What is an Income Statement?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Income Statements Explained

The income statement is one of the three most important financial statements used to report a company’s financial performance. Along with the balance sheet and statement of cash flows, the income statement gives key insights about the financial health of a business.

An income statement reports a company’s revenues and expenses during a specific time period. It is also called the statement of income, statement of earnings, or profit and loss statement, or P&L.

An income statement focuses on four specific measures:

- Revenue: The income statement reports operating revenue from manufacturing, sales, or services. Another correlated item is “Other Income”, often showing at the bottom of the income statement because it accounts for non-operating revenue such as interest, royalty payments, and rents from the business property (which aren’t the primary sources of income for the business).

- Expenses: Expenses include the cost of goods sold (COGS), general and administrative expenses, depreciation and amortization, and interest paid on loans.

- Gains: Gains refer to net money made on other activities, such as the sale of business assets.

- Losses: Losses include all expenses associated with the sale of long-term assets that result in a loss. They also include unusual or one-off expenses such as lawsuits.

Businesses can choose one of two formats for the income statement, the single-step or the multi-step format.

The multi-step income statement reports four profitability metrics:

- Gross Income

- Operating Income

- Pretax Income

- Net Income

The single-step income statement only reports pretax income and operating income, but gross income and operating income can be calculated based on other information contained in the report.

Cash vs. Accrual Accounting

It’s important to note that “revenue” and “expenses” are not always the same thing as “cash received” and “cash paid”. Depending on whether an income statement is being prepared under accrual accounting or cash basis accounting, there can be significant variances in how much revenue and expenses are reported on the same income statement for the same entity covering the same time period.

Robert C. Higgins explains accrual accounting pretty well in his book Analysis for Financial Management,

“Revenue is recognized as soon as the effort required to generate the sale is substantially complete and there is a reasonable certainty that payment will be received… For credit sales, the accrual princile means that revenue is recognized at the time of sale, not when the customer pays.”

On the flip side, with cash basis accounting, revenue is recognized when the cash from a sale is actually received, and expenses are recognized when the corresponding cash payments are made.

Cameron McCool explains some of the pros and cons of cash basis accounting in his article Cash Basis Accounting vs. Accrual Accounting,

Many small businesses opt to use the cash basis of accounting because it is simple to maintain. It’s easy to determine when a transaction has occurred (the money is in the bank or out of the bank) and there is no need to track receivables or payables.

The cash method is also beneficial in terms of tracking how much cash the business actually has at any given time; you can look at your bank balance and understand the exact resources at your disposal.

Also, since transactions aren’t recorded until the cash is received or paid, the business’s income isn’t taxed until it’s in the bank.

This video from Leila Gharani also explains the differences well…

Obviously, there are several considerations to bear in mind, and some approaches will make more sense depending on the specifics of the business.

