What Is a Quit Claim Deed?

REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

Quit Claim Deed Explained

Quit claim deeds (also called quitclaim or quick claim) can be used to transfer real estate from one person to another, from an entity to a person or from a person to an entity. It can also be used to change a person’s name on the title, grant or terminate easements, or similar transactions.

With a quit claim deed, the seller (grantor) is offering no warranty of any kind with regard to the property. The person signing the quit claim deed is simply releasing whatever ownership interest they may have in the property. They may have no ownership interest in the property at all. There may be outstanding mortgages on the property. There may be restrictions, liens, unpaid taxes, easements, rights of way, options, reversionary requirements, rights of first refusal, or other issues affecting the property. The person signing the quit claim deed is not making any guarantees of any kind.

Quit claim deeds usually include language to effect of:

“The grantor makes no warranty, express or implied, as to the title of the property.”

In essence, the seller isn’t even claiming to have any ownership in the first place. By signing a quit claim deed, the seller is saying,

“Whatever interest I may have in this property (if any), I am transferring it to the buyer.”

Even though you don’t own the property, there’s nothing stopping you from signing over a quit claim deed to the property.

A person receiving a quit claim deed may receive nothing at all (because the grantor doesn’t actually have any ownership interest), or they may receive a property with title issues that make the property unusable or unsaleable.

There is no protection against problems with a quit claim deed. All this to say, if a buyer is willing to accept this kind of deed, they should be doing their homework to ensure the property has a clear chain of title and is actually owned by the grantor who is signing over the quit claim deed. A person receiving a quit claim deed should perform due diligence to determine the ownership status of the property and any encumbrances, liens, rights, obligations, limitations or restrictions affecting the property.

Because of how open-ended this type of deed is, it has a tendency to create problems in the chain of title for future owners because it lacks any guarantees or clear statements about who owns the property. If good and marketable title to the property is desired, the prospective owner should first check with a title company to see whether title to the property is insurable.

RELATED: What is a Quiet Title Action?

A quit claim deed provides a fast way to handle real estate ownership transactions, which is why they are sometimes misnamed “quick claim deeds” because the owner is able to transfer the property very quickly.

Although it’s a quick and convenient way to transfer ownership, it also has the least protection for the buyer. The seller (grantor) offers no guarantees in a quit claim deed. The owner simply releases whatever ownership interest they have in the property (even if they have no ownership interest in the property at all).

