If there's any question I've heard hundreds of times, it's probably this one.

“Which counties are the best for finding land deals?”

It's a great topic for discussion because choosing the right market can and will have a HUGE impact on your ability to find great acquisition opportunities that are cheap enough and yet still have a big enough margin to resell them for a pile of cash.

When people ask this question, they want a concise “1 + 1 = 2” answer.

I wish the answer were this straightforward, I really do (it would save me a ton of time explaining it to people), but as with most things, SEVERAL variables can make a county an ideal or less-than-ideal place to start pursuing vacant land properties.

In this blog post, I will explain the most important attributes I pay attention to when evaluating new areas to invest in.

And for those who need a simple, black-and-white, formulaic answer, I will give you one of those, too. I can't promise the simple answer will always lead you to the right place, but with any luck, it might just help steer you in the right direction.

1. Population & Proximity

One of the first things I look at when deciding which county to pursue is not only the population of that area but also its proximity to the nearest major metropolitan area.

Why? Because as a vacant land investor, you will find far more acquisition opportunities in RURAL counties with a sparse population than in densely populated counties.

How sparse is “sparse enough”? It's not an exact science, but as a general rule, I try to look in the counties surrounding the big metropolitan areas, anywhere from a 1-3-hour drive to the big cities.

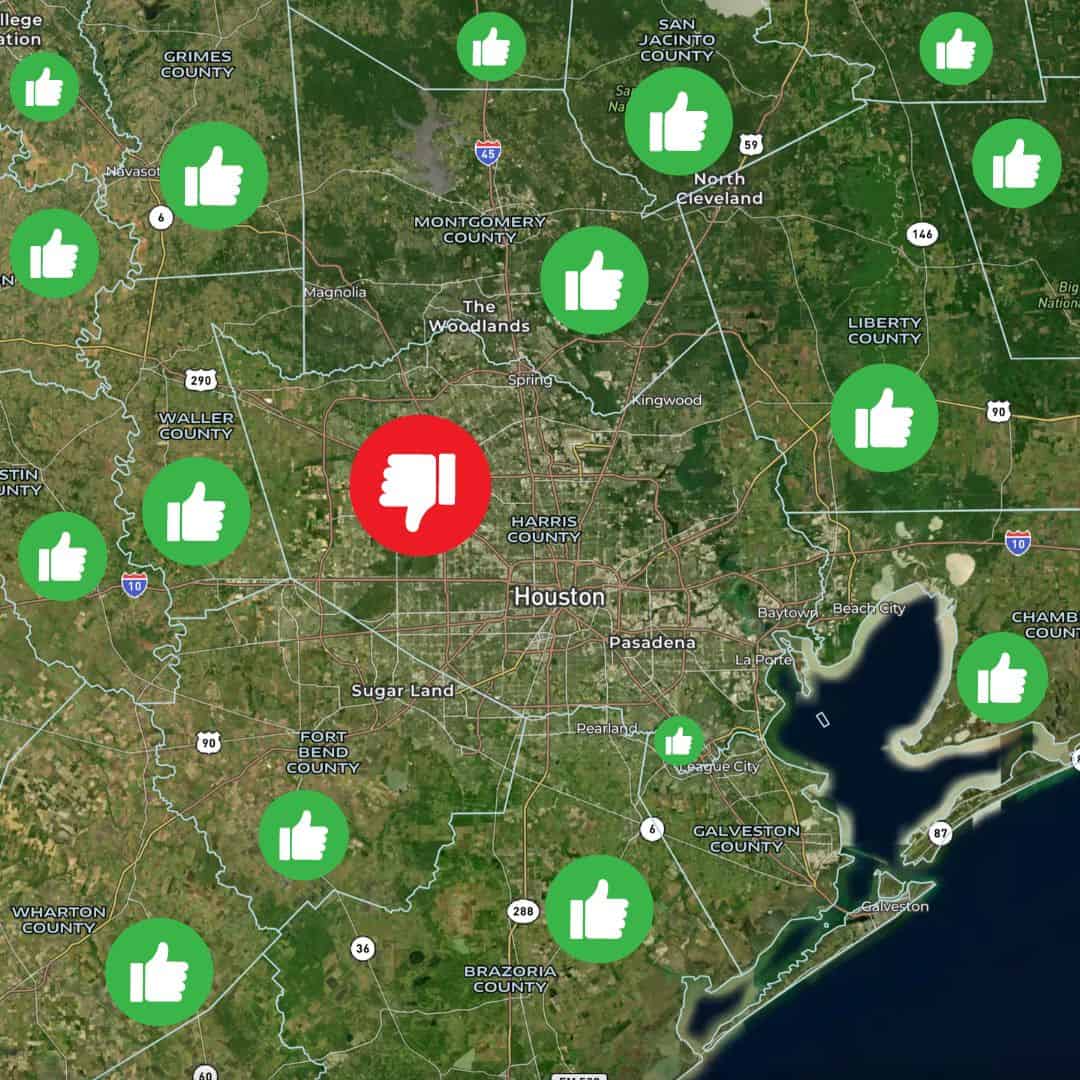

For example, if I were working in southeast Texas, I wouldn't start looking in Harris County (where Houston is located). I would start looking in the counties surrounding Harris County, like Brazoria, Chambers, Liberty, Jefferson, Hardin, Montgomery, Waller, Washington, Wharton, etc.

