REtipster features products and services we find useful. If you buy something through the links below, we may receive a referral fee, which helps support our work. Learn more.

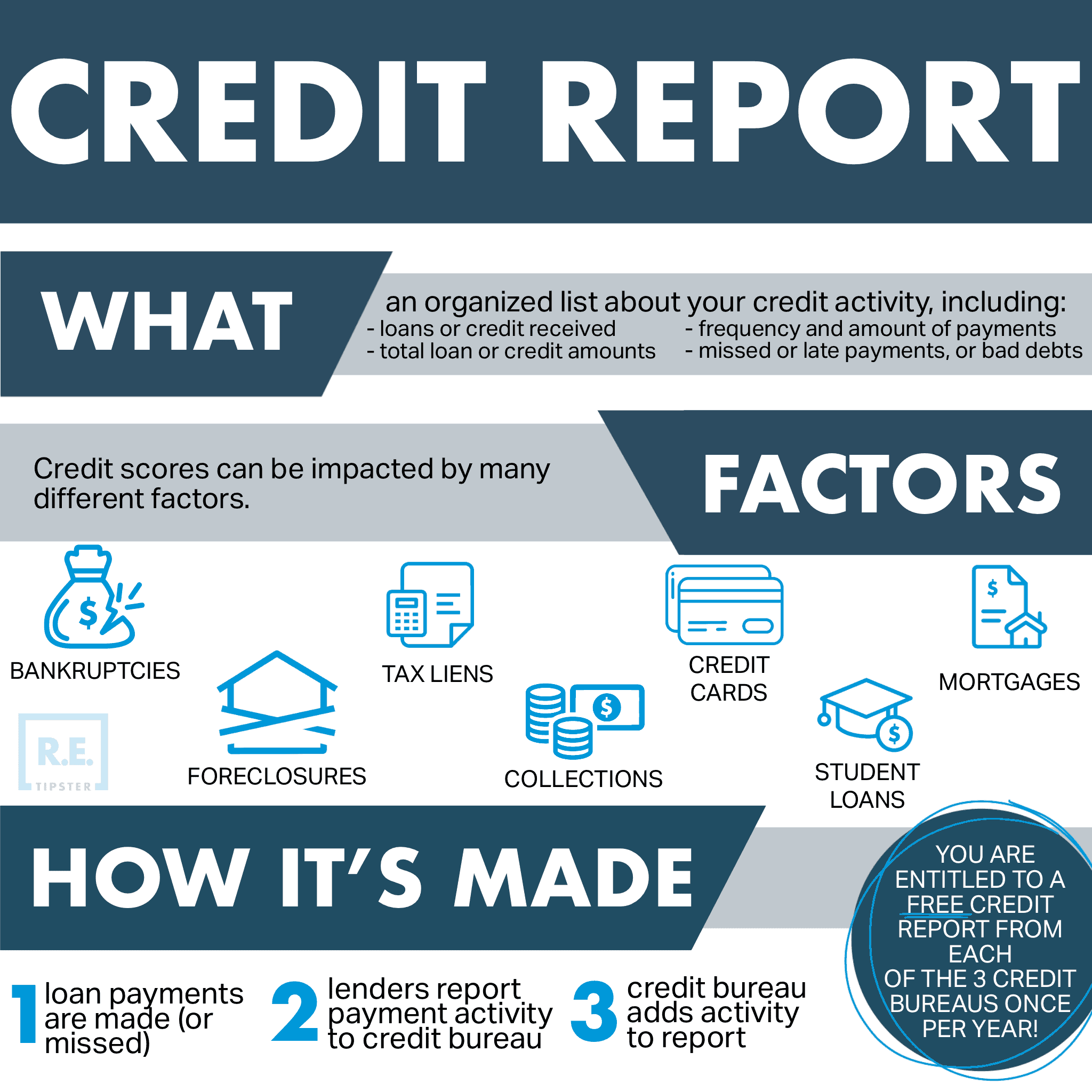

When evaluating a new relationship that involves YOU collecting payments from someone else, getting that person's credit report is never a bad idea.

