In this blog post, we're going to cover something called IRS Form 1098.

In this blog post, we're going to cover something called IRS Form 1098.

This form comes into play for anyone who is selling properties via owner financing, and more specifically:

- If owner financing is “in the normal course of the seller's trade or business.”

- If the seller is receiving $600 or more in interest payments from an individual borrower in each fiscal year.

Keep in mind, you don't necessarily need to be a bank or a hard money lender for seller financing to be “in the regular course of your trade or business.” The IRS expects any person or entity that receives $600+ of interest payments (such as real estate developers, house flippers, land flippers, loan servicers, or certain collection agents) from an individual borrower to file Form 1098 each year.

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Why Is IRS Form 1098 Necessary?

The whole purpose of the IRS Form 1098 is to ensure that borrowers can claim the appropriate tax write-off from the interest they've paid to their lender(s) each year. When a lender submits a 1098 to the IRS and the borrower each year, it helps both parties validate how much interest expense can be claimed by the borrower when they file their annual tax return.

In other words, when you submit a 1098 form to the IRS, it's just another way of telling them,

“Yep, this borrower paid me $_____ of interest this year.”

The IRS uses Form 1098 to verify a borrower's claim to have paid a certain amount of interest in a given year.

Disclaimer: Before we get much further into this, please be aware that I am not a CPA and the information in this article should not be interpreted as financial advice. Everything you read here is based on my own conclusions after reading the IRS Instructions for Form 1098 (and given how convoluted these instructions are, it's entirely possible that a CPA will have a different opinion than me). Be sure to double-check this information with a tax professional as it relates to your specific situation before you move forward.

When Do You Need to File IRS Form 1098?

If the transaction doesn’t fall within one of these exceptions, the IRS will most likely expect you to file Form 1098.

As I was reading the Instructions for Form 1098 (which you can find here), there were two questions that came to mind:

1. Does This Requirement Apply to Me?

IRS Form 1098 is also known as a “Mortgage Interest Statement” and the instructions repeatedly refer to “mortgage interest.” If my seller-financed properties aren't secured by a “mortgage” per se, but are secured by a land contract (which functions differently from a mortgage, because the deed doesn't transfer to the buyer until after the loan is paid in full), does this requirement still apply to me?

Luckily (or unluckily for me), the IRS took the time to clearly define the word “Mortgage.”

As I interpret this, if the loan is secured by the property you're selling (i.e., if you can repossess the property in the event of the borrower defaulting on the loan), then the IRS likely considers it to be a “mortgage.”

2. What Covers “in the Course of Trade and Business?”

Another phrase that comes up repeatedly throughout the instructions is this:

The question is, at what point are these deals “in the course of my trade or business?” Does this come into play after one deal? Three deals? Five? A hundred? Where's the line? How can I know when I DO and DON'T need to worry about this?

This is particularly important to me, as a real estate investor who occasionally sells vacant land with seller financing.

After talking with a CPA and a few attorneys, the general consensus I got was that ultimately, if you're doing two or more of these deals in a year, the IRS can potentially make a case that you're working as a “dealer” (which means it's in the course of your trade or business. Once you get into this territory, you'd better be filing your 1098s.

Of course, there are always exceptions. The true definition is anything but straightforward. There have been many court cases where the IRS disagreed with taxpayers about whether or not they were considered “dealers” or “investors.” So even though it's not always a clear line, if you have ANY inclination that you're flirting with dealer status, your best bet is to err on the side of assuming you need to do this.

When Is an IRS Form 1098 Not Needed?

On the other hand, there are naturally exceptions to the rule. You do NOT need to file an IRS Form 1098 if you:

- Are receiving interest from a corporation, partnership, trust, estate, association or company (other than a sole proprietor).

- Receive less than $600 in interest payments from your borrower each year.

- Are enlisting the help of a loan servicing company to assist in the collection of payments and/or you're paying a CPA to handle your accounting and tax-related issues. These companies will most likely handle the annual filing of any/all 1098 forms for you. That said, you have to verify this assumption with them.

- Receive interest that is not “in the course of your trade or business,” e.g., if you're financing the sale of your former personal residence or for a one-time, non-recurring type of transaction.

In addition, you don't need to file this form if the security for the loan is NOT “real property.” This includes land and anything built on it, growing on it, or attached to it.

There are a few other exceptions, but these are the most common. Read the full instructions for Form 1098 at the IRS website for specific details.

