What is a Balance Sheet?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

What is on a Balance Sheet?

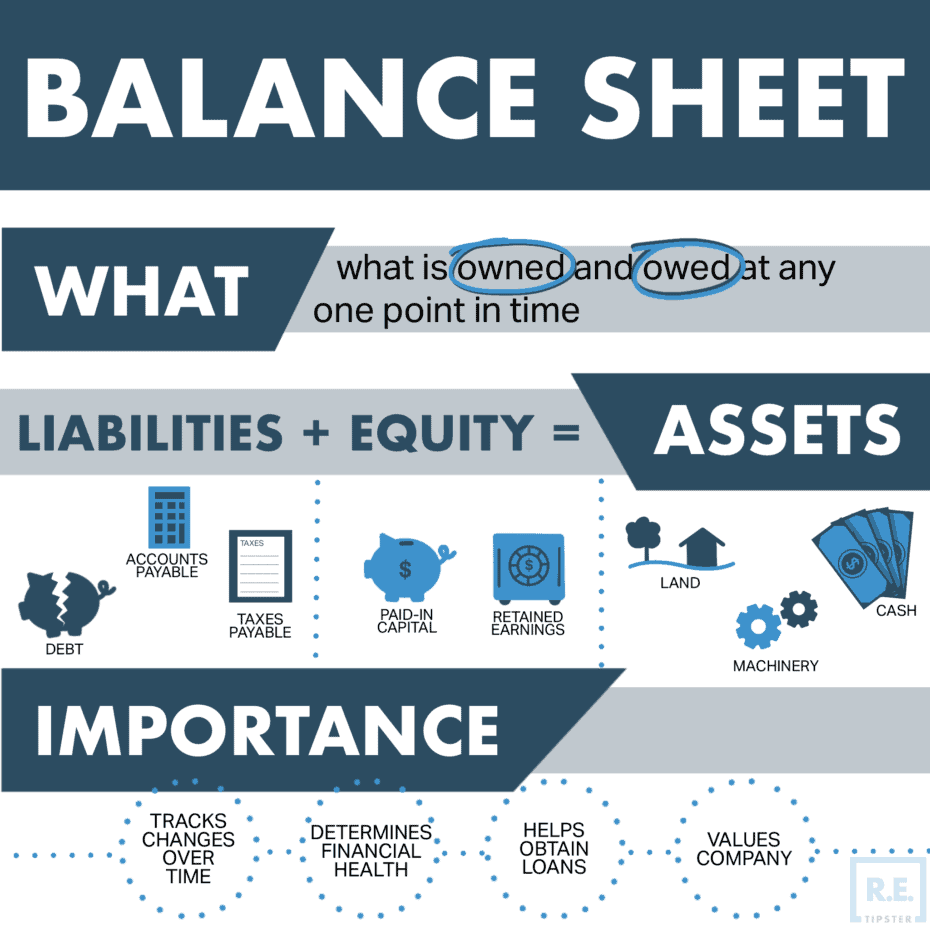

The balance sheet, along with the income statement and cash flow statement, make up an entity’s financial statements.

The balance sheet is a reflection of net worth. It shows what the individual or entity owes, owns, and its amount of owner or shareholder equity.

Balance Sheet Formula

The balance sheet is divided into two parts. One half represents all the entity’s assets (including cash, inventory, accounts receivable, real estate, and equipment, etc).

The other half lists the entity’s liabilities (accounts payable, wages payable, rent, mortgage notes, other long and short-term debt, etc) plus its equity.

The two halves must equal each other and “balance out.”

Assets = Liabilities + Equity

The formula is actually fairly intuitive. Everything an entity owns (it’s assets) must be accounted for in some way, whether the assets were acquired with debt financing (liabilities) or paid for with cash (owner’s equity).

