IRS Form 1099-S is an important (and often overlooked) step in the closing process for most real estate transactions, and if you're in the practice of closing deals yourself, this is something you probably ought to be doing.

IRS Form 1099-S is an important (and often overlooked) step in the closing process for most real estate transactions, and if you're in the practice of closing deals yourself, this is something you probably ought to be doing.

Why is IRS Form 1099-S Necessary?

The purpose of IRS Form 1099-S is to ensure that sellers report their full capital gains on each year's tax return (and, thus, pay the appropriate taxes to the IRS).

For example, if someone buys an investment property for $100,000 and sells it for $150,000 (giving them $50,000 of capital gains income) – they're supposed to report this as taxable income at the end of each year… but if they don't, the 1099-S will act as a safeguard by keeping the IRS informed about what's going on.

Disclaimer: The information in this article should not be interpreted as legal or financial advice. Everything you read here is based on my conclusions after reading the IRS Instructions for Form 1099-S (and given how convoluted these instructions are, your CPA or attorney may have a different opinion than me). Be sure to cross-check this information with your own tax professional before you move forward.

Who Has to File IRS Form 1099-S?

Depending on the sale price, who acts as the closing agent, who the seller is, and what kind of property is being bought and sold (among other things), there may be some differences in who is responsible for filing the 1099-S.

Here’s the good news:

- If you close a transaction with a title company or attorney (as most people do), they will collect the necessary information and file Form 1099-S for you.

- The transaction is not reportable if the seller certifies that the sale is for $250K or less and the sale is for their principal residence.

- If the “transferor” (seller) is a corporation or a government unit (e.g., if the property is sold at a county auction), the transaction is not reportable.

- The transaction is not reportable if the total money, services, and property received are less than $600.

There are a few other exceptions, but these are the most common. Read the full instructions for Form 1099-S at the IRS website for specific details.

Here’s the bad news:

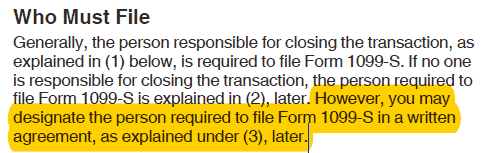

If the transaction doesn’t fall within one of these exceptions, and if you are facilitating the closing yourself, the IRS will likely expect you to file the Form(s) 1099-S since the IRS instructions state (in fairly unclear terms) that “the person responsible for closing the transaction” is required to file Form 1099-S.

Interestingly, the IRS will allow you to designate the person required to file Form 1099-S in a written agreement, as per this excerpt from their instructions…

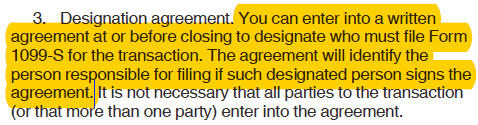

As we move on to Section 3, it says…

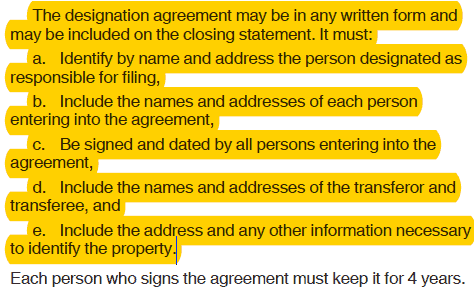

This section goes on to say,

Under these parameters, a purchase agreement seems to be an ideal document that can be written to include ALL of the above information.

Designating the Responsible Party

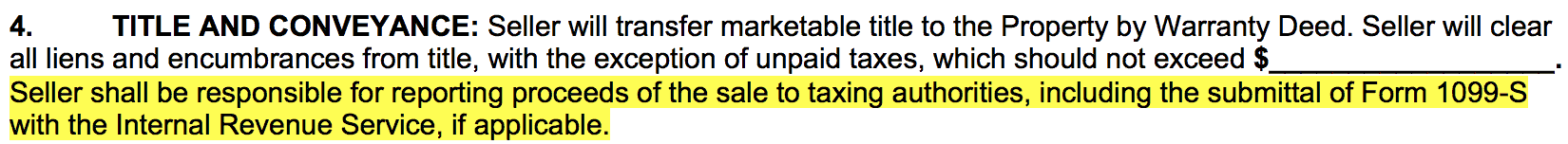

In transactions where I am the buyer, I can easily include a clause in my purchase agreement that identifies the Seller as the responsible party for any IRS reporting required as a result of their receipt of funds related to the transaction.

Here’s an example of what this clause could look like:

With this kind of language included in my purchase agreement, the seller can agree to bear the responsibility for filing the 1099-S. This is a significant help because, without this language, I would have to collect the seller's Tax ID number (which is something many people may be hesitant to provide), complete the 1099-S myself and send a copy to BOTH the IRS and the Seller.

Technically speaking, the process isn't all that difficult… but it's even easier for the seller to complete it on their own – because they have all the information and don't have to send anything to me – they would simply keep a copy for themselves and submit a copy to the IRS.

In transactions where I am the seller, I don't include the above-mentioned clause in my contract at all because it's not difficult for me to file the 1099-S on my behalf, especially since I already have all of the necessary information (including my SSN or TIN). I only need to provide this document one time to the IRS.

It's also worth noting that I don't necessarily include this “designation clause” in ALL of my purchase agreements. In many cases (depending on the size of the transaction, location of the property, and the parties involved), the closing may end up running through a title agency or closing attorney – and in those cases, THEY (the closing agents) are responsible for filing the 1099-S, so it's not always appropriate to put this task on every seller across-the-board.