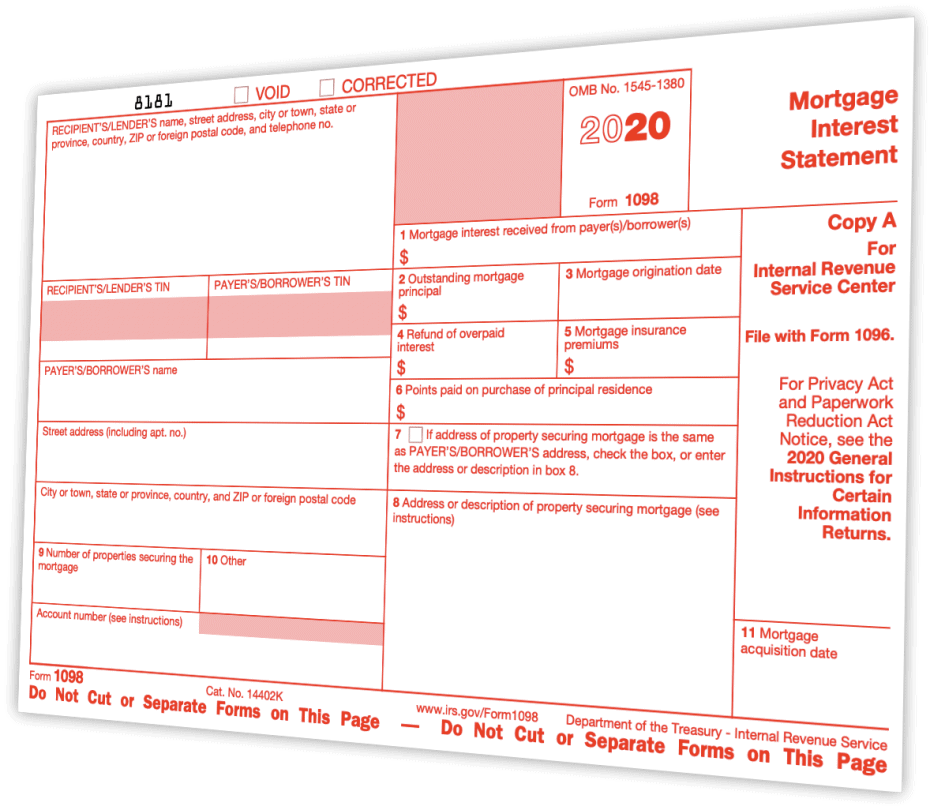

How to Complete IRS Form 1098

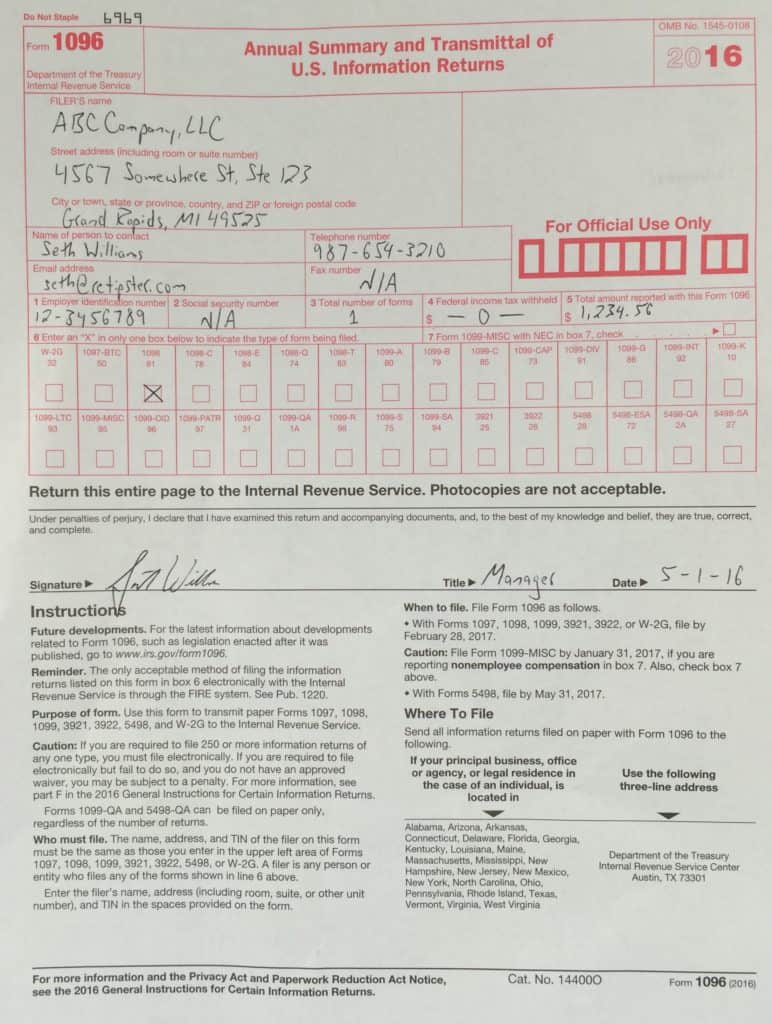

To complete the filing process, you will need to order blank copies of IRS Form 1098 and IRS Form 1096. You need a specific type of paper and ink to print these forms. It's possible to reproduce these documents from home, but it's usually easier to just order them from the IRS.

The forms are free and the IRS will send them to you by mail, usually arriving within about a week. It takes less than a minute to order. Here's the link.

Note: If you are filing more than 250 of these 1098 forms, the IRS requires you to file electronically. You'll probably want to engage the services of a CPA or loan servicing company well before you get to that point.

The Filing Process