At the same time, this information will only be useful to the extent that you understand how to read it.

If you're struggling to understand what a credit report is telling you (whether it's your own credit report or a new tenant or borrower you're evaluating), I will help you understand the basics below.

Where to Order a Credit Report?

These days, there are several easy (and free) ways to get a credit report from a potential tenant or borrower.

If you're a landlord trying to screen a tenant, there are some well-known and respected property management software options (TenantCloud, Avail) that have this kind of credit and criminal background check functionality built into them. You simply set up a new tenant profile and send the prospective tenant an invite to order and pay for their credit report (that's right, it's FREE for the landlord), and the information is sent directly to you when it's ready.

If you don't need or want a full property management solution, another option is to use SmartMove from TransUnion, which allows you to do a similar thing without getting entrenched in software that does much more than you need.

How Do You Interpret a Credit Score?

Here's a quick rundown of how I assess credit scores:

- 800 – 850 – Excellent! It's not often that credit scores come in this high. If you see anything north of 800, it's a good sign they've been doing something right.

- 700 – 799 – Good! When someone's credit score is in this range, their financial situation isn't necessarily perfect, but it's still in great shape.

- 650 – 699 – Pretty Good. There may be a few “dings” against their credit that are worth investigating, but nothing alarming.

- 600 – 649 – Meh… this applicant probably has some questions to answer. Dig deeper into the credit report to understand why the score isn't higher and look for any red flags. Figure out what has caused their score to be less-than-stellar and why.

- Less than 599 – Poor. There are most likely some significant issues you need to be aware of. Be very careful when you score in the range.

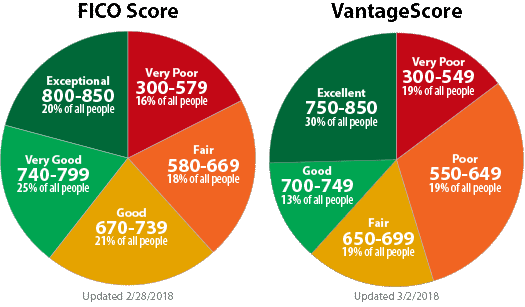

Remember, these bullet points are how I look at credit scores. If you want to see more of an “official industry standard,” these pie charts from Experian convey another perspective:

Don't forget, the credit score by itself never tells the whole story. Simply focusing on these three digits doesn't tell you WHY the credit score is high, low, or average.

You need to dig into the details to understand what's happening with a person's financial picture. A credit report has several parts that can uncover a person's past and current financial obligations.

RELATED: The Quick & Easy Guide to Tenant and Borrower Screening

Parts of a Credit Report

A typical credit report consists of several key components.

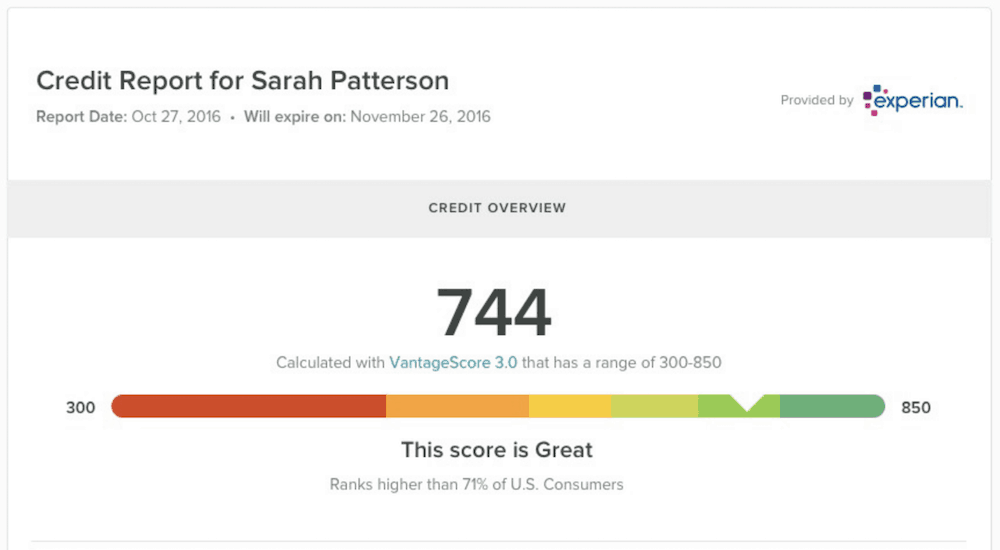

1. Credit Overview

The format may differ depending on where you obtain a credit report, but the first thing you should see near the top is the credit overview.

