What if you could buy a $100,000 property for $15,000?

If someone told you about a $50,000 piece of real estate that you could purchase free and clear for five thousand bucks – you'd be all over it, wouldn't you??

Suppose you knew exactly where to find an endless supply of these deals, how to buy them quickly, for pennies on the dollar AND repeat the process over and over again… can you even fathom that kind of buying power??

Let's just think about this for a minute…

- What could this do for your business?

- How quickly could you SKYROCKET your personal wealth with this kind of information?

- With access to such a vast supply of free real estate equity – it probably wouldn't take long to build up a MASSIVE (and debt free) real estate portfolio, would it?

The truth is – there is an endless supply of these opportunities… and they are all over the place. Most people will never know about them, because they have no idea where to seek them out – but in the next few minutes, I'd like to help you connect-the-dots and open your eyes to a new world of opportunity.

What Is the Delinquent Tax List?

When I first got into real estate investing, I had no idea that there were HUNDREDS of these opportunities all around me. Like most people, I just assumed the only properties I could buy were the ones with a “FOR SALE” sign in the front yard.

I was seriously mistaken.

The reality is – most of the best real estate deals on earth go completely unnoticed by the general public. Only a small handful of people even know where to look for these opportunities, and the rest of the world is largely oblivious to the goldmine sitting right beneath their feet.

I got lucky. Soon after I started investing in real estate, I learned about one of the most valuable resources of all time (and no, I'm not exaggerating). It's called the “Delinquent Tax List” and it was ESSENTIAL to my early success as a real estate investor. This was where I found my unfair advantage – and if I hadn't had access to this kind of information, I probably wouldn't have made it very far – that's the honest truth.

Let's start with some background…

As you probably know, every property owner in the United States is obligated to pay annual property taxes for the real estate they own. These taxes are paid to the city, the township or county in which they reside.

In order for a city, county or township to charge taxes on each property, they need to keep a detailed record of every property within its jurisdiction, including (but not limited to) the following information:

- Who owns the property.

- When they purchased the property.

- How much they paid for the property.

- How much each owner owes in taxes.

- and so on…

All of this information is public record, which means you find this data on any property in the United States if you just know where to look.