The balance sheet formula can also be stated like this:

Assets – Liabilites = Equity

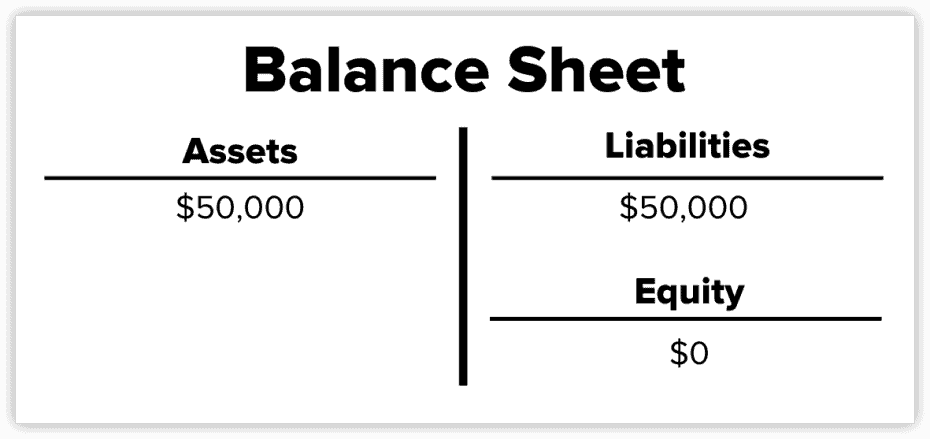

For example, if a business takes out a $50,000 loan to buy a $50,000 piece of equipment, the equipment will show up on the asset side, and the corresponding loan will show up on the opposite side as a liability.

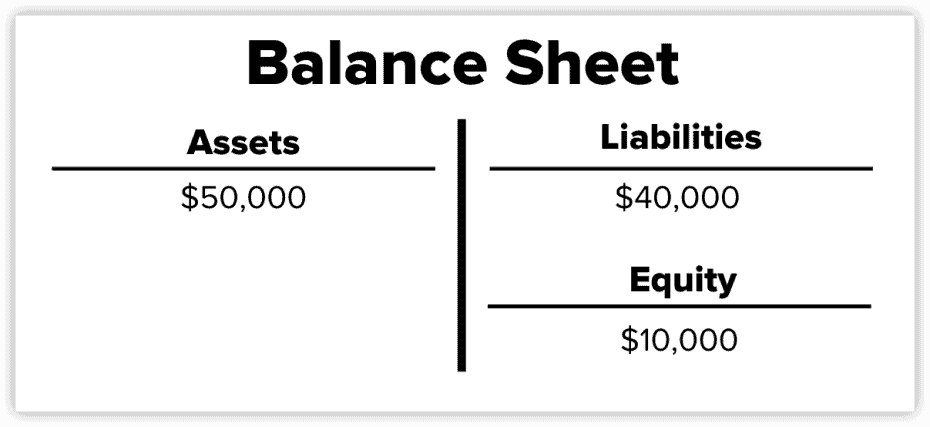

However, if the business took out a $40,000 loan and used $10,000 of its own cash to buy that same $50,000 piece of equipment, the balance sheet would reflect it like this:

Of course, this is a gross oversimplification of what balance sheets actually look like.

In the general ledger, assets, liabilities, and equity are broken down into several smaller accounts that vary by company type and industry. Generally speaking, however, assets consist of property, inventory, and cash; liabilities are payables and debt (taxes and amounts owed by the entity to other parties), and shareholder equity includes retained earnings.