This boils everything down to a three-digit number and gives a quick, high-level summary of where this person stands.

In this example, the applicant's credit score is 744. With this kind of score, we can be reasonably confident there won't be any huge, ugly surprises in their credit report. Even so, it's worth your while to keep reading to understand what information lies behind this number.

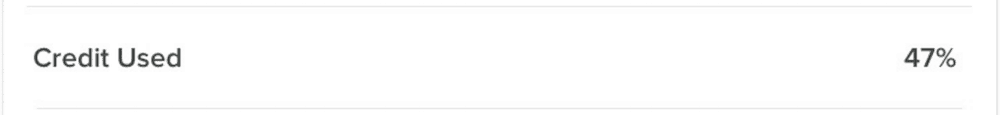

2. Credit Used

The next thing you'll see is the credit used.

The applicant has already leveraged 47% of their available credit in this example.

Another way of looking at this percentage is,

If this person can borrow up to $100, they've already obtained $47 of those dollars.

The idea is to simply offer an idea of how much borrowing capacity they still have left, given how much debt they've already taken on.

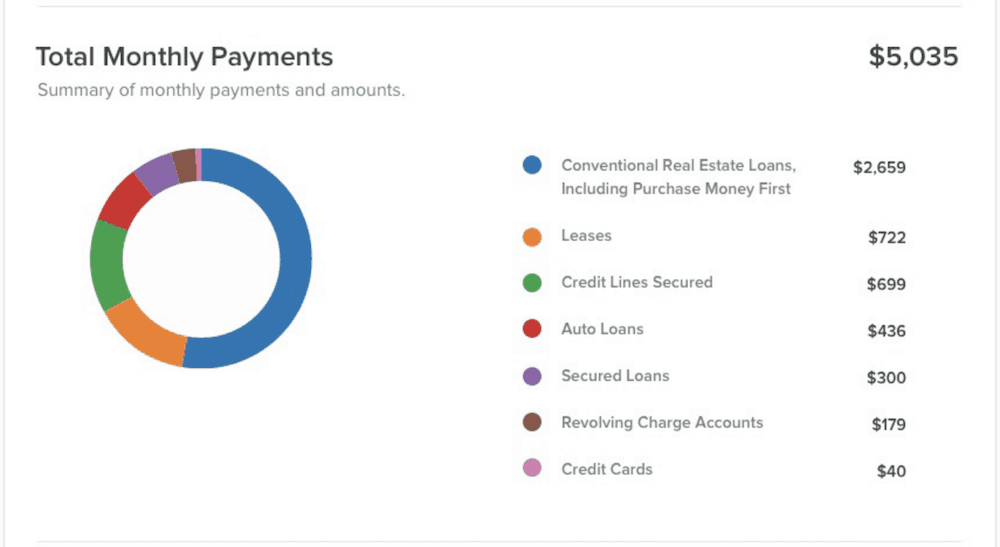

3. Total Monthly Payments

The next section of the credit report shows the person's total monthly payments, which is self-explanatory.

It details how much this person pays out each month to cover their outstanding debts and obligations.

This data will offer some quick insights into two things:

- What types of debts are already outstanding?

- What are the total monthly payments assigned to each type of debt on the list?

If the applicant has any big monthly payments that weigh them down, those will probably jump out in this section.

