What Is a Deed of Trust?

REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

How a Deed of Trust Works

In some states, a buyer may use a deed of trust to secure a home loan instead of a mortgage. There are three parties in a deed of trust:

- Trustor (the borrower).

- Beneficiary (the lender).

- Trustee (a neutral third party holding the legal title until the loan is paid in full)[1].

When a buyer or borrower enters into a deed of trust, the borrower (trustor) and the lender (beneficiary) confer the legal title of the property to an impartial third party (trustee), typically the title company or attorney that facilitated the closing of the trasaction[2], until the borrower pays off the entire loan. If the buyer defaults on the loan, the trustee can start a foreclosure proceeding so the lender can recover the money.

Note that during the loan term, the buyer still keeps the equitable title to the property, meaning they can occupy, use, and enjoy the property. More importantly, it gives them the right to acquire the legal title to the property once the loan is paid off.

What Happens When the Loan Is Fully Paid?

When the buyer pays the loan in full, the lender will issue a deed of reconveyance, a document that states that the borrower has fulfilled all of their loan obligations[3]. The trustee also releases the legal title of the property and transfers it to the buyer, who now becomes the owner.

The deed of reconveyance is recorded on the public record to cancel out the deed of trust. This act means any property title search will now show the property owner as the unencumbered owner of the home[4].

RELATED: How to Close a Deed of Trust In-House (Seller Financing Tutorial)

