REtipster features products and services we find useful. If you buy something through the links below, we may receive a referral fee, which helps support our work. Learn more.

It's fascinating to see how different real estate investors analyze rental properties.

It's fascinating to see how different real estate investors analyze rental properties.

While we all use (mostly) the same ratios and numbers, the sheer number of calculators, spreadsheets, and other analysis tools on the market is incredible. It often takes a lot of trial and error to find the method or tool that works best for you.

I used to analyze all my rentals using an Excel spreadsheet I made. It did a good job for a time. But in the last year or so, I spent less time at my computer and more time on the go with my cell phone and tablet. I needed something as powerful as my spreadsheet but something I could use on my mobile devices.

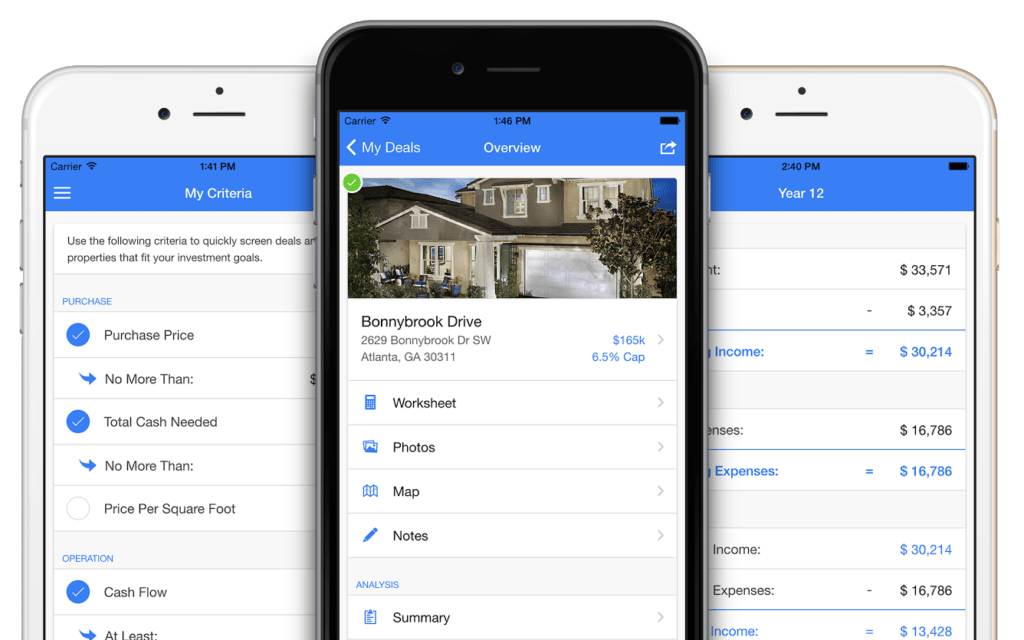

When I joined the team behind the DealCheck mobile app and started using it to analyze potential deals, I realized I had found the exact tool I needed. I gradually stopped using my spreadsheet altogether and now exclusively use DealCheck to analyze all properties I come across.

Here is how this app works:

Customizing Your Purchase Criteria

You can download DealCheck: Rentals for free for iOS and Android (it runs on phones and tablets).

You’ll see a list of what investors typically look for in rental properties. The default presets are a good place to start, but you should look over the following:

- Purchase Price and Total Cash Needed: We all have different financials and available cash reserves, so these two numbers will depend on what you can afford. The Purchase Price is self-explanatory. Total Cash Needed includes all the up-front costs associated with purchasing a property, including the down payment, closing costs, and rehab costs.

- Cash Flow: I like to have at least $150 in monthly cash flow after all expenses (including the mortgage payment) have been paid. You may have a different number in mind, but it’s generally better not to go below $100.

- Cap Rate: The cap rate for a property is calculated by dividing the Net Operating Income (NOI) by the Purchase Price. You are probably familiar with it, as it’s one of the most widely used metrics to evaluate deals. The cap rate can vary widely across different markets, so it’s hard to recommend a number that will work for everyone. I like mine at least 6-8%.

- Cash on Cash and ROI: The cap rate doesn’t always show the full picture, as it doesn’t consider the financing you use to acquire the property and the money you spend on closing and rehab. Most investors I know use the Cash on Cash (COC) return and Return on Investment (ROI) when analyzing their deals.