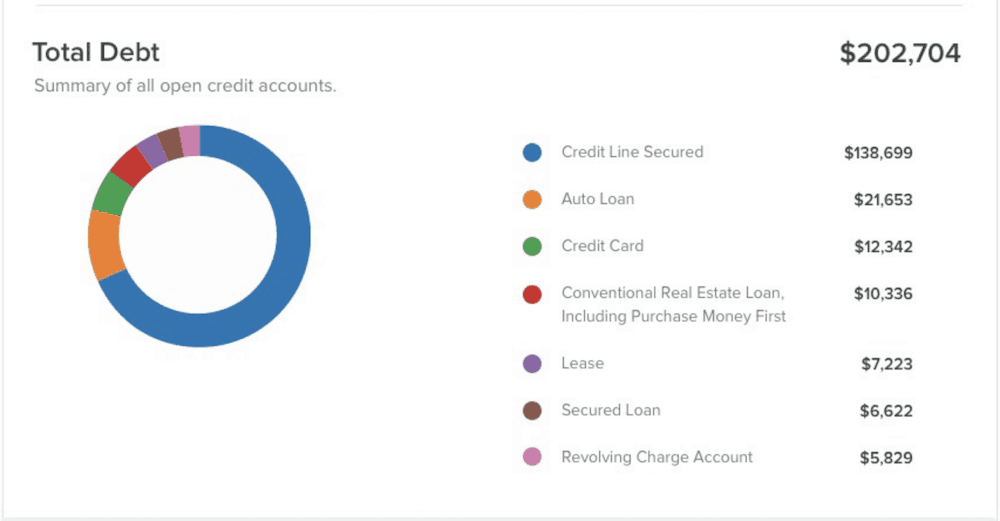

4. Total Debt

Beneath the total monthly payments section, we'll see the total debt.

Similar to the previous section, this part of the credit report shows us the current outstanding balance(s) of each type of obligation the applicant must pay.

Remember, this doesn't tell us anything about the person's monthly cash flow (i.e., whether or not they can afford these monthly payments). But it does tell us how much they'd have to pay to wipe out ALL of their existing debt right now.

Of course, knowing a person's total monthly payments and debt doesn't tell us anything conclusive about their creditworthiness. It simply tells us what's working against them.

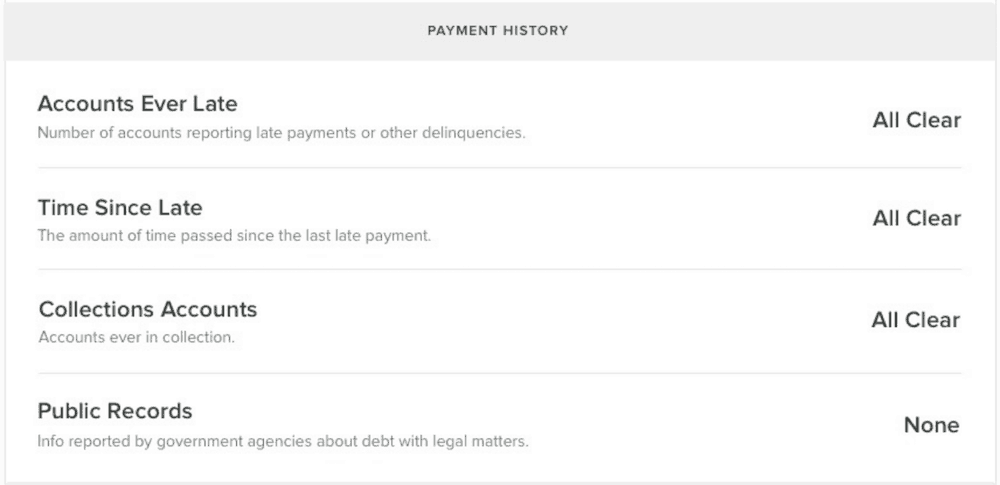

5. Payment History

Next on the credit report is payment history.

This section tells us how often (if ever) the person has been late on their payments and how many times they've missed their monthly payments (on current or past debts owed).

Furthermore, if any payments have been completely neglected or ignored, we can see how often their missed payments have been turned over to collections. This includes public records, such as failure to pay taxes or any amount owed to a government agency.

In the best-case scenario, the credit reports you analyze will look exactly like the example above. If you see the words “All Clear” and/or “None,” you can simply move on to the next section.

