What Is a Warranty Deed?

REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

What Is a Warranty Deed in Real Estate?

When you’re buying or selling property, you’ll want to know what a deed is, and you’ll be especially interested in the warranty deed, which is the most common type of deed used in real estate transactions.

A deed is simply a written instrument whereby a property owner (or grantor) transfers title to someone else (the grantee). A deed signifies that one person or entity is giving up ownership of a property to another person or entity. There are many different types of deeds. The main differences between deed types are the covenants, or promises, made within the deed.

With a warranty deed (also known as general warranty deed), the seller is giving the buyer their “warranty” (i.e., guarantee/promise) that the title to the property is free and clear and the buyer will receive all reasonable rights to the property. This type of deed should only be used when the seller knows for a fact that the property’s title is clear of any liens, encumbrances, or other title defects.

This deed offers the greatest protection to the buyer (grantee) and puts the greatest liability on the seller (grantor). Unless there are exceptions listed on the deed, the grantor fully guarantees (or warrants) that the property being sold has a clear chain of title with no outstanding liens or encumbrances.

Most educated buyers will strongly prefer this type of deed (and if a lender is involved, it will almost always be required).

Most sellers are okay with signing a warranty deed because:

- This was the same type of guarantee they received when they bought the property from the previous owner.

- They bought a title insurance policy when they purchased the property, which protects them from the most common title issues, should they arise in the future.

This is one of the primary reasons why title companies exist – to perform the necessary title research to verify that the title is clear and provide title insurance to cover the seller for liability.

