What is Net Operating Income?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

NOI Formula

The formula for calculating net operating income is simple enough:

Gross Annual Revenue – Total Operating Expenses = Net Operating Income

While gross revenue refers to the total annual rents and other property-related income, operating expenses are a slightly more difficult figure to calculate. Operating expenses include all of the following:

- Property taxes

- Insurance

- Maintenance and repairs

- Vacancy rate

- Property management fees

- Any utilities paid by the owner

- Any other operating expenses, such as janitorial or groundskeeping costs

NOI does not include financing costs such as interest. It also ignores income tax implications (although it does include property taxes).

Some of the expenses above are essentially fixed costs, such as property taxes. But others, such as vacancy rate, require an estimate. Investors can’t know the exact vacancy rate a given property will see next year, but by analyzing comparable properties, they can arrive at a reasonably accurate long-term average.

Even the concrete numbers like insurance premiums and property tax bills are subject to change.

It’s prudent for most investors to err on the side of caution by overestimating expenses. The last place you want to find yourself is stuck with an investment property that costs you money each year, rather than earns it for you.

Example NOI Calculation

Suppose you find a rental property for $100,000, that you believe will generate a strong cash on cash return. But before making an offer, you run the numbers carefully.

It rents for $1,200 per month, for an annual gross income of $14,400. Then you start doing your homework to estimate expenses. After analyzing the local market, you come up with the following figures:

- Property taxes: $1,500 (~10% of rents)

- Insurance: $1,000 (~7% of rents)

- Maintenance and repairs: $2,000 (~14% of rents)

- Vacancy rate: 4% ($576 per year)

- Property management fees: 12% ($1,728 per year)

- Utilities included: $0 (you opt to require the tenant to pay directly)

Tip: Investors should run expense numbers in both dollar amounts and percentages of the rent. It helps clarify the current figures and how expenses will rise alongside rents.

With property management fees, remember to include both rent collection percentages and an estimate of new tenant placement fees. In the example above, we are assuming 8% of monthly rents, plus a one-month new tenant placement fee every two years (which comes to around 4% of annual rents).

All told, the annual net operating expenses total $6,804 (around 47% of gross rents). Which makes the net operating income $7,596 ($14,400 – $6,804 = $7,596).

Uses of NOI

One of the primary uses of net operating income lies in calculating cap rates, or capitalization rates. Cap rates serve as a quick, easy way to compare potential returns among similar properties.

The cap rate formula is nearly as simple as the NOI formula:

NOI / Cost of Investment

Cap rates tell you the annual yield you can expect to earn on any given investment, ignoring loans or financing.

In the example outlined above, the cap rate would be 7.60%. Here’s how it’s calculated:

$7,596 / $100,000 = 7.60%

(note: cap rates are typically rounded to two decimal places)

NOI is similarly used to calculate cash-on-cash returns and the net income multiplier.

Lenders also use NOI when they calculate the debt service coverage ratio (DSCR). They need NOI to determine whether a property’s income is sufficient to cover its operating expenses and debt obligations.

When an Appraiser uses the income valuation method, they will calculate NOI to help them estimate the value of an income property.

Limitations of NOI-Related Calculations

Because NOI doesn’t include debt costs, it often doesn’t take the whole financial picture into account.

Imagine two identical buildings – Property A and Property B.

Property A is the example above with a cap rate of 7.60%.

Property B is a different building with a cap rate of 8.00%.

All else being equal, the 8% cap rate would make a better investment, right?

Not necessarily. In the real world, investments are never truly equal.

Suppose your primary lender doesn’t like Property B with an 8% cap rate and refuses to lend against it. You find another lender willing to finance it, but they charge a higher interest rate. When you include financing costs and calculate your cash-on-cash returns, you discover that Property A with the 7.60% cap rate offers you a 10% cash-on-cash return, while Property B only offers a 9% cash-on-cash return (due to the more expensive financing).

NOI also doesn’t include capital expenditures, such as replacing the roof or major mechanical systems.

Consider two properties, each selling for the same amount, each renting for the same amount, and each with the same NOI. Except one of these properties is brand new, and the other was built 30 years ago.

On paper, the numbers may look identical. But any prudent property owners should expect to shell out far more money over the next ten years for capital expenditures on the older property.

Finally, NOI tells you nothing about tax implications of any given property.

Again, imagine two identical properties with the exact same numbers on paper. But one of them qualifies for the Low-Income Housing Tax Credit (LIHTC), helping you pay lower taxes on your profits from it. Or, for whatever reason, one allows you to depreciate more of the property costs faster. Or one sits in a state where you’d have to pay income taxes on the profits, even if you reside in another state with no income taxes.

There are dozens of reasons why income taxes can change the math of a property purchase, and NOI won’t take any of them into account.