You'll want to understand which transactions you're planning to close in-house and only include it when applicable.

If you're still reading this, give yourself a pat on the back. This is pretty dense stuff, I know.

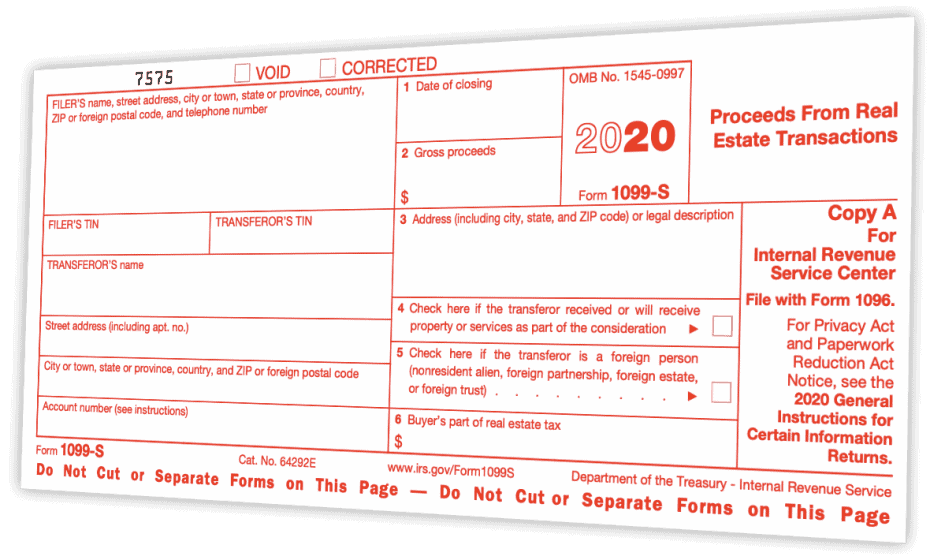

How to Complete a 1099-S

To complete the filing process, you must order blank copies of IRS Form 1099-S and IRS Form 1096. These forms need to be printed with a very specific type of paper and ink, and while it's possible to reproduce these documents from home, it's a lot easier just to order them from the IRS.

The forms are free; the IRS will send them by mail, usually arriving within about a week. It takes less than a minute to order. Here's the link.

Note: If you are filing more than 250 of these forms, you are required to file electronically (but you'll probably want to engage the services of a CPA well before you get to that point).

The Filing Process: When Buying

For each transaction where I am the buyer, there are a few different ways I can handle the filing of the 1099-S.

Option 1:

Ask the seller to complete IRS Form W-9 as part of their closing package. When this form is completed, signed, and dated, it will provide all the information needed (including their TIN / SSN) to complete the 1099-S and 1096 and file it appropriately.

This video explains how the W-9 works…

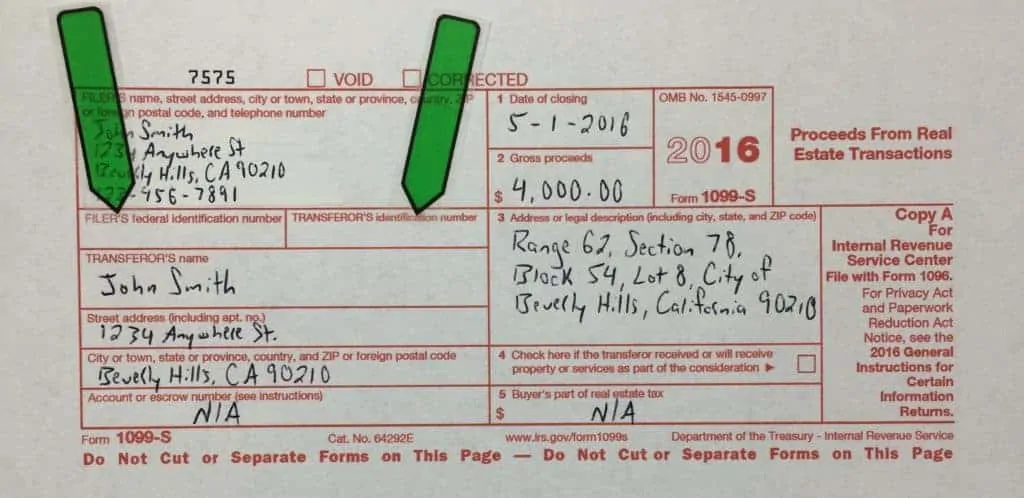

Note: If I'm the Buyer/Closer and I'm filing the 1099-S for the transaction, I would list myself as the “FILER,” and the seller would be listed as the “TRANSFEROR” on both the 1099-S and 1096.

Option 2:

If I've included the above-mentioned “designation clause” in my purchase agreement, I essentially don't have any further responsibility, because the seller has agreed that they will file these forms on their own behalf (this is something you'll want to get verified by your own paid tax professional).

