REtipster features products and services we find useful. If you buy something through the links below, we may receive a referral fee, which helps support our work. Learn more.

For a couple of years now, I've been hearing a lot about a website called Roofstock.

In a nutshell, Roofstock is a turnkey real estate website that helps real estate investors who want to buy a fully leased property (typically, a single-family home).

In a nutshell, Roofstock is a turnkey real estate website that helps real estate investors who want to buy a fully leased property (typically, a single-family home).

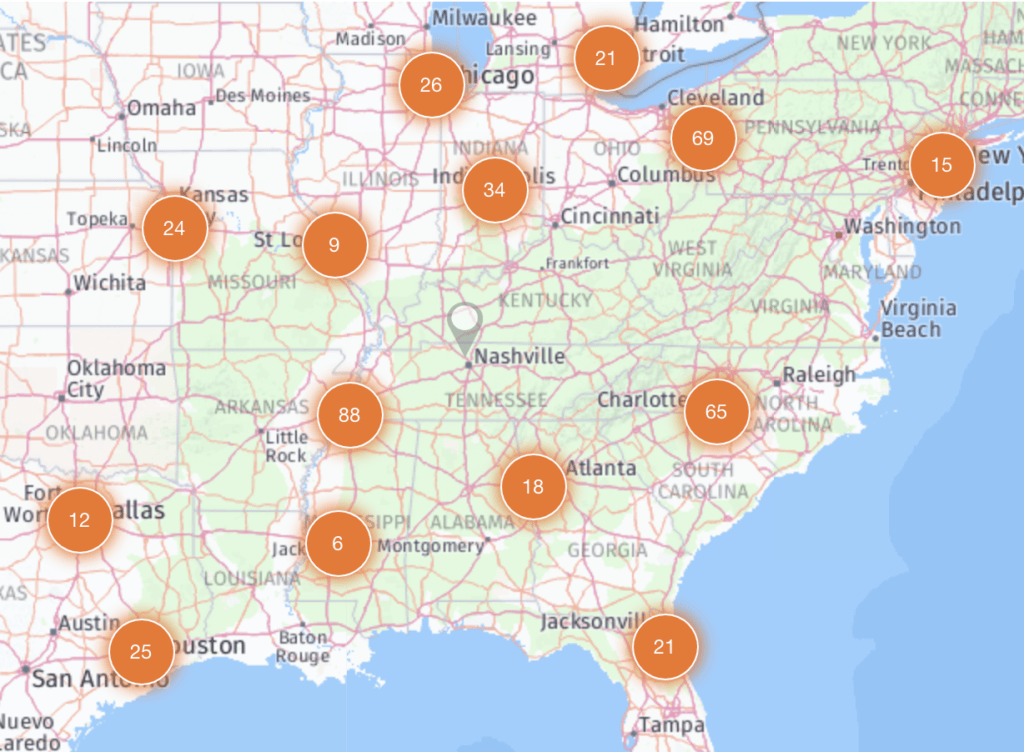

The company works in several key markets around the country that can consistently produce cash-flowing properties on the more affordable spectrum (typically, around $75K – $150K).

The bottom line is you should be collecting payments for your property almost immediately after buying it.

Roofstock provides a relatively easy way for investors to find and buy properties, particularly for those who live in coastal markets (wildly expensive cities like San Diego, San Franciso, New York, D.C., etc.) where it’s WAY too expensive for the average person to start buying properties around where they live.

With the markets that Roofstock plays in, the properties are significantly less expensive and tend to perform much better from an investment standpoint.