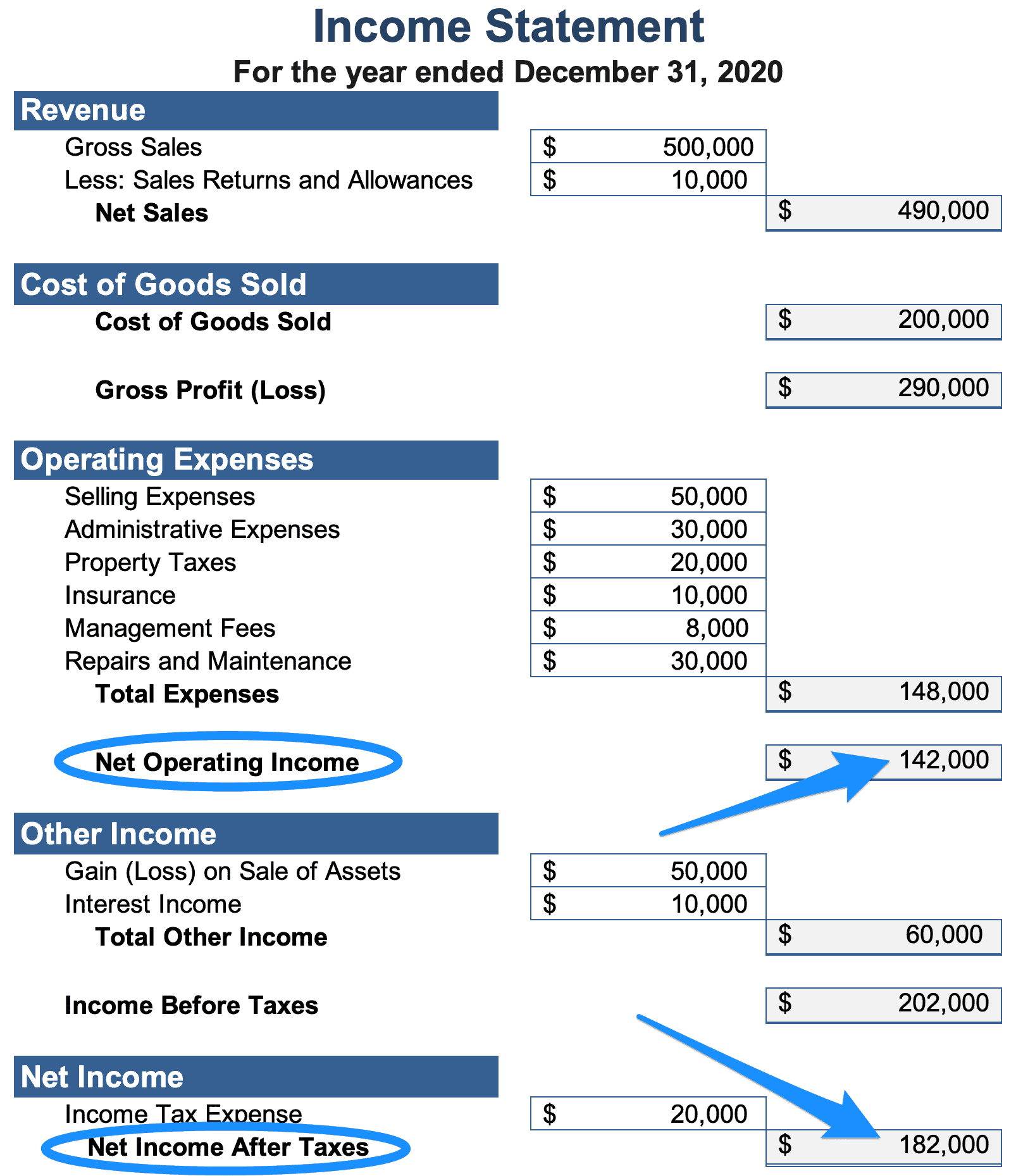

Net Income vs. Net Operating Income: What's the Difference?

Real estate investors often look at net operating income when evaluating potential properties. Although net income and net operating income sound similar, they represent two different line items on an income statement[3].

Net operating income is the profit after deducting day-to-day operational expenses. Operational expenses include property taxes, insurance, repairs and maintenance, management fees, and expenses such as legal, accounting, and marketing costs. Operating costs do not include depreciation, debt service, and income taxes.

Net operating income is gross rental income plus other non-rental income generated by the property minus total operating expenses. Net operating income is almost always calculated on an annual basis.

Net income is left after all other non-operating expenses are deducted from net operating income.

The net operating income formula varies a bit outside the real estate industry, but it is almost always total operating revenue minus total operating expenses.

Takeaways

Net operating income is one of the foundational calculations that real estate investors need to make, for any income property they consider buying. Get extremely comfortable with the calculation, because you’ll make it repeatedly in your investing career.

But calculations are only as reliable as the numbers that go into them. It doesn’t matter if one property appears to have a higher cap rate than another if you underestimated its vacancy rate and property management costs.

Err on the side of caution and use conservative figures as you estimate expenses. Always include property management costs, even if you plan to manage the property yourself, because you never know when self-managing will become impractical or impossible.

In calculating property taxes, use the sales price as the assessment value, rather than counting on paying the current property tax bill. You better believe your jurisdiction will bump up the assessment amount based on the sales price!

Calculating NOI will serve you well as an income investor — to the extent that you use accurate expense values when running the numbers.