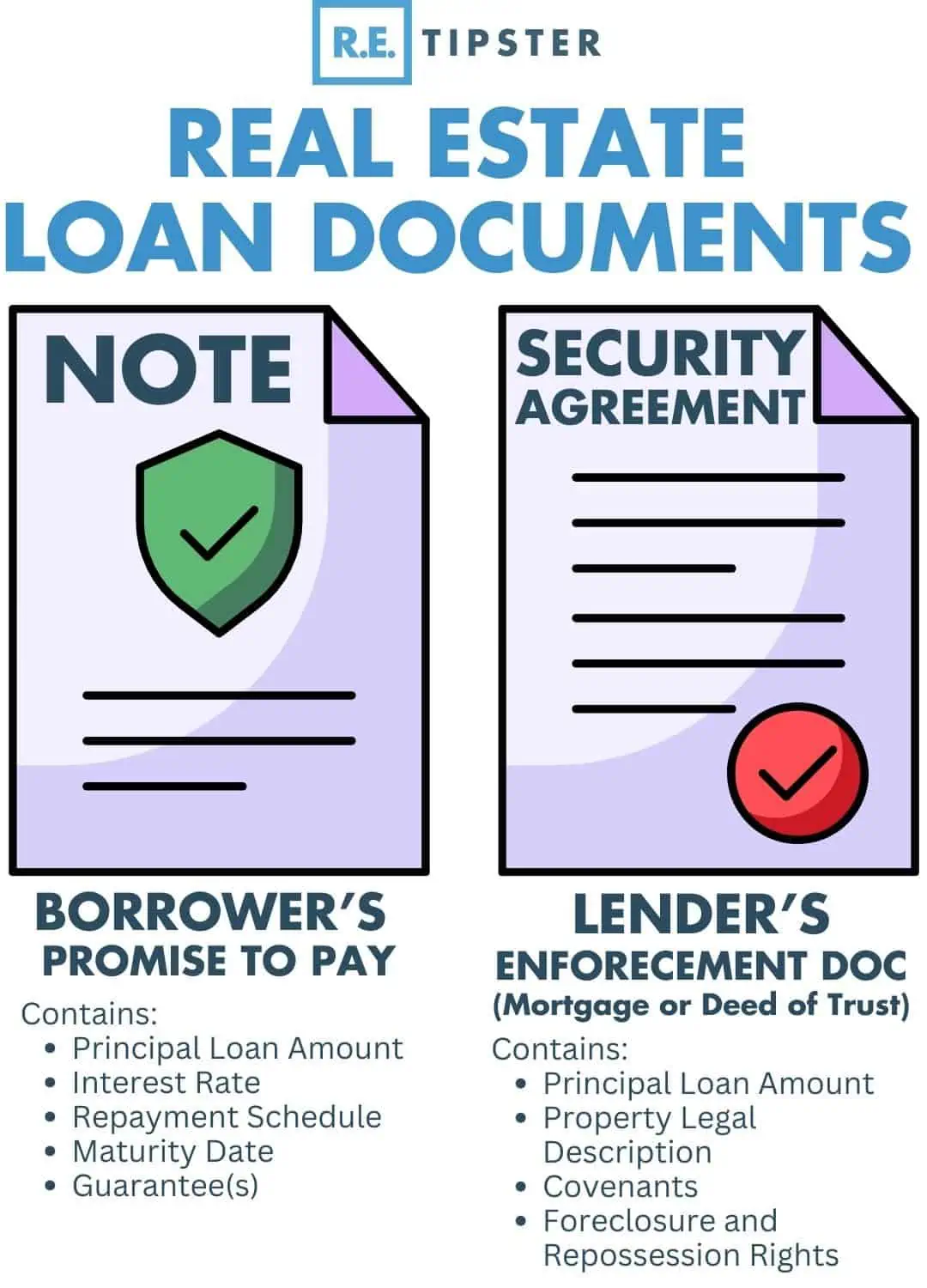

Deed of Trust vs. Mortgage

A deed of trust and a mortgage allows the home buyer to put up the property as collateral for the home loan. However, a mortgage is an agreement between only two parties: the lender and the borrower[5]. When borrowers sign a mortgage, they give the legal title directly to the lender as security for the loan.

By contrast, a deed of trust involves the borrower, the lender, and a third party. The latter is entrusted with the legal title of the property until the borrower has paid the loan in full.

Another difference between a deed of trust and a mortgage is the foreclosure process. With a deed of trust, foreclosures do not require any judicial proceeding[6]. The trustee may easily proceed with selling the property on the lender’s behalf, and the borrower cannot buy the property back after the foreclosure sale.

On the other hand, mortgages typically require the lender to go through the court process (known as a judicial foreclosure) before foreclosing on the property and selling it[7].

RELATED: The Full List of All Judicial and Non-Judicial States in the U.S.

Which States Use a Deed of Trust vs. a Mortgage?

More than 30 states use a deed of trust. Some states allow both a deed of trust and a mortgage, while others only allow one of the two[8]. A deed of trust is also a matter of public record in the county where the property is located.

The table below shows which states allow which document and which states allow both.

| State | Mortgage | Deed of Trust |

| Alabama | Y | Y |

| Alaska | Y | |

| Arizona | Y | Y |

| Arkansas | Y | Y |

| California | Y | |

| Colorado | Y | |

| Connecticut | Y | |

| Delaware | Y | |

| District of Columbia | Y | |

| Florida | Y | |

| Georgia | Y | |

| Hawaii | Y | |

| Idaho | Y | |

| Illinois | Y | Y |

| Indiana | Y | |

| Iowa | Y | |

| Kansas | Y | |

| Kentucky | Y | Y |

| Louisiana | Y | |

| Maine | Y | |

| Maryland | Y | Y |

| Massachusetts | Y | |

| Michigan | Y | Y |

| Minnesota | Y | |

| Mississippi | Y | |

| Missouri | Y | |

| Montana | Y | Y |

| Nebraska | Y | |

| Nevada | Y | |

| New Hampshire | Y | |

| New Jersey | Y | |

| New Mexico | Y | |

| New York | Y | |

| North Carolina | Y | |

| North Dakota | Y | |

| Ohio | Y | |

| Oklahoma | Y | |

| Oregon | Y | |

| Pennsylvania | Y | |

| Rhode Island | Y | |

| South Carolina | Y | |

| South Dakota | Y | Y |

| Tennessee | Y | |

| Texas | Y | |

| Utah | Y | |

| Vermont | Y | |

| Virginia | Y | |

| Washington | Y | |

| West Virginia | Y | |

| Wisconsin | Y | |

| Wyoming | Y |

What Is Included in a Deed of Trust?

