When I first learned about the land flipping business (when I took the time to understand what it was all about), it seemed like the biggest no-brainer investment strategy I'd ever heard of.

The concept was so simple, and when I realized I could find mind-blowing deals and make serious money with such a basic type of property, I couldn't believe this wasn't a more well-known, mainstream business model that everyone and their brother was doing.

Make no mistake about it – the land investing business is a CRAZY profitable investment strategy, and it does deserve more attention from the masses… but at the same time, I've found that a lot of people get into this business with a big, underlying misconception that it's EASY.

- Easy to find deals.

- Easy to get them sold.

- Easy to manage the business.

- Easy to make money.

The problem with “easy” is that it's a very subjective word.

As someone who has tried their hand at several other business opportunities before the land business, I can tell you that, comparatively speaking, land investing is easier than most business models out there.

However, simply saying it's “easy,” PERIOD, would be a grossly oversimplified statement.

Developing the Right Mindset

When most people start in the land investing business, they come from years of experience working a full-time day job.

There's nothing wrong with this (and it's precisely how I got started), but the problem with this background is that most day jobs come with certain luxuries (believe it or not) that almost everyone takes for granted.

For example, here are just a few built-in benefits that most W-2 employees assume…

- They're expected to focus on a handful of key responsibilities in a larger organization (without worrying about everything else happening in the overall business).

- They rarely have to work on weekends (or certain designated days of the week).

- They're allowed to unplug from work after they leave the office.

- They aren't held responsible/accountable for all of the company's problems (and they also don't share in the risks or rewards when things go well or poorly).

On the flip side – when you start your own business (even one as straightforward as land investing), you're effectively running an ENTIRE COMPANY as one person.

Even if your company consists of two or three people from the outset (if you're lucky enough to find a good business partner), running a company is a completely different ball game than most people are accustomed to.

- There are a lot of moving pieces to manage and keep track of.

- You'll encounter some BIG questions and vast areas of uncharted territory, and nobody will spoon-feed the answers to you. It takes serious work to connect the dots on your own.

- You may spend days, weeks, even MONTHS working on some aspects of your business with no financial payoff to show for it.

- There are some very real startup costs you'll have to cover at the outset, and they'll only yield rewards if you execute each step carefully and correctly.

- Ultimately, there is no guarantee of success. Even if you do everything right, it's still possible that the results won't be what you expect.

For many people – these concepts simply do not compute.

Every so often, I hear from someone who is frustrated by the fact that they've put in “X number of hours” or “X number of dollars,” and it hasn't resulted in “X amount of profit.”

As someone who spent several years trading hours for dollars in a day job, I fully understand the difficulty of changing this mindset. The proposition of “no guarantees” doesn't sound appealing to anyone, but that's exactly what comes with the territory when you become an entrepreneur.

When you're running a business, there are no promised paychecks that accumulate by the hour. A TON of work needs to get done, and your customers don't care how much of your time or money it consumes; they only care about the value you can deliver to them at the closing table.

The good news is – when land investors get paid, they tend to get paid very well… but these paychecks don't materialize by merely “taking action”; they materialize by taking the right actions.

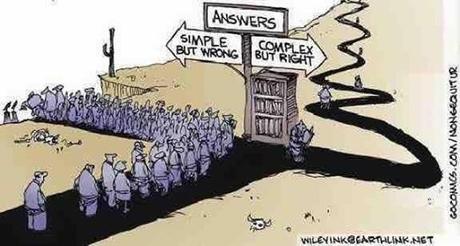

Everyone wants a simple, 1 + 1 = 2 system to follow… and to some extent, I think these systems do exist in the world – but even when you're following a proven set of instructions, there are still DOZENS of tiny variables that, when tweaked in certain directions, can have a significant impact (for better or worse) on the results.

What You Don't Hear in the Sales Pitch

Most people explain the business of flipping real estate as a two-step process:

Buy Low.

Sell High.

Sounds pretty simple, right?

Let's dissect this a bit, and talk about what is baked into the first step of “Buy Low.”

