With all the new excitement over the land flipping business in recent years, I sometimes hear from beginner investors concerned about competition.

“Do you think all the new players in this space will saturate the market and make it impossible to find the deals?”

“With all the new land investing courses out there, do you think this business will be sustainable in the coming years?”

“There are so many new investors flooding the market with direct mail, do you really think there are enough motivated sellers to go around?”

First, I'll start by saying these are all valid questions. I remember worrying about the same things several years ago when I started.

In my mind, I knew the land investing strategy was very special because raw land is a very easy type of property to deal with and because most other real estate investors don't recognize the opportunity and pursue it.

I remember having this nagging fear in the back of my mind…

“I better make a killing in this business while it still works. It's only going to take a few competitors and there won't be enough deals to go around anymore!”

I figured if hoards of new investors flooded the market, I wouldn't be able to make lowball offers and get acceptances anymore because every seller would already have better options. After all, this is a fragile business model that could easily get thrown out of balance, right??

Well… not exactly.

Being a land investor for the past decade, every year, my eyes are been opened wider to the incredible size and scope of this REI strategy.

The market for vacant land is a MASSIVE, larger than most of us realize.

There are 3,143 counties (and county-equivalents) in the United States. (Source)

Of all the counties accounted for by DataTree, there are more than 155 million parcels of real estate in the United States. And keep in mind this doesn't include the hundreds of counties that still haven't been reviewed by data companies like DataTree and Core Logic.

These numbers are mind-bogglingly huge, and it's far more than any single investor could reach on their own, but let's take this a few steps further.

The Market for Vacant Land is Huge

Now, when we're talking specifically about vacant land (i.e., the property owners we're actually going to target), these numbers start to shrink.

