has a free GIS mapping system online.

You can also use a service like Parlay or Land id (both of which require a paid subscription) and Google Earth (free) to find a parcel map of your property. Here's how it works:

Of course, none of these GIS mapping systems are perfect. The only way to be 100% certain about the size and shape of a property is to order a land survey. Still, these online mapping solutions can be very useful if you're looking for a faster, cheaper way to get a basic idea that is usually reliable.

12. Water Access

Many properties don’t have access to a municipal water supply (i.e., city water). This isn't necessarily a problem, but it does mean someone will have to drill a well to access a clean water source beneath the surface. There are a few ways to determine whether or not you'll be able to do this, but in most cases, if there are other buildings in the near vicinity (e.g., homes or other dwellings built next door), this is usually a good indication that you won’t have any problems accessing water either.

If you’re looking at a vacant lot in the middle of the desert or near the top of a mountain with nothing around for miles, you will probably want to verify that water will be acessible if/when you need it. If your only option is to have it hauled in by truck, you'll want to know how much this will cost on an ongoing basis.

13. Wetlands

Throughout most of the U.S., federal and state laws prohibit landowners from developing or using their land in any way that will adversely affect wetland areas (which renders most wetland areas unusable). This is why it's important to identify the presence of wetlands BEFORE closing the deal.

Ultimately, the only way to be 100% confident about wetlands is to enlist the help of a wetlands consultant and/or have the appropriate government agents conduct a wetland identification and delineation on-site.

This is a lot to ask, especially when the transaction needs to close quickly.

If you want to identify any obvious red flags without leaving your computer, it is possible to do reconnaissance-level research and get a more educated look at the wetland situation on your subject property. I'll explain one method in this video…

You can get started with the Wetlands Mapper or download the KML file and view this same Wetlands Data on Google Earth.

Now, since the wetlands mapper doesn't always provide the most accurate measurement in all areas, another tool you can use to assess the situation is the NRCS Web Soil Survey, which the UC Davis Soil Resource Lab compiles. I'll show you how it works in this video…

You can download this SoilWeb KML file by visiting the USDA Ag Data Commons.

Remember that using the Wetlands Mapper and/or the Web Soil Survey is NOT the same thing as hiring a wetlands consultant and/or having the USACE do a delineation on your property (there are no guarantees with this approach). However, if you're just looking for an educated guess, both online tools can be used as a starting point.

14. Junk, Tires, Rubble, Oil, or Other Contaminants

On a few occasions, I discovered that what I thought was a piece of vacant land was a makeshift landfill. If you buy a piece of land, make sure that all you’re getting is LAND (and if anything else is coming along with the deal, make sure it’s something you want).

These messes can be very expensive to clean up, and to avoid any unwanted surprises on this front, it's always a good idea to see the property you're purchasing.

If you're purchasing the property from a long distance and it simply isn't feasible to see it yourself, there are a few ways you can find a local set of eyes to find the property and get some pictures for you.

One easy way to do this is to find a local photographer (i.e., anyone with a cell phone camera) who can travel to the property and get pictures for you. You can do this by posting a job ad on Craigslist under the nearest city name > gigs > creative gigs.

Depending on how far they travel and how many pictures you need, usually $50 – $100 is sufficient for this kind of work.

You can also try to contact a few local real estate agents in the area and ask them if they can drive by the property and snap a few pictures when they have a chance. Most agents are regularly in the field anyway, and it isn't a huge request for them to swing by your property and get some pictures (especially if you show any interest in using them for future listings and/or paying them a few bucks for their trouble).

However you decide to look at the property, ensure you are 100% clear about where the property is located, and communicate this thoroughly to the person getting pictures (send them parcel maps, directions, even a video if you need to).

RELATED: How Land Specialized Real Estate Agents Can Change The Game For Land Investors

15. Previous Uses

Most states have environmental laws that pertain to commercially zoned property (i.e. – properties zoned “Residential” generally aren't held to these standards). If you’re considering a vacant lot zoned for commercial development, ensure you're not inheriting any environmental contamination with the property.

For most commercial properties, the best way to do this is by ordering a Phase I Environmental Report (many banks will automatically require this because it affects their collateral). This report will identify if there are any “Recognized Environmental Concerns” (RECs) on the property that you need to worry about.

If you neglect to do any environmental due diligence, the liability for any existing environmental contamination on the property could ultimately fall on your shoulders, making it more difficult and expensive to sell the property in the future.

Another way to get a quick look at what has been going on (and around) the property in question is to look at the historical satellite imagery of the property with a tool like Google Earth.

Here's a quick look at how it works…

As you can see, it's not necessarily the most comprehensive or scientific way to review a property's history – but it's quick, easy, and doesn't cost anything, which makes it a good place to start.

16. Surrounding Neighborhood

The properties next door can have some MAJOR implications for the value and “sale-ability” of a parcel of land (e.g. – Think about it, would you rather live next to Yosemite National Park or a Landfill?). For understandable reasons, most people care a great deal about who and what they live next to, so be sure to get a good idea of what the surrounding properties look like.

Is this a desirable area? Is it the type of place where you (or anyone else) would want to live? If the surrounding properties have any obvious issues beyond your control, you'll want to think carefully about what this means for the property's value and whether or not you want to own it.

For a quick tutorial on how to very quickly find out what the adjoining properties look like next to the parcel you're researching, this video explains one way to do it:

Note: As of 2022, AgentPro247 was discontinued. If you're looking for a good alternative, check out DataTree. It can do the same function explained in the video above, and you can get discounted pricing through the REtipster affiliate link.

