What Is After Repair Value (ARV)?

The Importance of After Repair Value (ARV)

A property’s After Repair Value or ARV determines what a property will be worth after it has been improved. As the name implies, it’s the value of the property after repairs. It compares the current value of a property in its existing condition (“as-is” value) with its anticipated value post-renovation.

ARV is crucial for investors as it helps calculate the potential profit margin when they sell the property, particularly those who buy distressed properties with the plan of improving them through sweat equity and re-selling them at a higher price in the future (e.g., house flippers and rehabbers).

If a real estate investor miscalculates the ARV of a property, they can underestimate repair costs or buy the property at an exorbitant price. Either way, they can ultimately lose money on the flip.

How to Calculate ARV

The conventional formula for calculating ARV looks like this:

Purchase Price + Value of Repairs and Improvements = After Repair Value (ARV)

Note that the cost of repairs and improvements is not the same as the value of repairs and improvements. Regardless of how much an investor might spend to acquire and renovate a property, the total amount spent doesn’t directly correlate with how much the property will be able to sell.

In addition, estimating the costs of repairs and renovations is vital, so it’s advisable to obtain itemized estimates from licensed contractors and account for material costs. Consider additional expenses in your calculations as well, such as closing, holding, and financing; overlooking these can impact the overall investment value.

Alternative Way to Calculate an ARV

As an alternative, investors in this school of thought determine the after repair value by running a Comparable Market Analysis (CMA), also referred to as running comps.

Here is a tutorial on how to perform a CMA:

When an investor determines the ARV through a CMA, the formula looks like this:

ARV = Asq X Tsq

where:

- Asq: average price per square foot of comps

- Tsq: total square footage of subject property

To calculate ARV via a CMA, follow these steps:

- Gather the following details about the subject property:

- Square footage.

- Bed/bath ratio.

- Style or structural layout (i.e., ranch-style, two-story, etc.).

- Identify three to five other properties that match the following criteria:

- Properties near the subject property (typically within a mile or less).

- Properties with a similar style, square footage, and bed/bath ratio to the subject property.

- Properties that have recently sold (typically within the last six months to a year).

- Determine the average price per square foot for these three to five properties.

- Multiply the average price per square foot by the total square footage of the subject property.