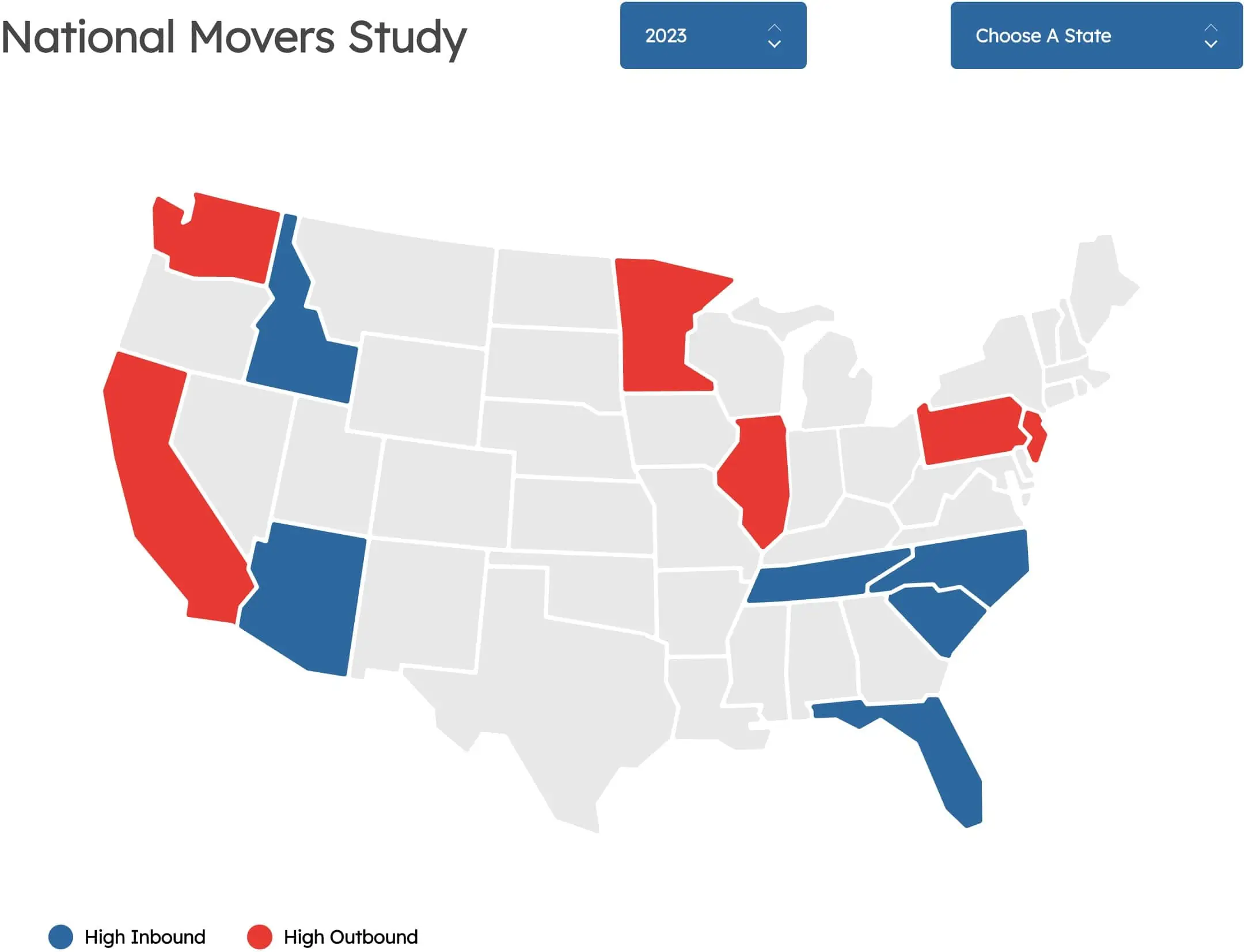

Aside from picking these rural markets surrounding the big metropolitan areas, it also helps to do this in states where the population is growing and not shrinking.

How can you figure this out? There are many ways to do it, but the simplest one I know of is the North American Moving Services migration map.

Keep in mind that this is the ultra-simple way to evaluate a market.

If this is the furthest you're willing to go, it's better than nothing, but if this is all you're willing to look at, you could easily make a bad decision and work in a market where things will be harder than they need to be.

See below for a more detailed picture of what's happening in the markets you're considering.

2. Sold-to-For-Sale Ratio

If you're looking for more data you can chew on, let me introduce you to the Sold-to-For-Sale Ratio.

This is nothing I invented. I know many other land investors who use this approach to determine in which markets they can sell their land fast vs slow.

For most land investors, the selling side is where they see the biggest bottleneck, so if you can work in an area where your land will naturally sell faster, that's a nice advantage!