On the other hand, if you see that there have been prior issues, you can gain even more insight into what might have gone wrong in the following section.

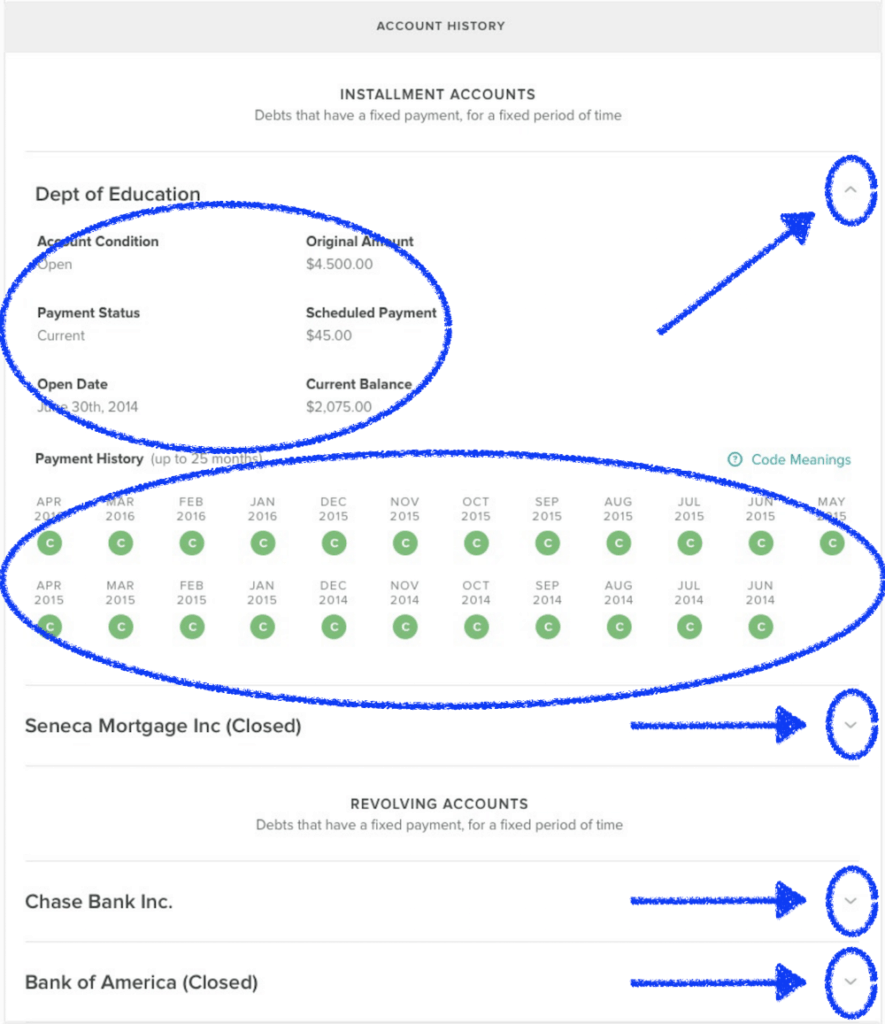

6. Account History

In the account history section, you can see much more detail about every monthly payment they've made for the past two years.

If they missed or late payments in that timeframe, you'll see when they happened, how late the payments were, and how long they persisted for. You can expand the details on each loan by clicking the down arrow next to each entry.

In this section, you may encounter a few different types of accounts:

- Installment accounts. These will have a fixed monthly payment, for a set period, with a loan balance that goes down steadily each month until the loan is paid in full. These types are usually for real estate loans, student loans, and other fully amortizing loans.

- Revolving accounts. These loans feature a loan balance that can go up and down as the funds are withdrawn, repaid, and redrawn again as needed for the duration of the loan agreement. Often, these accounts will be in the form of credit cards or home equity lines of credit, with loan balances that fluctuate monthly. The principal balance on this type of account doesn't need to be paid down to zero every month, only the interest.

- Closed accounts. Whether looking at a revolving or an installment account, you may see the word “Closed” in parentheses whenever the loan has been paid off and closed within the timeframe covered in the credit report.