The deed of trust must have accurate information and essential details to be a legally binding document, including[9]:

- The original loan amount or the amount of money that the lender is giving the borrower for the purchase of the property.

- The complete names of the borrower, the lender, and the trustee.

- The inception date or start date of the loan and the maturity rate or the date when the loan is expected to be paid in full by the borrower.

- The location of the property and the legal description of the real estate. This legal description refers to the one filed with the country recorder’s office. It may identify the parcel of land in metes and bounds or refer to the official name of the subdivision, the block number, and the specific lot number of the property.

- The specific provisions, requirements, and terms of the home loan that all parties agreed to.

- The terms and conditions regarding late payments, including the late fees, their amount, and when payment is considered late.

- What happens when any party breaches the agreement, such as when the borrower defaults on payment. Some deeds of trust and mortgage involve a power of sale clause, which allows the lender and the trustee to sell the property when a buyer defaults on the home loan.

- Prepayment penalties and other riders.

- Acceleration or alienation clauses. These allow the lender to demand immediate and full payment of the home loan if the borrower defaults, sells the property, or transfers the title.

Takeaways

- A deed of trust is a document that represents a real estate transaction, which entrusts the legal title to an impartial third party, a trustee. The trustee holds the property’s legal title until the borrower satisfies all their loan obligations.

- The deed of trust protects the lender in case the borrower fails to pay back the loan. If the borrower stops paying the loan, the trustee takes control of the property and starts the foreclosure process so the lender can recover the money.

- Some states use both a deed of trust and a mortgage, while others only allow one of the two. Both documents are matters of public record.

- When the buyer fully pays the loan, the trustee releases the legal title to the buyer, and the lender files a deed of reconveyance to the county saying that the buyer is the legal owner of the property, and all of their loan obligations have been satisfied.

Sources

- Weintraub, E. (2021.) What Is a Deed of Trust? The Balance. Retrieved from https://www.thebalance.com/definition-of-deed-of-trust-1798782

- Segal, T. (2021.) Trust Deed. Investopedia. Retrieved from https://www.investopedia.com/terms/t/trustdeed.asp

- Dehan, A. (2021.) Deed Of Reconveyance Explained. Rocket Mortgage. Retrieved from https://www.rocketmortgage.com/learn/deed-of-reconveyance

- Corporate Finance Institute. (n.d.) What is a Deed of Reconveyance? Retrieved from https://corporatefinanceinstitute.com/resources/knowledge/other/deed-of-reconveyance/

- Loftsgordon, A. (n.d.) What’s the Difference Between a Mortgage and Deed of Trust? Nolo. Retrieved from https://www.nolo.com/legal-encyclopedia/whats-the-difference-between-mortgage-deed-trust.html

- Wichter, Z. (2020.) What’s the difference between a mortgage and a deed of trust? Bankrate. Retrieved from https://www.bankrate.com/mortgages/deed-of-trust/

- Merritt, C. (n.d.) Difference Between a Deed of Trust and a Mortgage. SFGATE.com. Retrieved from https://homeguides.sfgate.com/mortgage-state-vs-deed-state-1362.html

- Rocket Lawyer. (n.d.) Which States Allow Deeds of Trust? Retrieved from https://www.rocketlawyer.com/real-estate/home-ownership/real-estate-financing/legal-guide/which-states-allow-deeds-of-trust

- Bond, C. (2020.) Deed Of Trust: What It Is And How It Works. Forbes Advisor. Retrieved from https://www.forbes.com/advisor/mortgages/deed-of-trust/