REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

When you sell real estate with owner financing, the most important ongoing task you need to oversee is getting paid.

Make no mistake, when you sell a property with seller financing, you are forming a long-term relationship with that borrower, and any good relationship takes effort to manage (some more than others).

If you want to avoid tension with your borrowers, you need to be clear with them about a few things,

- When to pay

- How to pay

- How frequently to pay

- How much to pay

- Who to contact if they have questions

In the banking world, this job is known as loan servicing. It's not the most glamorous task, but it is critical to keeping a lending operation running smoothly.

Different Ways to Collect Payments

Depending on the number of loans you have on your books, loan servicing can be a big task!

This is especially true if the borrower wasn't qualified and underwritten with care when the loan first came into existence.

Every missed or late payment will create new points of tension that the loan servicer will have to step in and resolve.

One way to make the loan servicer's job easier is to reduce friction in the payment process. Make it as effortless as possible for the borrower to send in their payment each month.

Better yet, make it easy for the borrower to get answers to their questions. Questions such as,

- What's my loan balance?

- When is my payment due?

- Where do I send my payment?

- How much interest did I pay last year?

This information should be readily available in a place your borrower can easily access and understand, so they don't have to waste their (or your) time calling YOU when these basic questions come up.

Different Ways to Handle Loan Servicing

There are a few ways you can handle the job of collecting payments from your borrowers. Some of them are efficient and easy, and some of them are inefficient and difficult.

Option 1: In-House Loan Servicing

When I closed my first few seller-financed deals, I decided to service them myself.

I used some loan amortization software to figure out what each borrower's payment amount and schedule should look like, and they mailed checks to me each month.

I quickly realized this was a horrible way to collect payments on my owner-financed properties. It required way too much effort for both parties to send, receive, and deposit the money each month.

Even when everything is functioning properly, it was probably the highest-friction way to get the job done. When you multiply this friction by ten, twenty, or thirty borrowers, it turns into a living nightmare pretty quickly.

Option 2: Loan Servicing Software

Another way to handle payment collection is with loan servicing software.

There are plenty of options, depending on your budget and needs.

Most of these can perform basic functions like creating amortization schedules, automatically charging the borrower's account at pre-determined intervals, and sending automatic notifications to the borrower if their payment is missed or their account has insufficient funds.

Some also provide the borrower with an online portal where they can log in and check the status of their loan, find their current balance, or view their payment history.

Terra Notes (formerly YourLandLoans) and ZimpleMoney are examples (just Google “loan servicing software,” and you'll find plenty of options).

Using automatic payment collection software is FAR better than asking borrowers to mail in checks each month, but the biggest drawback of software is that it's just software.

You can handle it up to a point with software, but at some point, you need to get an intelligent, free-thinking human involved to ensure everything is firing correctly.

Collecting payments and tracking loan balances is a big part of loan servicing, but there's more to it than that. At some point, an actual person needs to issue annual notices, send out forms required by the IRS, and answer questions that software can't.

This is where the capabilities software stops, and you must pick up the slack.

Option 3: Loan Servicing Company

If you want the best combination of software AND humans to service your loans, you'll need to find a good loan servicing company.

A loan servicing company is pretty much what it sounds like—a full-on company specializing in loan payment collection and acting as the intermediary between you and your borrowers.

Similar to how a closing agent is a neutral third party that facilitates the paperwork and transfer of funds for a real estate transaction, a loan servicing company plays a similar role for every payment for every loan on your books.

Many loan servicing companies perform these duties for banks, private lenders, note investors, and investors like you who collect payments on their seller-financed properties.

Not only can they collect payments from you borrowers in a multitude of ways, they will also give the lender and borrower an online portal to track the status of every payment, the loan balance and get other basic information about the loan in progress.

A loan servicing company can also handle late payment notifications and 1098 forms for the IRS. And better yet, when your borrowers have questions, they can contact your loan servicer instead of you (they won't see your SSN on any of the IRS forms they receive each year).

They can offer automatic withdrawal from the borrower's account and automatic deposit to the lender's account. They can even split up payments to multiple lender accounts each month if needed (e.g., if you've partnered with another investor and you both want to collect monthly payments from the same loan).

