REtipster features products and services we find useful. If you buy something through the links below, we may receive a referral fee, which helps support our work. Learn more.

As a real estate investor and former commercial banker, I have closed hundreds of real estate transactions throughout my career.

I've seen a lot of different situations and dealt with virtually every type of buyer, seller, lender, and property type imaginable. After working through many of the different scenarios that can materialize in the real estate closing process, I have to admit – I understand why most people are intimidated by the idea of closing a real estate transaction themselves. For understandable reasons – there can be a lot of confusion and fear about how to close a real estate deal without the assistance of a professional.

There always seems to be endless paperwork and many legal hoops to jump through (everybody wants to protect themselves from liability, etc.). While some of this documentation is certainly good practice – I've learned that when you boil it all down, closing a real estate transaction is a fairly simple process – especially when it's an all-cash transaction (no financing or mortgages involved).

When you're buying a property for just a few hundred bucks (which is how most of my deals work), and you're already on a tight budget to begin with, it can be difficult to justify paying twice the amount of your purchase price just to close the darn thing. If you're in a situation where you need to act fast, acquire a property inexpensively and make the closing as easy as possible, closing it yourself may be the most advantageous way to move forward.

If you're in this kind of situation (or just want to understand how the process works, inside and out), I want to show you the exact steps I use when closing a real estate transaction in-house. The process is very similar, regardless of whether I'm buying or selling a property.

Disclaimer: Please be aware that I am not an attorney and the information in this article should not be interpreted as legal advice. Every state has different laws, and every real estate transaction has unique variables that can affect these standard documents listed below. Even though these are the exact steps & documentation that I use in my closings – don't assume that this information fully applies to your situation. Before you act on anything described below, consult with an attorney or legal professional in your area to confirm you're following the right steps and procedure.

Conducting a self-closed real estate transaction isn't appropriate for all people and situations. The process DOES require some significant attention to detail and organizational skills. Some people are very good at staying organized and keeping track of these details, and others aren't. Don't try to close your deals unless you're willing to go slow and get the help you need to ensure you're completing each step by following the laws and regulations of your state.

RELATED: Closing With An Attorney – When and Where is it Required?

Why Is This Important?

Being able to close a transaction in-house is a huge asset. By handling this entire process in-house, you can minimize paperwork and make the process much less intimidating for the person on the other end of your transaction.

Depending on the property, you may even find that closing the transaction yourself can be faster and less cumbersome for everyone involved. If for no other reason – I've found that it's extremely helpful to have a basic working knowledge of how real estate transactions work. It's important to understand why title companies require what they do in a closing, which documents are an absolute must, and which documents are more discretionary.

It is often worth the money to hire a professional closing agent (I usually do it when I'm paying more than $5,000 for a property and/or if the property's fair market value exceeds $10,000). Still, when you're buying a property for pennies on the dollar, there are a lot of cases where you can easily close the deal and get by without this added cost.

Whenever I close a real estate deal in-house, my closing checklist includes the following steps:

