What Is Creditworthiness?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

How Is Creditworthiness Determined?

Creditworthiness measures how good a person is at handling debt. It implies the level of trust a lender has in their borrower to pay back their debt and how reliable they will be at repaying their debt in the future. Lenders[1] prefer borrowers who can manage their money well because they are less likely to default on their loan payments.

To see how creditworthy a person is, creditors pay attention to the 5 Cs of Credit:

- Creditors judge one’s character using their history of paying bills.

- Creditors measure a loan applicant’s capacity by comparing the size of the debt they want to obtain to their regular income.

- Creditors determine a loan applicant’s existing capital by checking the amount of cash a potential borrower has on hand.

- Creditors deem a borrower more worthy of a large debt when they can pledge collateral to secure the loan.

- Creditors study the conditions of the loan, such as its purpose and the prevailing interest rates.

A creditor can use the 5 Cs and other attributes of the borrower and the loan project to assess a borrower’s creditworthiness. Sometimes, a creditor may simply use a borrower’s credit score to do so.

What Is a Credit Score?

A credit score is a three-digit number that suggests how well an individual takes care of their finances. A higher credit score shows that an individual has a history of paying their debts and financial obligations on time, implying that they are more likely to meet their future financial obligations on time.

REtipster Affiliate Links: TenantCloud, Avail, TransUnion SmartMove

Two scoring models dominate credit scoring in the United States: FICO® and VantageScore®. While both use similar scoring models, they have slightly different criteria when assigning credit scores.

- In FICO 8 and 9[2], credit scores range from 300 to 855. Depending on their bracket, they can be rated as poor, fair, good, very good, or exceptional.

- In VantageScore 3.0[3], consumer credit scores start from 300 to 850. Divided into four rating brackets, they can be classified as poor, fair, good, or excellent.

No one starts with a zero score[4]. A person with no credit history will not automatically have a score of 300, either. Such an individual is just credit invisible[5].

FICO and VantageScore rate their credit scores to help creditors distinguish good borrowers (even with a currently bad score) from the truly bad.

Limitations of a Credit Score

Credit scores are not static; they change over time as their owners make financial decisions. The impact of a financial decision depends on the scoring model, and some factors affect creditworthiness more than others[6].

In addition, a credit score is neither a universal nor a consistently accurate solution. For example, a credit card applicant’s credit score cannot always tell what they would do with a mortgage later; the two are entirely different products. For this reason, a person can have multiple credit scores for different purposes.

BY THE NUMBERS: The average FICO Score and VantageScore among U.S. citizens are 711 and 688, respectively.

Source: The Ascent

What Is the Difference Between a Credit Score and a Credit Record?