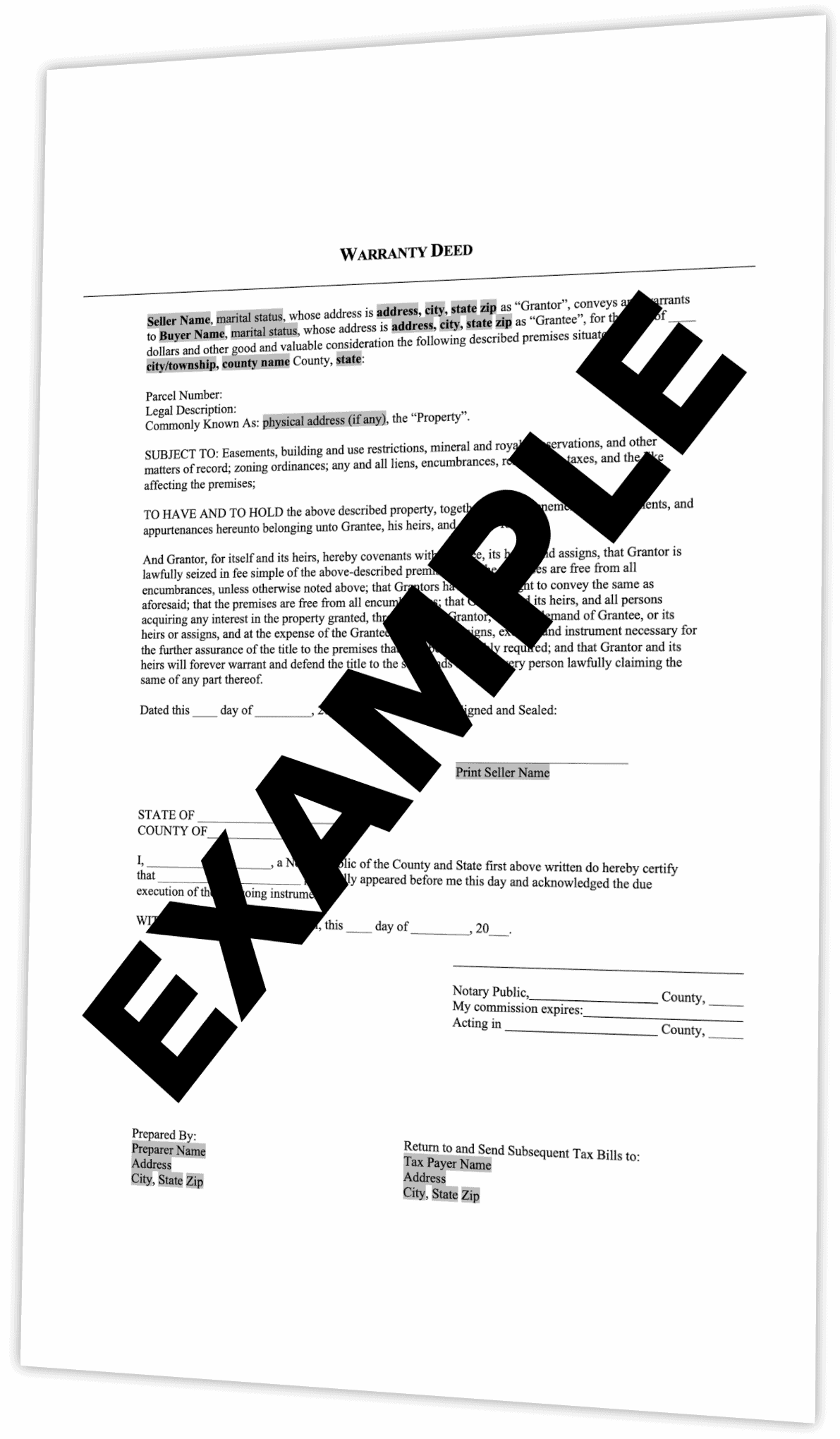

Warranty Deed Forms, Templates and Examples

A warranty deed is usually drafted by an attorney, title company, or the closing agent handling the transaction. However, in most states, a seller can create the document themselves if desired.

REtipster features products and services we find useful. If you buy something through the links below, we may receive a referral fee, which helps support our work. Learn more.

Some of the well-known do-it-yourself services and document libraries are as follows:

Note: Some states require the involvement of a licensed attorney to prepare any type of deed transferring real property, so it’s important to verify what the law requires in the state where the subject property is located.

RELATED: Closing Real Estate Deals with an Attorney – When and Where is it Required?

The grantor must have their signature notarized; some states may require an additional witness, as well.

The property title isn’t official until the grantee obtains a new title from the title company or seller and records the deed with the county recorder.

Types of Deeds

A deed is a document used by a property owner (or grantor) to transfer their title and ownership of a property to someone else (the grantee).

There are many different types of deeds. Each type has different use cases and levels of protection. Some of the commonly known deeds are:

Here are the most common types of deeds:

- General Warranty Deed

- Special Warranty Deed

- Bargain and Sale Deed

- Quit Claim Deed

- Correction Deed

Note: In some states, these types of deeds may be known by different names (e.g. – Covenant Deed, Grant Deed, Confirmation Deed, etc), but the functions served by each deed type are more or less consistent, even if known by a different name.

The general warranty deed, which many people simply call a “warranty deed,” offers the greatest protection to the buyer (otherwise known as the grantee), and puts the greatest liability on the seller (otherwise known as the grantor).

With a general warranty deed, unless there are exceptions listed on the deed, the grantor fully guarantees (or warrants) that the property being sold has a clear chain of title with no outstanding liens or encumbrances. The warranty deed must be reviewed to see whether exceptions are listed on the warranty deed. The warranty deed may say it is subject to easements and restrictions of record, such as a mortgage, subject to building and zoning requirements, such to conditions that an accurate survey may show, or other exceptions.

Warranty Deed Covenants (Promises)

Title protection under a general warranty deed is guaranteed by several covenants:

- Covenant of seisin

- Covenant of quiet enjoyment

- Covenant against encumbrances

- Covenant of warranty forever

- Covenant of further assurance

To fully understand a general warranty deed, you need to understand all the covenants.

The covenant of seisin means that the seller really does own the property. You can’t, for example, buy real estate from someone who has no right to sell it.

The covenant of quiet enjoyment assures the buyer that once they buy the property, no one can later claim ownership rights.

The covenant against encumbrances is the seller’s guarantee that there are no liens, deed restrictions, easements, encroachments, or licenses associated with the property that were not specifically disclosed to the buyer.

The covenant of warranty forever assures that the title is good and makes the grantor responsible to pay to clear up any future title issues that might come up.

The covenant of further assurance means that if demanded by the buyer, the seller must produce any additional documents necessary to fix any defects in the chain of title.

Deed Requirements

There are several requirements for any deed, including the general warranty deed, to be valid:

- The grantor must be identified, of legal age, and of sound mind.

- The grantee must be identified. Note that the grantee does not need to be of legal age or sound mind.

- There must be a consideration, which is the price paid for the property. If the grantor would like to give property to someone, there still needs to be a nominal payment from the grantee to make this legal.

- The deed must have words of conveyance, such as, “I hereby grant and convey …”

- There must be a full legal description of the property, which is an explicit and singular identification of the property. This is more in-depth than simply the street address. Examples include a government survey or a recorded plat description.

- Any reservations, exceptions, and restrictions should be noted in the deed. (A reservation is a right retained by the seller, such as an easement for continued use. An exception is when the seller retains title to part of the land. A deed restriction limits what can be done with the land and is usually imposed by the developer.)

- The grantor must sign the deed, and their signature should be notarized.

- There must be delivery and acceptance. This means the grantor must deliver the deed to the grantee who must accept it.

After all deed requirements are met, it is important for the buyer or their closing agent to record the deed. This action will establish the name of the buyer (grantee) in the county records as the new owner of record.

In many states and counties, additional paperwork may be required by the city or municipal tax office so that future property tax bills are sent to the correct owner (while it may not be intuitive, the county tax collector and the city tax collector are often not administered by the same office).

Reviewed by Mark H. Zietlow, Innovative Law Group