There are no right or wrong answers when choosing your purchase criteria. The most important thing to remember is that it should align with your short, medium and long-term real estate goals and help you find rentals that will benefit you for years to come.

Adding a New Property

After your purchase criteria are good to go, you can get to the fun stuff – analyzing an actual deal!

After creating a deal, you can go to the Worksheet to start entering the information about this deal. The Worksheet covers all the details in one place, including purchase information, financing (if you’re using it), closing and rehab costs, and operating income and expenses.

This is the most important part, as the numbers you enter will directly affect all the calculations. The app allows you to estimate many of the totals like closing costs, rehab costs, and expenses, although I prefer to itemize them. It does take a little bit longer and requires more research, but it makes your calculations more accurate.

At the end of the Worksheet, don’t forget to look over the assumptions, including vacancy, appreciation, selling costs, etc. The default values will work for most markets, but you should change them if they seem off. If you are new to investing, being more conservative with the vacancy rate is a good idea.

Getting to the Analysis

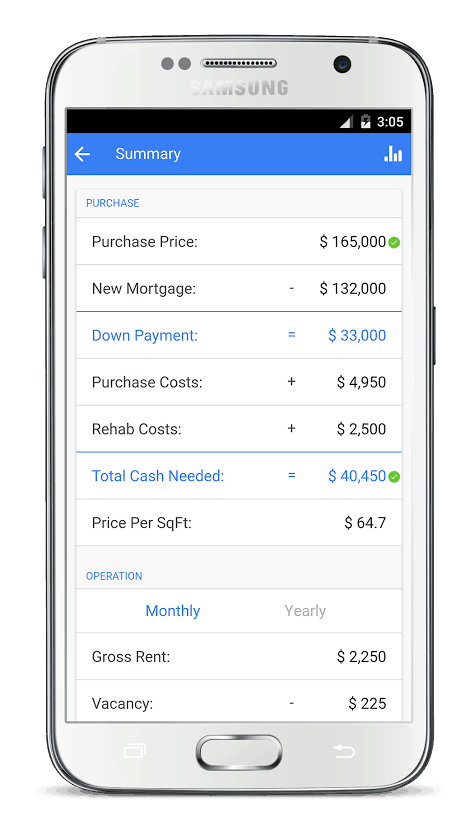

Once the Worksheet is filled in, you can tap the clipboard icon at the top to view the deal’s Summary page.

Right below that is the operation section, which breaks down your monthly/yearly income and expenses, calculates your mortgage payment and NOI, and shows you how much actual cash flow you will have each month and year.

Further down are the property’s returns, including the cap rate, cash on cash (COC) return, return on investment (ROI), rent to value, and the gross rent multiplier. You may not use all of these to compare deals, but the cap rate, COC, and ROI are worth checking.

If you entered your purchase criteria earlier, you would see a small green or red icon next to some items on the Summary page. These indicate whether this deal passed (green) or failed (red) the criteria you specified.

This helps you quickly see where the problem lies and allows you to work on adjusting the deal to meet all of your criteria. Or perhaps, the numbers are too far off, and you decide this deal isn’t worth pursuing further.

Viewing Long-Term Projections

If you plan to hold on to the rental for a while, you will find the Projections screen extremely useful. It shows how the property will perform from year 1, all the way out to year 35.

In addition to projecting your cash flow and returns, this screen will also show you equity accumulation, including how the property value and mortgage balance will change over time.

You can also see the tax benefits you would get from owning this property, such as the depreciation and mortgage interest write-offs.

When viewing this screen, I like to focus on what the numbers will look like after the mortgage has been paid off, typically after year 30. This gives me an idea for the cash flow I can expect when owning the home free and clear.

Adding Extra Info and Sharing Deals

You can add pictures and notes to each of your properties, which can come in handy when you visit the home during an open house or inspection. Then later at the office or at home, you can reference back to these to help you make purchase decisions.

If you entered the home’s address, you can also view it on the map right from the app and scope out the neighborhood with Google’s Street View. I’ve bought out-of-state rentals several times without visiting the area in person.

And finally, you have the option to share the deal with your partners, investors or other interested parties. For example, you can send the information to your lender to help him or her draft up the paperwork for the loan.

Using Technology To Your Advantage

I believe in using technology to simplify our lives, including finding good real estate deals. Since we often find ourselves on the road, it would only make sense to have a powerful real estate analysis tool like DealCheck in your pocket.