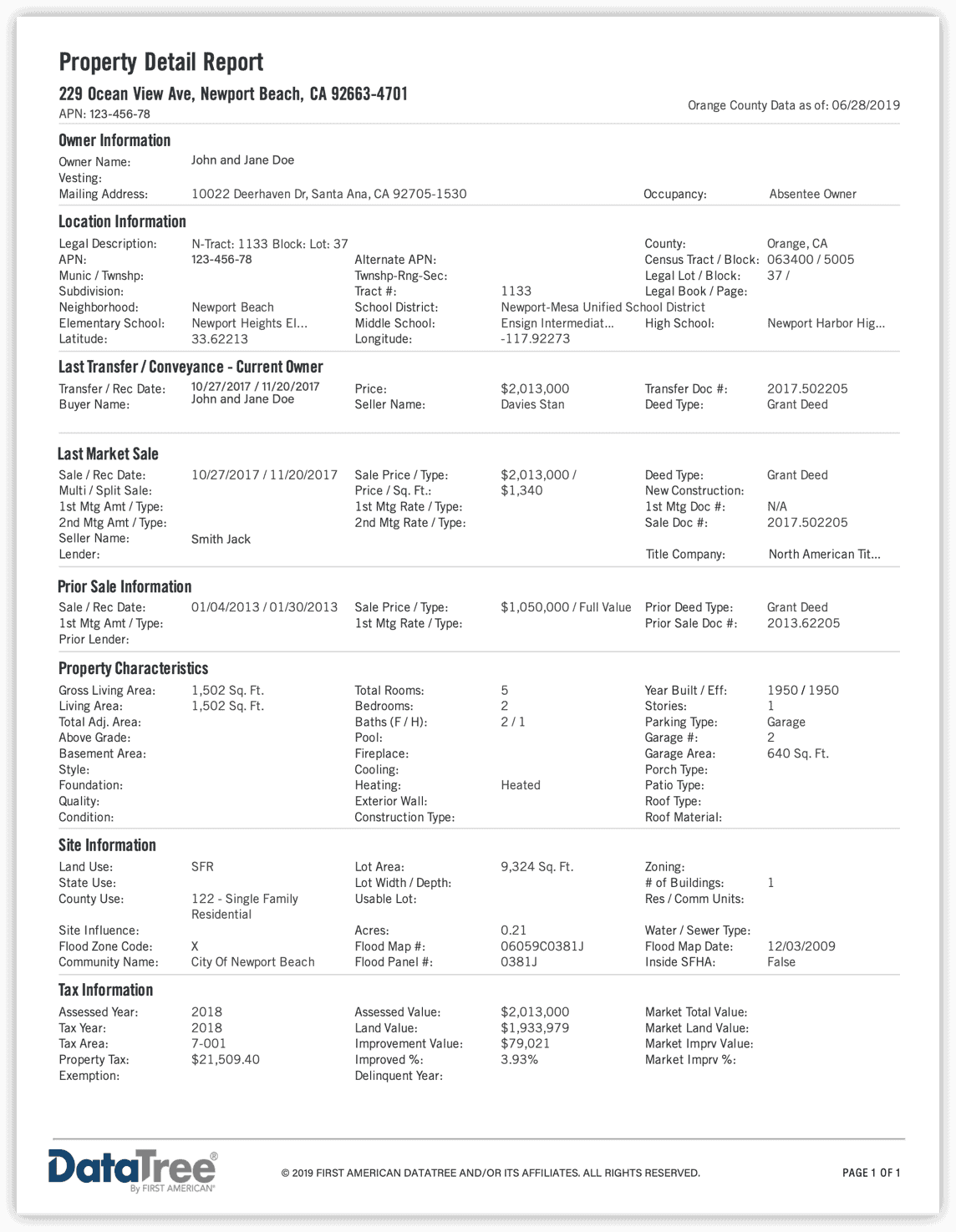

Most county websites will provide this information for free (though they usually have systems that are confusing and difficult to work with). Other services like DataTree and PropStream will provide much of the same data in an easier-to-understand package (like the example below):

How the Delinquent Tax List Works

So what happens when a property owner fails to pay their taxes?

It's pretty simple really.

Every county has a Treasurer (also known as a Tax Collector in some states) who is responsible for collecting and tracking the payment of these property taxes. When people don't pay their taxes, the Treasurer's Office will create a running list of who still owes them money (this is the same list they use to mail out their delinquent tax notices).

Some county Treasurers will refer to this list by different names, like:

- “Delinquent Tax Roll”

- “Tax Delinquent List”

- “Tax Forfeiture List”

- “Tax Assessor's Roll”

- (or something to that effect)

Though it can go by different names in different counties – they're all referring to the same thing.

When a property owner fails to pay their taxes, their name will be added to this list. Once they're on this list, the county will wait anywhere from 1 – 5 years (depending on the state) and when enough time has passed, the county will come in and take these properties from their respective owners via tax foreclosure. Regardless of how much money an owner may have invested in their property – if they don't pay their taxes, they will lose the entire property. Forever.

How Long Before the County Forecloses on the Property?

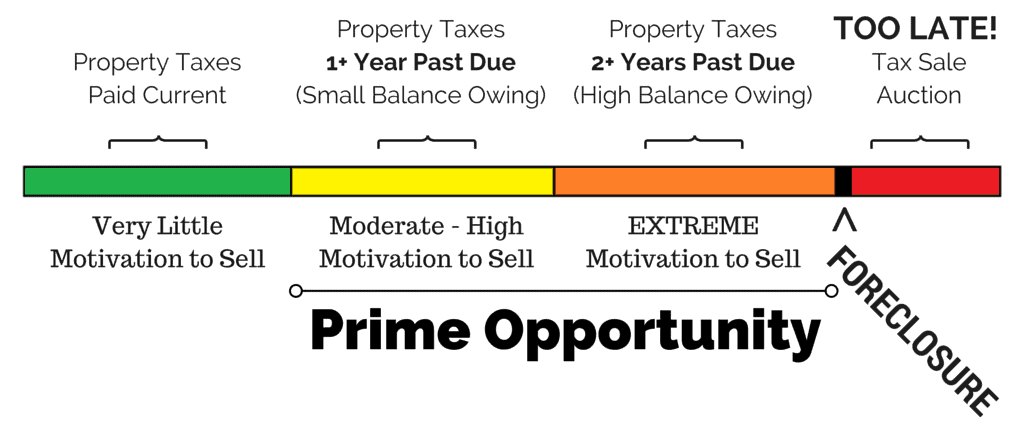

The “tax foreclosure timeline” works a bit differently in every state, so it's important to understand the rules wherever you're working. In my home state (and in many other states throughout the U.S.), a property can accumulate up to 2 years of delinquent taxes before the county can seize the property in tax foreclosure. This little diagram gives an illustration on how it works…

Now keep in mind – if the property owner wants their name to be erased from this list, they can do it at any time by simply paying off their property taxes (and all the late fees they've incurred along the way). As long as they pay off these taxes PRIOR TO the county's drop-dead date, they will maintain full ownership of their property.

