REtipster features products and services we find useful. If you buy something through the links below, we may receive a referral fee, which helps support our work. Learn more.

To succeed as a real estate investor, you must know how to find motivated sellers.

That's not just my opinion; it's a fact.

When I first started pursuing my real estate investing career, I wasted a TON of time trying to find these people the wrong way (at one point, I thought it was impossible). There came a point when I was almost ready to throw in the towel, and that's when I discovered direct mail marketing.

But it wasn't just any kind of direct mail marketing. Some very specific steps had to be followed, and if I hadn't put the time and effort into doing it right, I would have wasted a small fortune.

Moving through the process wasn't always fast, convenient, or cheap, but when I took my time and carefully went through the right motions, the floodgates opened, and I was inundated with more opportunities than I could handle.

Data: The Crucial Component

Knowing how to obtain the right information and use it correctly had everything to do with my ability to find unbelievable deals (truth be told – I can't think of any notable success I had before this discovery… it was that big of a deal)!

The funny thing is, for most marketers, direct mail is an incredibly ineffective marketing medium (it's the only industry where a 1% response rate is considered “acceptable”).

As real estate professionals, we must hold ourselves to a higher standard because most of us can't afford to invest millions in a strategy that isn't consistently working.

Luckily, the real power behind a successful direct mail campaign is in the data.

The good news is that several data companies have made it possible to comb through most of the 3,143 counties in the U.S. (and the wildly inconsistent organizational systems they all use), making it substantially easier to find the information we're looking for.

Having access to this kind of information is a big deal. It isn't possible in most countries outside of the United States because property ownership information is not of public record.

If you're a real estate professional who uses this information for direct mail, this organized data is worth paying for.

This blog post will look at some major players in real estate data. We'll examine what each one brings to the table, what their services cost, some of the pros and cons with each one, and what you can expect to see if you decide to work with them.

We'll also discuss some important aspects of real estate data that can greatly affect the success of your direct mail marketing efforts.

The Land Portal

The Land Portal is a relatively new player in the real estate data service arena, but it's quickly making waves, especially among land investors.

Developed by land investors for land investors, the Land Portal combines the best features of several data services into one competitively priced platform.

Of the many unique things The Land Portal can do, it has filters that no other data service has, including wetlands, road frontage, filtering landlocked properties, and more.

Pros of The Land Portal

- Combines the functionality of multiple services at a fraction of the cost.

- Unique filters tailored specifically for land investors (e.g., landlocked properties, road frontage).

- AI-powered vacant lot detection using satellite imagery.

- Integrated skip-tracing functionality.

- No long-term commitment is required.

- Covers the entire United States.

Cons of The Land Portal

- As a newer service, it may have occasional bugs (though these don't typically affect the end product).

- It may not have all the features of more established services for non-land-specific investing.

Key Features

- Advanced filtering options, including unique filters like landlocked properties and road frontage

- GIS mapping data for easy property visualization

- Ability to see individual records before downloading the list

- Integrated skip tracing at competitive rates

The Land Portal Pricing

At this time, The Land Portal offers a monthly subscription model with no long-term commitment. The exact pricing may vary, so it's best to check their website for the most current information. However, it's generally considered a more affordable option than many traditional data services.

Who The Land Portal is Best For?

The Land Portal is ideally suited for land investors who need specific, land-focused data and filtering options. Its unique features make it particularly valuable for those looking to identify vacant lots, assess property accessibility, and find motivated sellers in the land niche. While it may not have all the bells and whistles of some larger, more established services, its targeted approach and competitive pricing make it a strong contender for land investors of all experience levels.

Remember to verify the most current features and pricing directly with The Land Portal, as services and offerings may evolve.

DataTree

Of all the data services I've explored to date, DataTree is the one I've spent the most time with. Depending on which features you use and how much data you need to pull, it may also be the least expensive option on the market.