How to Read an Income Statement

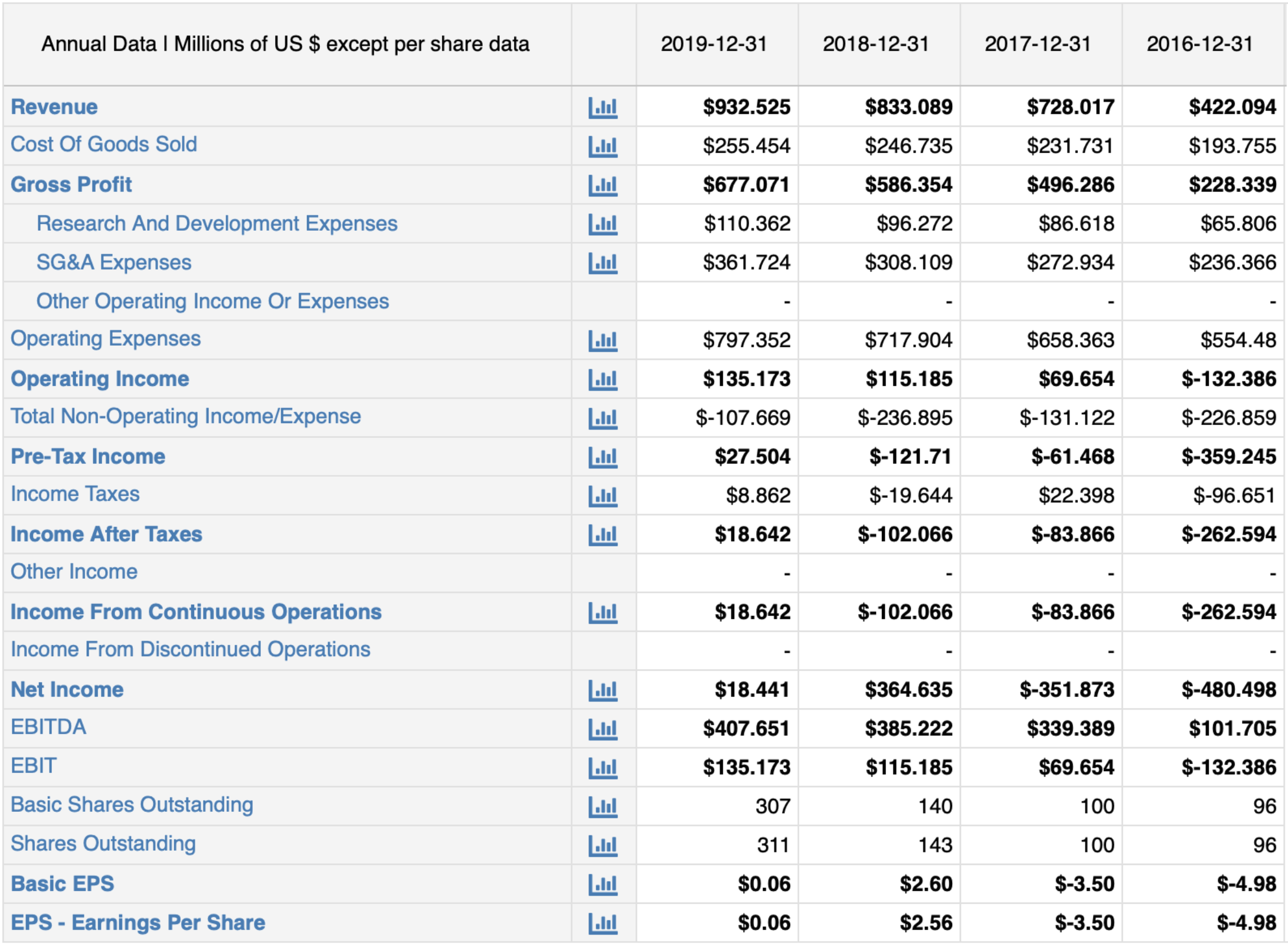

Below is the most recent income statement for SolarWinds, an IT infrastructure company. The company uses a multi-step income statement format.

The first number, Revenue, is also called the “top line,” and it represents all the company’s sales during the reporting period.

Cost of Goods Sold (COGS) is subtracted from the top line figure to arrive at Gross Profit (also known as Gross Income).

In this example, since Cost of Goods Sold was less than Revenue, the figure represents a positive number for Gross Profit. If COGS exceeded top-line revenue, gross income would be reported with a negative sign, or in brackets, to indicate a loss.

The next profitability metric, operating income, represents gross income minus operating expenses, R&D, SG&A, and other income or expenses.

Non-operating income and expenses are then added to and subtracted from operating income to arrive at pre-tax income, the third profitability metric in the income statement.

Then income taxes are subtracted from pre-tax income, and in the case of SolarWinds, after-tax income is also added in. The final profitability metric, net income, is the bottom line.

Some companies, including SolarWinds in the income statement above, also report other non-GAAP metrics on the income statement. In this case, the income statement includes EBITDA, EBIT, and Earnings Per Share (EPS).

Most income statements include columns for prior periods, which is helpful for analyzing significant changes. Some companies calculate percentages to simplify comparing yearly results.

Reading a Real Estate Income Statement

In the real estate industry, an income statement is useful for calculating how much profit a property will generate and for valuation purposes. Lenders also analyze the income statement in making credit decisions.

Although a real estate income statement follows the same format and flow of the income statement for other types of businesses, there are a few things to keep in mind.

- Gross Income typically reflects gross rents along with other income such as laundry facilities, parking, and late fees.

- Operating Expenses include property taxes, insurance, management fees, maintenance, cleaning, repairs, commissions, professional fees, utilities, depreciation, and interest on debts.

- Net Income is reported as net operating income, which is the property’s profit or loss. NOI can be used to calculate the property’s cap rate and the debt service coverage ratio (DSCR).

Investors should look for red flags on the income statement, such as significant changes in income or expenses year-over-year. Low maintenance and repair costs relative to the size and age of the property could indicate significant deferred maintenance that could result in major expenses later on.

Sources

- Higgins, Robert C. Analysis for Financial Management. 10thth ed., New York, NY, McGraw-Hill, 2012, p. 12.

- McCool, Cameron. “Cash Basis Accounting vs. Accrual Accounting.” Bench, Bench, 2 Oct. 2019, bench.co/blog/accounting/cash-vs-accrual-accounting/. Accessed 26 May 2020.