This list is kept up-to-date every day with the delinquent (or non-delinquent) status of each property owner. It's a set of information that is constantly changing, with new names being added and old names being removed as people pay (or don't pay) their property taxes.

When the County Takes Over

For those property owners who do ultimately lose their property to tax foreclosure, the county will hold an annual “Tax Deed Sale” or “Tax Lien Sale” (depending on the state). Essentially, they will hold an auction and sell off all of these properties to the highest bidder (and their only real goal for each property sale is to generate enough revenue to pay off the back due taxes they were owed – even if it's just a few hundred bucks).

For those property owners who do ultimately lose their property to tax foreclosure, the county will hold an annual “Tax Deed Sale” or “Tax Lien Sale” (depending on the state). Essentially, they will hold an auction and sell off all of these properties to the highest bidder (and their only real goal for each property sale is to generate enough revenue to pay off the back due taxes they were owed – even if it's just a few hundred bucks).

Now let me be very clear…

The properties being auctioned off at the tax sale are NOT the ones we’re interested in.

Why? Because by the time a property has been foreclosed on and put it up for auction – it’s too late.

At many of these property auctions, the typical investor (aka – you) will have to bid against dozens of other hungry buyers and deal with some serious competition, which can be a recipe for disaster. In many cases, these auctions can spiral out of control, with bidding wars that push the price of any good property far beyond its actual market value… and if you're someone who needs to find a good deal, this is a problem.

Now – is it possible to get good deals at a tax sale? Yes.

Are you likely to find a lot of good deals at a tax sale? In my experience, No.

When you have to fight against dozens of competitors, you don't have an unfair advantage and you're not in a position of power. I've learned the hard way that when you're not able to call all the shots and play the game by your rules – there is a much higher likelihood that you'll walk away empty-handed and/or make some really stupid decisions.

For a number of reasons – I've found that the tax sale model just doesn't work.

What's So Special About the Delinquent Tax List?

When we're talking about a “Delinquent Tax List”, it's important to distinguish what this list is and what it isn't.

These properties are still privately owned by their respective owners, but these people are just months (or even weeks) away from losing their property outright if they don't act soon.

Now here’s the real kicker…

Since the county hasn't yet seized these properties – they haven't published this information for the general public to see.

Why is this an important distinction? Because nobody else knows about these opportunities yet.

There are a lot of people on this list who are more than willing to sell their property at a steep discount – but they aren't going to advertise their desperation. Instead, they need someone like YOU to seek them out and make the process idiot-proof for them. When you have this list, you're holding some very lucrative information because you know who needs help, and you can get to them before anyone else does.

Reaching Out to an Owner

Let's say that one of these properties is a parcel of land worth $10,000 and the owner can't afford to pay their taxes. This person is a few months away from losing 100% of that $10,000 value if they don't pay off their taxes. If they do nothing, it will literally be taken from them and they will get $0 in return.

Fortunately for them, you know about their situation. You can tactfully reach out to them and communicate a few important things:

- Make sure they're aware of their “situation”.

- Let them know that you're an investor and you're interested in buying real estate in their area.

- Ask them to contact you if they want to:

- Sell their property (i.e. – Get rid of a nasty financial burden) AND get some fast cash in return (i.e. – Trade in their troubles for some immediate help).

Delinquent Tax List – Owner Profiles

Unlike any other list – the delinquent tax list is highly concentrated with motivated sellers. You can send these people some insanely low offers and you'll find that a good portion of them will actually sell their properties for 5% – 25% of market value… it may sound crazy – but they do it because, in their present situation, it really is their best option.

It's also worth noting that these people usually have a very different perspective than most people do about their property.

- The property was a bad investment and they're tired of paying for it. They want this property out of their life.