If you use DataTree for direct mail campaigns, this video shows how that process works…

Here's an overview of how to do individual property research with DataTree…

Note: We do have an affiliate relationship with DataTree. If you sign up for the service through our affiliate link, you'll get a discount off the regular price of the service, and REtipster.com will get a tiny commission if/when you choose to sign up.

Pros of DataTree

- Relatively inexpensive with an entry-level subscription.

- Very easy to pull lists and do property research.

- The advanced search function offers several filtering options, with the ability to mix and match specific filtering criteria in a way that I haven't seen from any other data service – which allows lists to be VERY targeted and specific.

- Most (but not all) counties come fully stocked with GIS mapping data, making it very easy to find property parcel lines and boundaries (this is especially useful for vacant land investors).

- One subscription offers access to the entire United States (not just a single county).

- Users can see the individual records before downloading the list.

- In my experience with DataTree, their customer service has been excellent.

Cons of DataTree

- Some counties are less current than others. However, it's always easy to verify when the data was last updated by pulling up any individual Property Detail Report in your working county.

- While DataTree offers the most list filtering options, this kind of flexibility is a double-edged sword because some options either won't work or are confusing to understand.

- DataTree requires a 12-month commitment in order to use their service. If you're ready to jump in with both feet, this shouldn't be a problem. However, if you're trying to test the waters, some may feel apprehensive about this.

