What is Net Income?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

How to Calculate Net Income

The formula for calculating net income is pretty simple:

Total Revenue – Total Expenses = Net Income

A business calculates net income by subtracting operating costs and expenses from its gross revenue. Individuals calculate net income by taking their gross salary and subtracting taxes, debt payments, and expenses.

In a business setting, net income can be manipulated by hiding expenses or inflating revenue through aggressive accounting techniques that do not comply with generally accepted accounting principles (GAAP). For example, bill-and-hold sales arrangements recognize revenue before the items or services are delivered.

Although it is useful to calculate net income as a measure of financial health, lenders and tax authorities do not recognize it. For example, mortgage lenders use debt-to-income ratio, not net income, for underwriting purposes. Meanwhile, the IRS uses adjusted gross income (AGI), not net income, to determine tax liability.

Net Income vs. Gross Income: What's the Difference?

In business, gross income is total revenue minus the cost of goods sold (COGS). Gross income and gross profit are synonymous in a business setting. Net income is what is left over after all other expenses have been subtracted.

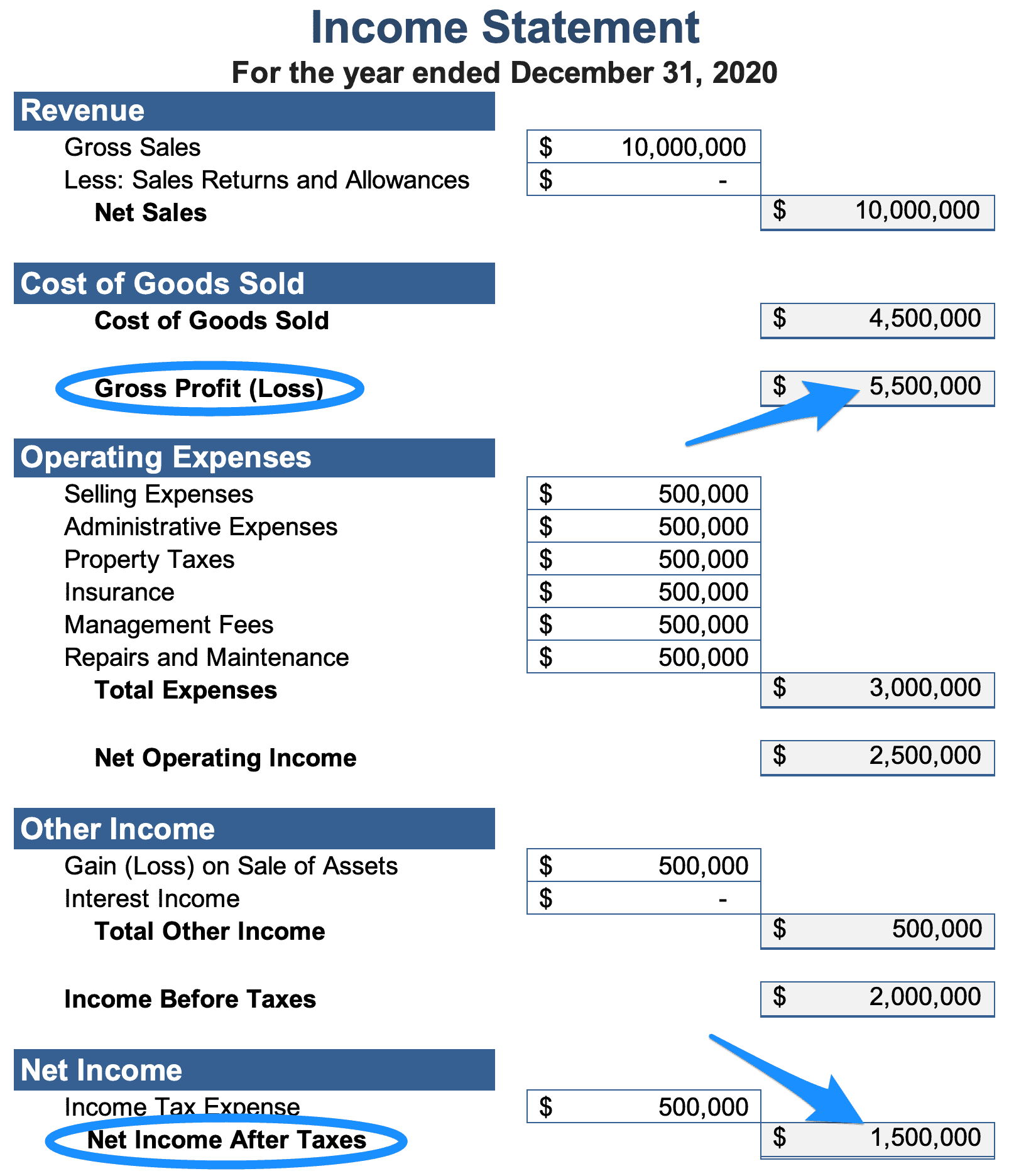

For example, ACME company manufactures toasters. It has a revenue of $10 million per year. ACME spends $1 million on raw materials, $1 million on supplies, $1 million on the machinery used to manufacture the toasters, $500,000 on shipping and distribution, and $2 million on salary for the workers directly involved in producing the toasters.

ACME’s cost of goods sold is $4.5 million, leaving it with a gross income (i.e. – gross profit) of $5.5 million. All other operating costs and expenses total $3.5 million, leaving ACME with a $2 million net income for the year before taxes, and $1.5 million net income after taxes.

For individuals, gross income is salary or other sources of income before any taxes or expenses are subtracted[2].

Net Income vs. Net Operating Income: What's the Difference?