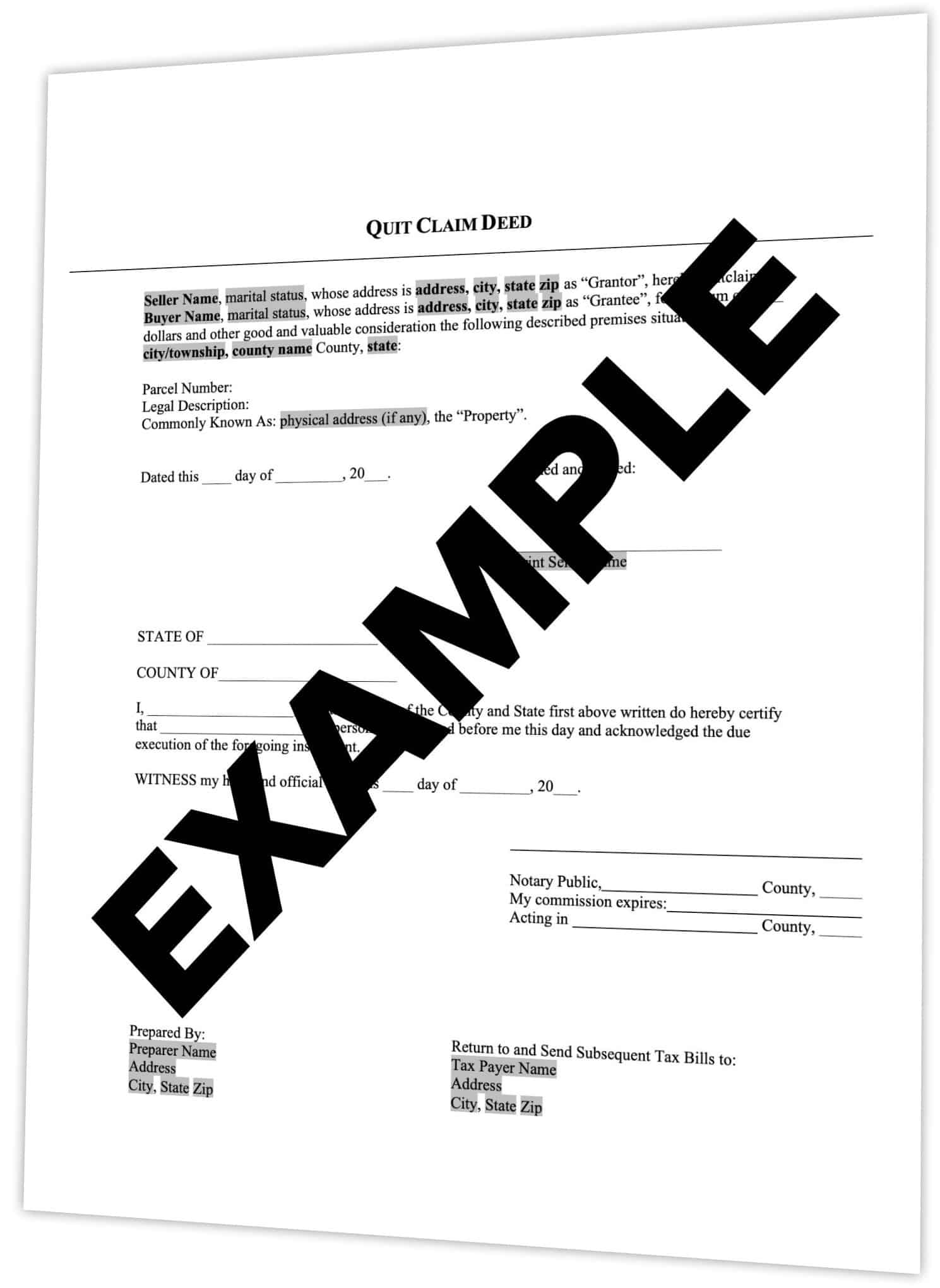

Where to Find a Quit Claim Deed Form

It’s easy to take a DIY approach to quit claim deeds; there are several sites where you can work with a pre-existing template.

REtipster features products and services we find useful. If you buy something through the links below, we may receive a referral fee, which helps support our work. Learn more.

Some of the well-known do-it-yourself services and document libraries are as follows:

The grantor must have their signature notarized; some states may require an additional witness, as well.

Note: Some states require the involvement of a licensed attorney to prepare any type of deed transferring real property, so be sure to verify what the law requires in the state where your property is located.

RELATED: Closing Real Estate Deals with an Attorney – When and Where is it Required?

The property title isn’t official until the grantee obtains a new title from the title company or seller and records the deed with the county recorder.

Types of Deeds

A deed is a document whereby a property owner (or grantor) transfers their title and ownership of a property to someone else (the grantee).

There are many different types of deeds. Each type has different use cases and levels of protection. Some of the commonly known deeds are:

- Warranty Deed: This deed guarantees the grantor has a clear title to the property and this guarantee extends to the property’s origins. This deed has the highest level of protection for the buyer and is most often used when ownership is transferred to a third party in a real estate transaction.

- Special Warranty Deed: This deed is similar to a general warranty deed except it only covers the period of time the property was owned by the grantor. The guarantee doesn’t extend to the property’s origins. This deed offers some protections for the buyer.

- Correction Deed: A subsequent deed that is intended to correct an error or omission in an earlier recorded deed.

The main differences between deed types are the promises made within them.

Why Would You Use a Quit Claim Deed?

Quit claim deeds are most often used to transfer property between family members—parent to child, husband to wife, brother to sister, etc. It’s also used in cases of divorce where one spouse is granted ownership of the home, so the other spouse requests a quitclaim deed to remove ownership interest.

It can also be used to transfer property ownership to a business or to convey it through a will.

Quit claim deeds can be used to clear a title defect in certain situations. For example, if a title search reveals that the spouse of a previous owner has an interest in the property because a past deed wasn’t executed properly, a quit claim deed can cure that defect.

Quit claim deeds do not affect mortgages, however. Many mortgages contain a “due on sale” clause which means the grantor needs to pay the balance in full once the title changes hands. Sellers using a quit claim deed to transfer mortgaged property should be aware of this potential.

Additionally, in the case of an assumed mortgage, granting a quitclaim deed does not protect the seller if the buyer stops making payments. If the seller believes a quit claim loan is the best way to accomplish a sale, additional legal documents are needed to protect the seller in the case of default.

Can I Get Title Insurance with a Quit Claim Deed?

Generally speaking, most title companies won’t work with a quit claim deed, because it offers no guarantees on behalf of the seller and opens the title insurance company up to the highest level of risk in the event of a title dispute.

If a property owner wants title insurance, it’s generally best to use a warranty deed. Most legal advisors recommend only using quit claim deeds with grantors you know well and trust.

Reviewed by Mark H. Zietlow, Innovative Law Group