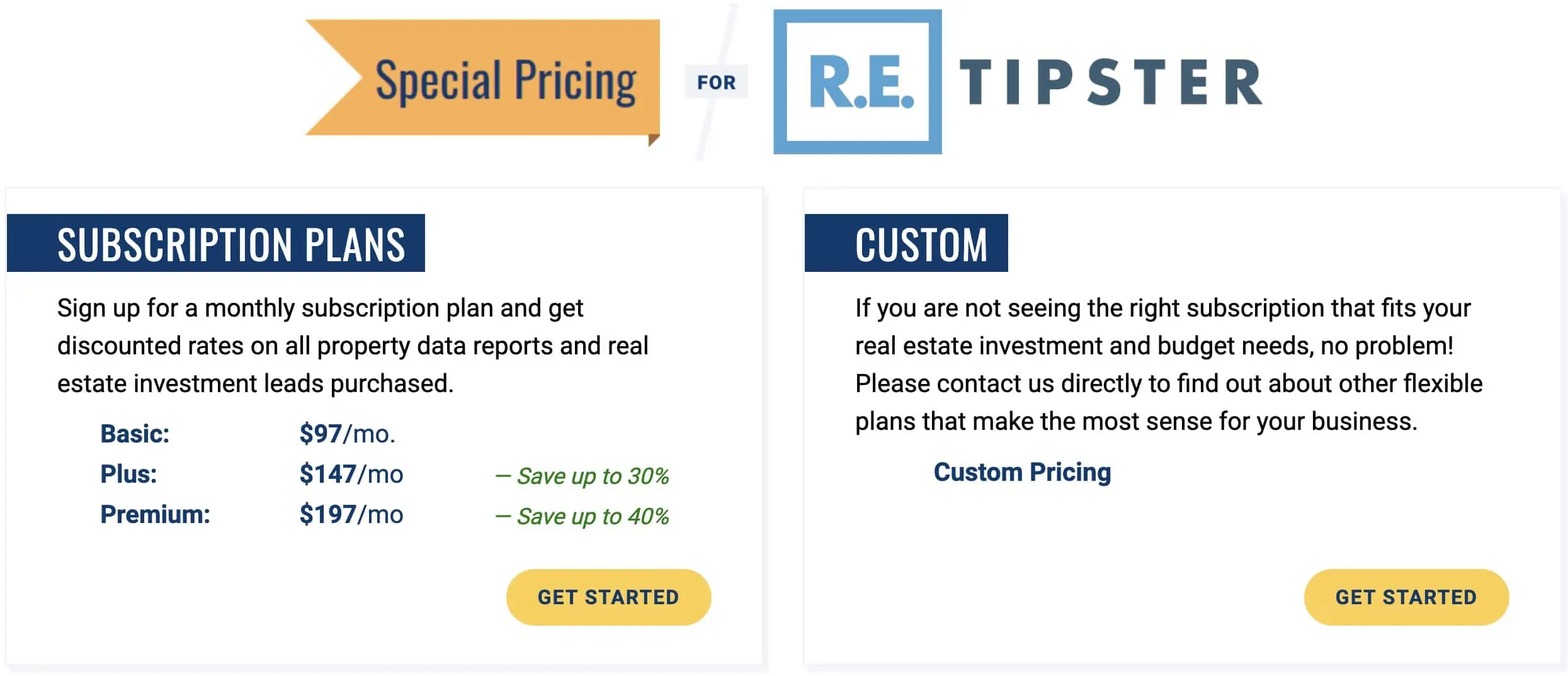

DataTree Pricing

The pricing for DataTree will vary depending on what you use it for and which plan you select, but whatever plan you choose, you can only get a substantial discount if you sign up through the REtipster affiliate link.

DataTree uses a “credit system” of sorts, where you agree (on a 12-month contract) to pay a set amount each month for the ability to use the service. When you pull a Property Detail Report or a Property Characteristics Report (or anything else listed above), each instance will deduct the quoted amount from the monthly credits you have available.

Once you exceed the number of credits you have at your disposal each month, it will continue to charge you above and beyond your monthly commitment for each time you use it, at the same quoted amount. So, if you know you'll be pulling a TON of data, signing up for the Premium subscription makes sense because the cost of each additional pull will be exponentially less than if you signed up for the Bronze subscription.

Also, remember that DataTree can do much more than generate lists. You can find a series of tutorials showing all its other uses in this blog post: DataTree Hacks Every Real Estate Investor Should Know

PropStream

What I like about PropStream is that it's fairly easy to use AND pulls from multiple databases. Unlike DataTree, which relies on a single, well-maintained, nationwide database, PropStream pulls in a lot of information from multiple sources. This means it can potentially give you better, more current information in some cases, making it a great secondary service you can use to cross-check information and verify the accuracy of your information, regardless of your primary data source.

PropStream was designed specifically for real estate investors (primarily house wholesalers and house flippers), whereas DataTree was designed for a broader audience. Unfortunately, because they target the house audience, it lacks some features that would be very useful for land investors. However, the issues are overcomeable.

Here's an overview of how to generate a list with this service:

(Note: To see an overview of PropStream's “Quick List Choices,” check out this page)

Here's an overview of how to do individual property research with PropStream:

Something I appreciate about PropStream is that, similar to DataTree, their system will show you exactly how current their database is in every county around the country (not every data service offers this kind of transparency).

I also appreciate how the service is priced at a flat monthly fee, whereas most data services will charge a monthly fee PLUS a per-lead fee for every record you download (which can add up).

PropStream also has a great mobile app and the ability to do skip tracing and send out direct mail and email marketing campaigns (among other things) all from your PropStream account.

Granted, most land investors won't need to use all of these things… but it's still a nice set of tools to have available if/when you need them.

Pros of PropStream

- Flat, monthly fee with a generous amount of leads to download.

- Subscriptions are month-to-month, with no long-term commitment required.

- Pre-build filtering options to assist in targeting motivated sellers.

- Skip tracing, direct mail, email marketing, and website-building capabilities.

- Limited access to MLS data in many markets.

- Users can see the individual records before downloading the list.

Cons of PropStream

- Some counties are less current than others, and some counties don't have any data available. It doesn't always do a great job of communicating this (if you search in a county that isn't covered, it just won't show you any results).

- It's great that PropStream has access to multiple data sources, but it can be problematic when you can't see which source is being used. Since there are varying degrees of reliability from one database to another, it would be helpful if there was a way to know which source you're seeing.

- The process isn't always user-friendly or intuitive for land investors searching by a property's APN (when doing individual property research). The software was made primarily for house investors and not land investors.

PropStream Pricing

At the time of this writing, the standard pricing for PropStream is $97/mo if you sign up through the REtipster affiliate link.

