REtipster features products and services we find useful. If you buy something through the links below, we may receive a referral fee, which helps support our work. Learn more.

If you're trying to sell a property with owner financing and want to understand how the process works, I will show you the process I go through when closing this type of real estate transaction with a Deed of Trust (Trust Deed).

Disclaimer: A deed of trust is not the right loan instrument for every seller-financed transaction. The goal of this blog post is not to replace a professional closing agent or suggest what type of loan documents you should be using. The goal is to educate you about how the closing process works with a deed of trust, so you understand the significance of each document.

I am not an attorney or CPA; this information is not legal advice. This is also not a suggestion that you should (or shouldn't) use a deed of trust or close your own deals. Every state has different laws, and every transaction has unique variables that can affect the documents and steps listed below. Before you act on anything described here, please work with a licensed, qualified attorney in your area to ensure you're using the right documentation and following the right procedures.

How a Deed of Trust Works

In the areas where a Deed of Trust is commonly used for seller-financed real estate transactions, it's a type of loan instrument that can make the foreclosure process much easier for the seller if the borrower ever defaults on the loan.

When closing with a Deed of Trust, there are three key documents (among others) that work together to transfer the property and provide security for the Lender. Those documents are:

- The Deed

- The Deed of Trust

- The Promissory Note

As we go through all the steps and documentation involved with a Deed of Trust closing, we'll establish how these three documents fit together.

1. Purchase Agreement

As with any real estate deal, everything starts with both parties signing a Purchase Agreement.

A purchase agreement (sometimes abbreviated at ‘PA') will clearly state the Buyer's and Seller's intentions, establishing all the terms, conditions, and details of the financing arrangement.

- The Sale Price

- Interest Rate

- Term (Duration) of the Loan

- Closing Fees

- Servicing Fees

- Late Payment Fees

- Prepayment Penalties (if any)

- Escrow Arrangements (if any)

- Earnest Deposit (if any)

- Inspection Period

- Closing Deadline

- Etc.

Unlike a cash transaction (where the buyer and seller go their separate ways after closing), a seller-financed real estate deal creates an ongoing relationship between both parties. When the deal is closed, the buyer and seller will effectively become the “borrower” and “lender,” they will continue to work with each other for the remainder of the loan term. As such, both parties must agree on their respective commitments to the deal.

When I sell properties with owner financing, I work with raw land. This type of property is remarkably uncomplicated (with no tenants, no improvements, no utility bills, etc.), so my purchase agreement doesn’t have to be long and confusing. The terms I offer my buyers are very similar from one deal to the next, and because of this, I can use a very simple contract to get the job done.