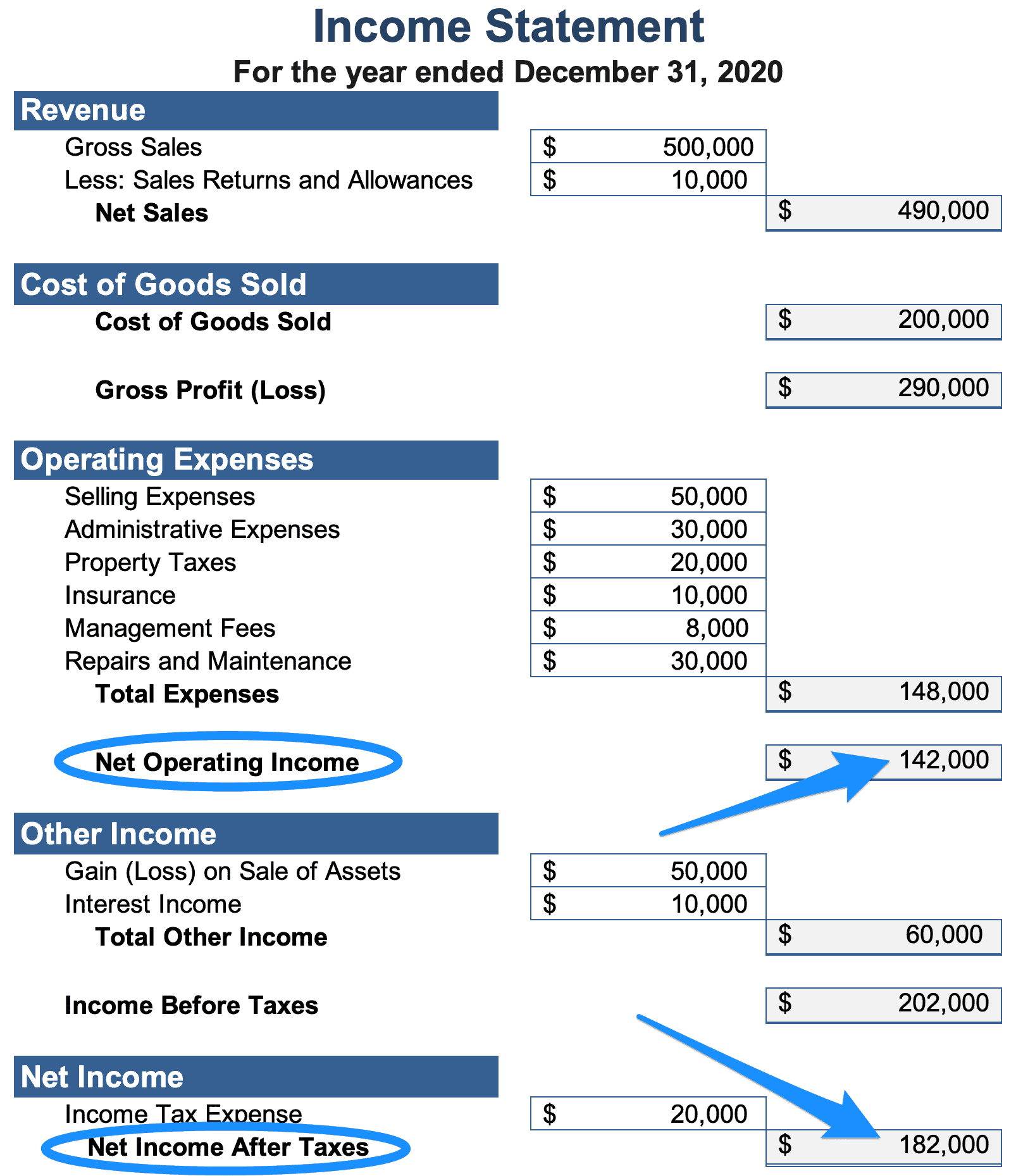

Real estate investors often look at net operating income when evaluating potential properties. Although net income and net operating income sound similar, they represent two different line items on an income statement[3].

Net operating income is the profit after deducting day-to-day operational expenses. Operational expenses include property taxes, insurance, repairs and maintenance, management fees, and expenses such as legal, accounting, and marketing costs. Operating costs do not include depreciation, debt service, and income taxes.

Net operating income is gross rental income plus other non-rental income generated by the property minus total operating expenses. Net operating income is almost always calculated on an annual basis.

Net income is left after all other non-operating expenses are deducted from net operating income.

The net operating income formula varies a bit outside the real estate industry, but it is almost always total operating revenue minus total operating expenses.

Net Income vs. Cash Flow: What’s the Difference?

There is no direct correlation between net income and cash flow. Net income is not a measure of the amount of cash the business generated in a given year. Income statements account for many other non-cash expenses, such as amortization and depreciation.

Net income is a measure of profitability, whereas cash flow is a measure of how successful a business is at generating cash to pay operating expenses and debt obligations. A business can increase its cash flow by merely increasing operational activities; i.e., if a company manufactures and sells more widgets, it will generate more cash flow.

