What is Equity?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

What is Real Estate Equity?

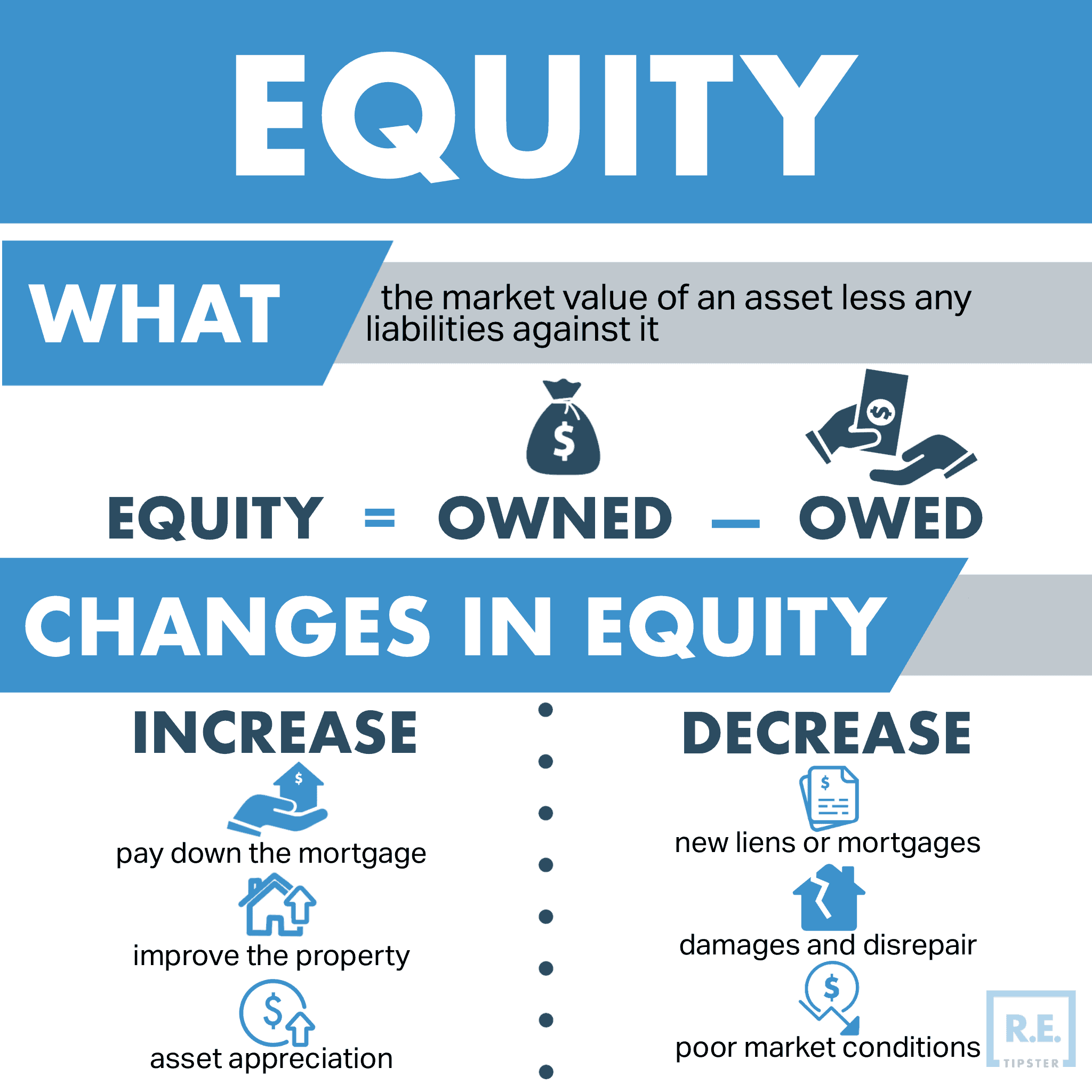

Real estate equity represents the owner’s financial interest in a property. For example, if a home has a fair market value of $350,000 and there is a $250,000 mortgage against it, the owner’s equity would be $100,000.

$350,000 Asset – $250,000 Liability = $100,000 Equity

Mortgage loans are not the only thing to be deducted when calculating real estate equity. A property may have other liabilities such as unpaid property taxes or contractor liens against it. These liabilities should also be deducted from the property’s appraised fair market value in order to find true real estate equity.

Why is Equity Important?

The equity and cash flow of an investment property are two of the most important considerations for real estate investors. Investors often prioritize cash flow because it represents a consistent source of income that is liquid and immediately available for use.

Equity should not be overlooked, however. Investors can leverage the equity in their properties to finance the purchase of additional properties or improvements, thus increasing the size and value of their portfolio. Equity is also realized as a gain when the property is sold.

Lenders will also look carefully at a property’s appraised value to determine how much equity (i.e. – down payment) their borrower should be required to put into the property vs. borrowed money. The loan-to-value ratio is a key metric that lenders use to assess risk in any real estate loan. When a borrower puts down a higher down payment (i.e. – equity) into the purchase of a property, the bank’s exposure is reduced relative to the appraised value of the property.

How is Real Estate Equity Increased and Decreased?

There are a few common ways an investor or homeowner can increase real estate equity:

- Pay down the mortgage. An owner’s equity in a property increases with each amortized mortgage payment. The process can be accelerated by making extra principal payments.

- Improve the property. An owner can increase equity in the property by materially improving it. However, if the improvements are financed by a second mortgage or HELOC, they won’t necessarily increase equity unless the cost of the improvements is less than the increase in fair market value after they are made. If the owner pays cash or uses another line of credit to finance the improvements, the entire value of the improvements is added to the property’s equity.

- Asset appreciation. As a property appreciates in value over time, new equity is added to the property. This happens whether the property has an outstanding mortgage or is owned free and clear. Granted, if the owner refinances their mortgage with a new, higher loan balance or introduces new debt to the picture through a home equity line of credit (HELOC), this new debt could eliminate some or all of their gained equity. However, if the loan balance stays the same or decreases while the property value increases through appreciation, additional equity would be created through this process.

There are also some common ways a property owner can lose equity in their real estate property:

- New liens or mortgages. If the owner uses the property as collateral for another loan or line of credit, their equity would decrease by the amount financed, because this introduces a new liability into the equation (Assets – Liabilities = Equity). The same holds true for other types of liens taken against the property by tax authorities, contractors, or homeowners associations.

- Damages and disrepair. If the property is poorly maintained or damaged, the fair market value decreases, thus decreasing the owner’s equity.

- Poor market conditions. Occasionally, the local market and/or economic conditions can depress real estate prices. If fair market value falls due to market conditions, owner equity decreases.