1. Purchase and Sale Agreement

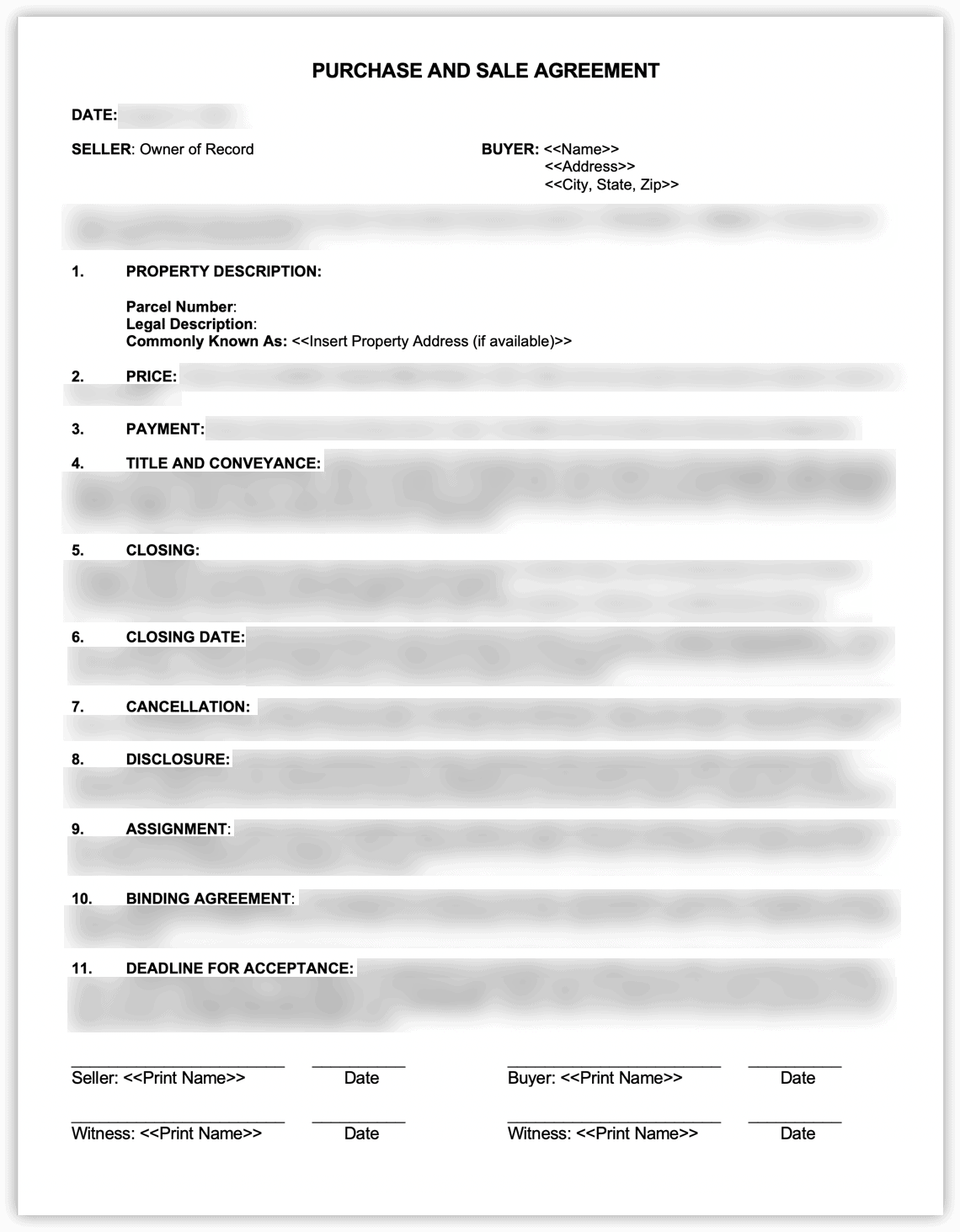

Most real estate agents use a very long and confusing template for this contract – but this document doesn't need to be complicated. I use a very simple, 1-page document that lays out the basic terms of the deal (whether I'm buying or selling the property – the language is 98% the same in either scenario). It looks something like this:

As you can see – this is a no-frills contract and the basic items included are as follows:

- The date of the agreement, the date when the agreement expires, and the date by which the transaction must be closed

- The property's purchase price and how the price will be paid (e.g., via cash, wire transfer, cashier's check, etc.)

- The state, county, parcel number, and legal description of the property being bought/sold

- The name and signature of both the buyer and seller (in some states, these signatures will need to be witnessed by a third party as well)

- Details on which party will pay closing costs (e.g., property taxes, title work, recording fees, etc.)

- How will the seller convey the title to the buyer (e.g., via Warranty Deed, Quit Claim Deed, etc.)

If you're looking for some examples (a bit more complex and detailed than my template), you can also refer to a website like Rocket Lawyer to find what you're looking for.

2. Title Search

For this part of the process, you can either hire a title company to issue you a title insurance policy (which will ensure a clear title to the property) or try to complete the title search yourself.

If you’re trying to do your title search, the process starts with obtaining the “abstract of title” (all the relevant documents that pertain to your property, usually dating back about 40 years).