How It Works

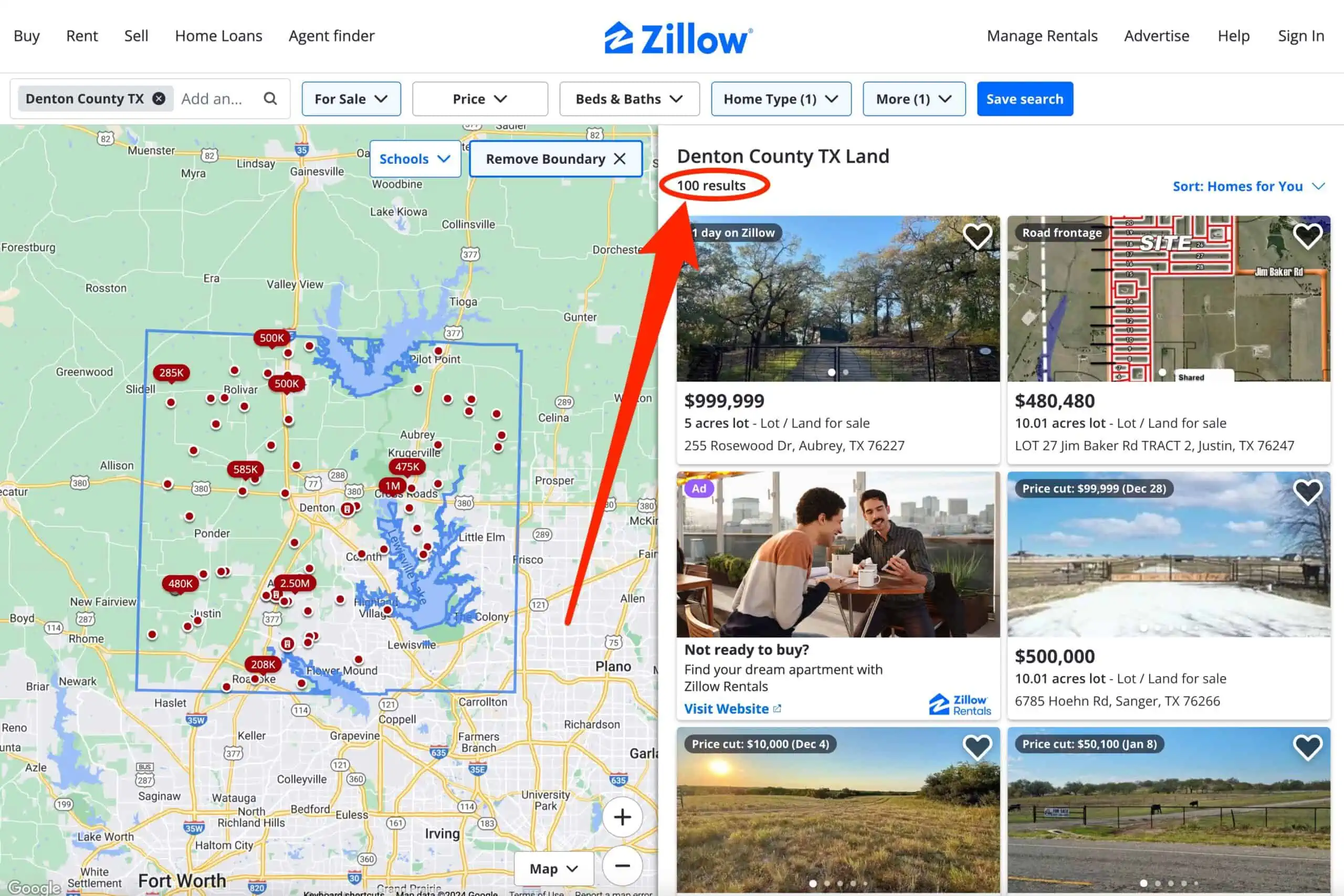

When calculating the Sold-to-For-Sale Ratio, I usually use Zillow and possibly another source, like Redfin or Realtor.com.