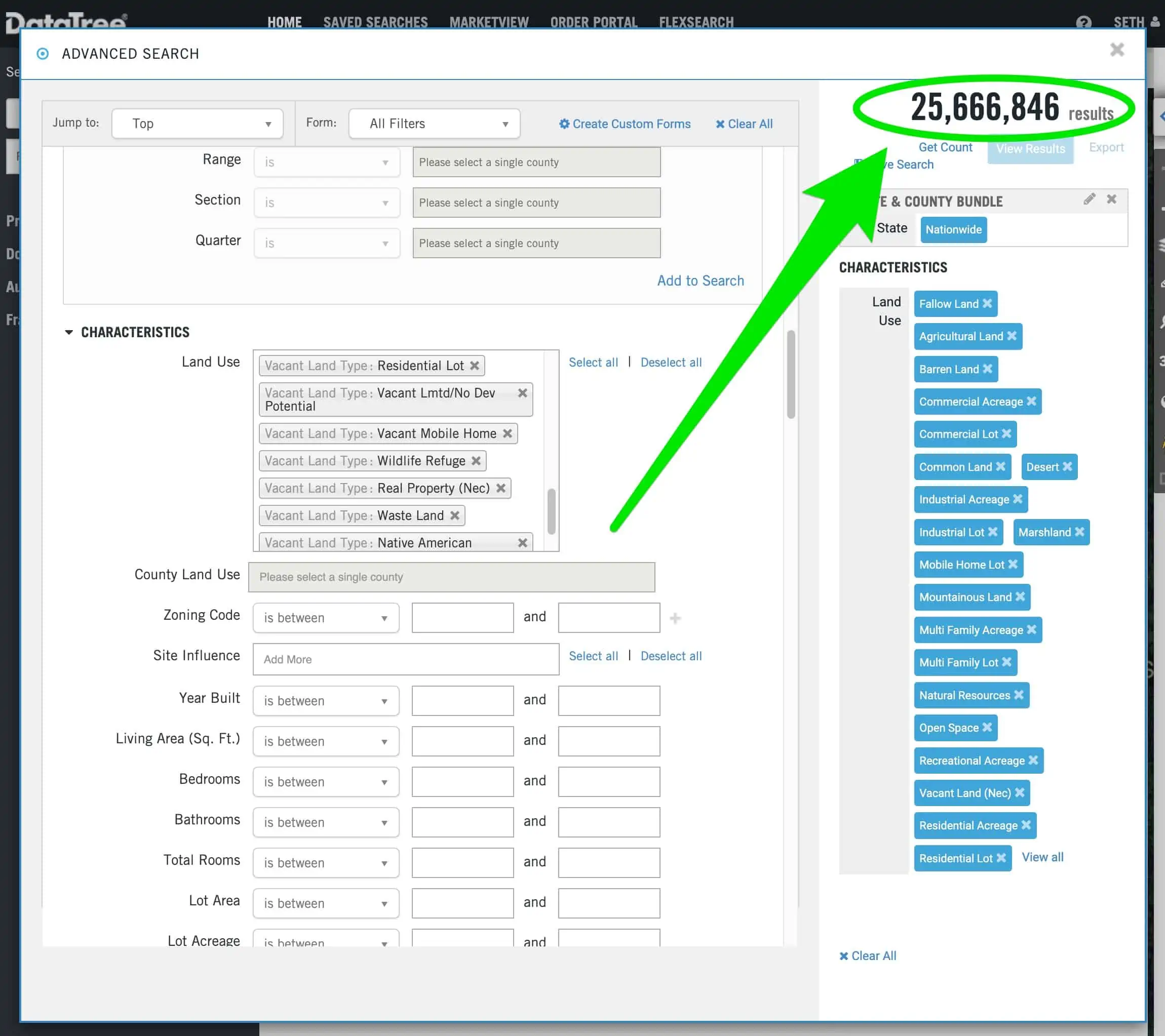

Let's do a quick (and very unscientific) search on DataTree.

If we select all the properties in the U.S. that are classified as “Vacant Land” or “Agricultural,” more than 25 million parcels fall into these categories.

And keep in mind, this number STILL doesn't show us the full quantity of vacant lots in the country because many aren't categorized correctly by the county. As such, they won't appear in this list (for example, properties identified as “Single Family Residential” with an improvement percentage of ZERO or properties zoned for a specific purpose but haven't been improved yet).