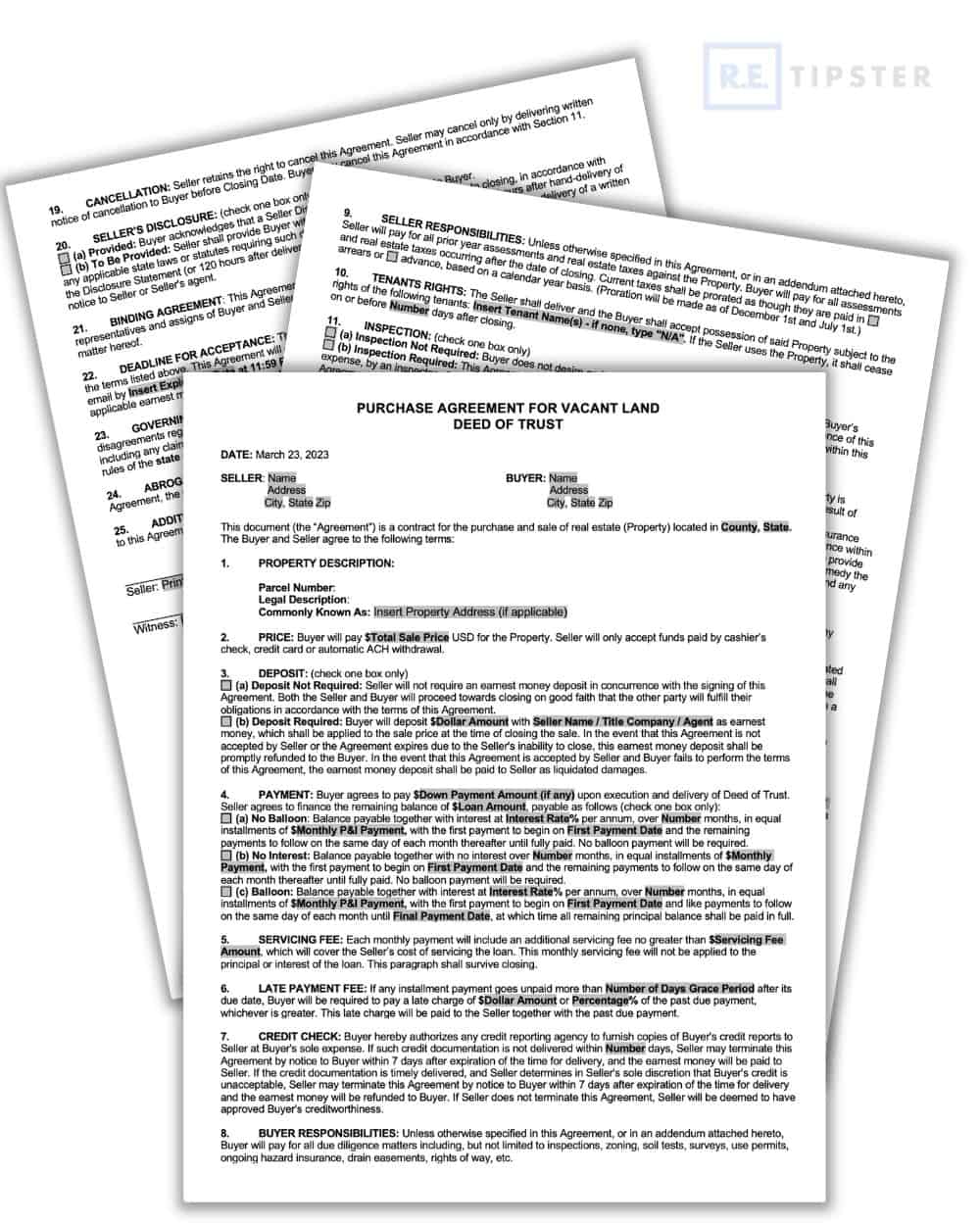

My template is just three pages long, and it looks something like this:

As you can see, it's pretty simple, and I like it this way because it doesn't intimidate the other party. It's straightforward, to the point, and easy for people to accept and move forward.

Filling out all of these details at the outset will take a few minutes, but once it’s finished and both parties have signed, all the subsequent steps become much easier because this agreement spells out all the details needed for the Promissory Note and Deed of Trust (below).

Need to generate a loan payment schedule? With this calculator, you can solve for the term, interest rate, principal, or payment. Enter three (3) of the four known fields, then press the button next to the empty field to calculate!

Once calculated, click “View Amortization Schedule” to see the results!