Option 3:

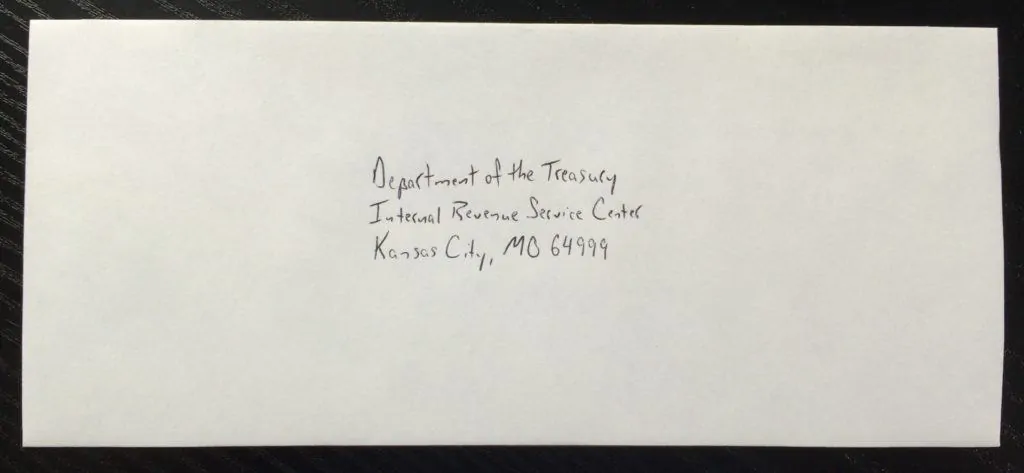

If I didn't get a W-9 completed by the seller and/or if I failed to include the “designation clause” in my purchase agreement (or even if I did but wanted to make the process easier for the seller), I could put together a letter of instruction and send it to the seller along with all the forms they'll need to complete and submit to the IRS. In addition to the forms, I could provide a pre-addressed envelope for the sellers to send their forms to the IRS.

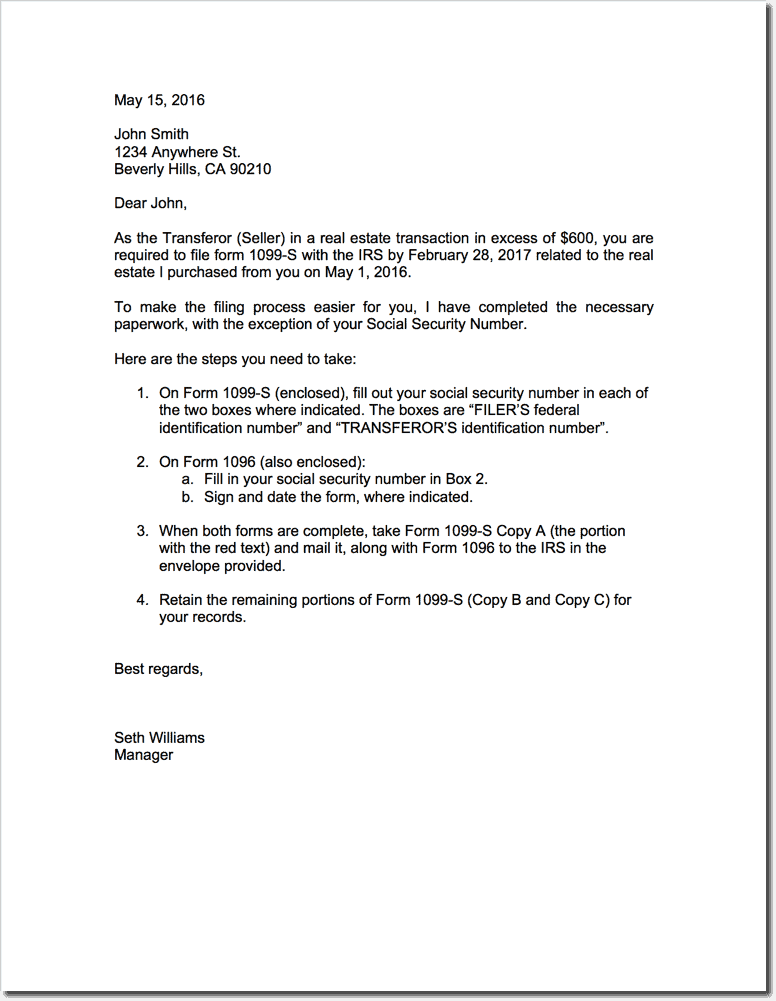

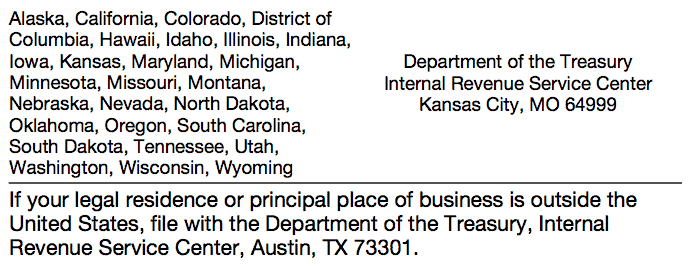

Here's an example of what it might look like:

Note: In this example above, the property is a vacant lot without a physical address (which is why I listed the legal description). If it had been a common single-family home, I could have just entered the physical street address of the property and been all set.