In a land flipping business, the “Acquisition Process” usually looks something like this:

- Get a List

- Sort the List

- Send Your Marketing Campaign (Mail, SMS, Cold Calling, etc)

- Field the Responses

- Make and Finalize Offers

- Complete Your Due Diligence

- Close the Deal

Still sounds fairly straightforward… right?

When we start working through each step, we'll find that each stage can be FILLED with obstacles and pitfalls that can derail the whole process if we aren't careful (click on any one of those links above, and you'll get a feel for how much work is baked into each step).

RELATED: The Land Flipping Lifecycle

For example, let's consider what it takes to Get a List.

There are a couple of routes you can take when obtaining your list…

- One option is to get your list (specifically, a delinquent tax list) directly from the county (which will present a unique series of headaches to deal with).

- Another option is to get it from a real estate data service (of which there are many to choose from).

There are several consequences (both good and bad) that will result from whichever choice you pick.

For example… let's say you're getting your list from a county.

After you call enough counties, you'll inevitably find that,

- Some county workers will have no idea what you're talking about.

- Some county workers will give you the wrong list.

- Some counties will charge too much for the list.

- Some counties won't provide the list in the right format.

- Some counties won't provide the list at all.

Alternatively, another list of caveats and issues can lurk in the background if you're using a data service.

- Some county databases may be old and outdated.

- Some county databases may be incomplete or inaccurate.

- Some data services are far too expensive for a beginner to justify.

- Most databases will not come with current or accurate delinquent tax data (if that's something you care about).

- If you don't understand how to filter the data appropriately, your marketing efforts will be watered down, and you'll waste untold amounts of money.

As you can see, whichever method you pick – there is MUCH more to the story than simply “Get a List.”

As you continue working through every subsequent step after this, you'll find that each one has A LOT of little obstacles to get over… and if you aren't aware of all the difficulties that could come up along the way, any one of these problems could sabotage your success.

The land investing business model can be extremely powerful when you follow each stage until completion. Still, you'll only see these results first-hand if you have the endurance to overcome these obstacles and not give up at the first, second, third, or tenth sign of trouble.

This only happens when you can see the bigger picture, and many new investors can't see it.

RELATED: Will Growing Competition Ever Kill The Land Investing Business?

Luck and Experience

It's important to remember that all of these little problems, questions, and bumps in the road are 100% normal. Every business has them.

When you've worked in this business for years and seen your fair share of great deals, you eventually learn what NOT to do. Making all the right business moves starts to become second nature, and you'll start taking all the right steps almost without thinking about it.

For some of the more experienced land investors, it's easy to forget about the mountain of challenges they initially faced.

It's easy for them to over-simplify the process when explaining it to others because they're so far removed from what it was like when they were getting started.

Seasoned pros tend to forget the fear and uncertainty of not knowing what they are doing.

To some extent, I think it's true in any profession that the more “pro” a person gets, the more disconnected they can become from just how many difficulties there are for beginners.

In his book The Art of Explanation, Lee LeFevre refers to it as the “curse of knowledge.” When you get to the point where you know a lot about something, it's hard to remember what it was like back when you didn't know squat.

People with lots of experience make it sound so easy – and for the most part, it's hard to fault them for it. After all, they've built up a MASSIVE mental database of knowledge and personal experience and they're not making it up. For them (and the small handful of people on their level), it actually is pretty easy.

But what about the other 99% of investors still trying to figure things out? A novice only knows what they're told. While following instructions can be instrumental in setting a person on the right track, the REAL learning (the stuff that actually sticks) oftentimes doesn't happen until they start doing the work.

Even with all the instruction in the world, most of us don't fully understand how much we don't know. Before the lessons solidify, we must experience a few painful missteps first-hand.

How Much ‘Luck' Is Involved?

It's worth noting that most long-term land investors had some kind of ‘lucky break' early on.

When land investors follow the proper steps, find a profitable deal, and see it through the full land flipping lifecycle, they will experience the thrill of making money from a land deal. This early win is an incredible high.