2. ID Statement

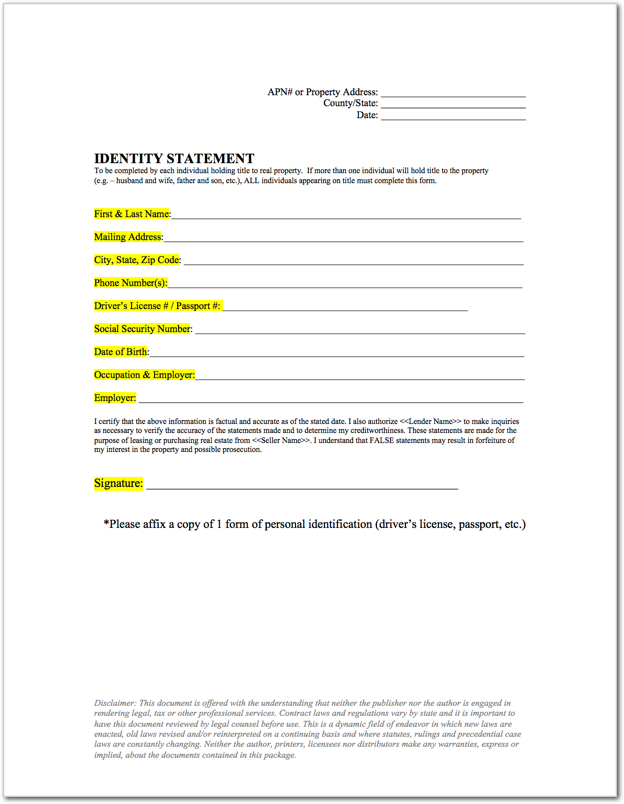

A personal identity statement is another simple form that will be helpful as you prepare the documents to close a seller-financed real estate transaction.

This is a 1-page document that asks for the following information from your buyer/borrower:

- First & Last Name

- Mailing Address

- Phone Number(s)

- Driver’s License or Passport Number

- Social Security Number

- Date of Birth

- Occupation & Employer

- Signature

- Copy of Driver’s License or Passport

Here’s what mine looks like:

This form accomplishes a couple of things:

- It helps verify the borrower's FULL legal name (which is important to ensure the buyer’s information is correct when preparing the loan documents).

- If the proper language is included, this form authorizes the seller/lender to pull a personal credit report on the buyer/borrower if needed.

Many title companies and closing attorneys will ask for all the same information when handling the closing. This document will also tell you a very brief but helpful story about who your borrower is, which is good information to know if you want to understand who you’re working with.

3. Promissory Note

The Promissory Note is one of the critical loan documents that should be executed between the Buyer and Seller at the time of closing.

This legal agreement between the Borrower (Buyer) and Lender (Seller) lays out the loan terms. It should include all the basic details, such as:

- Loan Amount

- Date of the Loan (including the first payment date)

- Interest Rate

- Payment Amount

- Number & Frequency of Payments

- How the Loan will be Paid (e.g., principal & interest, installments of interest-only with one lump sum on a specific date, or due on demand)

- How the Note will be secured (e.g., by a Deed of Trust)

- Whether the Lender can sell or transfer the note to another party

While it's not required, including an amortization schedule with the promissory note can help make it abundantly clear when each payment is due, the amount, and what portions of each payment will be applied to the principal vs. interest.

If you need a quick and easy way to create this schedule, you can do it with this simple loan calculator.

The Borrower should sign the Promissory Note, but it does not need to be recorded by the county. It acts as a legal document that can be used in court if you ever need to demand what you owe a defaulting borrower.

Important: Keep an original copy of this document (with the wet signature) in your files after the closing. Most documents can be scanned and stored digitally in your system, but this is one document that may be required if you ever need to foreclose on the borrower if they default on their loan.

4. Deed of Trust (a.k.a. – Trust Deed)

The Deed of Trust (also known as a “Trust Deed”) is a document that gets recorded along with the Deed in the county's records, and it acts as the “security instrument” for the lender's collateral.

In a seller financing scenario, a Deed of Trust technically involves three parties:

- The Buyer (Borrower)

- The Seller (Lender)

- The Trustee

This document contains much of the same information listed in the Promissory Note, with some additional language (which usually varies by state) that describes the Borrower's, Lender's, and the Trustee's options on how they can proceed in the event of default.

In most of the states where the Deed of Trust is recognized, this type of security instrument will allow the Trustee (which is usually designated as a title company, attorney, or loan servicing company) to handle the entire foreclosure process out of court, which is known as non-judicial foreclosure.

Non-judicial foreclosure isn't free (the lender will have to pay the Trustee to handle this process), but it can save considerable time and hassle by avoiding an even longer and more expensive court procedure, as would be required with any other type of loan instrument.

The “Power of Sale” Provision

For the Lender to take advantage of the non-judicial foreclosure (in the states where this option is available), the Deed of Trust must include the proper “Power of Sale” language within the document.

The non-judicial foreclosure process typically involves a series of notifications to the borrower, followed by a public auction, where the Trustee has the authority to either sell the property to a third party and recoup the cash, or in some cases, the Lender may be able to buy the property back from the Trustee.

To prepare the Deed of Trust form, you'll have to get the right template and complete it with all the pertinent details.