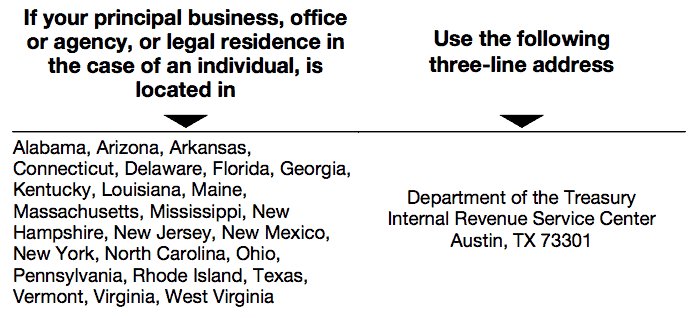

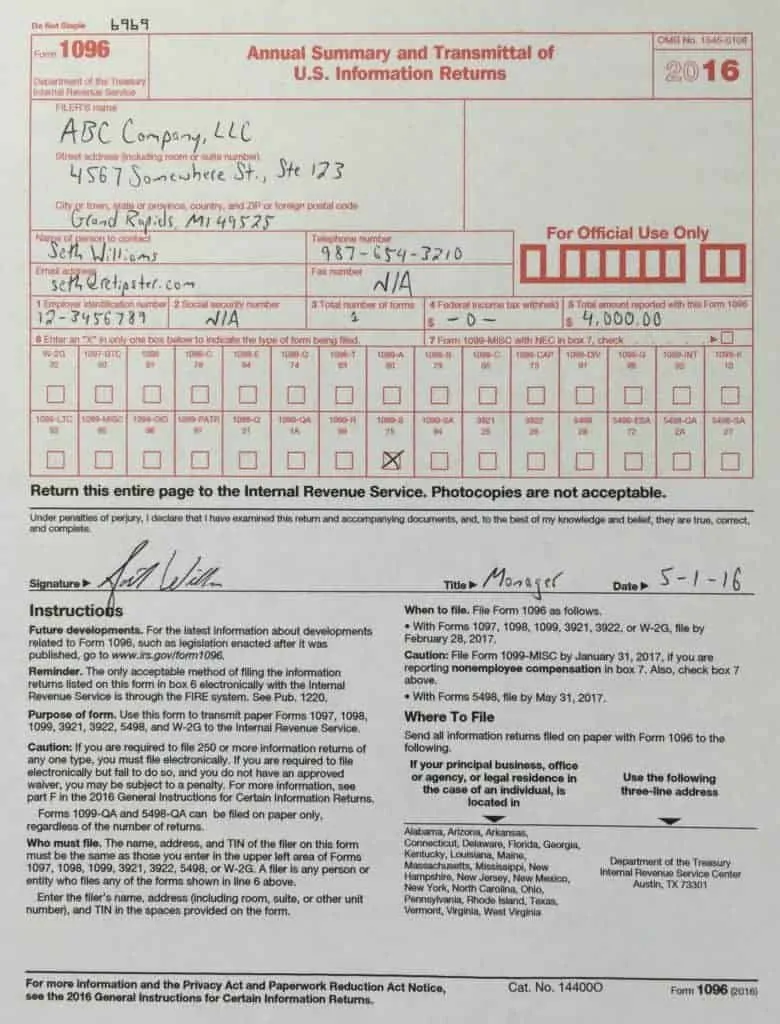

Note: If you're not sure which address to include on the pre-addressed envelope, check the instructions on IRS Form 1096. This is what it said on the 2016 version of this form:

The Filing Process: When Selling

For each transaction where I am the seller, the filing process is pretty straightforward because I have all the information I need to complete and submit these forms myself.

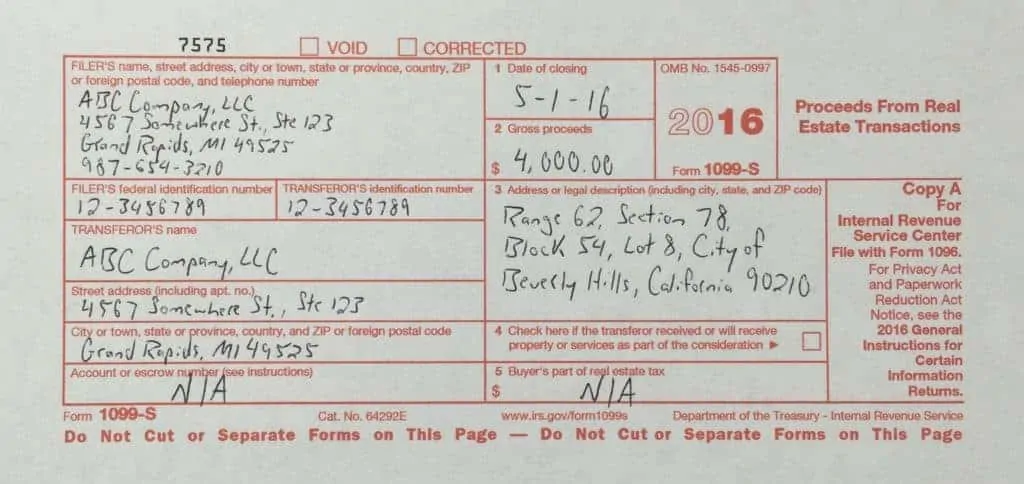

I would complete a 1099-S for the transaction by filling out ALL the information on the form (including my Tax Identification Number because I'm operating as an LLC) as both the filer and the transferor.