Connected Investors

Connected Investors (formerly known as ‘PiN') is an easy-to-use, budget-friendly online resource for generating marketing lists. It works a lot like DataTree but has unique filters and features I haven't seen in any other data service (like expired listings and ‘list stacking' by combining multiple sources of motivation).

Unlike most bigger data services like DataTree, RealQuest Pro, and Site X Pro, which were made to serve many different industries, PiN was built specifically for real estate investors, which means it's packaged to deliver exactly what real estate investors need.

Connected Investors is a monthly subscription with no long-term commitment, and each month, they'll give you 2,500 free skip traces and 5,000 free records, which is an incredible value, seeing as most data services will charge you .05 – .15 cents per record for the same thing! I'll show you in this video.

Start Your 7-Day Free Trial with PiN!

In my experience using this software, I encountered the occasional bug in their operating system, but nothing affected the end product of the lists and data I could export.

If you're new to the real estate business or want to check out what another data service might have to offer, try Connected Investors for free. I think you'll see the same thing I did—it's a great value!

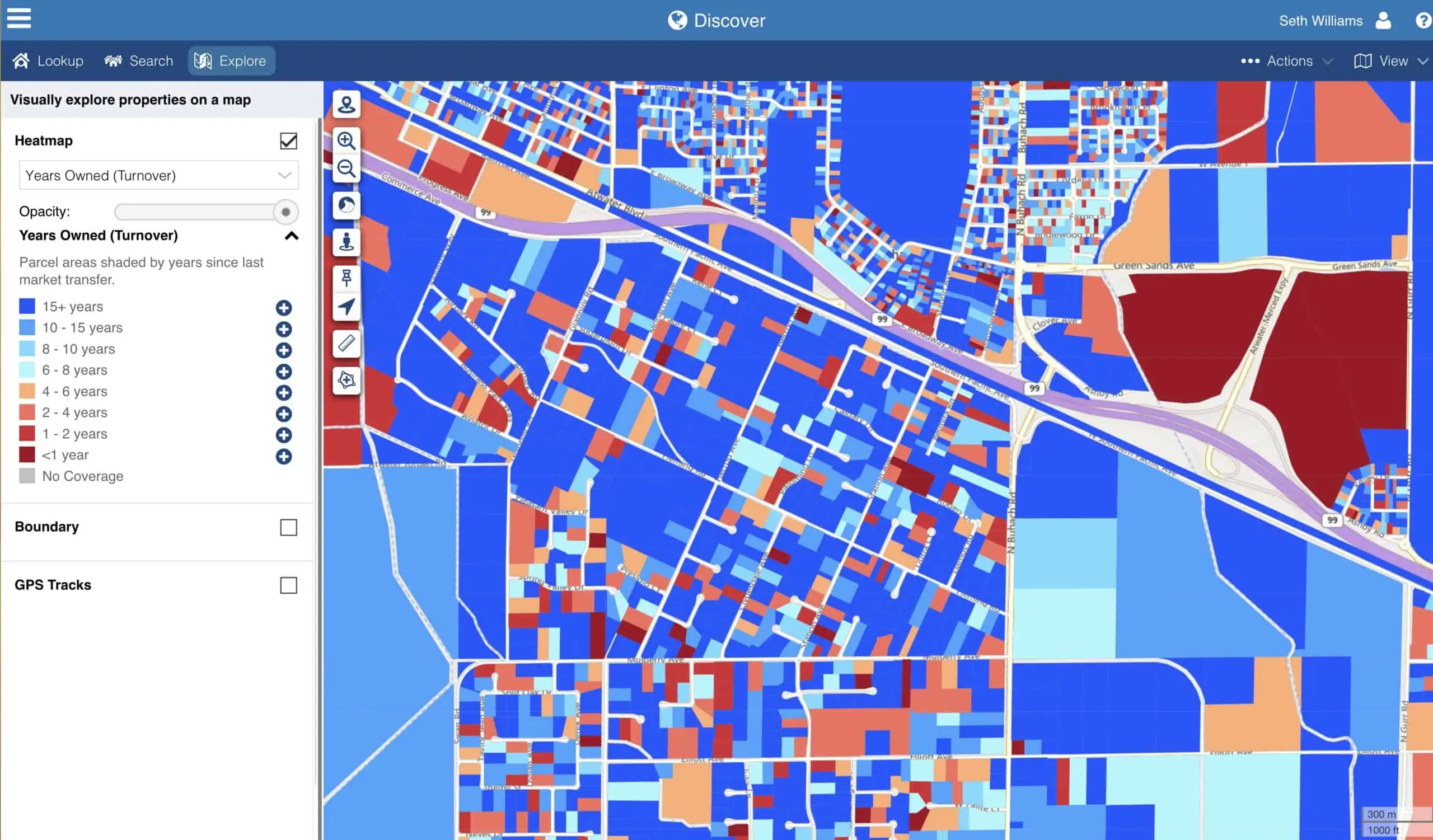

PropertyRadar

PropertyRadar is a robust data service with many similarities to DataTree and PropStream, but it has some very cool features that I haven't seen in any other data service out there.

It allows you to generate lists of property owners for your direct marketing campaigns and do individual property research on specific properties you're looking closer at.

Get Started With PropertyRadar!

It also allows you to visualize your market area using a heat map feature, revealing hidden opportunities that would otherwise be difficult to spot.

PropertyRadar doesn’t exactly disclose where it’s sourcing its data, though it's clear that the information comes from public records (the specific databases remain unknown). I notice that some labels for vacant land appear identical to those seen in DataTree, which comes from First American… so this hints that First American is at least one of the sources they use.

Get Started With PropertyRadar!

PropertyRadar has advanced filters to help you zero in on specific criteria like age and availability of contact information. The refined lists can then be exported for further analysis and customization. This granularity makes it a potent tool when you're gearing up for your next investment move.