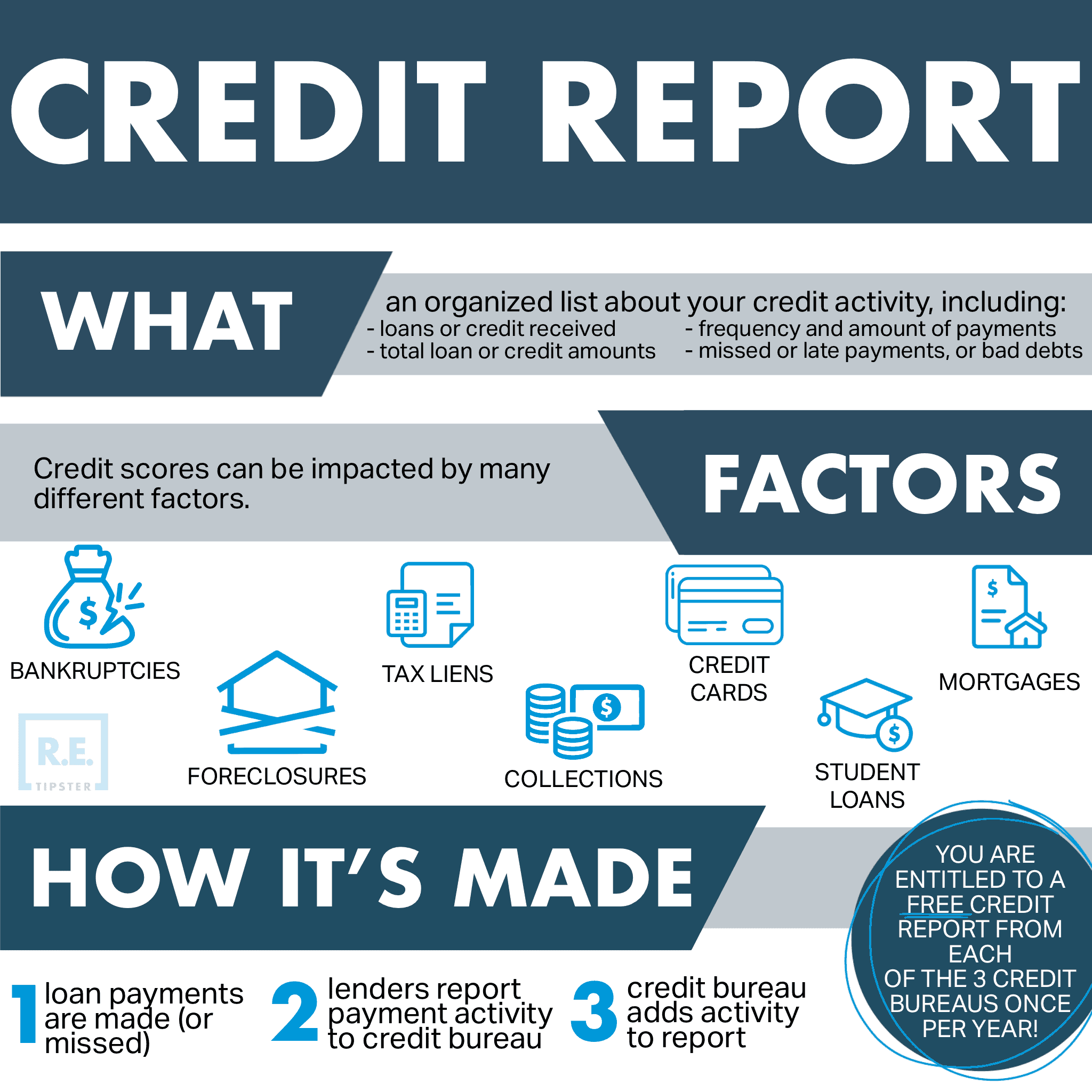

A credit record or a credit report shows how a person handles their credit accounts over a certain period. This report contains the information used as the basis for calculating credit scores.

The organizations that compile credit reports are called credit bureaus. They collect consumers’ financial data from various sources, called data furnishers.

In the United States, data furnishers must submit accurate and complete data and resolve disputes within 30 to 45 days[7]. Data furnishing is voluntary[8]. However, it is in their best interest to help credit bureaus know about consumers’ financial decisions as much as possible. After all, they are the ultimate beneficiaries of credible credit scores[9].

Considering these aspects, the contents of a credit report can vary greatly. If a data furnisher submits information to only one credit bureau, the rest will not have a proper view of a person’s creditworthiness.

Furthermore, credit bureaus decide which data to consider in credit scoring. They generate reports based on the market they intend to serve. For example, those focusing on a specific area like tenant screening, retail, or utilities[10] may ignore some financial data.

Moreover, errors in credit reports can skew the credit scores of people. Incorrectly added negative items[11] can drive down a score from fair to poor. Uncredited positive items can also dock some points from a person’s credit score.

BY THE NUMBERS: Only 66% of Americans have found their credit reports to be error-free.

Source: CNBC

What Are the Three Different Credit Bureaus?

The most popular credit bureaus in the United States are Equifax, TransUnion, and Experian. They are known nationwide because they provide credit reports across the country. All three use FICO 8, but each takes a different approach to calculating credit scores for different types of lending. This way, they can properly score consumers for the exact type of debt.

These credit bureaus provide regular credit reports and credit score updates and monitor credit across the three bureaus. In addition, they can send fraud alerts, protect against identity theft, and fix credit report problems.

They have also teamed up to develop VantageScore[12], an alternative to FICO. VantageScore’s goal is to even the playing field for consumers that usually do not get scored properly[13].