How to Read a Balance Sheet

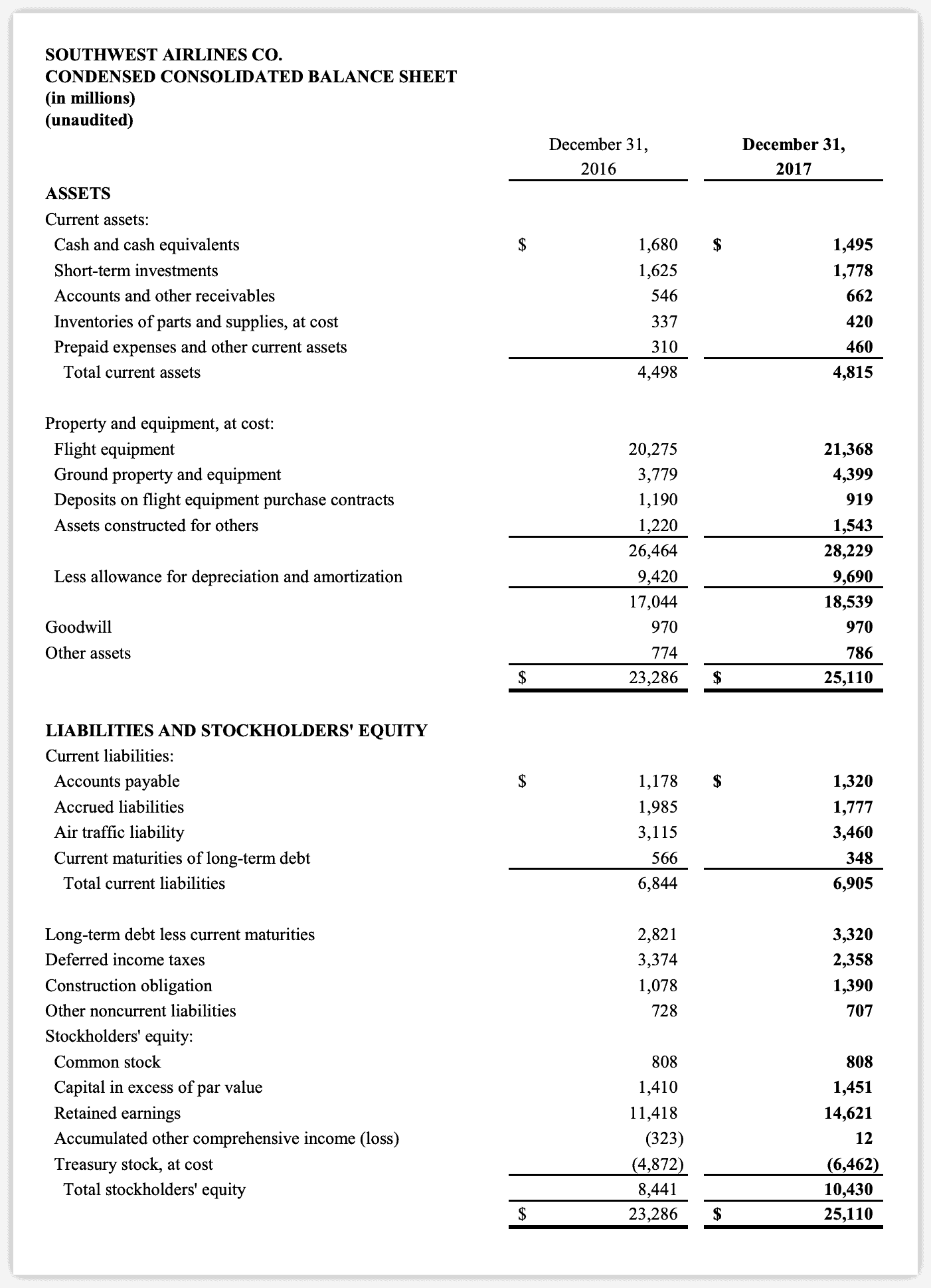

The following is the consolidated balance sheet from Southwest Airlines:

Balance sheet courtesy of Southwest Airlines

Assets are generally broken into current and noncurrent assets. Current assets include cash and items of value that will be converted to cash within a short period of time, typically a year or less. In the case of Southwest, “inventories of parts and supplies” is a current asset because they will be put into use within the reporting year.

Noncurrent assets include tangible equipment (flight equipment, ground property, assets constructed for others), and intangible assets (goodwill).

Liabilities are similarly broken into current and noncurrent categories, with current liabilities due within the year and noncurrent liabilities representing those due at least one year past the reporting date.

Shareholder equity is the entity’s net worth. It includes the owner’s initial investment and any retained earnings reinvested into the company at the end of the year.

Analyzing the Balance Sheet

Financial ratio analysis is the most common way an investor, banker, accountant, or other financial professional can gain insight into a company’s financial position and profitability.

The debt-to-equity ratio demonstrates the company’s operational efficiency and overall financial health. It represents the degree to which a business is financing its operations with debt. It also measures the extent to which a business is leveraging its assets (also see: Loan-to-Value Ratio).

RELATED: What is Cash on Cash Return?

If debt is used to finance growth, it could ultimately result in shareholder benefit. On the other hand, if the cost of financing is greater than the income generated by growth, it reduces shareholder value.

Activity ratios, such as accounts receivable turnover, inventory turnover, and return on equity, demonstrate whether the company is effectively managing its operating cycle.

Limitations of the Balance Sheet

Ultimately, the balance sheet is essential for analyzing a business, but it does have certain limitations. The balance sheet is a static report representing the business at a particular moment in time, often as compared to another static point in time in the past.

Because the balance sheet is a static report, it is often useful to analyze the balance sheet in tandem with the cash flow statement and income statement, which gives a more dynamic picture of the company’s financial situation.