Important: Since the Deed of Trust works in conjunction with the Promissory Note, there should be no disagreements or variations in the terms listed in both documents (e.g., same loan amount, same interest rate, same payment terms, etc.). Failure to keep this information consistent between both documents could cause future problems for the Lender.

Preparing the Deed of Trust

In many cases, an attorney is hired to tailor this document specifically for each transaction. When a title company prepares the Promissory Note and Deed of Trust, they usually work from a state-specific, boilerplate template.

If you're looking for a more general template to work with, you could contact a local real estate agent to see if they have any state-specific templates available, or you could use a service like Rocket Lawyer, which makes the process extremely easy. This video explains how it works:

Once you've got the correct form and verified that it meets all your state's requirements (and includes the proper “Power of Sale” provisions), take a few minutes and read it through very carefully. Every state has differences in how this form is written, and as a general rule, it's important to understand exactly what you and the other party are agreeing to.

Note: When the transaction is closed, the Deed of Trust should be recorded by the county along with the Deed (see below).

5. Deed

At the same time, the Deed of Trust (item #4, above) should also be completed and recorded, which will effectively create a security interest in the property for the Lender by designating the Trustee as the person/entity with authority to exercise the Lender's foreclosure rights when appropriate.

Several types of deeds can be used with a Deed of Trust. The standard deed types can vary by state, but let’s cover a few of the more commonly known ones below (and what implications are inherent in each).

Warranty Deed

With a Warranty Deed, the seller is giving the buyer their “Warranty” (i.e., Guarantee/Promise) that the title to the property is free and clear, and the buyer will receive all reasonable rights to the property. This type of deed should only be used when the seller is confident the property's title is clear of liens and encumbrances.

Most educated buyers will strongly prefer this type of deed (and if a lender gets involved – it will almost always be required).

Most sellers are okay with signing a Warranty Deed because:

- This was the same thing they received when they bought the property.

- They paid for a title insurance policy when they purchased the property, which protects them from any issues (should they arise).

You probably don't want to use a Warranty Deed if you’re not certain you have a clear title to the property you’re selling.

Quit Claim Deed

With a Quit Claim Deed, the seller offers no warranty concerning the property’s title. In essence, the seller isn’t even claiming to have any ownership in the first place. By signing this document, the seller is saying,

“Whatever interest I may have in this property (if anything), I am transferring it to the buyer.”

If a buyer is willing to accept this, they should be doing their homework to ensure the property has a clear chain of title.

Because of how open-ended this type of deed is, it tends to create problems in the chain of title for future owners since it lacks guarantees or clear statements about who owns the property. If the seller’s goal is NOT to guarantee the title from the beginning of time, another alternative is to issue a Special Warranty Deed (more on that below).

Note: In my experience, most buyers have no idea the difference between a Warranty Deed and a Quit Claim Deed and what implications come with each, but as an educated investor, this is a distinction that you definitely need to be aware of.

If you need help preparing a Quit Claim Deed (or, for that matter, a Warranty Deed), you can try the US Legal Deed Library or check out Rocket Lawyer.

Special Warranty Deed

An alternative to the Warranty Deed and the Quit Claim Deed is the Special Warranty Deed. In most cases, this type of deed is used when the seller is willing to guarantee that no defects occurred with the property's title during the time they owned it.

With a Special Warranty Deed, the seller ISN'T necessarily saying the property has a spotless record going back to the beginning of time; only that it accrued no defects during their period of ownership (there's a big difference – and a Special Warranty Deed can help you spell this out).

Here's a little tutorial showing how to create a Special Warranty Deed with a service called Rocket Lawyer (you can use this same service to create a Warranty Deed and Quit Claim Deed).

If you're looking for an alternative source to get some blank deed templates, you can also check out US Legal.