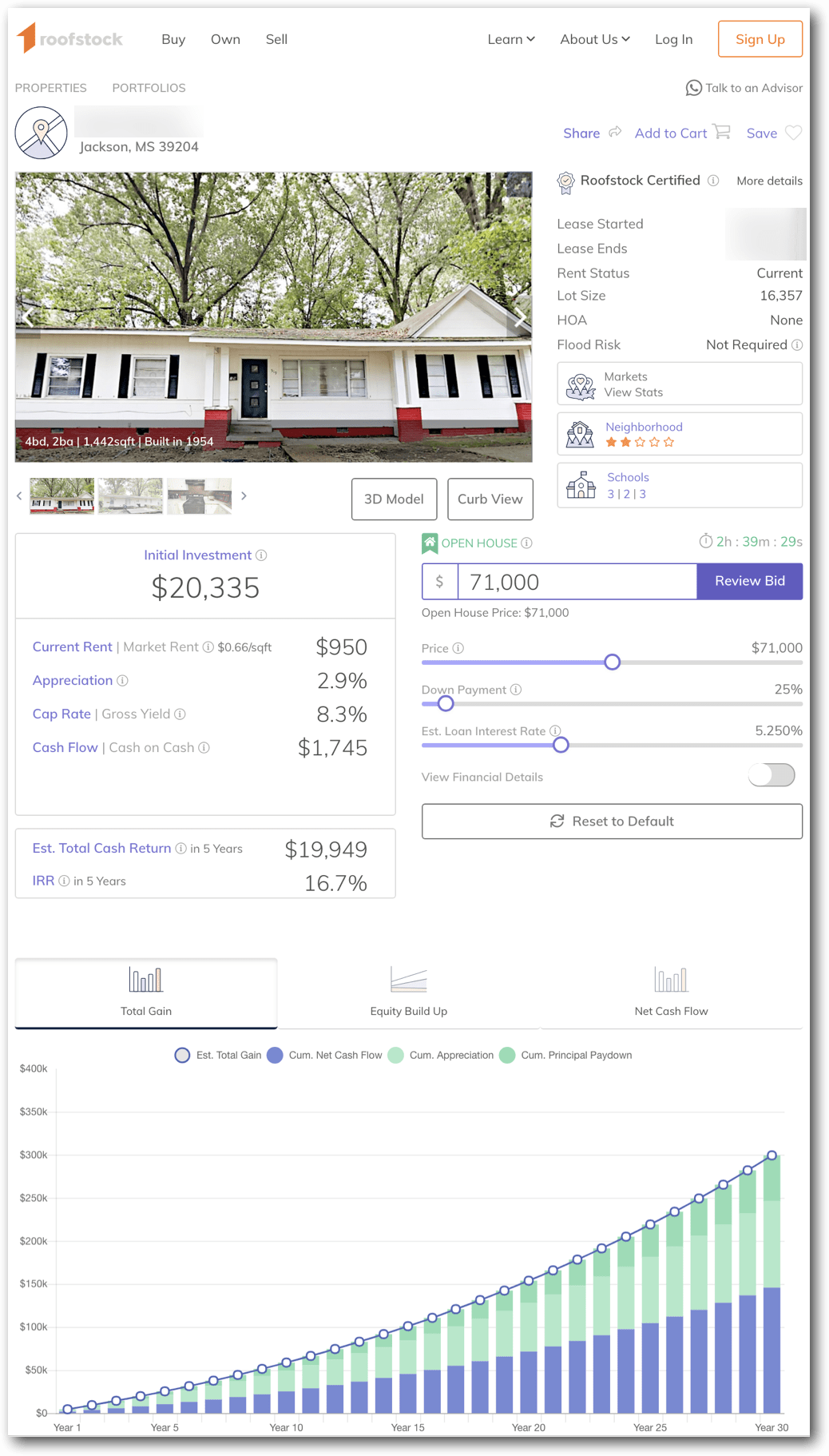

When you're shopping for potential investment properties on their website, they provide a TON of helpful information so that you can understand some very important decision-making criteria:

- What kind of property you're investing in (condition and curb appeal).

- What kind of return you can realistically expect.

- What kind of tenant you're inheriting (whether they're current or late on rent).

- What kind of neighborhood the property is in.

When you click on each listing, you'll be able to explore more in-depth information about each property. Here's a quick screenshot showing what kind of information they have available (if you want to interact with the site yourself and see some of their live listings, click here to see what they have available).

Roofstock also does some pretty in-depth inspections on the properties they list. They also provide each investor with access to the inspection reports and background information on the property AND the existing tenant (they provide all this info up front, just for registering)… so there will be very little confusion about what you're getting into if you decide to purchase one of these properties.

What About Property Management?

How is the average out-of-town investor supposed to find a trusted property manager to adequately service these tenants and their properties?

Whenever Roofstock launches their services in a new market, they have a team that establishes partnerships with local property managers (usually 5-8 individual managers), then narrow that down to the best 2-3 on their list, and those are the ones they recommend.

It's also important to note – Roofstock has no financial affiliation with the property managers they recommend, so there’s no bias around who they end up choosing to recommend to their investors.

RELATED: Finding The Right Property Management Company

Investors also aren't contractually obligated to work with any particular property manager. An investor can choose who they want to work with, if/when they want to fire their property manager, or whether they want to manage the property themselves (say, if you want to use a service like TenantCloud or Buildium).

Are There Any Guarantees?

Ultimately, it's up to YOU as an investor to make smart decisions, verify the numbers and ensure you understand the good, bad, and ugly of the property you're buying. Roofstock simply gives you an abundance of information to help you do that.

What About Financing?

Most of the investors who buy properties from Roofstock are not cash buyers. They need to determine their financing method for each deal.

If you're in the market to buy a rental, there's a fair chance you've already got a lender in mind, but if not – Roofstock can make it easy to get rates and apply for pre-approval with some of their recommended lenders. Ultimately, though, each investor can work with whoever they choose.