Generally, VantageScore and FICO consider the same factors when measuring the likelihood of defaulting on debt, but not on the weight of each factor on the final credit score. For instance, VantageScore and FICO both think that payment history should be the most influential. However, they disagree when it comes to debt balance and length of credit history.

Unlike FICO, VantageScore tends to be more lenient with consumers that use credit infrequently. VantageScore no longer weighs tax debt as heavily as it used to. It also considers a person’s habits of spending money and using credit over the past two years.

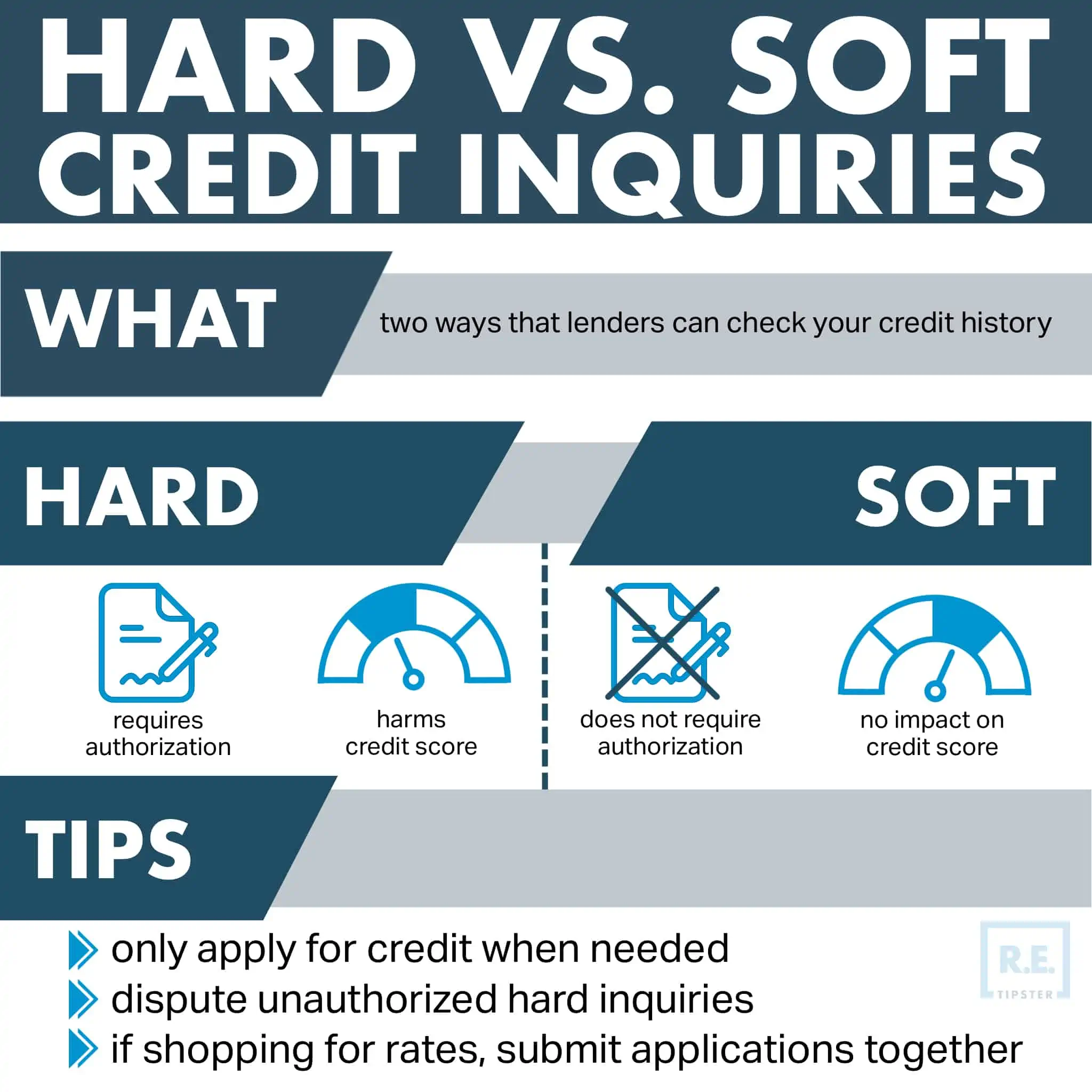

However, it counts multiple inquiries[14] as one within 14 days only, unlike FICO’s 45-day threshold. Taking longer to shop around for the same type of credit can also result in more point deductions in VantageScore than in FICO.