The 70% Rule in ARV

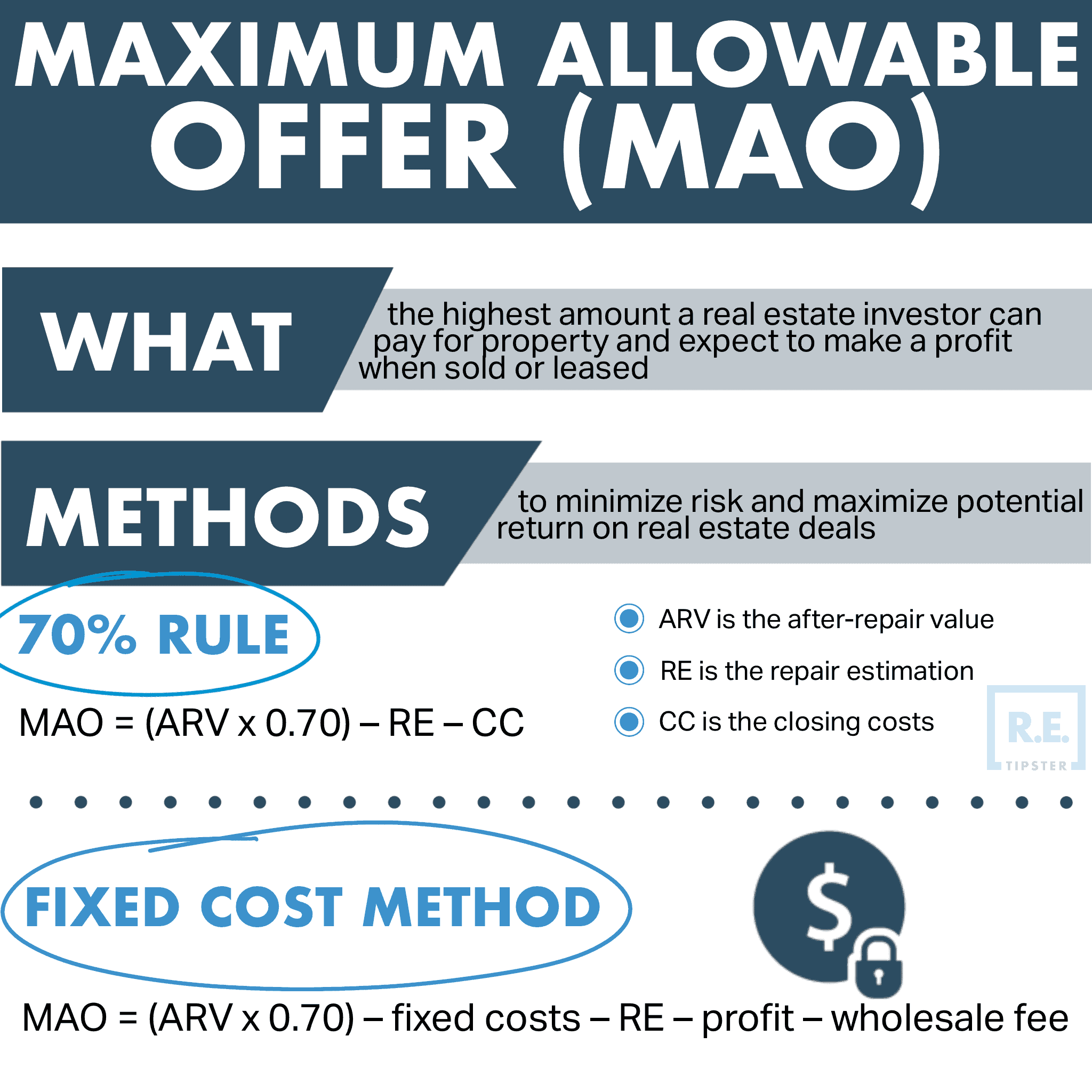

The 70% rule in real estate investing is a guideline used to determine the maximum price for a property that needs repairs. In other words, it sets a ceiling on how much an investor should pay for a property that needs repair and still expect to profit from it.

According to this rule, an investor should not pay more than 70% of the After-Repair Value (ARV) of the property, minus the costs of the necessary repairs.

The formula is:

Maximum Purchase Price = (ARV x 0.70) – Repair Cost

For example, if a property’s ARV is estimated at $100,000 and requires $20,000 in repairs, the maximum purchase price under this rule would be $50,000 ($100,000 x 0.70 – $20,000).

The 70% Rule is one method of arriving at a Maximum Allowable Offer (MAO) for a target property; the other is a Fixed Cost Method.

Challenges and Limitations of the ARV

It’s certainly beneficial for an investor, particularly a flipper, to know the ARV of an asset they intend to sell, because it can give them an idea of how much cash flow they can expect from the deal. However, relying solely on this figure can be a bad idea from an investing standpoint, as ARV doesn’t tell the whole story.

Here are some of its limitations:

- Over-dependence on market conditions: ARV is highly reliant on current market conditions, which can change rapidly. Economic shifts, interest rate changes, or local market dynamics can significantly alter property values, impacting ARV accuracy.

- Snapshotting: ARV represents a value at a specific point or a “snapshot” in time. It doesn’t account for future market fluctuations or potential challenges during the renovation process, such as unexpected repair needs or cost overruns.

- Estimates are subjective: The calculation of ARV can vary greatly depending on who is making the assessment. Different appraisers or investors might use varied methodologies or interpret data differently, leading to a range of ARV figures for the same property.

To mitigate these limitations, it’s best to use ARV in conjunction with other real estate valuation methods. This might include a detailed analysis of market trends, consultation with real estate experts, or the use of available tools for property valuation. Incorporating multiple perspectives and data sources can lead to a more balanced and realistic investment analysis.

Frequently Asked Questions: After Repair Value (ARV)

What is the most important factor to consider when calculating ARV?

The accuracy of repair and renovation cost estimates is the most important factor in calculating ARV.

These estimates should include all potential expenses, such as labor, materials, permits, and unforeseen costs. Accurate estimation requires thoroughly understanding the property’s condition, local labor rates, and material costs. Investors should consult with experienced contractors for detailed estimates and consider conducting a professional property inspection to identify potential issues that might escalate costs.

It’s also a good idea to factor in a contingency budget for unexpected repairs, typical of older or poorly maintained properties.

Can ARV change during the course of a project?

Yes, ARV can fluctuate during a project due to various factors.

Market conditions, such as changes in housing demand, interest rates, or economic shifts, can impact property values. Renovation challenges like discovering structural issues, plumbing or electrical problems, or the need for additional permits can increase costs and affect ARV. Regular market research and flexibility in the renovation plan can help mitigate these risks.

It’s also advisable to reassess the ARV periodically throughout the project to accommodate any market changes or project creep.

Is the 70% rule always reliable in real estate investing?

The 70% rule is a popular guideline in real estate investing (see above) but, like the ARV, it isn’t universally applicable. It’s most effective in stable markets with predictable renovation costs and property values. The rule may not provide an accurate estimate in volatile or unique markets, such as luxury real estate or areas with rapid economic changes.

Additionally, the rule doesn’t account for nuances like the property’s location, historical value, or unique features, which can significantly affect its value post-renovation. Investors should use this rule as a starting point and adjust their calculations based on specific property and market characteristics.