What is the Typical Property Like?

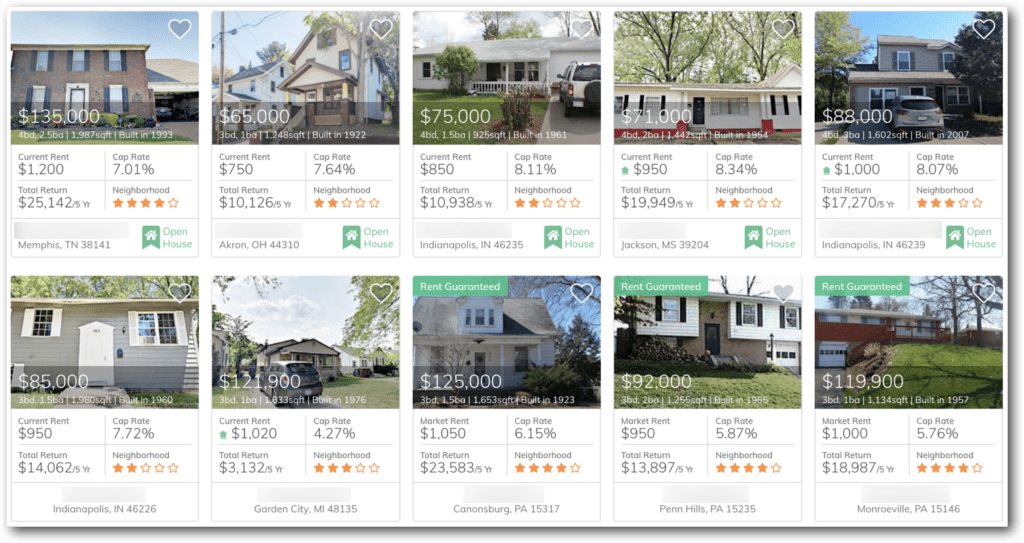

If you take some time to look through the property listings on the Roofstock website, you'll get a feel for the average property (price, condition, neighborhood, appearance, etc).

For the most part, the properties on this site are NOT the kind that has just undergone a full rehab. There will likely be odds and ends that need to be replaced and updated, and most properties will show signs of wear and tear.

Again, before you buy any property (whether you're doing it on your own, or through a website like Roofstock), you should ensure you're getting plenty of information describing the property's condition and what kind of tenant is currently in place.

RELATED: The Beginner's Guide to Buying Rental Properties (A Case Study)

Roofstock's objective is to be transparent and provide most of this information upfront, which makes the decision-making process quite a bit easier.

Where Does Roofstock Get Their Inventory?

Most of the listings you'll see on the Roofstock website are sourced through partnerships with larger institutional owners and a growing number of individual owners who want a hassle-free way of selling a single-family property.

The company makes its money by charging a 2.5% listing fee to the seller (which comes off the final sale price when the property sells) AND a 0.5% fee from the buyer (which is paid when a submitted offer is accepted). In any event, it ends up being less expensive for sellers, who don't have to pay a 6% fee to a real estate agent, and the buyer gets a good value because they're able to find and buy a turnkey rental property with some degree of ease.

What is the Typical Return On Investment?

The typical return on the properties from Roofstock is decent (positively cash flowing, with cap rates that range from 3-4% on the low end to 8-9% on the high end).

To be honest, I wouldn't consider these kinds of returns to be “amazing” (I've done much better with the properties I bought during the most recent recession), but when you're working in a seller's market and cash-flowing properties are much more difficult to find, I would consider these to be pretty decent… especially considering how easy Roofstock makes it easy to shop for properties, get all the information you need and piece all the details together.

If you want to get started as a real estate investor (or if you're just looking for a solid place to park some of your cash… a place that will also give you some nice tax write-offs), Roofstock seems to be one of the easiest turnkey shops I've seen to date.

RELATED: How to Buy 10+ Rental Properties in the Next 5 Years

First-Hand Experience

Whenever I write reviews like this, I want first-hand experience with the website/product/service I'm talking about.

In this case, unfortunately, I don't. All the information above is based on my conversations with the folks at Roofstock and my initial thoughts and impressions of perusing the company's website.

In these situations, I'm curious to hear what the experience has been like for others who have used them.

Luckily, I stumbled across this review on the BiggerPockets forums, where a couple of users were kind enough to thoroughly document what their experience was like buying through Roofstock. I also found a few others on Reddit who also shared their experiences.

The long and the short of it is, every opinion and review I've seen to date has been positive (and these first-hand reviews were not coming from anyone with a financial interest in promoting the company – like I am in this blog post :).

After seeing all of this, I was able to get pretty comfortable with putting this piece together, and if you're in the market for buying a turnkey rental property, I hope you found this helpful!