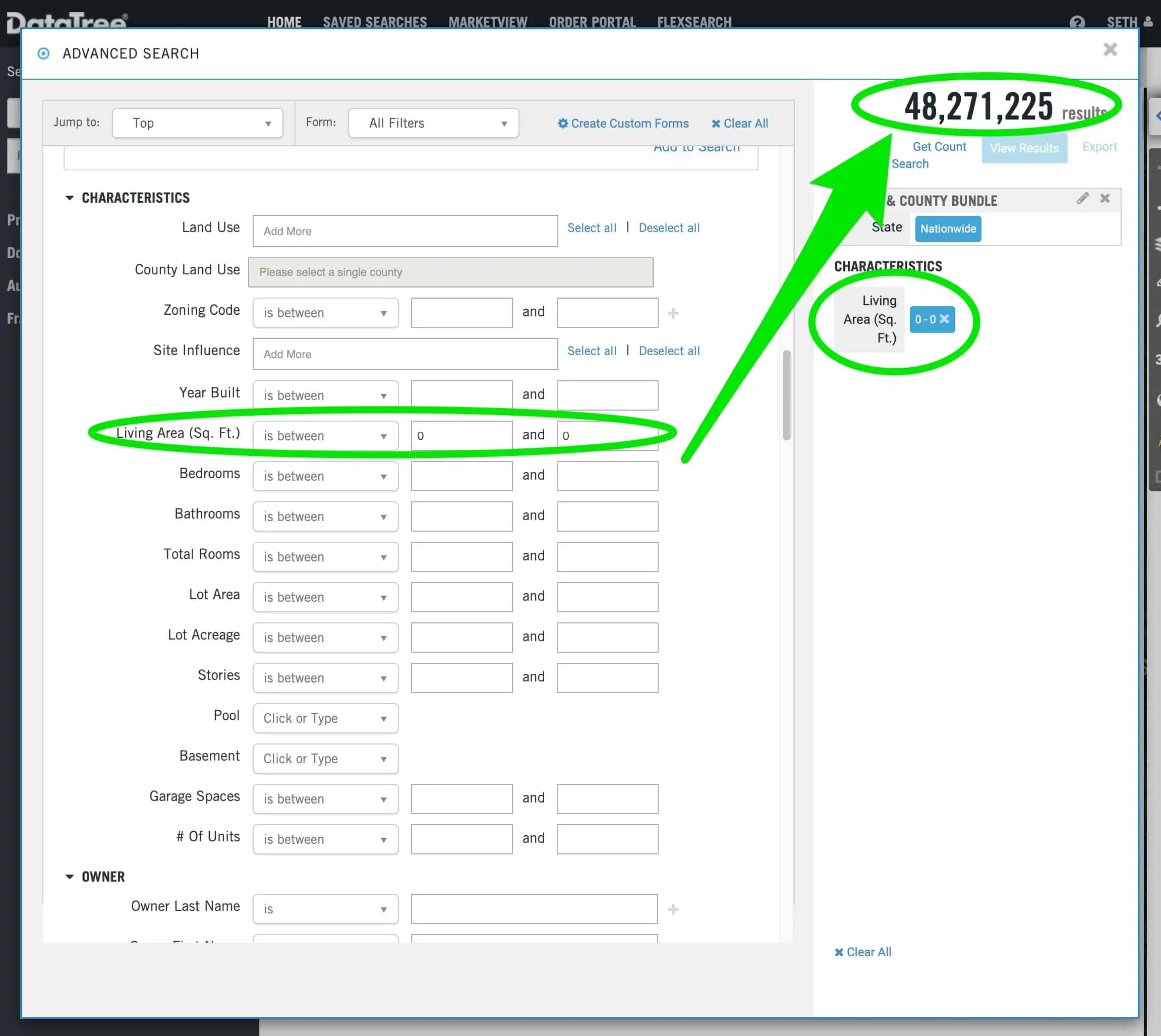

When we back into it (by filtering our list for ALL properties, in ALL states, with a square footage of zero), we can see that there are easily another 20 million vacant lots (and probably more) we could add to this list.

If you take every property in the DataTree database (155 million+), MINUS all the properties with any square footage to show (107 million), we're left with approximately 48 million parcels (or 48,271,225, to be exact) of vacant land or vacant land equivalents.

A Closer Look at the Numbers

Again, the calculations above aren't perfectly precise, but the point is, if there are anywhere close to 48 million vacant parcels in the US, that's a lot of vacant land!

To give us some perspective, let's think about how many mail units are sent out in the average direct mail campaign.

If you're using a delinquent tax list, it doesn't take more than a few thousand mail units to keep the average land investor busy for a week or two. If a list is filtered properly, you should be walking away with at least a deal or two from a campaign of this size.

Alternatively, if you're using a more general list of landowners from a data service and sending out a few thousand blind offers at a time… even if you do DOZENS of these campaigns over a year, you'll hardly scratch the surface of what's available out there.

Heck, let's go crazy. Let's say you send out 500,000 mailers in one year (an insane amount of direct mail that a land investor could never process without a full-time staff). Your marketing budget alone will be in the hundreds of thousands, and at this rate, you should reach millionaire status fairly quickly.

And even so… reaching 500,000 landowners with your direct mail is a drop in the ocean of opportunities. If our assumptions are even remotely accurate, that would be approximately 0.01% of all the vacant lots in the U.S., and remember, these are markets you can continue to hit again and again in the years to come.

And let's not forget most successful land investors operate at a MUCH smaller scale and don't do more than 20,000 – 30,000 direct mail units per year.

Of all the land investors I know, I couldn't name more than a handful who come anywhere close to 100,000 units of mail each year.

