What is a Real Estate Appraisal?

Understanding Real Estate Appraisals

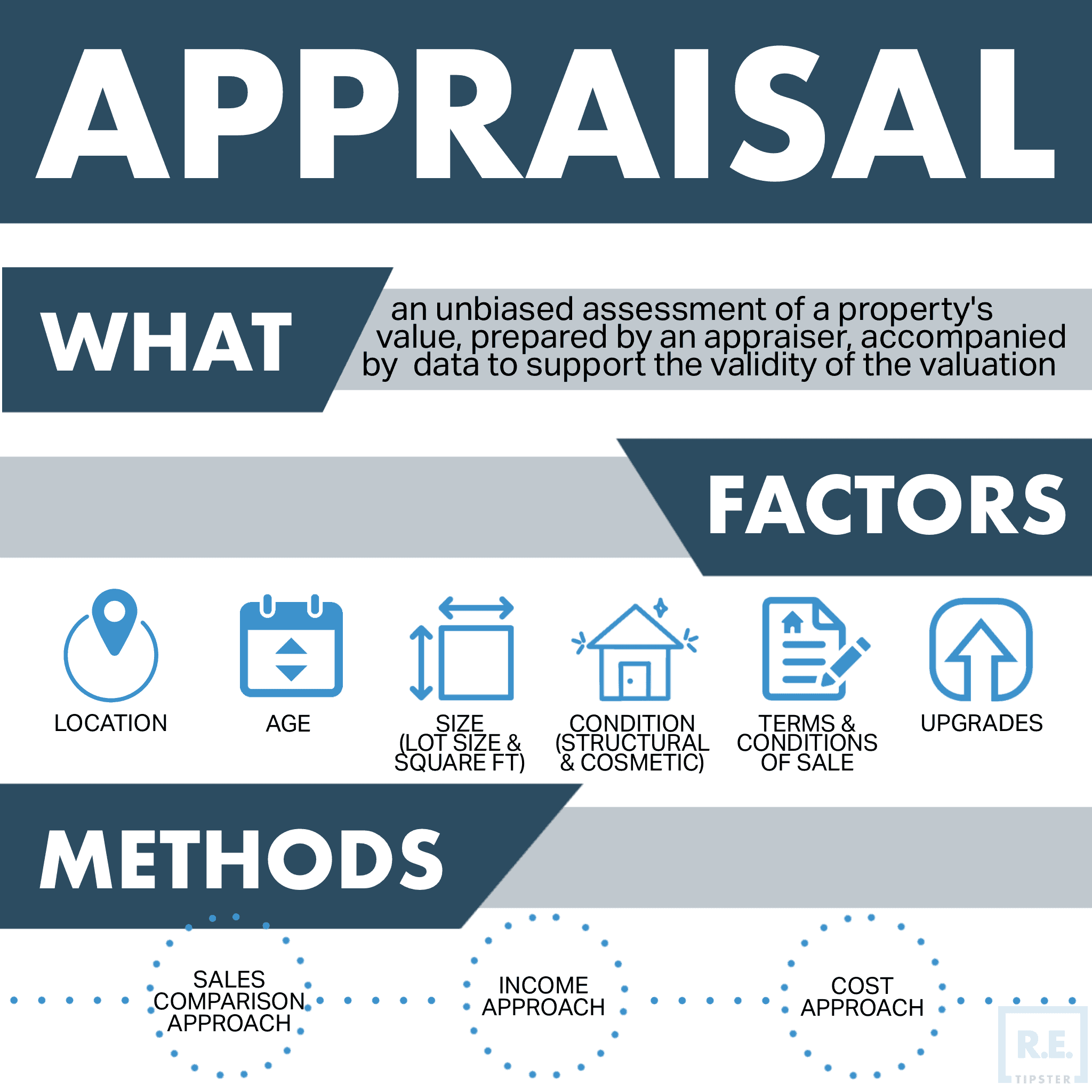

An appraisal plays an important role in most real estate transactions.