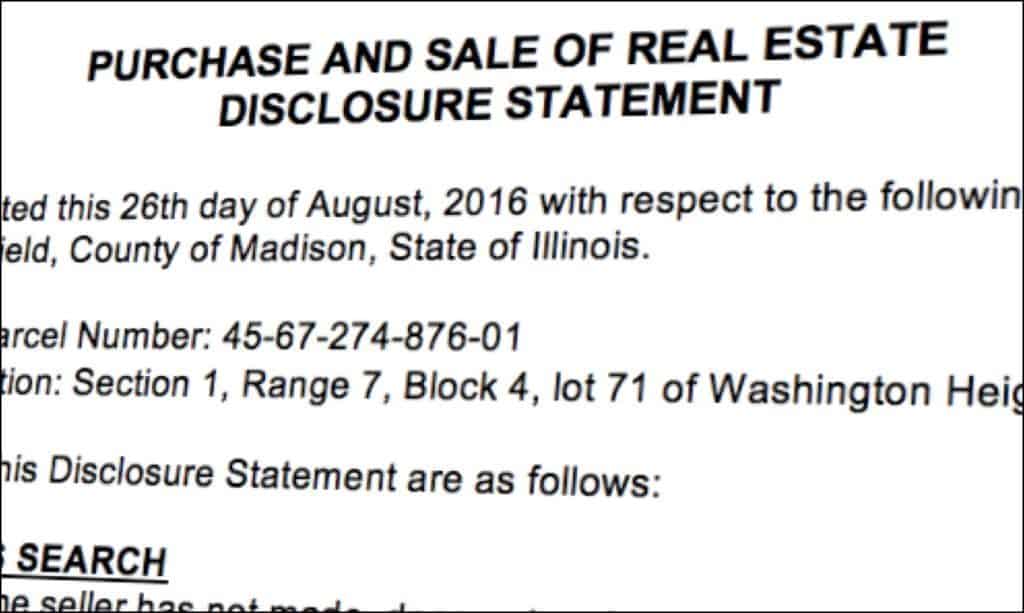

6. Disclosure Statement

The purpose of this form is to ensure that the buyer is responsible for doing their due diligence, not the seller.

This isn't a standard form that all closing agents and title companies require, but I decided to add it to all my closing packages for some extra protection.

When buying and selling properties quickly, I don't always have time to research every potential issue under the sun. I make a point of investigating the most common issues that are relevant to me, but since it's almost impossible to know everything, this document confirms a few things in writing:

- The buyer understands it's their responsibility to do their homework before they purchase the property. The seller won't be blamed for the buyer's failure to investigate.

- The seller will not assume any liability or responsibility for issues they were never aware of in the first place.

- The buyer is releasing the seller of all liability in the transaction (i.e., they won't come after the seller at the first sign of trouble).

Don't get me wrong, I've never even come close to getting sued or encountering legal issues with this type of thing, but if I ever did, a statement like this would be very helpful to have in my corner. This is why I've made it a required document that gets signed every time I sell a property.

It's also worth noting that some states have specific disclosures required in every closing scenario, so you'll want to investigate whether there are any additional forms you should complete as required by your state.

7. Closing Statement

A Closing Statement spells out the “math equation” behind the transaction. It shows how much of a down payment the borrower is bringing to the table, what the closing costs will be, what portion of the sale price is being financed, and more.

A closing statement is just basic math. However, for someone who isn't accustomed to them, compiling a closing statement can require a bit of thought, especially if it involves complicated fees or prorations.

This document can be confusing, so it's important that they are completed correctly.

8. Supporting Documentation

Many states require additional “supporting documentation” to notify the local municipality (i.e., City or Township) about the transaction that just took place.

The county should be fully aware of this change in ownership because they recorded your deed, but in many cases – the city or township administration is in a separate office, and they don't share the same systems with the county. As such, they need to be notified separately about the property's change in ownership (if they aren't made aware of the change, they'll continue sending the property tax bills to the old owner).

In most cases, this is a simple form that consists of one page, and it does a few key things:

- Lets the city/township know that the property has been transferred to a new owner.

- Informs the local assessor of the sale price (which assists them in determining the property's new assessed value).

- Notifies the local treasurer where they should send all future tax bills.

Unfortunately, the exact name of this document varies quite a bit from state to state, so even though it serves the same basic purpose, it can seem a bit more complicated than it really is. For example:

- In Arizona, it's called an “Affidavit of Property Value” and it looks like this.