The true number of potential investment opportunities is FAR more than what any single land investor (or, for that matter, a thousand land investors) could cover on their own.

What To Do When Competition Shows Up

As land flipping has grown in popularity, it has become increasingly common to see evidence of other land investors actively working in the market.

For example…

- Some land investors are getting offers from other land investors to buy their properties.

- Some land investors have received calls back from the recipients of their blind offers, saying things like,

“Take me off your list! I've already gotten 5 of these offers in the past few months!”

- Some land investors are seeing their response rates declining in some areas. For whatever reason, fewer people are responding to their direct mail campaigns and accepting their offers.

- I recently talked with a seller from a blind offer campaign who had verbally accepted my offer and then emailed me a few days later to say…

“Would you believe I just received another offer for this property last Friday? After 15 years of no offers, this seems very coincidental, so I’m going to do some checking on the property on Monday.”

I was shocked when I first started hearing about this (and even experiencing it myself).

In all my years in this business, I had NEVER gone head-to-head with another land investor for a deal I was pursuing. This kind of thing was simply unheard of.

For a moment, it honestly made me wonder,

“Is this really happening? Is the market getting oversaturated with land investors? Have we finally reached the tipping point??“

No. Here's Why…

After doing some more digging, I discovered a few important details.

In every instance where someone was “bumping heads” with another land investor, at least one (and usually more than one) of the following issues were coming into play:

- The land investor used the same (or very similar) data service as several other investors in the area.

- The land investor used the same (or very similar) list filtering criteria as several other investors in the area.

- The land investor used the same (or very similar) blind offer template as several other investors in the area.

- The land investor used the same marketing medium that most other land investors use (direct mail).

- The land investor was sending direct mail in one of the same few counties where several other investors had publicly bragged about having success in the past.

When I took these factors into account, I realized what was happening.

We had a lot of land investors who were using the same (or very similar) cookie-cutter approach while focusing their efforts on the same small handful of counties, in the same region of the country, at the same time.

They weren't putting in the time and creative energy to be different by:

- Discovering new markets

- Coming up with a new, unique list-filtering criteria

- Using a unique letter template in their campaigns

- Using a different marketing medium altogether (texting, ringless voicemail, etc.)

They were all copying the same material and going through the same motions without putting their unique spin on the process.

Now granted, if they weren't ALL doing the same thing in the same areas, it would be fine to go through these motions… but when you put hundreds of people on the same dance floor, with a finite amount of space to move about, at some point, they'll start bumping into each other!

Why Competition Is Still Okay

Even after I recognized that a few select areas in the country were getting a little more attention than the rest, I realized it was still okay. The sky wasn't falling.

In my experience, this kind of “competition” has been exceedingly rare in the land business. Even in the few unique cases where I've sent offers to a county simultaneously with another land investor, I could still close deals.

Just because two or more land buyers may have some overlap in their direct mail campaigns, this doesn't automatically mean everyone is going to walk away empty-handed.

Why?

Because when two investors are doing independent mail campaigns, they aren't necessarily going to hit ALL of the same people. Chances are there will be some variation in how they've filtered their lists (even if only a little) and the types of offers they're sending out.

For example…

- Person A may filter their list for all properties between 1 – 10 acres.

- Person B may filter their list for all properties between 5 – 20 acres.

- Person A may be sending their mail only to out-of-state owners.

- Person B may be sending their mail to all absentee owners.

- Person A may be structuring their offers based on acreage.

- Person B may be structuring their offers based on assessed values.

- Person A may mail all individuals, corporate entities, and trusts.

- Person B may be sending mail to only individuals but no corporate entities or trusts.

In all of these situations, there will most likely be some overlap, but there will also be many NON-overlapping recipients. The chances of two or more investors filtering their lists in the same way (even when they're using the same strategy) is actually very, very low.

Competition Doesn't Spell Doom for Land Investors

I know, competition sounds like a horrible thing when you aren’t used to dealing with it… but honestly, even if a TON of new land investors entered the market and stayed in the business, it’s going to be fine.