Real estate investors, lenders, taxing authorities, and insurance companies all rely on an accurate valuation of each property in order to do their jobs effectively.

For example:

- Lenders rely on the appraised value to determine their loan amounts and Loan-to-Value Ratio.

- Insurance companies use the appraised value to determine insurance coverage and premiums.

- Tax authorities rely on accurate property valuations to determine annual property taxes.

- Real estate investors need to understand a property’s value in order to make an appropriate offer, make improvements and eventually, make a profit.

An appraisal report is always accompanied by supporting data to support the validity of the valuation.

Appraisals can also be prepared to estimate the true value of a business, equipment, and other asset classes.

Property Valuation Basics

In economic terms, property value is defined as the worth of future benefits accruing to the owner of the property.

With most consumer goods, the benefits of ownership are realized virtually immediately. The benefits of real estate, on the other hand, are realized over a long period of time.

For this reason, a real estate appraisal must take into account the long-term effect of the four elements of a property’s value:

- Demand – The level of desire (or necessity) to purchase a property combined with the financial ability to do so.

- Scarcity – The supply of similar properties to meet demand.

- Utility – The ability of the property to meet the needs of current and future buyers.

- Transferability – The ease with which property rights can be transferred to future owners.

It’s important to point out that value is not the same as cost or price. With regard to real estate:

Cost is the amount of money needed to build or acquire the exact same property in today’s dollars.

Price is what a buyer actually pays for the property.

Value is what the appraiser believes a buyer would be willing to pay for the property based on his assessment of the four elements mentioned above.

Value isn’t static or concrete. Most appraisals point to the fair market value, which assumes that both the buyer and the seller are reasonably knowledgeable about the property, acting in their own best interests, and free of external pressures that would result in a hasty transaction.

Real estate investors may need to know other types of property valuations. For example, value-in-use describes the financial benefit of a specific property for a specific use, such as the revenue derived from a beachfront vacation rental. Liquidation value estimates the price a property might bring if sold at auction in the event of foreclosure, for example.

Real Estate Appraisal Methods

Different types of real estate transactions require different appraisal methods. For example, the data used to develop an appraisal for the sale of a single-family home will be much different from the data needed to estimate the value of the commercial real estate.

Generally speaking, there are three methods for appraising the value of real estate:

Sales Comparison Approach

The sales comparison (or market data) approach determines the value of a property by comparing it with similar properties in the near vicinity that have recently been sold.

In order for the comparable properties, or “comps”, to be valid, the similar properties must be sold within the previous 12 months. Typically, preference is given to the most recent sales, but not always.

Fannie Mae offers the following guidance on this:

Comparable sales that have closed within the last 12 months should be used in the appraisal; however, the best and most appropriate comparable sales may not always be the most recent sales. For example, it may be appropriate for the appraiser to use a nine month old sale with a time adjustment rather than a one month old sale that requires multiple adjustments. An older sale may be more appropriate in situations when market conditions have impacted the availability of recent sales as long as the appraisal reflects the changing market conditions.

Since no two homes are exactly alike, there’s a fair amount of subjectivity at work in the sales comparison approach. For example, the appraiser needs to make adjustments to the property value for things such as:

- Location

- Age

- Size (both lot size and square footage of the building)

- Condition (both structural and cosmetic)

- Terms and conditions of sale, (i.e. if the property sale was discounted between family members or sold under duress)

- Upgrades and enhancements (mature landscaping, kitchen remodel, solar panels, etc.)

The sales comparison approach requires at least three or four comps for an accurate appraisal and extra weight is given to comps that require the fewest adjustments.

Income Approach

The income approach (or income capitalization approach) is used frequently in commercial real estate appraisals. This approach is based on the property’s historical net operating income and rate of return. This approach is most reliable when the property will generate future revenue and has relatively predictable expenses.