- They bought the property 20+ years ago and haven't seen it since then. They've completely lost interest.

- They inherited the property and they never wanted it in the first place. They don't care how much they get, all they know is that they don't want it.

- They're tired of paying taxes on a property they never use and they're too lazy to sell it the conventional way.

- The property has turned into a financial disaster and they want it out of their life.

- They have terrible memories associated with the property and they want to wash their hands of it.

Think about it… why else would someone knowingly allow their property to go into foreclosure like this?? To most of us, it makes absolutely no sense UNLESS you look at it from one of these perspectives above.

Getting the Delinquent Tax List

By now, I hope you're starting to see just how valuable this list can be. Trust me, this list is a big deal!

Can you think of a county that you'd like to get this list from? In most cases, you can probably get it, but keep in mind that good information is worth money. Always expect the list to cost something.

Most county Treasurers (aka – Tax Collectors) are probably going to charge you something to generate this list and send it to you. Some counties will charge A LOT and other counties will charge you a nominal amount (and if you're really lucky, some counties might even give it to you for free).

The least I've ever seen a county charge for their list was 1 cent per parcel (or a flat rate of $100). This kind of price is awesome and a great value (I would gladly pay this price without thinking twice).

The most I've ever seen a county charge for their list is $1.50 per parcel. This kind of price is ludicrous (this list could easily cost into the thousands of dollars – which is crazy). NEVER cough up this much cash for a delinquent tax list… it doesn't have to be this expensive.

The cost of the full list from most counties will fall somewhere in between $100 – $500. The most common pricing I see is 25 cents per parcel and at this rate, some lists can get pricey, but in most cases, it's still worth the price.

As a general rule of thumb, I try not to pay more than $500 for any single list. Not because it isn't worth the price – but because this is the line I've drawn for myself (to keep from getting carried away and putting all my eggs in one basket). That said, most of the lists I've bought have been somewhere in the $100 – $300 range.

Paying the County

Most counties will ask you to mail a check to their office along with a “letter of instruction” (explaining what you want them to do) or pay over the phone via credit card. In either case, you will need to explain very thoroughly that you want them to email the delinquent tax list to your specified email address OR mail the list to you on a CD (or something similar). The process may differ slightly depending on what county you’re working, but you can refer to the Treasurer / Tax Collector for specific instructions.

Wielding Your Newfound Power Effectively

The delinquent tax list is a highly effective tool when it's used correctly—I've literally never had a poor response rate when using it. Admittedly, it can involve extra steps (because these lists can be fairly expensive and take more time to sort). But in my experience, it has ALWAYS been worth this extra bit of trouble.

Part of the reason these delinquent tax lists are so effective is that they're packed full of motivated sellers, precisely the kinds of property owners we want to talk to. What's even better is that 99% of the other real estate investors in your market probably fall into one of the following camps:

- Unaware (they aren't aware that this list exists).

- Indifferent (they don’t understand why this list is important).

- Skeptic (they don’t believe the list will actually yield any results because they've never tried it).

When you're marketing to a list like this, you don't run into competitors. This means that when you find an amazing deal, you're the only person on earth who knows about it, making this approach very lucrative and powerful.

I don't usually like to keep things “exclusive” on this blog, but the subject matter in this article is highly sensitive information. Frankly, I don't want everybody and their mother to have access to it.

That's why I've decided to limit access to this full blog post to those who are willing to “pay the toll,” so to speak. I suspect it will turn away a lot of readers, but these are ones who would only saturate the market and water down the opportunity for those who would take it seriously.

The full version of this blog post is about 5,000 words long. By this point, you've read only 50% of it. The second half contains more substantial information, including these topics:

- Getting the list.

- Finding the right people in the county.

- Asking for the list and get what you need.

- Putting the right information in the list.

- Dealing with lists that are difficult to organize.

- Communicating with property owners on the list.

- Listening to audio clips with real-life examples of how to request a delinquent tax list.

And three bonus lessons:

- Tutorial on sorting a list with Microsoft Excel.

- How to send your first campaign with an online service that will print, stamp and mail everything for you.

- Free “letter of instruction” template to request your first delinquent tax list in writing.

When you sign up as an REtipster email subscriber, I’ll send you an instant $20 off “discount code” for this item, and if you enroll in the Land Investing Masterclass, you'll get access to this item for FREE. There's no pressure—just want to make sure you're aware.