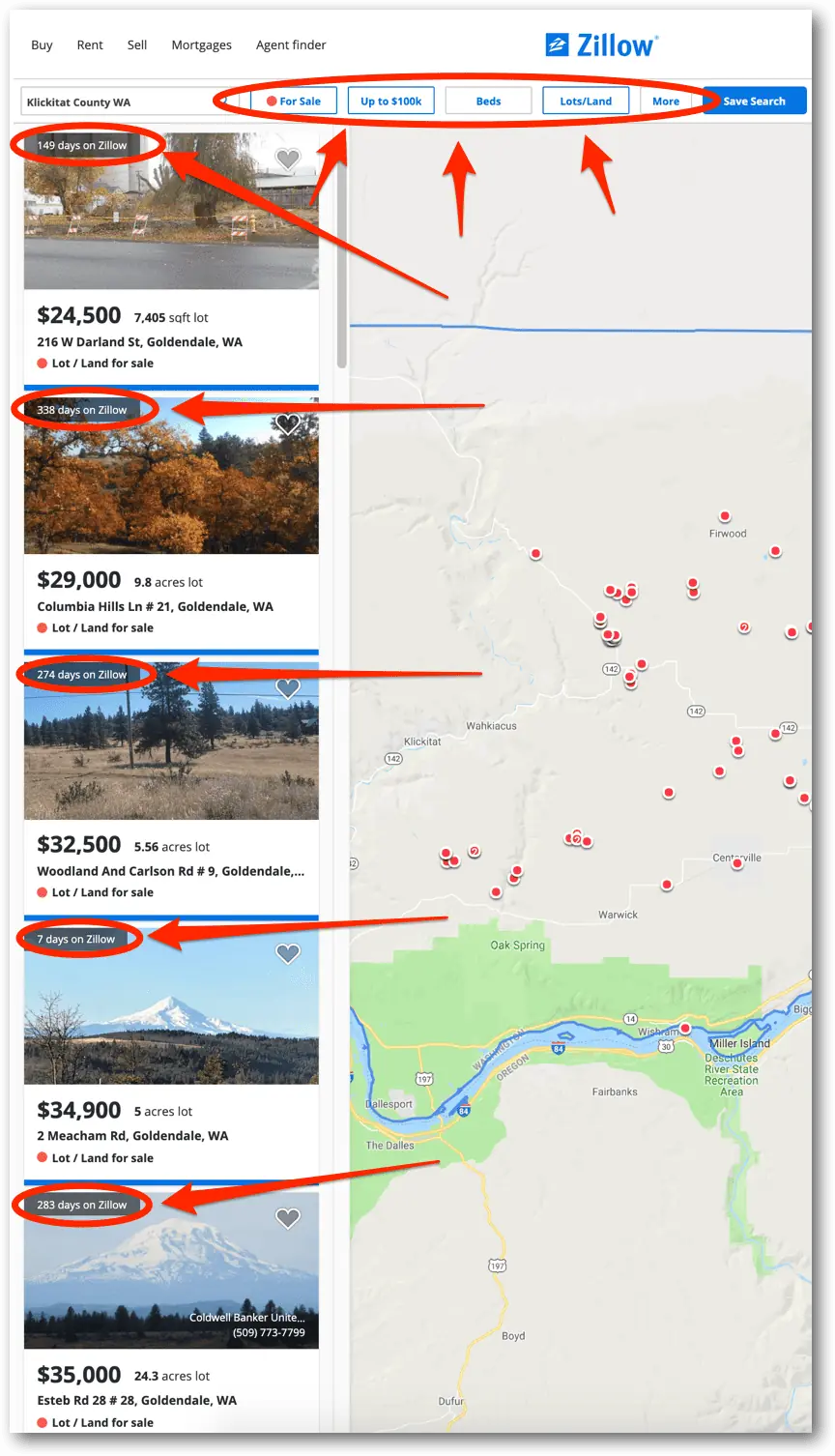

Once you're on Zillow, follow these steps:

- Select County.

- Select Lots/Land from Property Type.

- Select Only “For Sale” Properties.

- Under More, Select Acreage Range (10-20 Acres or whatever property size you’re targeting – if you filter it from 5 acres and up, you can usually avoid the ultra-cheap properties in most markets).

- Under ‘More,’ Select ANY Days on Zillow.

- Zillow will show you the number of results in the right sidebar.