The increased operational activity, however, also increases operational expenses. Therefore, unless the business increases its operational efficiency, its net income will not increase.

Ultimately, net income varies from industry to industry and from company to company, so it is difficult to draw a meaningful comparison between the net income of two different businesses. In this case, it is almost always better to view net income as a percentage of revenue, a figure known as the net profit margin.

Takeaways

Net income is listed on the last line of the income statement, which is the origin of the term “the bottom line.” Net income is another word for profit; it is the cash remaining after total expenses are subtracted from total revenue.

Although net income is a metric of financial health, it is not recognized by lenders and tax authorities. Net income taken alone is not as meaningful as the profit margin, which expresses net income as a percentage of revenue.

Sources

- Corporate Finance Institute. (n.d.) What is Net Income? Retrieved from https://corporatefinanceinstitute.com/resources/knowledge/accounting/what-is-net-income/

- Nicoll, A. (2019.) What Is Gross Income? Definition and How to Calculate. TheStreet. Retrieved from https://www.thestreet.com/personal-finance/what-is-gross-income-14665389

- Murray, J. (2020.) What Is the Difference Between Net Income, Earnings, and Profit? The Balance Small Business. Retrieved from https://www.thebalancesmb.com/net-income-earnings-and-profit-what-s-the-difference-398353