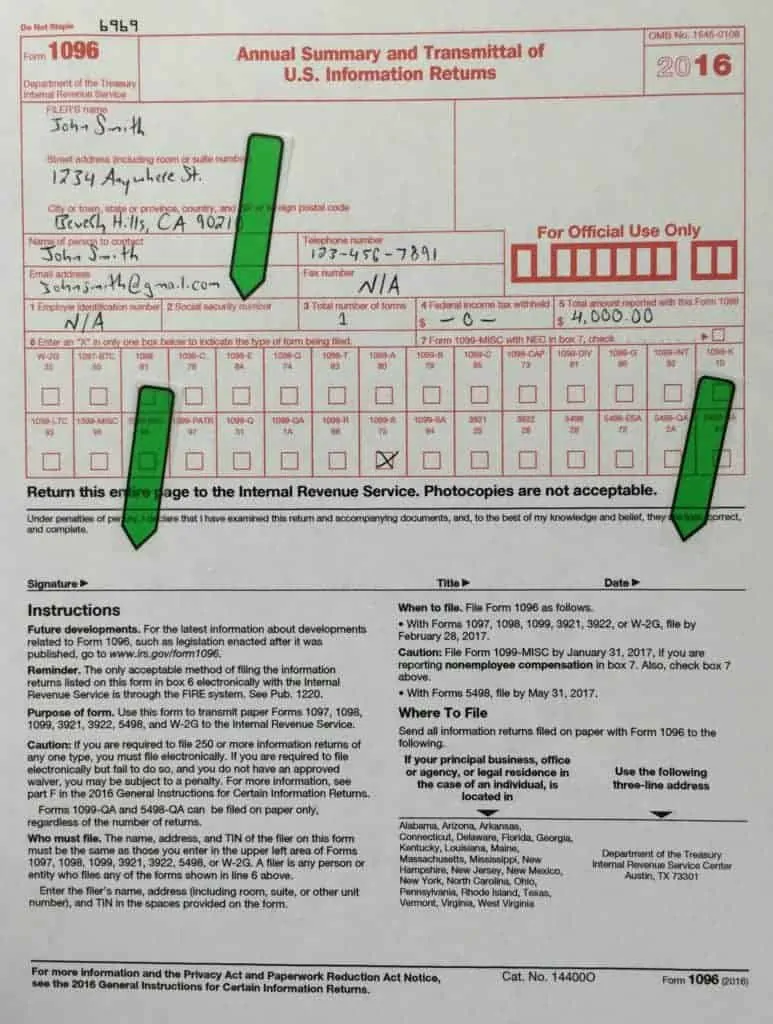

I would also complete one 1096 transmittal form with my information, including my TIN, as the filer. The IRS and I are the only recipients for both of these forms, so I would simply send the 1099-S (Copy A) and the 1096 form to the IRS.

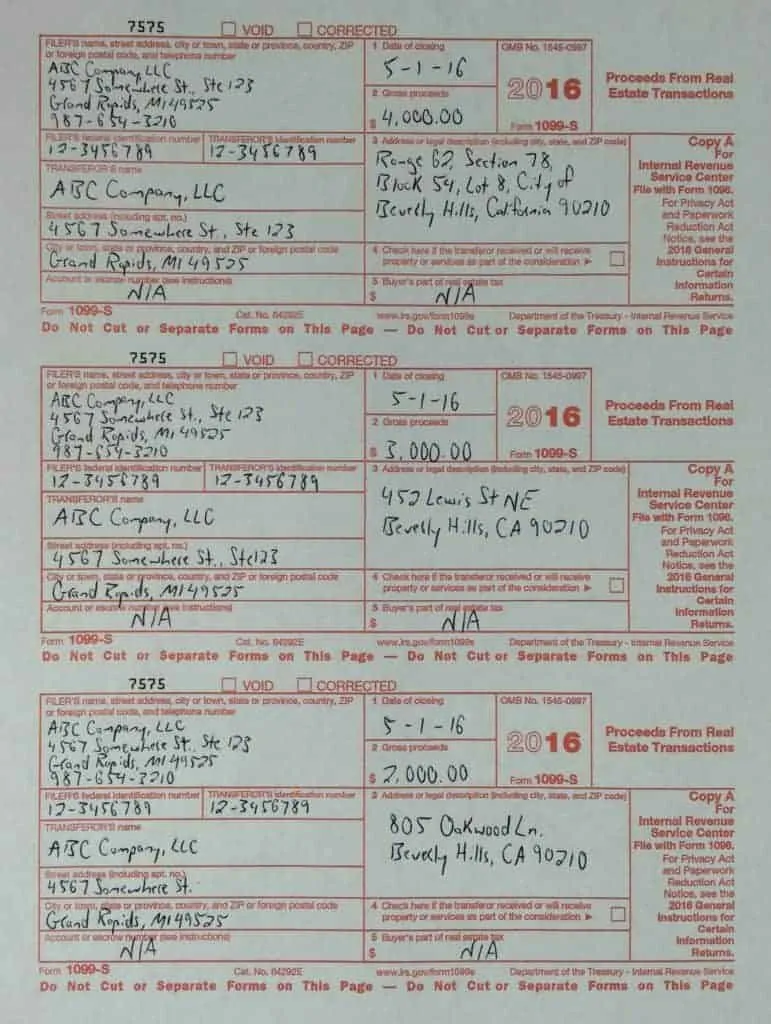

Here's an example of what those forms might look like:

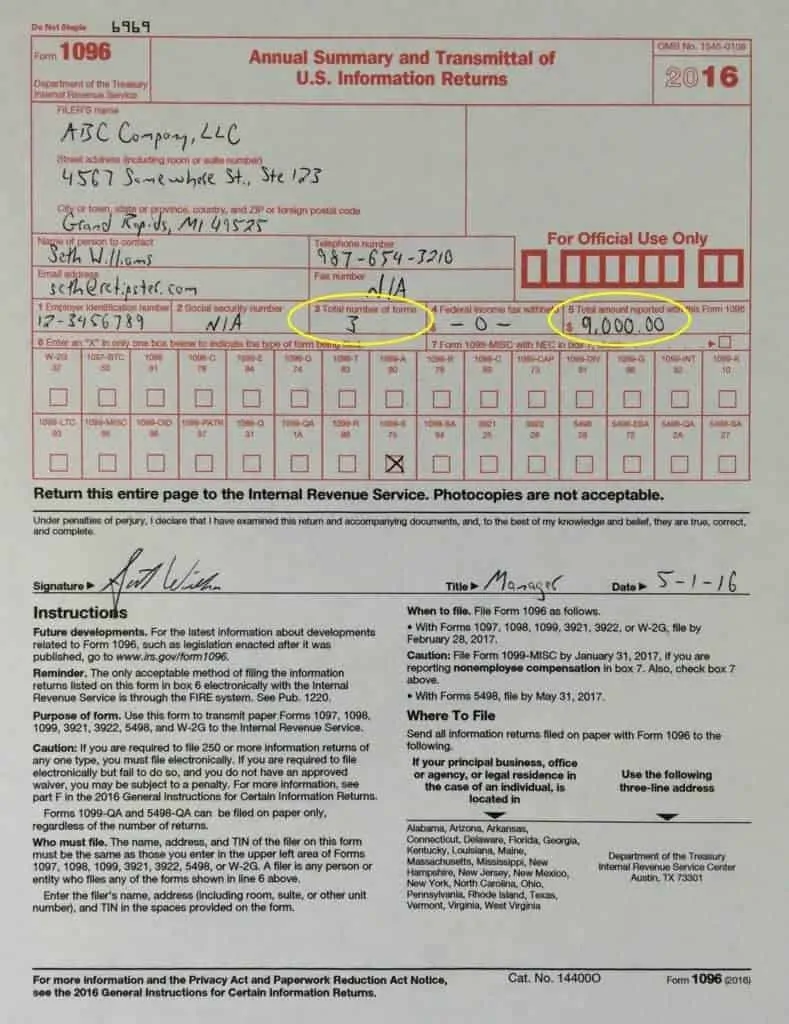

It's also worth noting that if you sell multiple properties for which a 1099-S filing is required, you will need to fill out a separate 1099-S form for each sold property, but you only need to complete one 1096 transmittal form.

Just add up the total amounts from box 2 of each of the 1099-S forms, enter it into box 5 of the single 1096 form, and enter the total number of forms for which the 1096 covers in box 3 1096.

In other words, if you sold three properties to one buyer, your 1099-S form might look like this…

And your 1096 might look like this…

Note: See the totals in boxes 3 and 5 of form 1096? That's what I'm talking about. 🙂

What If You Fail to File Form 1099-S?

What if you fail to file a 1099-S for one of your self-closed deals? Will something bad happen to you??

If you fail to file any type of 1099 form, the IRS can technically start issuing penalties starting at $250 per failure to those who don't follow through with this requirement (that is, if they ever find out about it).

The thing to remember is… if you're using the same closing rationale I do – there's a fairly small window for the transactions where you'll have to worry about this form in the first place.

Keep in mind:

- A 1099-S is NOT required if the transaction is for less than $600 (and it's not uncommon to find acquisition opportunities in the price range).

- A 1099-S is NOT required if the seller certifies that the sale price is for $250K or less and the sale is for their principal residence.

- A 1099-S is NOT required if the seller is a corporation or a government unit (this includes most foreclosures and properties sold at county tax auctions).

- If a property is being sold for $5,000 or more, it's fairly easy to justify the use of a title company to close the transaction (and when you use a professional closing agent, they will handle this entire process for you).

So in my mind… I'm primarily concerned with deals that fall between $600 – $4,999, are safely considered “investment properties,” and are being done with private individuals (…and not to mention, when I include the above-mentioned “designation clause” in my purchase agreement, I only need to take action on behalf of myself when I'm the seller).

Where to Report the 1099-S on Form 1040

Possible reporting options include, but may not be limited to:

Sale of:

- Investment Use Property, Schedule D

- Primary Residence, Schedule D and Form 8949

- Business or Rental Property, Schedule D and Form 4797

- Like-Kind Exchanges, Form 8824, Like-Kind Exchanges, with cash, or “boot”, received

For Form 1040 filers, the 1099-S related income and any other amounts required on these forms (for other purposes) will flow through Form 1040 based on the instructions for these forms and for Form 1040 found in the instructions for the respective forms.

IRS forms and the instructions for the forms can be found here.

Do You Have to Pay Taxes on a 1099-S?

Yes.

Form 1099 is used to report non-employment income to the IRS. There are up to 20 different types of 1099 forms. 1099-S is one of those types, and it's used for reporting capital gains on real estate transactions.

Businesses (such as title companies) and other persons involved in real estate transactions where no title company is involved must issue a form 199-S to anyone who receives at least $600 during the year.

If the business or other party involved in the real estate transaction submits a 1099-S form to the IRS, as they are required to do by law, and a taxpayer does not report it, the IRS will likely send a bill for taxes owed on the income.

Taxpayers do not have to include 1099s with their tax returns submitted to the IRS. Still, the IRS uses computerized matching algorithms to match 1099s received from businesses or other parties involved in the real estate transaction to check if taxpayers include the income on their returns. So, it is a good idea to include the income and keep the 1099 forms with tax return records for audit protection purposes.

Further Reading: How to a 1099-S and 1099-S Affect My Taxes?

Do You Always Get a 1099-S When You Sell A House?

You may not always receive a 1099-S form.

When selling your home, you may have signed a form certifying you will not have a taxable gain on the sale. If you completed a 1099-S Exemption Certification Form and you met all six criteria for not having to report the sale on your tax return, the title company or closing attorney may not send IRS Form 1099-S, which reports the sale to the IRS and to you. (See the section on Exemption Certification).

In the unlikely event that the sale was for less than $600, you probably would not receive a 1099-S. Or, if the transaction was closed without a title company or closing attorney and you agreed to be responsible for reporting of the sale (see the section on Who Issues 1099’s), you would not receive a 1099-S.