There are a few different ways to get this, as I'll explain in the video below:

Also, keep in mind if you're a DataTree user, you can also perform your own title searches in some (but not all) markets around the country. If you're working in a county where DataTree has this data available, it can be a much faster and cheaper way to get the job done.

Here's a link to DataTree's GeoCoverage Map, to see if this will work in your area.

Once you have the title work, it's time to look through it to verify that there are no clouds on the title or breaks in the chain of title. Here are some basic instructions for doing it (you can also find more details here).

As you’re trying to make sense of these documents, there are a few key things you’ll want to look out for:

1. Does the seller (i.e., the person you’re buying from) have a clear title to the property?

You’ll know the seller has clear title to the property if you don’t see any breaks in the chain of title (the previous deeds of record should show a clear chain of ownership, from owner A to B, owner B to C, owner C to D).

If you see a gap in the chain of ownership that isn’t explained (with deeds going from owner A to B, and then from owner D to E, with nothing connecting them), that is a break in the chain of title. If the seller still claims to own a clear title to the property, they need to provide the missing documents to prove it (because, according to the county’s records, they don’t).

2. Are there any Deed Restrictions on the property?

If a property comes with any deed restrictions (which effectively limits what the owner can do with it), they will usually appear as a separate document in the chain of title, OR the restrictions may even be written into one of the previous deeds (which is why it’s important to actually read what each deed says).

Most deed restrictions come into existence as part of a Home Owners Association, but there can be other reasons for them.

3. Are there any Liens or Mortgages on the property?

Any liens or mortgages on the property should appear in the chain of title, usually as a separate document. If you do find any of these documents in your title search, it means the seller needs to eliminate them by paying off the appropriate parties who hold the lien or mortgage and then getting those liens/mortgages discharged.

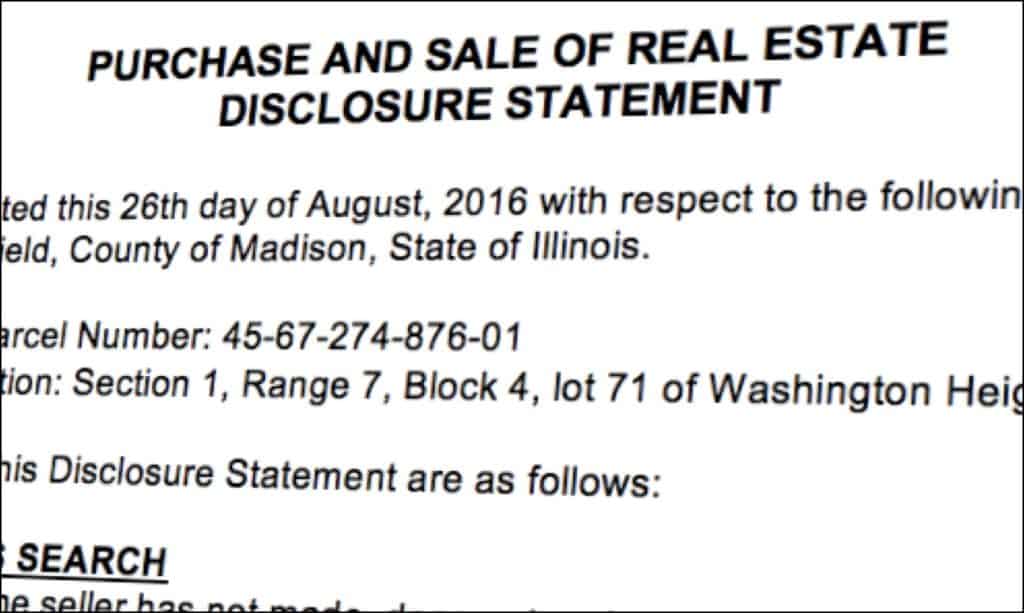

3. Disclosure Statement

The purpose of this form is to ensure that when I'm selling a property, the buyer is 100% responsible for doing their due diligence, not me.