- In Michigan, it's called a “Property Transfer Affidavit” and it looks like this.

- In Nevada, it's called a “Declaration of Value” and it looks like this.

- In Maine, it's called a “Real Estate Transfer Tax Declaration” and it looks like this.

- In Hawaii, it's called a “Conveyance Tax Certificate” and it looks like this.

If you're unsure whether your state requires this form, this video explains how you can figure it out…

See what I mean? Hopefully, you get the idea.

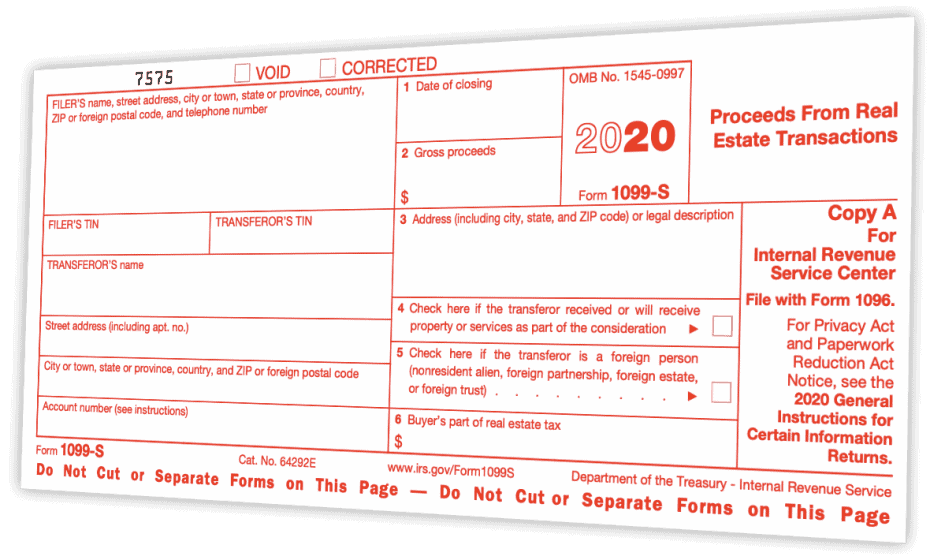

9. IRS Form 1099-S

In many situations, the person responsible for closing the transaction is required to file Form 1099-S with the IRS.

To learn more about why the 1099-S is important and how you can handle the filing process in your closings, check out this blog post.