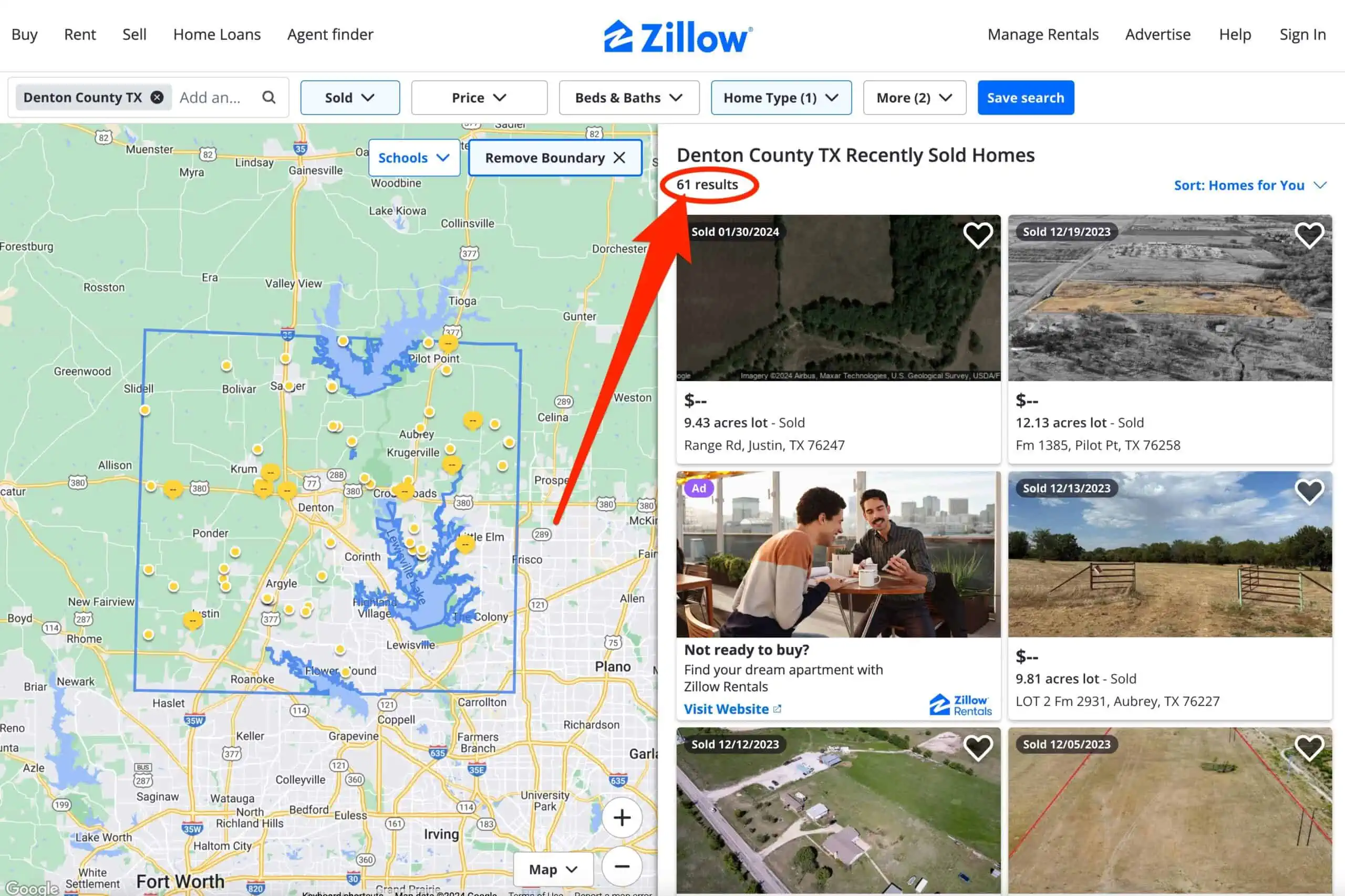

Now, repeat the same steps, but change “For Sale’ to “Sold,” and under ‘More’ only select the past 12 months (instead of ANY time range).

Once you have the total number of properties “Sold” in this time range and the total number of properties For Sale today, divide the sold number by the for sale number to get your final number.

In this case, when sorting the property to include only vacant lots between 5 – 20 acres in Denton County, Texas, we can see 61 Sold over the past 12 months and 100 For Sale.

61 / 100 = 0.61

What does this mean? Is this a good or bad ratio?

If you see a ratio of 1.00, this is a clue that there is good equilibrium in the market. In essence, this tells us that for every property listed today, the same number of properties have sold over the past 12 months.

A ratio higher than 1.00 indicates more demand than supply (a seller's market). A ratio lower than 1.00 indicates there is more supply than demand (a buyer's market).

Either can work, but if it’s below 1, you should expect sales to be on the slower side, and as such, you should err on the side of offering lower amounts for the properties you buy. If it's above 1, you can expect properties to sell faster than average, and you can take more liberties by offering higher prices.

There isn't a magic number, but I like to see a ratio between 0.75 and 1.50.

Some people are fine with a ratio as low as 0.50. Some are okay when it's as high as 2.00, but it is important to understand what this number tells you.