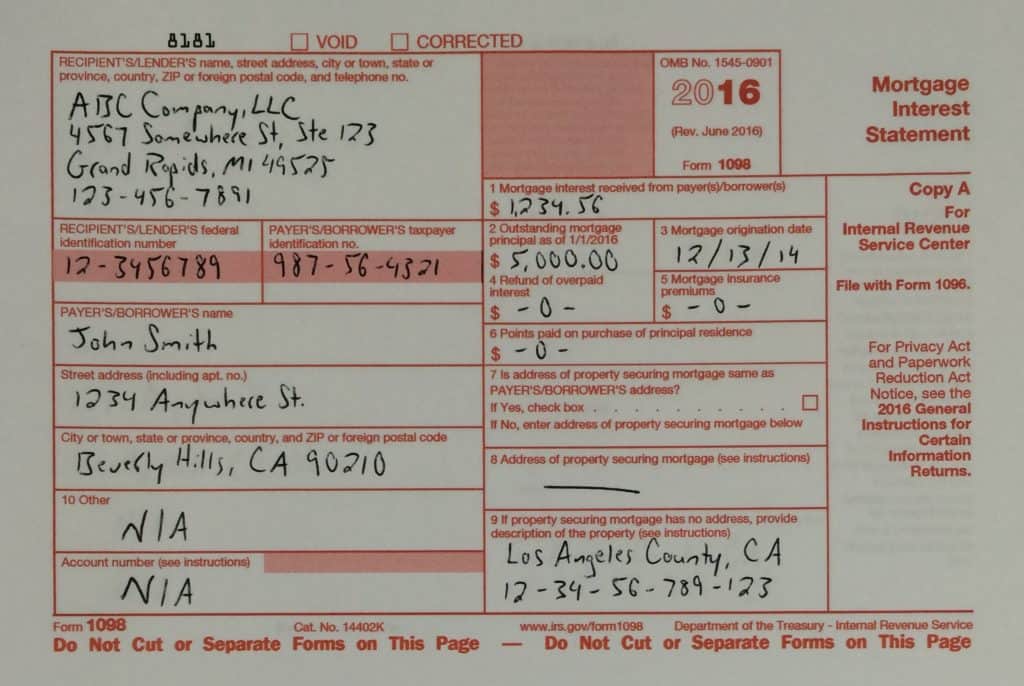

To complete the 1098 form, you'll need a few key pieces of information, including the Payer's/Borrower's social security number.

If it wasn't already completed at the time of closing the transaction, ask the seller to complete IRS Form W-9. Once completed, signed, and dated, it will provide you with all the information you'll need (including their SSN) to complete the 1098 and 1096 appropriately.

You can find IRS Form W-9 here. This video explains how the W-9 works…When you've got the information you need, it's time to fill out the 1098 form.

I'm typically the seller in these types of transactions in my case. So, I would list myself as the “RECIPIENT/LENDER” and the buyer as the “PAYER/BORROWER” on both the 1098 and the 1096.

