REtipster features products and services we find useful. If you buy something through the links below, we may receive a referral fee, which helps support our work. Learn more.

If you're renting out real estate or selling your properties with seller financing, you probably know there are a lot of dishonest and irresponsible people out there.

When you list a property on the market and start getting calls and email inquiries from people who want to buy or rent it from you, some of these people will be honest, reputable, and trustworthy, and some of them will be the exact opposite.

If you want to separate the great tenants and borrowers from those more likely to give you headaches, it's on YOU to investigate their background and understand who you're dealing with.

Whenever you're considering a new business relationship with someone who “promises” to send you regular payments, it's never a bad idea to do some fact-checking and gather historical data about the person on the other side of the deal.

Better to be armed with some information than no information – right?

The good news is, it's surprisingly easy to get these answers and it doesn't have to cost you a dime.

In the next few minutes, I'll show you how you can run credit checks AND background checks on the potential tenants or borrowers you're working with (and if you stick with me, I'll show you how to read these reports too).

Introducing: Cozy

In case you're not familiar with Cozy, this is an online, cloud-based software designed to assist “mom and pop” landlords in handling the essential, ongoing tasks of managing their rental properties.

I'm talking about things like…

- Listing properties For Rent

- Pulling credit reports and background checks

- Collecting monthly rent payments online

- Processing rental applications

- Determining the right amount to charge for rent

- Getting set up with Renters Insurance

Now, I've only used Cozy to pull credit reports and background checks, but I've talked with a lot of other landlords who use Cozy to fully manage their rental properties and I'm not exaggerating when I say this – EVERYONE has told me they love this software (which isn't something I can say about most online software and services out there).

How to Run a Credit Check for FREE

So let's dive into it.

If you need to pull a credit report or background check on a potential tenant or borrower, here's how you can do it:

- Go to this page, scroll down and click on Request Screening Reports (don't be afraid to sign up for an account – it's worth it).

- Select which report(s) you want to generate.

- Type out the first name, last name and email address of the applicant.

- Enter your free account information (it takes less than 10 seconds).

- Click on Send Requests.

…and Cozy will handle the rest.

I'll show you exactly how it works in this video:

Overall, there are a lot of reasons why I like Cozy:

- The website is beautifully designed and very easy to follow (for both parties). If you know how to use a computer and check your email, it's basically impossible to get lost or confused during the process.

- For the person requesting the credit report (i.e. – YOU), it doesn't cost anything.

- The reports are clean, concise and easy to read. You don't have to be a banker or finance professional to understand what you're looking at.

- If you want to use the service to handle other aspects of your rental property business (e.g. – property listings, finding tenants or payment collection), it can do a lot of other stuff too.