That said, be careful not to make your parameters too restrictive. If your list shrinks too much, it may be a sign that you're over-filtering. Also, there may be some slight discrepancy in the data, which is always a risk with these data services. It’s important to cross-check and ensure the accuracy of your lists before you spend too much money using them.

RealQuest Pro

RealQuest Pro is a service that can be used for researching properties and generating lists (a similar concept to DataTree, but at a much higher price, with information pulled from a completely different database).

Similar to ListSource, RealQuest is owned and operated by CoreLogic, which means the data for both services is pulled from the same pool of information.

The user interface offers a lot of flexibility and options to meet the needs of most real estate professionals.

Here's an overview of how to generate lists with RealQuest.

And here's an overview of their property research tool.

Something I appreciate about RealQuest is its wide degree of functionality within its system. I also appreciated that RealQuest allows users to see the “Latest Recording Date”, so there will never be any question as to the currency and accuracy of the data you're working with (and when it comes to direct mail – this is a big deal).

The only thing that turned me off from RealQuest was the price (which was very high in comparison to the other services on the market). I also wasn't a fan of how their subscriptions are only available with a 12-month commitment. These high barriers to entry made the service a tough sell for someone like myself.

Pros of Real Quest

- Access to data anywhere in the United States (with the higher-level subscription packages).

- Users can reference “Latest Recording Date” to verify the database is current in each county.

- A very flexible system in determining the recipients that go into the desired list.

- Versatile functionality and GIS parcel mapping data are available for doing property research and locating properties.

- Most of the CoreLogic database is kept very current and up to date.

- Users can see the individual leads before downloading the list.

Cons of RealQueset

- The service is only accessible through a fairly expensive 12-month subscription (with additional charges for using their list generating service).

- Higher barriers to entry (signing up can only be done through a live call with a sales rep, and subscriptions are only available with a 12-month commitment).

- One of the most expensive subscriptions on the market.