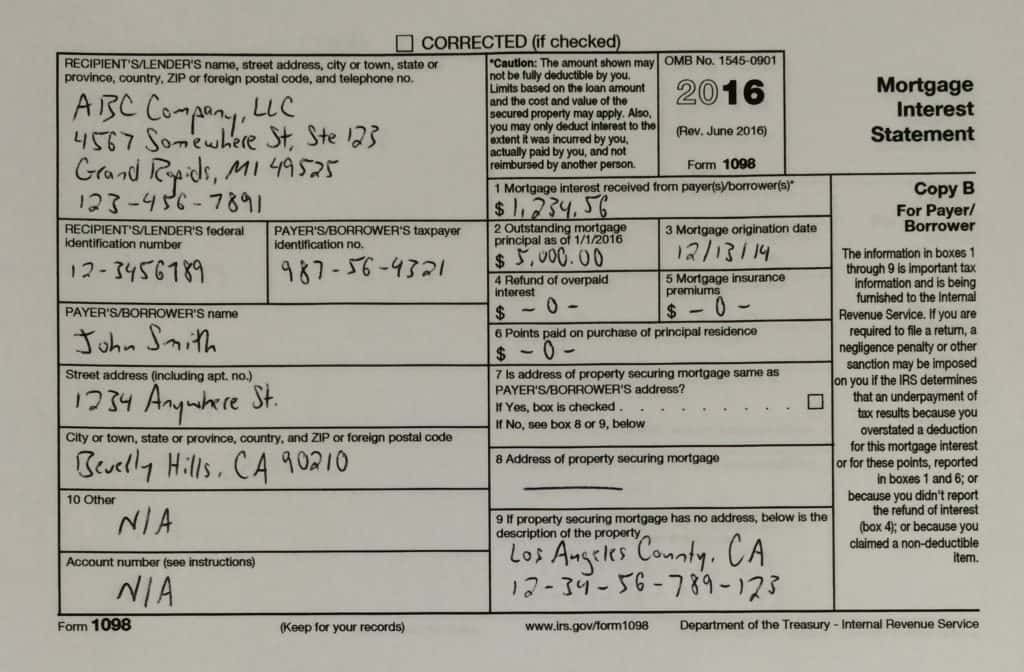

In this example, the property is a vacant lot without a physical address. This is why I drew a line through Box 8 and listed the county name and parcel number in Box 9. If it had been a common single-family home, I could have just entered the physical street address of the property in Box 8 and then left Box 9 blank.