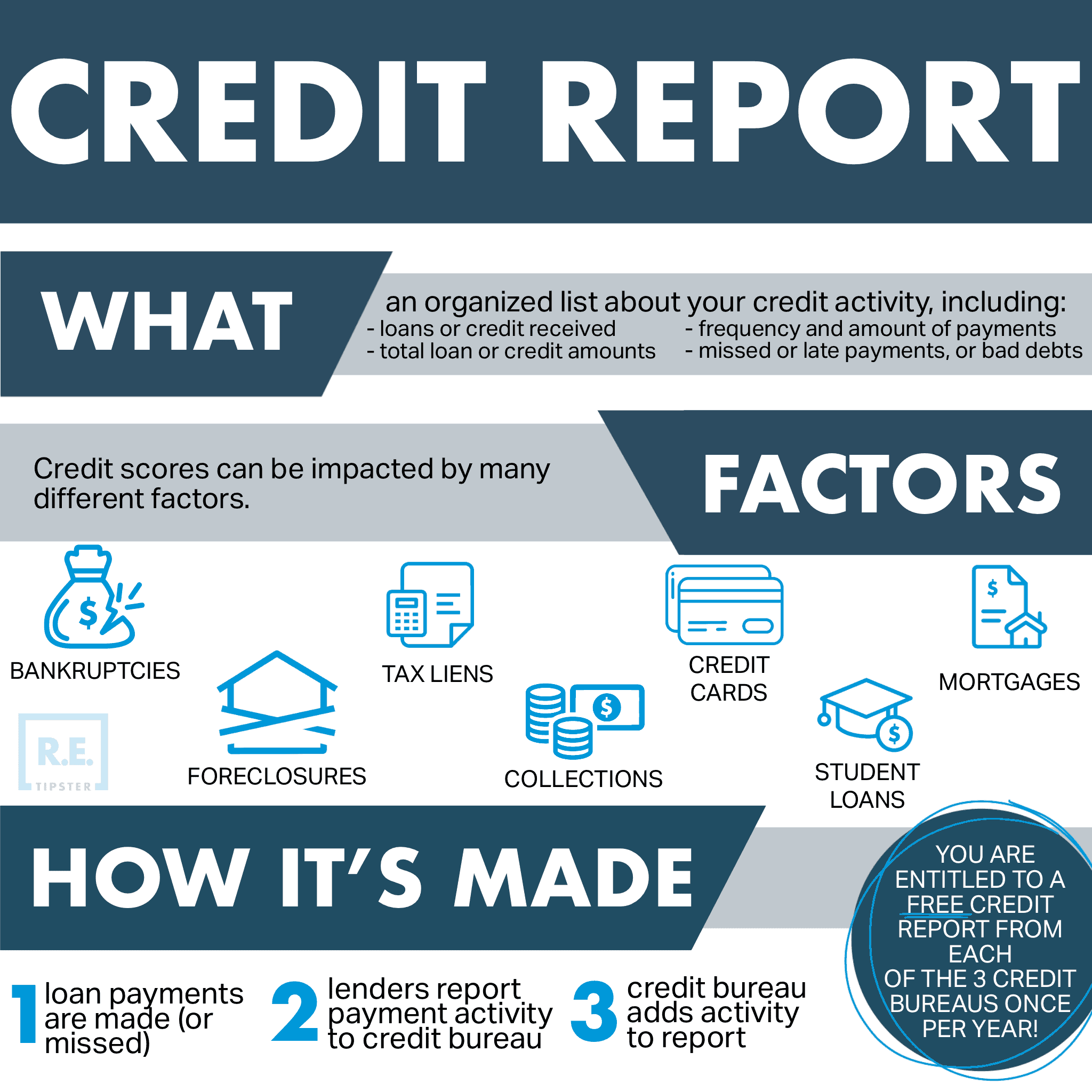

And when it comes to credit reports, there's another important thing to remember.

When most conventional lenders and creditors “pull credit” on their applicant, it’s usually a one-sided transaction with no involvement from the tenant or borrower. As a result, it lowers the applicant's credit score with every inquiry (this is why they call it a “hard inquiry”).

However, Cozy DOES involve the applicant in this process (as shown in the video above), and as such, the credit bureaus treat it as a “soft inquiry”, which doesn’t ding their credit with every inquiry. It’s treated as if the applicant pulled their own credit, which they don’t get penalized for.

Why Screening Matters

When I was a real estate novice, pulling a credit report seemed confusing (and even intimidating) to me.

You see, I had no idea how to get my hands on someone's credit report, and even if I did – I wouldn't have known how to make any sense of it (I never would've admitted this openly at the time because I didn't want to look or feel stupid).

For many years, I used to sell properties with seller financing and didn't run ANY credit checks on the borrowers I worked with.

I know it might sound crazy (and maybe it was a little), but I was able to justify this for a couple of reasons:

- I was buying properties for around 10% – 30% of market value and selling them for 50% – 70% of market value… sometimes more. This gave me a BIG, built-in profit margin, and I usually recoup my total investment into each property before my borrowers had a chance to default on their payments to me, so I was pretty well covered, no matter what happened.

- If a borrower ever stopped paying, I could repossess the property without much trouble (because I only work in states that made the process easy). As a result, this allowed me to sell the property to someone else and start making money again (which could potentially make the deal even more lucrative in the long run).

In my situation, there were some valid arguments for skipping the credit report, but even then, when you consider how easy this process is, how valuable the information is, AND the fact that it doesn't even cost anything… why would you not do this??

I'll be the first to tell you – even if you're not losing money on the deal; it's still a big hassle when a borrower or tenant stops paying. Even with mechanisms to get the property “unstuck,” it still chews up a lot of time and energy to make it happen.

For many reasons, it's smart to get educated about the people you're looking to work with – especially when a website like Cozy makes the process painless.