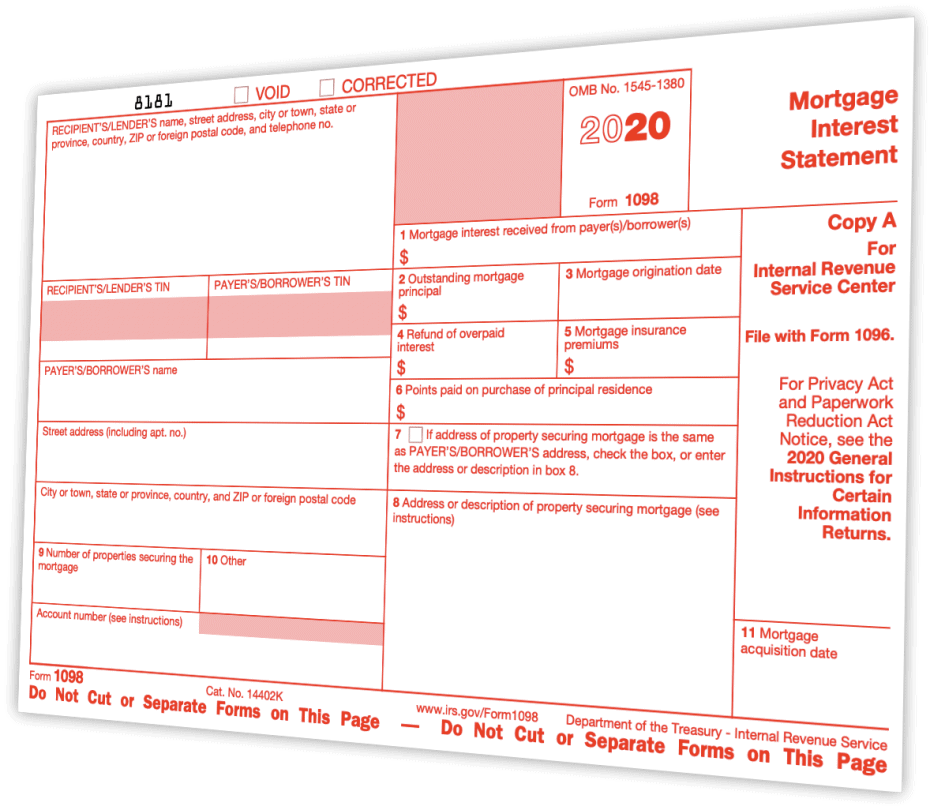

10. IRS Form 1098

If you’re doing a substantial number of seller-financed deals AND servicing these loans yourself, you should also plan on filing Form 1098 with the IRS for every borrower who pays you $600 or more of interest in each fiscal year.

If you’re using a loan servicing company, they will most likely handle this for you, but be sure to check with them to verify.

If you plan to handle this requirement yourself, it’s a fairly straightforward process (similar to the 1099-S), but it can take a bit of education to understand the mechanics of it. Check out this blog post for more details.

Record Keeping

Once your transaction is closed, the documentation is complete, and the county has recorded all the appropriate forms, be sure to keep copies of all the fully executed documents in your files (the borrower should also have copies of all the documents for their records as well).

Most of the copies I keep in my system are digital (in pdf format), and I keep a pretty clean filing system with individual folders for each borrower. I’d recommend figuring out a similar system and backing up your files.

Reminder: If there's any single document to keen an ORIGINAL hard copy (with wet ink), it's the promissory note. In many states, the original copy of this document may be required if you ever need to foreclose on the borrower.

Post-Payoff: Deed of Reconveyance

One thing to keep in mind is that once the deal is closed – the documentation on the seller's behalf isn't over just yet.

When the borrower has made their final payment on the loan, the Lender will need to notify the Trustee to prepare and submit a “Deed of Reconveyance” (aka – “Reconveyance of Deed of Trust” or “Release of Lien”) to the county for recording. This document confirms that the borrower has fully repaid the loan and it eliminates the Deed of Trust as a lien in the property's chain of title.

Just like every document in this process, there isn't a one-size-fits-all template for this particular form – but if you're looking for an example to reference, check out this one from Rocket Lawyer. Again, some states have specifics that need to be addressed in accordance with the wording of the original Deed of Trust, so be sure to consult with a legal professional in the state where you're working to verify that your template is worded correctly.

Document Templates

By now, you've seen the documentation and detail required to close a seller-financed real estate transaction.

For most people, this job is best left to a professional closing agent (a title company or attorney) who is well-versed in these steps and handles this job every day.

There are plenty of opportunities to make mistakes in this closing process, and even if you do get everything right, it can take a lot of time and mental energy to get this job done!

These days, I outsource all of this work to a title company or attorney because they're better at the job than I am, and it frees up a lot of my time to do more important things in my business.

Whatever you decide to do, it's beneficial to understand what's going on in each closing, so you can make sense of “how the sausage is made.”

When Should You NOT Utilize Seller Financing?

The more you learn about selling properties with owner financing, the more you might start asking yourself,

“Is it really worth the extra effort to sell my properties this way?”

It's a good question because, in my opinion, there are plenty of scenarios where it's not worth the extra time and hassle to offer seller financing to your buyers.

Getting into a seller-financed deal with someone is a real commitment, and it's important to set clear boundaries so you know when to say “No.”