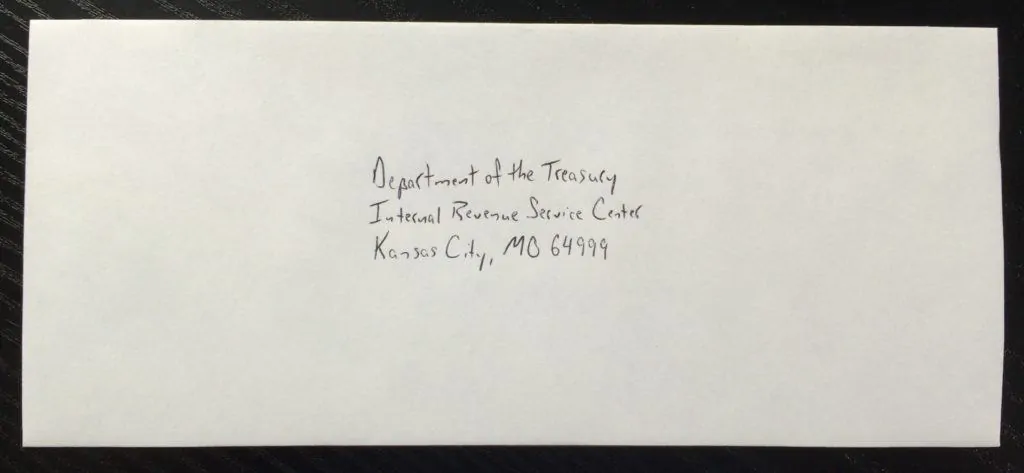

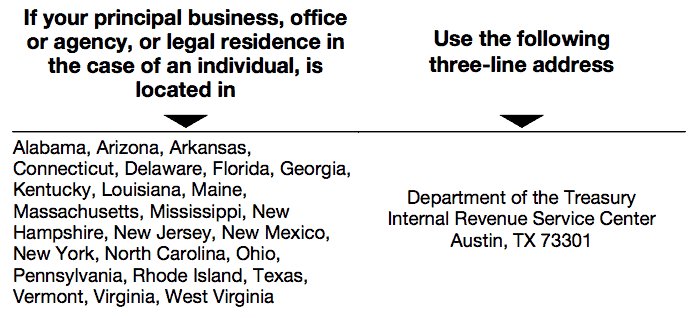

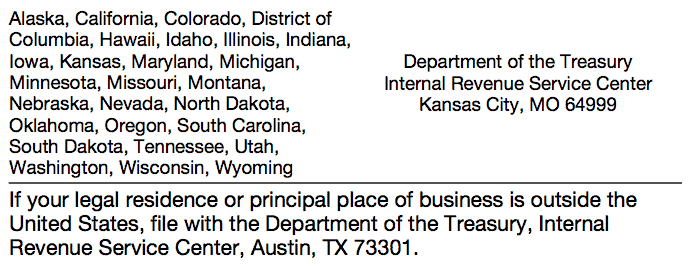

When I've got both the 1098 (Copy A) and the 1096 complete, I would mail both forms to the IRS. If you're not sure which address to include on the pre-addressed envelope, check the instructions on IRS Form 1096. This is what it said on the 2016 version of this form:

As I'm filling out the 1098, there will also be two copies: Copy B and Copy C. The first should be sent to the Payer/Borrower and the last is for the Recipient/Lender. Here's what I would send to the Borrower.

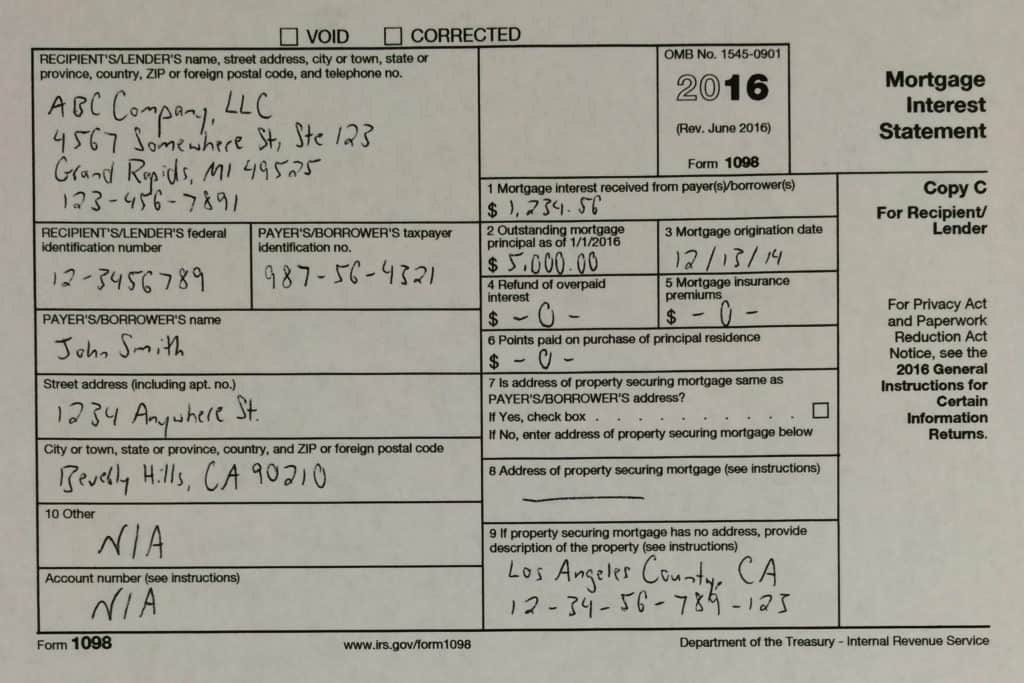

And here's what I could keep in my files.

Pretty simple stuff, right?

What Happens If You Fail to File Form 1098?

Say you miss one of these forms and fail to file Form 1098 for one of your seller-financed deals. Will something bad happen to you? The IRS can technically start issuing penalties starting at $250 per failure to those who don't follow through with this requirement. That is, if they ever find out about it).

For this reason, if you're going to handle your loan servicing in-house (and if it's clearly in the normal course of your trade or business), make sure you're doing at least one of the following:

- Hire a competent CPA or accountant who will catch this requirement and accomplish it at tax time each year.

- Enlist the help of a loan servicing company that will handle this requirement each year automatically.

- Use a service (I use ZimpleMoney, for example) that will help you calculate the interest paid on your loans each year. It won't necessarily handle the entire task, but it should at least help simplify the process to some extent.

Historically, I've used a loan servicing company for the bulk of my seller-financed deals. My accountant has always caught this requirement for each loan I have, so it has never been a problem for me. However, it could easily become an issue if you don't have some checks and balances to catch this each year.

In a nutshell, make sure someone is paying attention to this item if/when it becomes a requirement. Do that you should be just fine.