Again, ideally, you'll see every payment listed as a green circle with a “C” (current) in this section. But if you see anything else, you may put together a list of questions for the person you're reviewing. Or, if you're looking at your credit report, take note of any surprises you see here so you can resolve them with the appropriate creditors.

Are There Justified Late Payments?

When you see indications of late or missed payments, it doesn't necessarily mean the person isn't creditworthy, but it should at least tip you off that something unusual is going on.

Remember —sometimes there are legitimately good reasons for late or missed payments.

In my days in the banking world, I saw some good, creditworthy people with horrible credit scores. Why? Because sometimes, people will withhold payments because of incomplete work, defective products, or various payment disputes. Sometimes they aren't even aware of money owed in the first place! This happens a lot with small medical bills that get lost, which are then sent to their collections agency when they unpaid. Reporting errors can happen, too, so don't assume every credit report tells you the gospel truth. Look at this as one of many research tools.

When you see issues in this report section, ask some questions. Dig deeper to find the whole story.

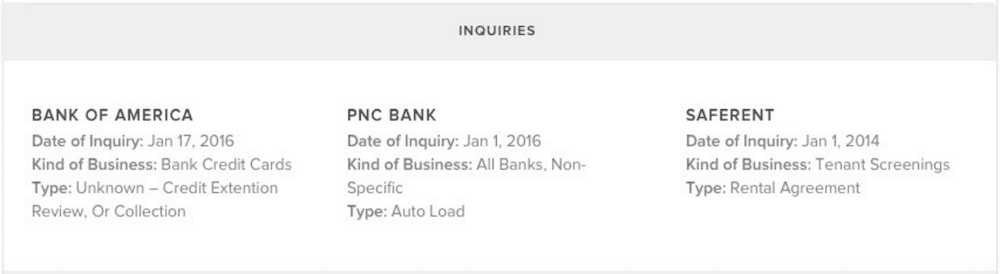

7. Inquiries

In the inquiries section of the credit report, you'll see a list of other financial institutions, lenders, landlords, and screening companies (among others) who have run credit checks on this individual. It will also say what date the credit report was pulled and what type of application it was pulled for (e.g., auto loan, credit card application, rental agreement, etc.).

When a person has several credit inquiries in a short period, it can hurt their overall credit score. These inquiries are referred to as a “hard inquiry” or a “hard pull,” which typically occur when a mortgage lender or credit card issuer runs a credit check during their underwriting and decision-making process. If someone is simultaneously applying for a loan with more than one lender, this can hurt their credit score.

Hard inquiries will typically be listed like this on a credit report for about two years after the fact. Soft credit inquiries don't hurt a person's credit score.

8. Addresses and Employment

In the addresses and employment sections, we can see some other basic details about where this person has lived and where they've been employed.

It's worth noting that this credit report section isn't necessarily an all-encompassing “employment history.” Rather, it's a list of information from the applicant's other lenders.

When a person completes a new loan application (such as for a mortgage or line of credit), part of the application typically requires them to fill out their home address and the name and address of their current employer.

These lenders will then report this information from these loan applications to the credit agencies, and that's how this information ends up on credit reports.

This list of employers is only refreshed when a person applies for new credit. Even then, it's not always provided to the credit reporting agencies, so it's not exactly a definitive list of the applicant's current and previous employers.

Keep in mind that while this information is somewhat useful for verifying a person's address and employment situation, this section of the credit report has no impact on a person's credit score.