These are the questions I ask myself before I buy any piece of vacant land. This isn't intended to be an all-inclusive list of EVERY possible issue you could ever encounter, but I’d say it covers about 95% of the potential concerns you ought to be aware of. Most of these issues come up very infrequently, but they are very important things to consider nonetheless. Remember, you don't need to be afraid of buying vacant land. You just need to be informed.

17. Soil Quality

If a parcel of land is going to be used for agricultural purposes and growing crops, the quality of the soil will play a big role in determining if this is an ideal use for the property.

Everything from the health of the soil (salinity and alkalinity), the status of the water table, and the extent of water table depletion, the fertility of the land, and historical crop yield, and many other factors will contribute to understanding whether a parcel of land will have good, tillable soil to offer.

RELATED: The Beginner's Guide to Farmland Due Diligence

18. Load Bearing Capacity

Many land buyers will pay for a geotechnical investigation if they plan to develop the property or build any kind of structure. This investigation will take soil samples to determine how much weight the ground can handle.

Why is this important? Because if the soil is too soft in certain areas of the property, the foundation of the building could potentially sink and cause structural damage to the building, the foundation, and the façade. Nobody wants to spend big money to construct a beautiful building, only to see it fall apart because it wasn't built on firm soil.

For this reason, a geotechnical investigation can provide critical information as to whether a property is suitable for building and/or if any changes should be made to the soil before pouring the foundation.

Keep in mind not all vacant land purchases warrant this type of investigation. For example, if a vacant lot is in an established, platted subdivision, chances are this investigation was already completed back when the subdivision was first constructed. However, if you're buying raw land that has never been evaluated for building, this could be an important step in your due diligence.

19. Title Search

This will be handled as part of their closing process when you close your land purchase through a title company or real estate attorney. However, if you are buying land directly from the seller and conducting the closing yourself (which I would not recommend if you're paying more than a few thousand dollars), there are a lot of things you'll need to verify to ensure you are receiving a clear and equitable title to the property. The last thing you want to do is buy a property from someone who doesn't own the property.

This blog post explains many of the basics of how a title search works, but some of the key takeaways are,

- It's important to be sure you're receiving a warranty deed from the seller

- You'll want to perform your title search to ensure there is a clear chain of title and there are no outstanding liens or other clouds on title

- If there are any outstanding restrictions or easements on the property or rights other parties own (mineral rights, timber rights, crop rights, grazing rights, etc.), you'll want to be fully aware of those before you buy the property, not after you own it.

RELATED: The Biggest Legal Issues Land Investors Need to Know About w/ Clint Coons

20. Site Plan and Preparation

Again, if you're buying a property to build any type of structure, an often-overlooked cost that most people don't consider is the cost of creating the site plan and preparing the ground for construction.

Every construction project needs a well-thought-out plan. Not only for the building itself but also for the ground beneath it. If the earth needs to be re-shaped, if a well needs to be drilled, if sewer pipes, utility lines, and other amenities need to be added before the construction can begin, all of this needs to be thoroughly understood before the project starts.

Civil engineers are typically hired to compile these plans, and (surprise, surprise), they cost money. Sometimes a lot of money! Whatever you're planning to build on your property, be sure to talk with your general contractor or a local civil engineer to get an idea of how much additional cost this will tack onto your budget for the property.

21. FSBO Scammers

For Sale By Owner scammers are a growing problem in some markets around the country. These con artists will find a property (one they don't own or have any vested interest in), list it for sale, pretend to be the owner, and try to sell the property to an unsuspecting buyer.

Once the scammer collects the cash, they disappear with the money, and the buyer is left with a fake deed or, in some cases, no deed.

It's a troubling trend in the industry because our current system of recording deeds and transferring property ownership is old and antiquated, and it leaves plenty of opportunity for scammers to exploit the system.

It's also an easy trick to fall for because the average person doesn't understand how property transfers work, how to conduct a title search, or why it even matters.

An easy way to negate this issue is to close your deal through a title company, but not just any title company (because some of these scammers will even create a website for their own fake “title company” to close the deal, just to throw off the scent). Make sure it's a well-known, reputable title company that YOU know and trust because it will be on them to sniff out any potential issues with fraud and catch this for you.

RELATED: 134: SCAMMED! When Someone Tries to Steal Your Property, What Can You Do?

Don't Be The “Greater Fool”

The trick with vacant land is to understand why it's vacant in the first place. I've encountered quite a few vacant lots that seemed attractive at first glance, but eventually, I discovered that nobody was using them because you CAN'T use them. If one (or more) of the above issues prohibits someone from putting a property to good use, you don't want to find out after you own it.

When some people look at the prospect of owning land, they get wrapped up in the dream of property ownership. The idea of owning a large tract of property can seem very appealing, even if it is of no practical use to them. This kind of trap is especially easy for people to fall into with land because it's a low-maintenance property and doesn't seem complicated (even though there are a lot of factors to consider).

MANY people buy into the dream of property ownership – even if the investment makes no sense from a financial standpoint. If you don't believe me, check out this guy who sells land on the moon:

Unfortunately, many parcels of land are sold to “the greater fool.” When people don't do their homework and think things through, they can get hurt.

Don't be the greater fool. Always be sure you have done a reasonable amount of research, and don't take on a property until you thoroughly understand what you are getting into.