It's great when properties sell faster, but remember, you don’t want the area to be too hot either. For example, if you see a ratio of 8.00, this is way too hot, and based on this ratio alone, it's a clue that it will be very difficult to find properties to buy in a market like this because the demand far exceeds the supply.

Go through this exercise for 5 – 10 markets and compare the numbers. Based on what the ratios say, some of them will make a lot more sense than others.

Why Use a Second Data Source?

Why can't we just work with Zillow and call it good? Why get Redfin or Realtor.com involved?

In some cases, I stick with Zillow and call it good (because it is usually pretty accurate), but using a second source of data is to help ensure Zillow isn't missing anything. For example, if I find that Zillow and Redfin are showing me wildly different results, I may want to find a third data source and run the numbers a third time, so I can spot which one is off and make sure I'm getting an accurate look at the market.

Why Look Back 12 Months for Sold Comps?

Why not 3 months, 6 months, or 24 months? There is some subjectivity to this. You could use 6 months if you wanted, but you'd want to account for the difference that half the time would give you. I like to look back 12 months because a full year will help me see a well-rounded picture of the market in case there are any seasonal peaks or valleys in the numbers (in many markets, properties sell much slower in the winter months than in the summer).

What the Ratios Don't Tell You

This calculation isn't perfect because our available data usually won't include every property listed or sold in your market. For example, it tells us nothing about the properties listed or sold FSBO. If someone sold their property on Facebook Marketplace, Craigslist, or Land.com, those numbers won't necessarily show up in the Zillow database.

Even so, it’s still good enough to give you an idea of what’s happening.

3. Transaction Volume

The Sold-to-For-Sale Ratio matters, but this number alone won't tell you the whole story.

You can have great ratios, but if only a few transactions happen for your ideal property type in the county each year, this isn't enough to build a thriving, sustainable business. A market with a small volume of transactions will also make it harder to find professionals you can work with repeatedly (like agents, title companies, drone photographers, etc.) because there won't be enough volume to sustain those relationships.

As such, we want to see evidence that plenty of deals are happening each year.

How many transactions should you see?

It depends a lot on how large the county is. If it's a massive county in southern California (San Bernardino County, Kern County, Riverside County, etc.), you should see hundreds, maybe thousands of transactions each year, depending on how narrow your filtering criteria are.

If it's a smaller county in the Eastern half of the U.S., you might see a few dozen transactions per year. When I'm looking at these numbers for a county I plan to work in again and again, 100+ is great, 20-100 is okay. Less than 20 is pretty low.

4. Days On Market, Views & Saves

Along with transaction volume, it's also helpful to know how long properties typically take to sell.

For this, we can head back over to Zillow.

We'll have to filter our search by the state, county, price range, and, most importantly, lots and land.

You can also specify a lot of other characteristics if you want, but this should work for this example:

Each listing displays how many days each property has been listed on Zillow.

You can spend some time manually looking through each one to get a “gut-level” idea of how long the average property sits on the market before it sells, or you can also use a tool like Price Boss, which can automatically pull out this data for dozens of listings and find the average and median days on the market for you in seconds.

Whichever way you decide to do it, this number indicates how quickly properties are selling in your market.

When I'm looking at this data, if I see that the average number of days on Zillow is 150 or less, this tells me properties are selling fast.

If the average number is a bit longer (around 365 days), this tells me that the market isn't necessarily “hot,” but it's not terrible, either. Properties are selling eventually, but not at break-neck speed.

When this average number gets up to 700, 800, or 900 days or longer, this tells me that properties are moving slowly.

Keep in mind: Most of these listings and sellers come from a different situation than you. These property owners probably didn't buy their land for pennies on the dollar. That means YOU should be able to list and sell your property much faster than the average days on the market. Even so… this is still a good metric to help you understand how quickly the “normal” properties are selling in the county you're considering.

