Debt Service Coverage Ratio (DSCR) Definition

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Debt Service Coverage Ratio Explained

Debt Service Coverage Ratio (DSCR) is useful for analyzing financial statements and estimating cash flow for a business or investment property. Commercial lenders commonly use the debt service coverage ratio to establish creditworthiness and determine the size of the loan.

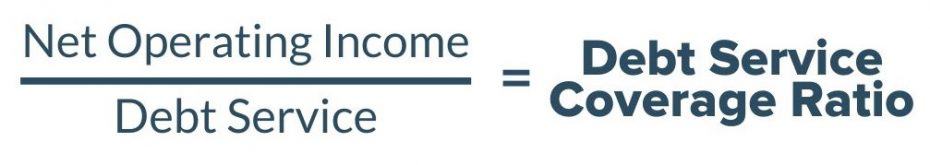

DSCR expresses the net operating income divided by the total debt service for a particular property.

If the net operating income (NOI) is $100,000 and the total debt service is $80,000, the DSCR would be 1.25, often notated as 1.25x.

This means that the property’s NOI covers debt 1.25 times.

Aside from getting insight into financing options, the debt service coverage ratio is a useful metric for real estate investors to use when comparing properties to add to their portfolio. DSCR provides a good cash flow estimate for prospective properties and can help an investor determine an offer amount.

How to Calculate Debt Service Coverage Ratio

While the equation is simple enough, the calculations that go into NOI differ depending on the property and to a lesser extent the underwriter.

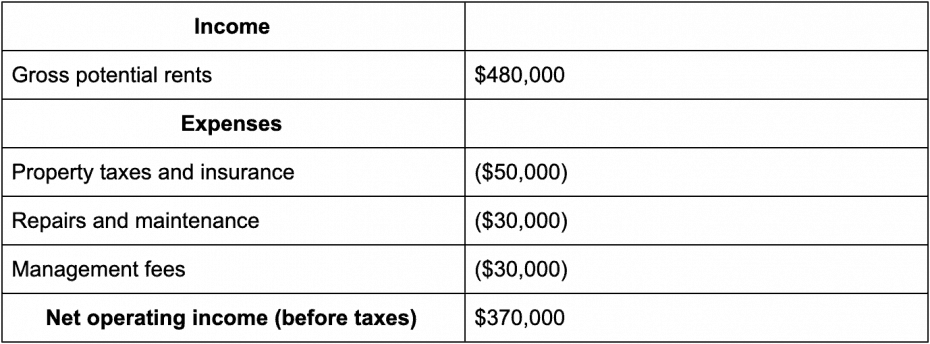

An investor might do back-of-the-envelope NOI calculations on a 40-unit property like this:

Now assume the annual debt service for the loan the investor is seeking will be approximately $275,000 per year. With a back-of-the-envelope calculation, the investor thinks the DSCR is 1.35x, which should be more than enough to satisfy this aspect of the underwriting process.

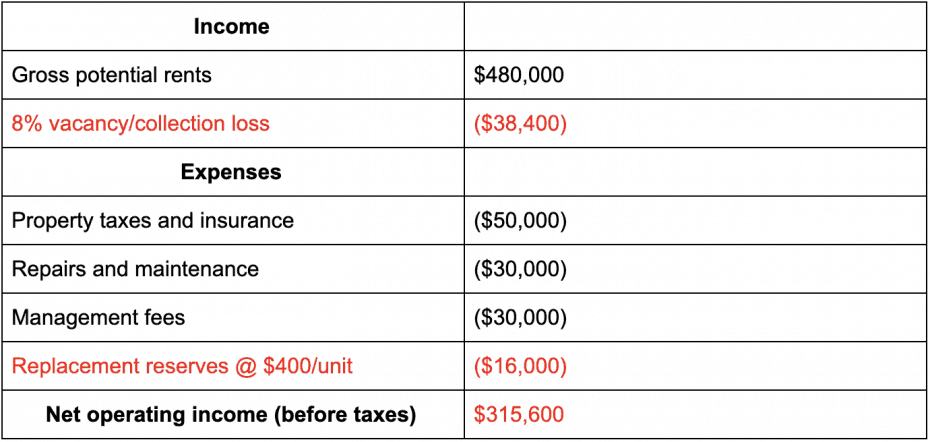

However, a more realistic analysis would also subtract a percentage of gross rents based on the vacancy rate for similar properties in the area and add replacement reserves to the expenses to estimate cash flow before financing costs.

Using the underwriter’s calculations, the DSCR is 1.15x, which isn’t nearly as attractive for commercial loans.

What DSCR Do Commercial Lenders Look For?

There’s no hard and fast rule on what DSCR should be. A reasonable DSCR depends on the industry, the property type, the risks inherent in the deal, the 5 Cs of Credit and several other factors.

Most asset-based lenders will require DSCR of 1.20 or higher if the business or property is operating in a higher-risk industry or market. A business or investment property with a DSCR of 1.5 – 2.0 or higher may have a case for obtaining preferential rates on their loan, at the discretion of the lender.

If the DSCR is too low, the lender may come back with a smaller loan amount to get the ratios in line with underwriting requirements.

Loan to Value (LTV) and DSCR are two of the most important underwriting metrics in asset-based loans. If a commercial loan can’t be approved, it’s usually either debt-constrained or leverage-constrained. In those instances, some lenders may use a global debt service coverage ratio, which factors in the investor’s outside sources of income and expenses to boost DSCR so the borrower can qualify for a more highly leveraged loan.