RealQuest Pricing

At the time of this writing, there are a few different pricing options available:

Option 1 – Starter Package $150/mo (12 month subscription)

- 150 Property Detail Reports, Comparable Searches, Street Map Plus Reports (Aerial Map Included), Foreclosure Detail Reports and Map Searches

- Custom Search – $0.10/record

- Property Characteristics – $0.10/record

- Expanded Property Characteristics – $0.05/record

- Mortgage Info – $0.12/property

- Transaction Info – $0.12/property

- Specialty Fields – $0.12/property

Note: The Starter Package is for one state only.

Option 2 – Growth Package $225/mo (12-month subscription)

- 250 Property Detail Reports, Comparable Searches, Street Map Plus Reports (Aerial Map Included), Foreclosure Detail Reports and Map Searches

- Custom Search – 1,500 records/mo

- Property Characteristics – $0.12/record

- Expanded Property Characteristics – $0.12/record

- Mortgage Info – $0.23/property

- Transaction Info – $0.23/property

- Specialty Fields – $0.23/property

Note: The Growth Package covers the entire United States.

Option 3 – Portfolio Package $275/mo (12-month subscription)

- 500 Property Detail Reports, Comparable Searches, Street Map Plus Reports (Aerial Map Included), Foreclosure Detail Reports and Map Searches

- Custom Search – 3,000 records/mo

- Property Characteristics – $0.12/record

- Expanded Property Characteristics – $0.12/record

- Mortgage Info – $0.23/property

- Transaction Info – $0.23/property

- Specialty Fields – $0.23/property

Note: The Portfolio Package covers the entire United States.

From what I saw, this service has some very good information and their system works very well (I couldn't detect any glitches or problems in its functionality) and I was very impressed at how the filtering criteria allows users to narrow down the types of properties on each list to some very specific segments.

The only downside I saw was that the service costs 10x more than every other option on the market. RealQuest is not cheap.

But here's the thing… I'm not a heavy data user. I've never been one to send out 10,000 mailers per month, and my business doesn't rely solely on direct mail to find motivated sellers – so even though I could easily fit this into my budget, it would be overkill for my situation (like trying to kill a fly with a canon).

On the flip side, if you are a high volume data user and if you need to get extremely specific about the types of recipients who belong on your lists, this could be precisely the service you need to bring your business to the next level.

ListSource

ListSource is another service by CoreLogic, and it's one of the more well-known platforms for generating direct mail lists.

This service is extremely popular because of its convenience. It is very easy to generate a one-off list with no subscription required.

That being said, ListSource does not have any function available for property research, so you'll only find it useful if you're in need of a direct mail list.

That being said, if a quick list is what you're after (e.g. – if it's your first time pulling a list and you're not ready to commit to a subscription) – it's a nice option to have at your disposal.

This video below (taken from a blog post I published last year) will give you an idea for how their system works.

The only downside of ListSource is almost entirely in the price. A common theme I found with CoreLogic brands is that they aren't cheap. However, the service seems to make up for it in convenience and ease of use. The fact that you can use it without any long-term commitment makes it an ideal option for the beginner (and for the long-term user, there are discounts available if you're willing to utilize their bulk pre-pay and/or subscription options).

Pros of ListSource

- Access to data anywhere in the United States.

- Extremely convenient, with no subscription required – very easy to generate lists in a matter of minutes.

- Very flexible filtering criteria in determining the recipients that go into the desired list.

- Decent customer service is available.

Cons of ListSource

- No Delinquent Tax data is available.

- No convenient way to know when the data was last updated for each county.

- No way to research individual properties.

- One of the more expensive list generating options on the market.

ListSource Pricing

There are three different ways to purchase lists from ListSource:

Option 1* – ListSource Prepaid Bulk Account (12-month subscription)

| Prepaid Amount | Standard Rate | # of Leads |

| $600 | $0.15 | 4,137 Leads |

| $1,000 | $0.14 | 7,407 Leads |

| $1,725 | $0.13 | 13,800 Leads |

*Rates based on standard property lead filters and output selections.