When I'm buying and selling properties rapidly, I don't always have time to research every potential issue under the sun. I investigate the most common issues that are relevant to me, and then I move forward.

Knowing that it's possible for the occasional property to have issues that I'm simply not aware of, the purpose of a Disclosure Statement is to confirm a few things in writing:

- The buyer understands that it's their job to do their homework before they purchase the property. I'm not going to be blamed for their lack of research.

- (as the seller) am not assuming any liability or responsibility for issues I was never aware of in the first place.

- The buyer is releasing me of all liability in the transaction (i.e., they won't turn around and try to sue me at the first sign of trouble).

Don't get me wrong – I've never even come close to getting sued or encountering legal issues with this type of thing, but if I ever did – a Disclosure Statement like this would be very helpful to have in my corner. This is why I've made it a standard order of business always to get this document signed when I am selling a property.

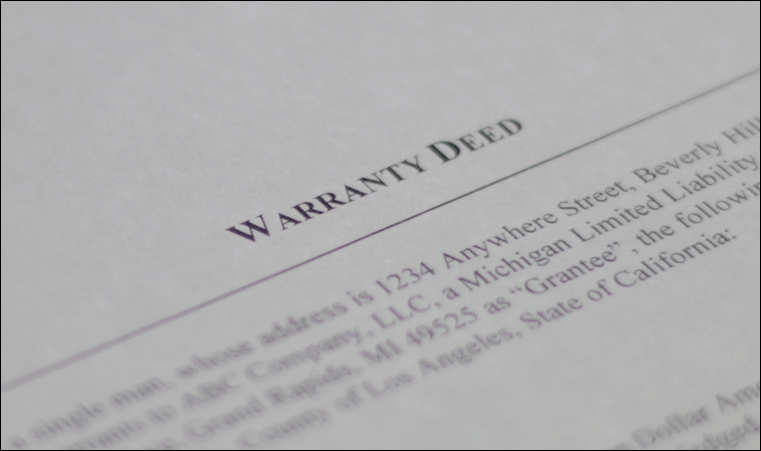

4. Deed

The ultimate definition of who owns a property comes down to what's written in the DEED. This is the document that everything else revolves around.

Several different types of deeds can be used when transferring real estate. Let's cover a few of the most commonly known ones (and what implications are inherent in each one)…

Warranty Deed

With a Warranty Deed, the seller is giving the buyer their “Warranty” (i.e., Guarantee/Promise) that the title to the property is free and clear, and the buyer will receive all reasonable rights to the property. This deed should only be used when the seller knows for a fact that the property's title is clear of any liens and encumbrances. Most educated buyers will strongly prefer this type of deed (and if a lender gets involved – it will be required).

Most sellers are okay with signing a Warranty Deed because:

- This was the same thing they received when they bought the property.

- They paid for a title insurance policy when they bought the property, which protects them from any issues (should they arise).

If you’re unsure whether the title is clear, don’t use this kind of deed when selling a property.

Quit Claim Deed

With a Quit Claim Deed, the seller offers no warranty concerning the property's title. In essence, the seller isn't even claiming to have any ownership in the first place. By signing this document, the seller is saying,

“Whatever interest I may have in this property (if anything), I am transferring it to the buyer.”

Because of how open-ended this type of deed is, it tends to create problems in the chain of title for future owners since it lacks any guarantees or clear statements about who owns the property.

All this to say, if a buyer is willing to accept this, they should really be doing their homework to ensure the property has a clear chain of title.

Note: In my experience, most buyers have no idea what differentiates one type of deed from another – but as an educated real estate investor, this is a distinction you need to be aware of.

If the seller's goal is to simply not guarantee the title from the beginning of time, another alternative is to issue a Special Warranty Deed.

Special Warranty Deed

An alternative to the Warranty Deed and the Quit Claim Deed is the Special Warranty Deed. This type of deed is typically used when the seller is willing to guarantee that no defects occurred with the property's title during the time they owned it.

With a Special Warranty Deed, the seller ISN'T saying that the property has a spotless record going back to the beginning of time; only that it has accrued no defects during its period of ownership (there can be a big difference here, and a Special Warranty Deed can help you spell this out).