The cost of working with a loan servicing company is often comparable to that of loan servicing software (depending on your chosen software).

Loan Servicing Company Directory

If you're looking for a loan servicing company to collect payments on a seller-financed property in your area, you'll need to find one licensed to work in the state where your property is located.

Most loan servicing companies are not licensed in all 50 states (a few of them are, but most are not), and some intentionally choose not to work in certain states because of problematic laws that impact the lender/borrower relationship.

To find the right loan servicer, you'll need to locate one that works in your state, contact them, and compare their services and costs.

I spent some time tracking down several of them and listed their basic details below.

- FCI Lender Services works in all 50 states. Their phone number is 800-931-2424 x-651.

- NSC Note Servicing Center works in every state except New York and New Jersey. Their phone number is 559-665-3456 x.305 or x.301.

- Madison Management Services works in 46 of the 50 states (every state except for Montana, New Hampshire, New York, and Oregon). Their phone number is 877-563-4164.

- SN Servicing Corporation works in all 50 states and some territories (Guam and Puerto Rico). Their general phone number is 800-603-0836. For setting up loan servicing on a seller-financed note, David Pollio is the guy to talk to. His number is 603-673-9800.

- SecureNet Loan Services works in Texas, New Mexico, Oklahoma, and Louisiana. Their phone number is 888-212-3642.

- Fahe Servicing works in Kentucky, Tennessee, West Virginia, Virginia, Alabama, and Maryland. Their phone number is 859-986-2321 x2120.

- BIFI Loan Servicing (By Investors For Investors) works in Alabama, Arizona, Arkansas, Georgia, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maryland, Michigan, Minnesota, Mississippi, Missouri, Nebraska, Ohio, Oklahoma, South Carolina, Tennessee, Texas, Utah, Virginia, Wisconsin. Their phone number is (888) 217-7652.

- Del Toro Loan Servicing can service most states outside of Georgia, Massachusetts, and New York, provided they are business purpose, non-owner occupied loans (eg, commercial, rental, apartments). Their phone number is 619-474-5400 Ext 131. You can also find more information about them on their FAQ page.

- Evergreen Note Servicing works in Texas. Their phone number is 866-358-6683.

- Safe Loan Servicing serves Texas only. Their phone number is (512) 817-1302.

- Allied Servicing Corporation works in Washington state. Their phone number is 509-893-0240.

- Lake City Servicing focuses on servicing non-owner-occupied investment purpose loans, which does not have a licensing requirement in most states. They do hold licenses in Idaho, Oregon, and California. See their NMLS page here. They cannot service loans in Arizona, Nevada, North Dakota, South Dakota, and Vermont. Their phone number is 800-630-9252.

Between these options listed above, you should be able to find multiple options in all 50 states and even some US territories (Guam, Puerto Rico, etc.).

Note: I have not worked with all these companies myself, so I can't vouch for them or “recommend” any specific one to you. However, I did find (after talking with most of them on the phone) there were some big variances in the quality of service and communication (don't worry, I didn't bother to include the remarkably bad ones in the list below). Be sure to talk with someone at the company before you decide to work with them.