On the other hand, it's an incredible low to do all the same work, spend the time, money, and energy, and then not find a profitable land deal. Whether an investor experiences this incredible high or low can greatly impact their decision to continue or quit their land investing business.

When I reflect on my first year in this business, I honestly might not have survived if I hadn't found a profitable deal in my first few campaigns. I knew how crucial it was to see positive results early on, so I proceeded painstakingly slow. My perfectionism from the start paid off, but I also have to admit that a bit of ‘luck' was involved.

While hard work often leads to more luck, it doesn't guarantee success.

It's easy to work hard at the wrong things—I've done this more times than I'd like to admit.

Sometimes, success is about being in the right place at the right time, whether by chance or divine intervention. But the one thing we can control to increase our chances of luck is to ensure we're showing up and doing our part.

Given the importance of early wins, it's critical to focus on finding solid, profitable deals.

Avoid unprofitable activities that waste time. If an activity won't lead you directly to a profitable deal, don't do it.

We all have a finite amount of patience. The clock is ticking, and any normal person will become demoralized if they don't see tangible results in a reasonable time.

Why Do Land Investors Fail?

While there's a lot that contributes to a land investor's success or failure, if I had to boil ‘failure' down to one single thing, I would say the amount of work is what kills off the dream for many new land investors before they ever find their groove.

It takes a great deal of effort to start and grow a land investing business. While I firmly believe it is less risky and less complicated than most real estate investing niches in the world today, it still requires some serious work—which is overlooked by many when they're getting into the business.

Most aspiring land investors get turned on to this business idea because of its simplicity and the MASSIVE opportunity for finding insanely profitable deals.

And make no mistake, it IS an amazingly compelling concept – I still get excited about it today! Most of us can agree that buying a property for a small fraction of its true market value and then reselling it for a jaw-dropping profit is a pretty cool concept.

What you don't hear about in all those gleaming testimonials and sales pitches (or perhaps you do hear it, but fail to recognize its significance) is that for every success story, that person usually spent a solid year (maybe longer) educating themselves, learning A LOT of lessons, and probably fighting a long, uphill battle filled with moments that tested their resolve, and would've sent most people running.

Sometimes people get lucky, but more often than not, a person will have to dig even deeper after their first attempt to reevaluate and alter their approach where necessary and execute the process again.

And let's not forget that these challenges are what ultimately make success satisfying.

This is a business that anyone can do, but many people won't stick with it. Not because it doesn't work, but because many people aren't cut out for the entrepreneurial life (and that's okay).

We all love thinking about the upside potential of self-employment, but the downside isn't nearly as fun to deal with.

RELATED: Truth and Lies About Full-Time Real Estate Investing

The “Success” vs. “Failure” Mindset

As someone in the education space for land investors, I've had the benefit of seeing MANY people who made it in this business and those who didn't stick with it.

Between the two groups, I've noticed distinct differences in how each type of person approaches problems…

- People who fail get stuck in one place because they feel paralyzed by their lack of knowledge.

- People who succeed are energized by the information gaps and find great satisfaction in discovering the answers to their questions.

- People who fail cannot move forward without getting “permission” from me (or another experienced land investor) to take each new step.

- People who succeed are fascinated by the process. They know how to consider all ideas and think independently. They aren't afraid to find new “hybrid” approaches and discover new ways to get the results they're looking for.

- People who fail see the world in black and white. When one approach doesn't work with ease, they conclude that “it doesn't work,” they throw in the towel and search for something that sounds easier.

- People who succeed see the world in many dimensions. When one approach doesn't work, they challenge themselves to figure out why. They test new ideas, take new steps forward, and when one approach doesn't work, they learn how to isolate their mistakes and never repeat them.

Successful land investors take full responsibility for building and running their businesses. They know when and how to ask questions, but they don't wait for someone else to explain every last detail and put all the pieces together before they'll take action.

If you want to succeed as a land investor, take the initiative, work to comprehend the essentials, be sure to tweak and refine your approach when changes are necessary, and no matter what, keep pushing forward.