You can look at house flippers and house wholesalers as prime examples.

There are a lot more people working in the space for improved properties than there are in the space for vacant land. Many of these people are applying a very similar direct mail strategy and have a MUCH higher likelihood of stepping on each other's toes – and guess what… they're still getting deals too.

Direct mail works well for many real estate investing strategies, even the highly competitive ones. Land just happens to be a property type that very few people are pursuing… but even if there were a lot more folks in this space, it would still work.

Just because a handful of counties get more attention doesn't mean the proven direct mail marketing strategies will suddenly stop working. It may require a stronger push and a bigger reach in each new campaign over time, but is that really such an awful thing?

Let’s not forget that most direct mail marketers would be drooling with envy if they saw us getting a typical response rate from a direct mail campaign to land owners. Land investors have always had it good (maybe even to the point of getting spoiled), and the opportunities will still be plentiful, even if we have to step it up a notch.

Remember What Has Always Worked

There's another important thing to remember here. If you want to avoid competition, it's possible. You just have to follow the same timeless principle that has always worked.

Look where nobody else is looking.

There is one powerful skill that can help with this a great deal.

Learn How to Find Great Counties

Thousands of good counties are still largely overlooked, even by the land investing community. There is fertile ground all over the country, but A LOT of people will incessantly hit counties in the southwest U.S. (Arizona, New Mexico, Colorado, California, Nevada, etc.)

I'm not saying these aren't great places to do business because they are – but the opportunity is much bigger than this.

It's important to take the time to understand what attributes make a great county for land investing (hint: it's a very dynamic thing, with many factors to look at). If you can become a true professional at this, you'll find that many markets fit the profile of what we need to see, some even more so than the southwest.

When you know how to identify a great market, you'll find that these lucrative counties are everywhere. Just because many have succeeded in one small section of the country doesn't mean you must also limit your reach to those areas.

Abundance vs. Scarcity

Will growing competition ever kill the land investing business?

I think the answer is “no,” but at the same time, it's also important to recognize that this question is coming from a place of fear.

For people who have never worked in this business or seen any success, it's easy to fall into the trap of fear, skepticism, and the “scarcity mentality,” – which holds many people back from true greatness in any profession.

While some people are sitting on the sidelines and asking, “What if?” many people are actively closing deals and making a lot of money. They aren't putting fear in the driver's seat. They understand what needs to be done and aren't wasting time; they're doing it.

When you realize just how freaking huge the vacant land market is, you'll come to grips with the fact that this opportunity is FAR larger than the potential for houses – because there is still a TON of land available, with a minuscule number of people actively pursuing it.

Case in point, I still get constant submissions on my buying website from motivated sellers who don't have any other offers. These people are desperate and seeking me out; I don't even have to send them any mail! They aren't being tapped by any other land investors, which is verifiable proof that there is still an untold number of motivated sellers ripe for the picking – all you need to do is find them and give them an “easy button.”

The Price of Success

As I explain in this blog post, there's one last thing to remember in all of this…

Many, MANY people who try their hand at land investing don't stick to it.

It's not because the business model doesn't work (plenty of people have proven otherwise). Land investing requires a lot of careful planning, good decisions, a lot of work, patience and perseverance, and even a little luck.

Land investing isn't for wimps, and just because a person buys a course or completes their first direct mail campaign doesn't mean they're going to stay in this business for the long term. In my experience, the number of people who pay for education and/or get excited about this business does not indicate how many legitimate land investors are working in this market.

It pays to be patient and persistent in this business because many people don't have the stamina to overcome the initial obstacles (and believe me, the biggest and most difficult challenges happen in the very early stages).

So, am I concerned about competition? No, not really.

If my business were completely dependent on one or two of the highest traffic counties in the southwest… then yeah, I would probably have some concerns – but luckily, I've never spent much time looking in those areas because I recognize that the world is FILLED with opportunities… and there's no sense in feeling constricted to one region when there are deals all over the place.