The appraiser can use either the direct capitalization method or the gross income multiplier method.

Direct Capitalization – The appraiser uses the net operating income (NOI) and applies the capitalization rate to estimate the price an investor would pay for a particular property.

Gross Income Multiplier – This method is used for properties that aren’t usually purchased as investment properties but could be used to generate income. The appraiser uses sales and rental comps to estimate a sales price and divides it by the expected rental income to arrive at the gross income multiplier (GIM). GIM is applied to the rental income to arrive at fair market value.

Cost Approach

The cost approach is used to appraise properties that have been improved by the construction of one or more buildings. The value of the land and the buildings (less depreciation) are estimated separately and added together to arrive at the appraised value.

The assumption behind the cost approach is that a buyer would not pay more for an improved property than he would pay to build something similar on a vacant parcel of land.

The cost approach is most often used for properties such as hospitals, churches, and schools. It can also be used for new construction where costs are known.

When Do You Need An Appraisal?

Every real estate transaction benefits from an appraisal. Appraisals are useful for investors who are buying or selling a property; if there is a lender involved in the transaction, an appraisal is almost always required.

But appraisals aren’t limited to real estate transactions. Appraisals are essential to real estate investing tax strategies; they are used to determine depreciation and to evaluate property tax assessments. Many investors use routine periodic appraisals to keep tabs on the value of their portfolio and calculate their rate of return.

Who Can Perform a Real Estate Appraisal?

The Appraiser Qualifications Board of the Appraisal Foundation is the only body authorized by Congress to set licensure requirements for appraisers. Appraisers are licensed by the state and must be objective third parties to each transaction.

There are three categories of licensed real estate appraisers:

Licensed Real Property Appraiser: This appraiser can evaluate non-complex one- to four-unit properties valued at less than $1 million or complex one- to four-unit residential properties valued at $250,000 or less. (“Complex” in this context applies to atypical properties such as historical structures.)

Certified Residential Real Property Appraiser: This appraiser can evaluate any residential structure of up to four units with no transaction limit. They are not qualified, however, to evaluate subdivisions or commercial properties.

Certified General Real Property Appraiser: This person is qualified to evaluate all real property including commercial and federally related transactions.

How Much Does An Appraisal Cost?

The cost of an appraisal varies based on the location and complexity of the property and the credentials and experience of the appraiser. According to Bankrate, a typical residential home appraisal costs between $300 and $500. In larger metropolitan areas or more expensive markets, the range may be significantly higher of $600 to $1,000.

Expect to pay quite a bit more for commercial appraisals. According to the Commercial Lender Databank, the baseline for commercial appraisals is about $2,000 to $4,000 for transactions up to $1 million. Larger projects cost between $10,000 and $25,000.

How to Prepare for an Appraisal

Preparing for an appraisal is different depending on which party you are in the transaction and your relation to the subject property. Generally, it helps to have your own datasets to assist the appraiser or dispute the report if necessary.

Here are a few tips to help prepare for an appraisal:

Always request a local appraiser. Although you may not be able to request a specific appraiser, you can insist on one familiar with the local area.

Understand your comps. Most appraisers work from MLS data, so they may not look at all the most detailed or specific information related to the subject property. Try to get information about low comps—perhaps there were structural flaws or a poorly designed interior. With the new Home Value Code of Conduct (HVCC) rules, you may have better information about comps than the appraiser.

If you are flipping a home, provide all the information the appraiser needs to write their report. After the walk-through, give the appraiser a renovation overview, before and after pictures, and cost breakdown.

If you feel the appraisal is too low or too high, read the report carefully for errors. Research your local market and review the comps.

For residential properties, compare your appraisal with online home appraisal apps. Remember, the appraiser may not have all the local and property-specific information you have when he prepares his report, so do your own homework and be prepared to back up any disputes with facts.

Reviewed by Ryan Lundquist, Sacramento Appraisal Blog