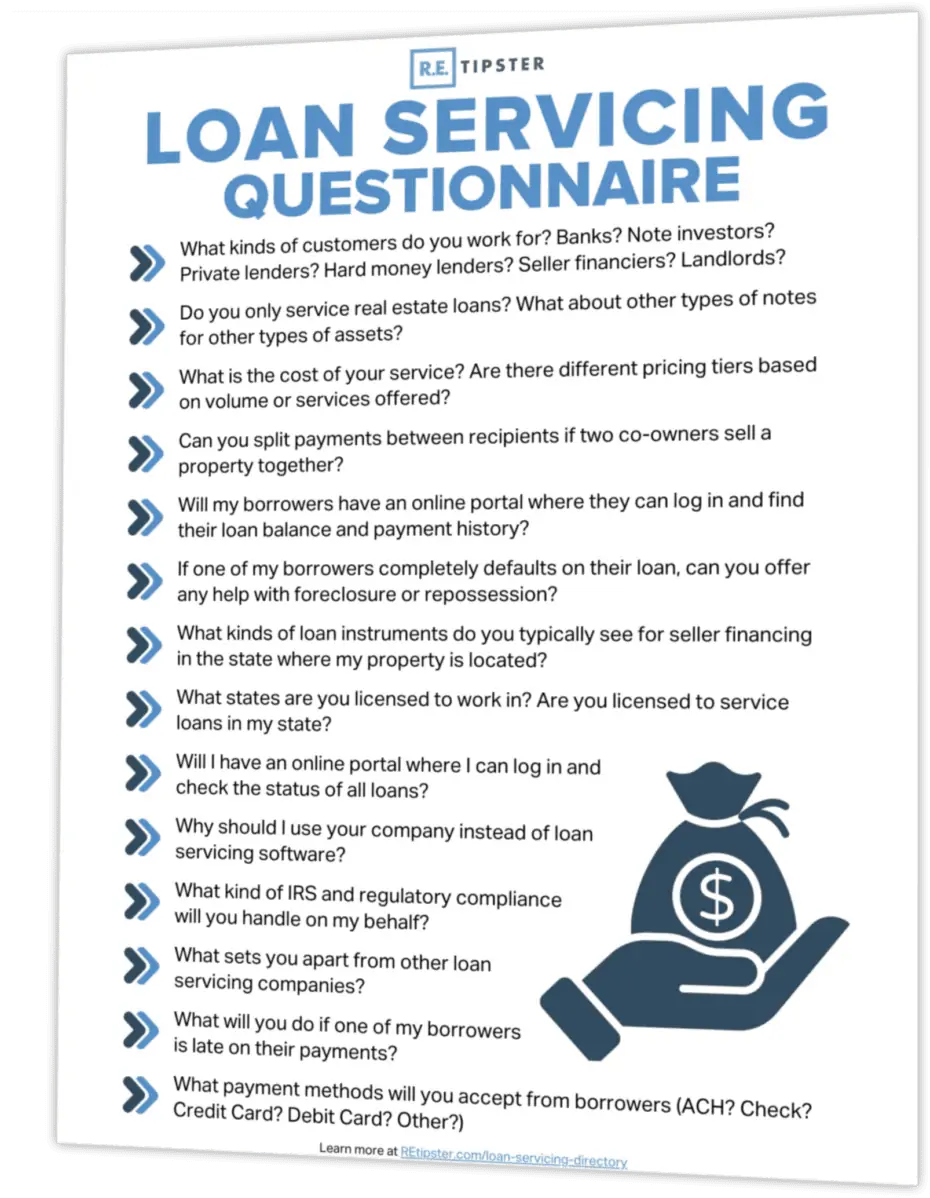

Loan Servicing Questionnaire

A loan servicer is a very important position that will handle a lot of money and play a pivotal role in the relationship between a lender and a borrower.

If you're unsure how to vet a loan servicing company or what questions to ask, here are some important things to investigate.

- What kinds of lenders do you work for? Banks? Note investors? Private lenders? Hard money lenders? Seller financiers? Landlords?

- Do you only service real estate loans? What about other types of notes for other types of assets?

- What is the cost of your service? Are there different pricing tiers based on volume or services offered?

- Why should I use your company instead of loan servicing software?

- What kind of IRS and regulatory compliance will you handle on my behalf?

- Can you split payments between recipients if two co-owners sell a property together?

- Will my borrowers have an online portal where they can log in and find their loan balance and payment history?

- Will I have an online portal where I can log in and check the state of all loans?

- What will you do if one of my borrowers is late on their payments?

- If one of my borrowers completely defaults on their loan, can you offer any help with foreclosure or repossession?

- What kinds of loan instruments do you typically see for seller financing in the state where my property is located?

- What states are you licensed to work in? Are you licensed to service loans in my state?

- What payment methods will you accept from borrowers (ACH? Check? Credit Card? Debit Card? Other?)

- What sets you apart from other loan servicing companies?

If you'd like to download a pdf with these questions for reference, you're welcome to do it right here!

As you can see, it's not just about knowing which companies you can work with. It's also important to know which loan servicer you should work with based on the services they offer and how well they'll be able to serve your needs.