Here's a little tutorial showing how to create a Special Warranty Deed with a service called Rocket Lawyer (you can use this same service to create a Warranty Deed and Quit Claim Deed as well).

Alternatively, if you're looking for an alternative source to get some blank deed templates, you can also check out US Legal.

Legal Description and Title Vesting Information

When you're buying or selling a property – you'll also want to make sure the property is being transferred to the buyer with the correct ownership structure.

When a buyer is just a single person, it's pretty simple. You can just write their name and their marital status as “single,” “married,” or “unmarried” (e.g., John Smith, a single man).

If the buyer is a Corporation or an LLC, you can write the exact legal name of the entity and the state in which it resides (e.g. – XYZ Properties LLC, a Florida Limited Liability Company).

However, if two or more people are buying or selling the property (like a married couple, for instance), you need to pay close attention to the details and verify how they should be holding or transferring the title. Some states use slightly different terminology – but these are some of the more common ways that two people can hold the title to a property.

- Tenants by the Entireties

- Joint Tenants

- Tenants in Common

- Joint Tenants with Full Rights of Survivorship

Again, you'll want to determine the correct terminology to use in your state to ensure you're drafting this part of the deed correctly.

One easy way to get the correct vesting information and the full legal description of the property is with DataTree, as this video explains.

DataTree has this information in a lot of markets around the country, but not every market.

If DataTree isn't an option, you can also get this information by looking at the most recent deed in your title search. DataTree just makes it a bit easier to copy and paste the information exactly as it's written in the chain of title, to help you avoid making any errors.

5. Supporting Documentation

Many states require some additional “supporting documentation” as a way of notifying the local municipality (i.e. – City or Township) about the transaction that just took place.

The county should be fully aware of this change in ownership because they recorded your deed, but in many cases – the city or township administration is in a completely separate office and they don't share the same systems with the county. As such, they need to be notified separately about the property's change in ownership (and if they aren't made aware of the change, they'll continue sending the property tax bills to the old owner).

In most cases, this is a simple notification form that consists of one page, and it does a few key things:

- Lets the city/township know that the property has been transferred to a new owner.

- Informs the local Assessor of what the sale price was (which assists them in determining what the new assessed value of the property should be).

- Notifying the local treasurer who/where they should send all future tax bills.

Unfortunately, the exact name of this document varies quite a bit from state to state, so even though it serves the same basic purpose, it can seem a bit more complicated than it is. For example:

- In Arizona, it's called an “Affidavit of Property Value” and it looks like this.

- In Michigan, it's called a “Property Transfer Affidavit” and it looks like this.

- In Maine, it's called a “Real Estate Transfer Tax Declaration” and it looks like this.

- In Hawaii, it's called a “Conveyance Tax Certificate” and it looks like this.

- In Nevada, it's called a “Declaration of Value” and it looks like this.

If you're not sure whether your state requires this form, this video explains how you can figure it out…

See what I mean? You get the idea.