Option 2* – ListSource Monthly Billed Subscription (12-month subscription)

| Monthly Fee | Standard Rate | # of Monthly Leads |

| $150 | $0.13 | 1,153 Leads |

| $300 | $0.12 | 2,500 Leads |

| $500 | $0.11 | 4,545 Leads |

*Rates based on standard property lead filters and output selections.

Option 3 – Build List (no subscription required)

Without a subscription or prepaid draw account, the average cost for a one-time list will be in the range of .30 – .45 cents per record. In my experience, the lists I've generated were around .18 cents per record – so the price doesn't necessarily have to be quite this high. The cost will vary depending on which filtering criteria you're using.

Note: ListSource requires a $50 minimum purchase through their website and PayPal is the method of payment (however, this does not apply to pre-paid purchases).

Who Has The Best Information?

Remember, there are well over 3,000 counties in the United States, and 50 random counties is a VERY small sampling with which we can draw any sweeping conclusions. However, I think it does give us a reasonable idea of how all three databases are doing.

Based on the information I saw, it didn't appear that any single database was notably better or worse than the others. CoreLogic seems to be stronger in some counties, just like Black Knight seems to be stronger in others, and First American offers the best in its own set of counties.

All in all, they all seem to be in the same general place in terms of how current and reliable they are as a whole. None of them are perfect, and as much as I wish I could point you to one obvious choice, I can't say that one of them was the far-and-away the best over the others.

Using the Right List Criteria

If you want the best possible response rate from your direct mail marketing efforts, it's critical that you're sending your message to the right people – and the only way to do this is to use the right filtering criteria to generate your list.

In order to do this with any success, you need to know EXACTLY who your target audience is – and take special care to specify what types of properties and owners you need to include (and exclude) from your list.

Every service works a little bit differently, so it's impossible for me to tell you exactly which filtering criteria you need to use – but you'll find that most of them have many of the same general filtering options available.

Depending on who your target audience is, here are a few examples of how your list could be filtered…

Cash Buyers List

If my goal is to generate a list of real estate investors who are actively purchasing properties without financing in my target market (i.e. – “cash buyers” who have shown that they're actively looking for opportunities in the area, and they've got the cash available to buy now). My filtering options would look something like this:

- County Name, City Name, or Zip Code(s) (specify the geographic location of your target market)

- Equity %: 100-100 (investors who own 100% of the equity in their property and have no outstanding mortgages of record)

- Last Market Sale Date: Last 6 Months (properties that were purchased/sold within the past 6 months)

- Owner Occupied States: Absentee Owned (property owners who do not live in the subject property)

Vacant Land List

If my goal is to generate a list of property owners who currently own vacant land and are motivated to sell, there are SEVERAL potential ways I could filter my data, but these bullet points give a general framework by which to start the process (this is with the assumption that these filtering options were all available in my market and with my data service of choice):

- County Name, City Name, or Zip Code(s) (specify the geographic location of your target market)

- Improvement Value: 0-0 (properties with no improvements/structures built on them)

- Land / Market Value: 10000-100000 (vacant land with a market value between $10,000 and $100,000)

- Acreage: 1-100 (properties sized anywhere from 1 acre to 100 acres)

- Land Use / Zoning: Agricultural, Residential, Mobile Home, Unimproved Vacant Land, Single Family Residential, Recreational, etc. (properties with a wide array of potential uses, including farming, housing, mobile homes, recreation, etc)

- Occupancy: Absentee Owners, Out-of-County or Out-of-State Owners

- Tax Distressed/Default/Delinquent: YES (if possible, only include the properties that are currently delinquent on their property taxes) Note: This will substantially decrease the size of your list, but will also greatly increase its potency.

Remember – your filtering criteria may vary depending on the type, size, location (and more) of the vacant lots you're trying to target.