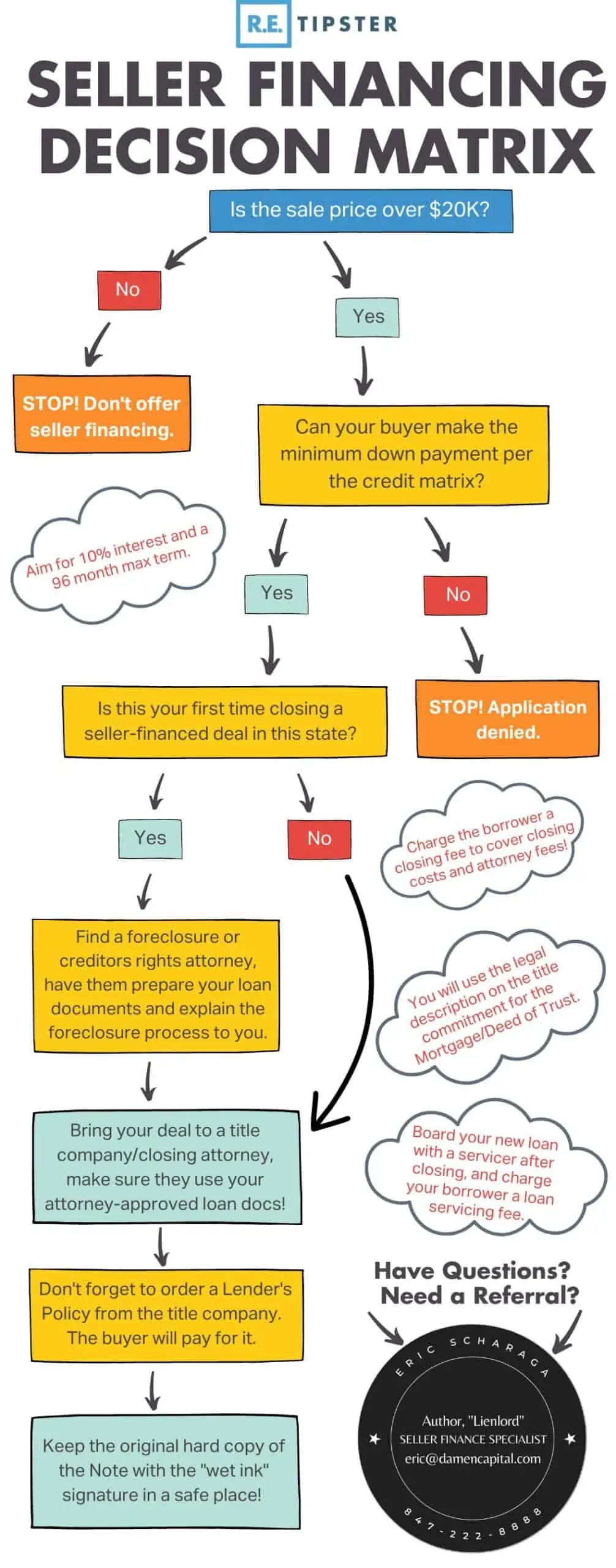

Here's the decision matrix I use to decide on the direction of each deal.

- If the sale price is less than $20K, I don't offer owner financing at all.

- If a property sells for $20K or more, and the buyer wants owner financing, I'll outsource the closing to a title company or attorney.

- If it's my first seller-financed transaction in that state, I'll find a foreclosure/creditors rights attorney to compile the correct loan documentation and help me understand what the foreclosure process looks like.

- If it's not my first seller-financed transaction in that state, my title company will use my attorney-approved templates to close the deal.

- Whatever costs are needed to close the deal, I'll have the borrower pay a minimum $500 closing fee (maybe higher, in some cases) to help offset the costs.

With these guidelines in place, I can only use seller financing on deals that are worth the trouble, and the borrower pays a good portion of the costs, so it doesn't come off my bottom line.

Here's a flowchart I put together with Eric Scharaga (note investor and seller financing aficionado) to help you visualize this decision-making logic.

Seller financing is a huge convenience we can provide for buyers, but we aren't obligated to do this, especially if it doesn't make good financial sense for us.

As a seller, you can choose when you do and don't want to make this available for each buyer. You don't have to follow the same logic explained above, but if you have no idea how to make this decision, this is a decent place to start.

Need More Help?

When I was closing my first few deals, I had a TON of questions, and it would have been very helpful if someone could have held my hand and thoroughly explained what each document was all about, what kinds of issues to watch out for, and how to navigate through each step of the process.

The Land Investing Masterclass has a BIG module about seller financing (see Module 8). If that sounds helpful, be sure to check it out!