Do Credit Scores Only Exist in America?

Other developed countries like Australia, Canada, France, Germany, and the Netherlands use credit scores too. Likewise, developing nations such as Brazil, Cambodia, and the Philippines have launched formal credit scoring systems.

In addition, the three American credit bureaus operate in the United Kingdom as well. However, unlike in the U.S., being a registered voter can boost someone’s credit score.

In Japan, Americans can use their credit scores if they have an account with an international bank with ties to a local financial institution. Being fluent in Japanese can also help a U.S. national seek credit with the country.

The credit system in China is still under development. However, the Chinese government seems to be keener on implementing a social credit system instead[15].

Takeaways

- Creditworthiness measures the likelihood that an individual will pay their bills and loan payments on time.

- Credit bureaus obtain financial data from credible sources to score consumers and create credit reports.

- Credit bureaus calculate credit scores using scoring models like FICO and VantageScore.

- Other countries use credit scores to distinguish consumers that are likely to fall into arrears on their debts.

Sources

- Irby, L. (2021.) 8 People Who Check Your Credit Report. The Balance. Retrieved from https://www.thebalance.com/people-who-check-credit-report-960517

- myFICO. (2019.) FICO® Scores Versions. Retrieved from https://www.myfico.com/credit-education/credit-scores/fico-score-versions

- Tak, C. (2019.) The VantageScore 3.0 Model & How It Works. Credit Sesame. Retrieved from https://www.creditsesame.com/blog/credit-score/vantagescore-30/

- O’Shea, B. (2021.) No Credit Score Doesn’t Mean a Zero Credit Score. NerdWallet. Retrieved from https://www.nerdwallet.com/article/finance/no-credit-score-zero-credit-score

- White, A. (2021.) What does it mean to be credit invisible? CNBC. Retrieved from https://www.cnbc.com/select/what-does-being-credit-invisible-mean/

- Experian. (n.d.) What Affects Your Credit Scores? Retrieved from https://www.experian.com/blogs/ask-experian/credit-education/score-basics/what-affects-your-credit-scores/

- Consumer Data Industry Association. (2018.) Overview – For Furnishers of Data. Retrieved from https://www.cdiaonline.org/resources/furnishers-of-data-overview/

- Egen, S. (2021.) Who Reports to Credit Bureaus? Credit One Bank. Retrieved from https://www.creditonebank.com/articles/who-reports-to-credit-bureaus

- The Consumer Law Group, P.C. (n.d.) Data Furnishers Must Provide Accurate Information to Credit Reporting Agencies. Retrieved from https://www.theconsumerlawgroup.com/library/legal-obligations-of-data-furnishers-under-fcra.cfm

- Consumer Financial Protection Bureau. (n.d.) List of consumer reporting companies. Retrieved from https://www.consumerfinance.gov/consumer-tools/credit-reports-and-scores/consumer-reporting-companies/companies-list/

- Backman, M. (2021.) 3 Types of Credit Report Errors to Look Out For. MSN. Retrieved from https://www.msn.com/en-us/money/personalfinance/3-types-of-credit-report-errors-to-look-out-for/ar-BB1glum4

- Brozic, J. (2021.) VantageScore vs. FICO: What’s the difference? Credit Karma. Retrieved from https://www.creditkarma.com/advice/i/vantagescore-vs-fico

- Burns, B. (2012.) Who Are “The Unscoreables”? Hint: It’s Not Who You Think. National Association of Federally-Insured Credit Unions. Retrieved from https://www.nafcu.org/nafcuservicesnafcu-services-blog/who-are-unscoreables-hint-its-not-who-you-think

- Fried, C. (2021.) Soft vs Hard Credit Inquiries: What’s the Difference? American Express. Retrieved from https://www.americanexpress.com/en-us/credit-cards/credit-intel/hard-inquiry-vs-soft-inquiry/

- Brussee, V. (2021.) China’s Social Credit System Is Actually Quite Boring. Foreign Policy. Retrieved from https://foreignpolicy.com/2021/09/15/china-social-credit-system-authoritarian/