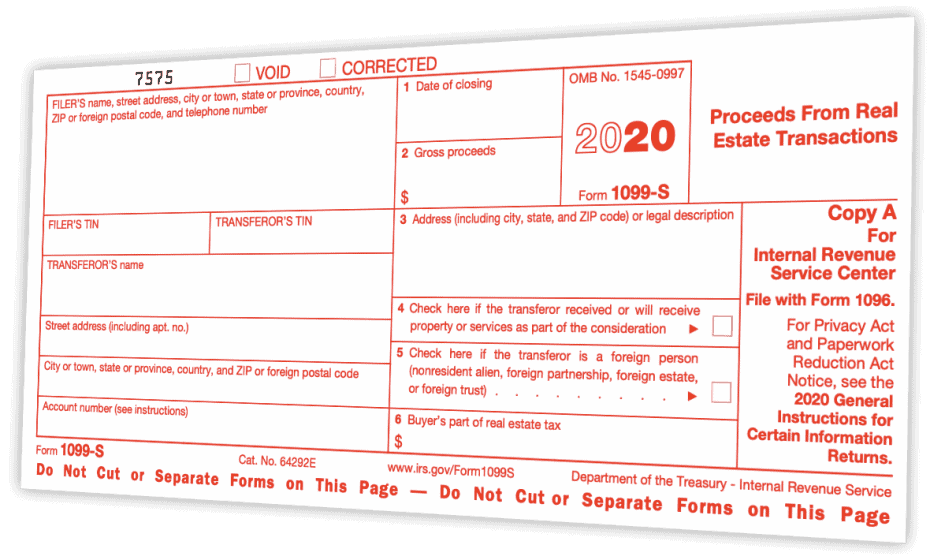

6. IRS Form 1099-S

There are some exceptions where this form isn't required, but as a general practice, if you're planning to facilitate the signing of these closing documents yourself, it's a good idea to either:

- Plan on filing this form yourself.

- In a written agreement, designate the other party as the responsible person.

Whether you file the form yourself or designate the other party to do so – it's a fairly straightforward process (but it can take a bit of learning if you've never done it before). To learn more about why the 1099-S is important and how you can handle the filing process in your closings, check out this blog post.

7. Record Keeping

Once a transaction is closed, and everything has been signed, sealed, recorded, and delivered, you should keep copies of all the fully executed documents in your file (and you should make sure the other person in your transaction has copies of these things as well).

Closing your own real estate deal doesn't have to be difficult. When I am buying or selling a property with a cash sale (most of my deals are cash transactions these days), it's just a matter of taking the time to ensure that all the documents are completed with the correct information, signed by all appropriate parties and then sent to the appropriate places for recording (the deed should be sent to the county for recording and the supporting documentation should be sent to the local city, township or municipality office for their records).

Document Templates

A lot of attorneys would love you to believe you have to cough up $1,000+every single time you need to close a deal. There may be the occasional case where you have a VERY complicated deal that ought to be handled by an attorney (and in some states, the involvement of an attorney is required – see this blog post for more information). Still, I've found that in many cases, there is nothing wrong with using these basic templates to close transactions in-house.

In my first several years of closing my deals in-house, I used US Legal as a resource to get the document templates I needed. I still think they're a great resource, but I use Rocket Lawyer these days because they do a great job of making the process easy and helping me fill out each document in the questionnaire format.

Whatever you decide to do, realize that it doesn't take a huge investment to get the basics you'll need to close your own deals. You could save thousands of dollars in attorney fees with these online resources (and don't forget, most of these templates can be used repeatedly).

Need More Help?

As you’re nearing the end of this guide, all of this information may seem overwhelming.

Don’t panic, and don't try to become an expert overnight. I can tell you from experience that my first self-closing felt like a marathon, but it gets significantly easier on the second, third, and fourth time through the process (and every subsequent time after that).

Closing your real estate deal doesn't have to be difficult, but it is important to go slow and ensure you're completing each process step correctly.

Unfortunately, I can't provide the exact legal documents and instructions for every one of your closings because I'm not an attorney, and endless variables can affect your closing documents.

At the same time, the standard closing process involves a similar set of documentation to get the job done… and if you need help connecting the dots and understanding how the process works, I’d love to help you get there.

When I was closing my first few deals, I had a TON of questions, and it would have been very helpful if someone could have simply held my hand and thoroughly explained what each document was all about, what kinds of issues to watch out for, and how to navigate through each step of the process.

It's all available as part of Module 6 in the Land Investing Masterclass, so if that sounds like it might be helpful, be sure to check it out!

Closing With Seller Financing?

The steps above are fairly similar to transactions that involve owner financing. The primary exception is that a deal that involves owner financing requires a few additional documents. Depending on the state and the transaction specifics, some seller-financed deals will make the most sense to use in conjunction with a land contract (aka – contract for deed), which I explain in this blog post). Likewise, other seller-financed deals will make more sense to use in conjunction with a Promissory Note and Deed of Trust, which I explain in this blog post.

I hope you'll start to realize just how doable this process is. Once you get comfortable with these steps and the specifics pertaining to the state your property is located in, it is possible to start closing deals yourself.