Further Reading: 12 Tax Tips When You Sell Your Home

Further Reading: Is it unusual not to receive a 1099-S Form for the sale of your home?

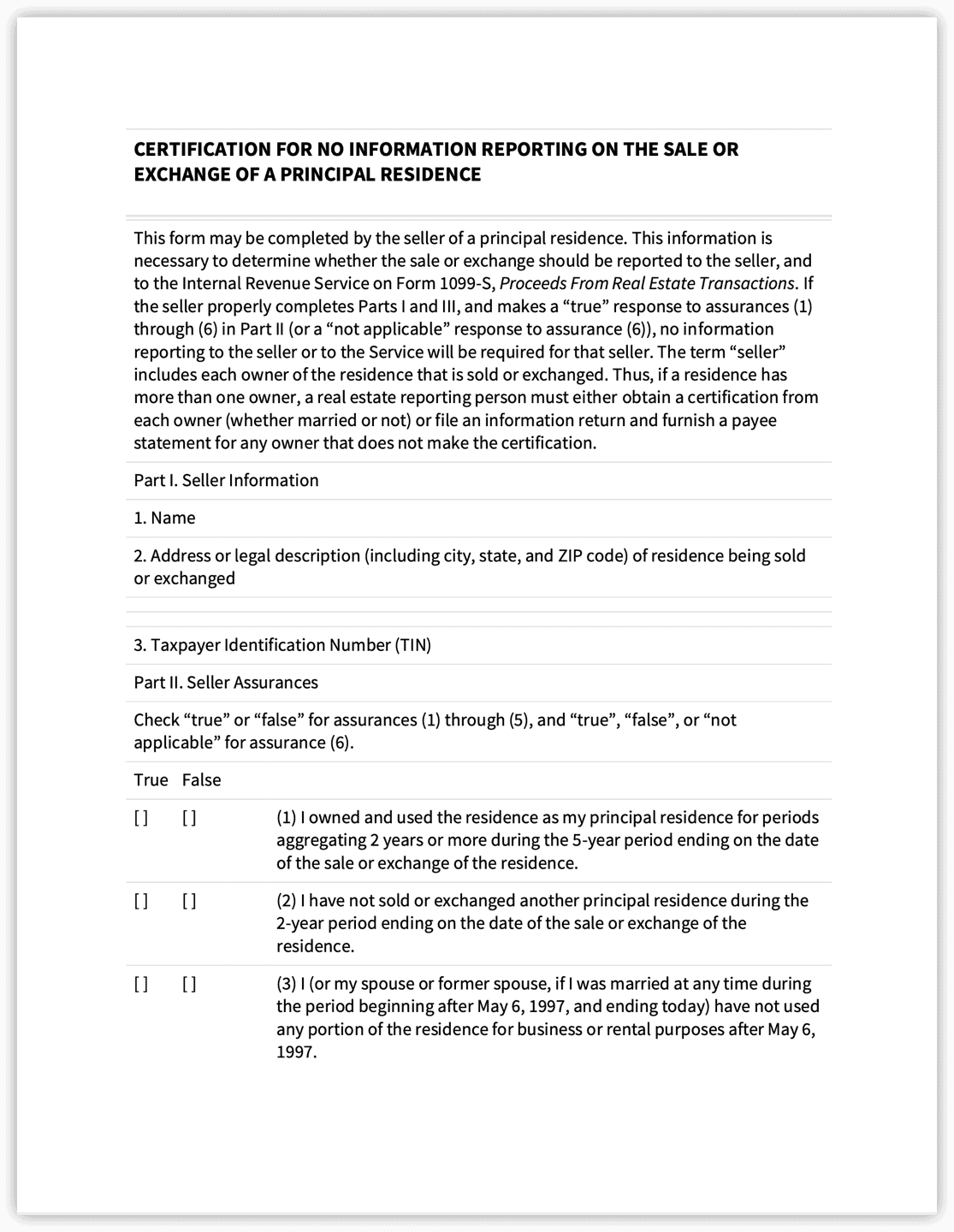

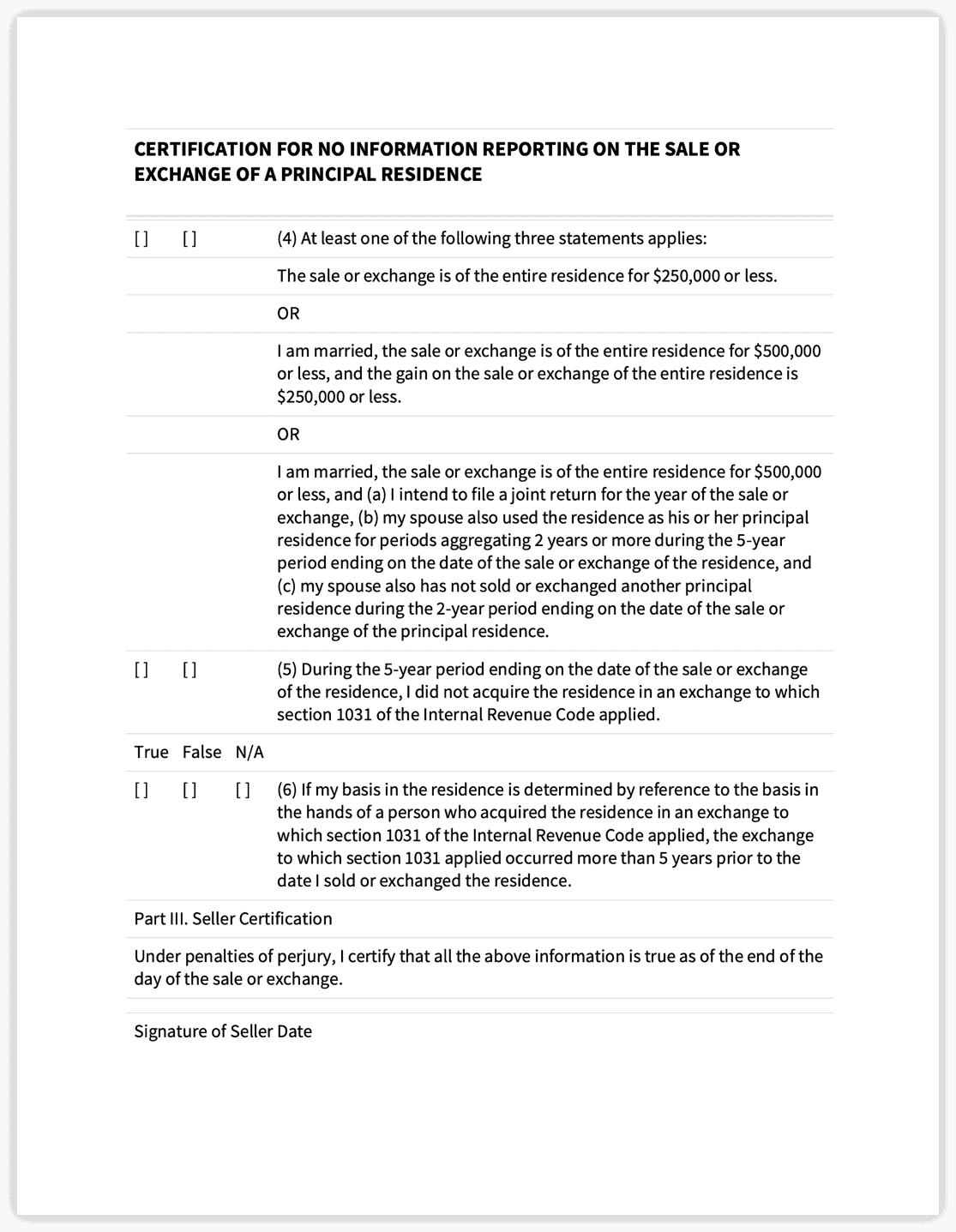

The 1099-S Certification Exemption Form

The 1099-s Certification Exemption Form applies to principal residences only.

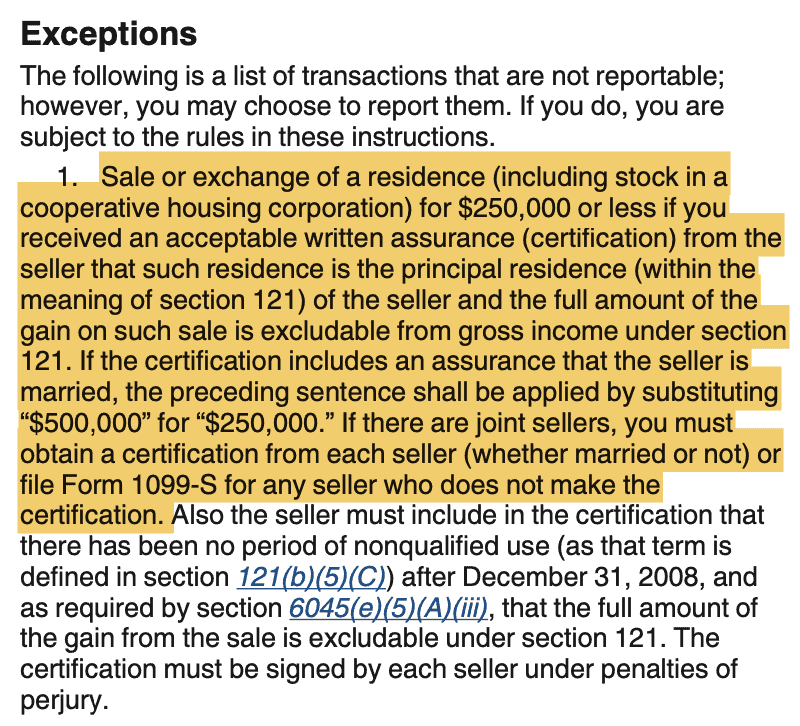

The IRS Instructions for Form 1099-S, on page 1 and under the section entitled “Exceptions,” outlines transactions that are not 1099-S reportable. One of those transactions – the sale of a principal residence under certain conditions – is not reportable if certain criteria are met.

The IRS requires written assurance (certification) that the criteria have been met. The IRS Instructions for Form 1099-S can be found here.

An example of an IRS acceptable certification form can be found in the appendix to IRS Revenue Procedure 2007-12 here and is duplicated below.

Additionally, Old Republic Title has a pdf version of such a form available here.

Generally, the IRS requires certification of these six items:

- Owned and used as the principal residence for 2+ years of the five years ending on the date of the sale or exchange of the residence.

- Had no sale or exchange of another principal residence during the two years ending on the date of the sale or exchange of the residence.

- No portion of the residence was used for business or rental purposes.

- The sale or exchange is of the entire residence and for $250,000 or less; if married, for $500,000 or less, the gain is $250,000 or less.

- During the five years ending on the date of the sale or exchange of the residence, it was not acquired in a 1031 exchange.

- If the basis in residence is determined by the basis of another person who acquired it in a 1031 exchange, that exchange must have occurred more than five years before the sale or exchange.