Single Family Homes List

If my goal is to get a list of absentee owners who own single-family homes and are highly motivated to sell, this is the criteria I would use to generate my list (assuming these filtering options were all available in my market and with my data service of choice):

- County Name, City Name, or Zip Code(s) (specify the geographic location of your target market)

- Equity %: 80-100 (property owners who own most of the equity in their property and have a low/no mortgage balance outstanding)

- Market Value: 20,000-100000 (I'm only targeting houses with a market value between $20,000 and $100,000)

- Use: Single Family Residential, Residential (General), Residential Improved, etc. (properties that are clearly being used for residential housing)

- Tax Distressed/Default/Delinquent: YES (include only the properties that are currently delinquent on their property taxes) Note: This will substantially decrease the size of your list, but will also greatly increase its potency.

Depending on which service you're using and which county you're pulling your list from, there will be times when not all of these filtering criteria are available.

For example – the “Tax Default” option isn't available from all of the services listed above – and of the ones that do make it available, even they can't provide this information everywhere, because this data changes daily, and many counties aren't sophisticated enough to publish this information on a daily basis.

That's okay, but it also means your list may be a bit more “watered down” in terms of finding the specific types of property owners you want to talk to. If you're still determined to get the tax delinquent data from these counties (as I usually am), your only alternative option is to get a delinquent tax list directly from the county.

A Note About Delinquent Tax Data

Probably the most effective filtering technique I've ever found is narrowing down the property owners currently delinquent on their property taxes.

It's usually a BIG red flag when someone owes back due property taxes. For one reason or another, the owner and their property are a TOTAL mismatch, inherently making them highly motivated to sell.

Some (but not all) of the services above will offer “Tax Default” or “Tax Delinquent” as one of their many filtering options in some (but not all) counties.

The challenge with this kind of data is that it's very time-sensitive. It changes daily, which makes it even more challenging to track. If you find a current county with good information, it can work extremely well, but once the data is more than a few weeks old, there can be some substantial changes to that list – which will cause it to start losing its potency very quickly.

As you can see from the county comparison above, some counties are kept very current, but some aren't. If the delinquent tax filter is important to you (as it is to me), you'll want to make sure you're only working in a county that is kept current.

The unfortunate truth is – in many counties, there's only one way to do this right. When delinquent tax data is important to me, I skip all of these services and get my lists directly from the county.

Getting this data from the county can be a HUGE pain in the neck for many reasons. Even though the data works well, most counties won't make it easy. If you can get their list, it will usually be in a format that is far less organized than the services above provide – but if you can find a few counties that will provide their list in an acceptable format at a reasonable price (0.01 – 0.25 cents per parcel is what I'm accustomed to paying), you'll also find that it works incredibly well, and can only be rivaled by a few data services in a few select counties around the country.

If you're interested in taking the plunge and getting your list from the county, this blog post explains exactly how.

Also, note – delinquent taxes are NOT the only cause of seller motivation. I've bought a lot of properties from owners who were not tax delinquent… so keep in mind, while it's certainly an effective filtering criterion when it's available, you can still find PLENTY of opportunities from owners who have their property taxes paid current.

Which Data Service is Right for You?

While compiling this information and recording these videos from each data service, I took away from this exercise that none of them are perfect, and none of them have everything I would want to see.

Some are GREAT at certain things (like pulling lists) and TERRIBLE at others (like doing property research). Others are extremely effective at filtering lists to narrow down certain property owners and types while completely incapable of filtering out others.

Some data companies offer much filtering flexibility and powerful data solutions but charge a very high price for access to their database. Others provide a very affordable and easily accessible platform but aren't necessarily the best fit for every real estate professional (and, of course, you'll never hear any data company talk about the things they aren't best suited for).

In the end – nobody seems to have it figured out from all angles, but if you know exactly what kinds of properties you're looking for, and if you know that the specific data you need is available in your area AND it's accurate and up-to-date, you should be able to nail down which of these services can best meet your needs.

I can't tell you which one is best for you – but if you thoroughly understand what you need and how much you're willing to pay for it, you should be able to find the best option. The most important thing is for YOU to understand what you need, what properties you're pursuing, and what information you will need to do the job effectively.

Every data company brings some value to the table, but to get the kind of value that is actually useful to you, there needs to be very little ambiguity about what you're looking for.