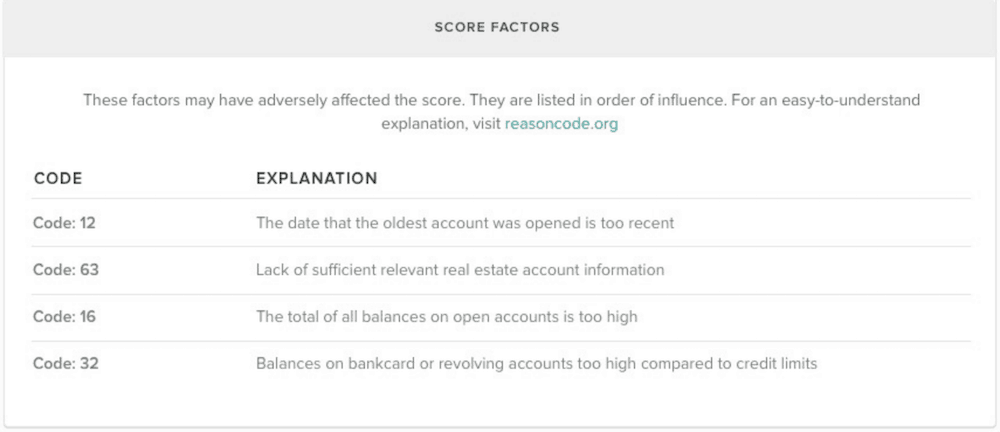

9. Score Factors

The last thing you'll see in this type of credit report is the score factors. This is a quick list of reasons indicating why the credit score is what it is.

This section may help decipher why a person's credit score seems lower than it should be. For example, if they have an excellent payment history but they've had 20+ hard inquiries against them over the past 30 days. You can use your best judgment to decide whether or not the person is a legitimate credit risk.

Credit Report Income Verification (Don't Forget This!)

A credit report can be extremely helpful as you do homework on a potential tenant, borrower, employee, or otherwise. But it's also important to recognize that the credit report isn't everything.

This data tells you their personal debts and obligations (i.e., the total loan balances and their monthly payments) and what they looked like historically.

What it does NOT tell you, however, is how much income they generate. If you're trying to determine their personal debt to income (DTI) (i.e., how much they pay out for their monthly debts vs. how much income they generate each month), you'll need more than just the credit report to see the full story.

Most lenders and landlords will request additional information (recent pay stubs and W-2s) on top of the credit report to verify their applicant's income because they simply cannot make an educated decision without it.

Without a W-2 from the applicant's employer, a copy of their most recent tax return will also show their annual income in the previous year. The W-2 is usually easier to produce, which is why most lenders and landlords start with it.

With this information, you should have reasonable assurance of two things. First is how much the applicant earns; the W-2 will show what the applicant was paid in the most recent fiscal year. Second, how much they currently make per month; pay stubs will show what the applicant makes each pay period.

Does This Cover the Whole Income Angle?

It's worth noting that while these documents by themselves can offer some pretty solid assurance of an applicant's employment situation, they still won't guarantee that the applicant is currently employed. For example, in the unlikely event that they just got fired in the past few days, or if they fabricated their W-2 and pay stubs, you would have no way of knowing this by referring only to these documents.

This is why it's also a good idea to contact the person's current employer to request employment verification. If you're relying on the applicant's tax returns, you may even go so far as to verify these documents with the IRS by using Form 4506-T, which will provide you with a transcript of the person's tax return.

Does a Credit Report Show the Full Picture?

Critical thinking is important when looking at a credit report.

Whether a person's credit score is exceptionally high or low, you need to figure out the “why.” For instance, consider the credit scores of Applicants A and B.

Applicant A

This person has a credit score of 580.

They lost their job last year and couldn't pay their student loans, which sabotaged their credit history. However, during their loss of income, they chose to continue paying their rent. In other words, they prioritized their payments to their landlord over their other obligations, even to the detriment of their credit score.

They recently got a new job and are currently on their payments, but it will take time to fix their credit score.

Applicant B

This person has a credit score of 780.

Their credit score appears to be very good because they owe money on several loans and are always paid on time. However, they also have $20,000 in credit card debt (yikes!) and no history of making rent payments. Their borrowing capacity is already highly leveraged, and we aren't sure which payments they would prioritize if they lost their job tomorrow.

When you compare both applicants and understand the FULL picture of why their credit scores are high or low (along with other factors like their income, employment situation, and the results of their background check), you may start to see how a low credit score doesn't necessarily mean someone will be a bad tenant. Conversely, a high credit score doesn't necessarily mean their payments will come with a stronger guarantee.