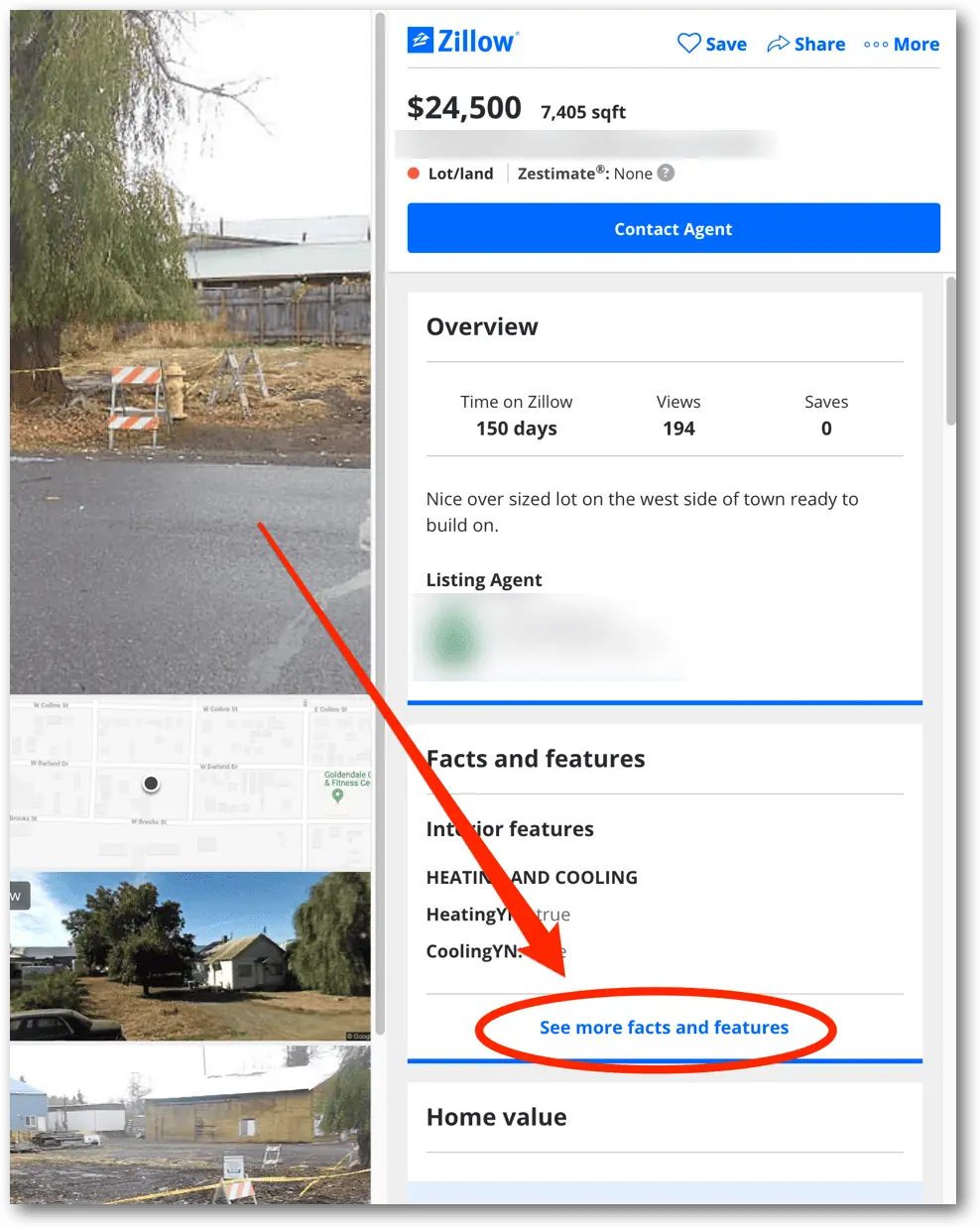

How Many People View Each Listing?

While you're on Zillow, clicking on several of these listings and looking at the “See more facts and features” section is useful.

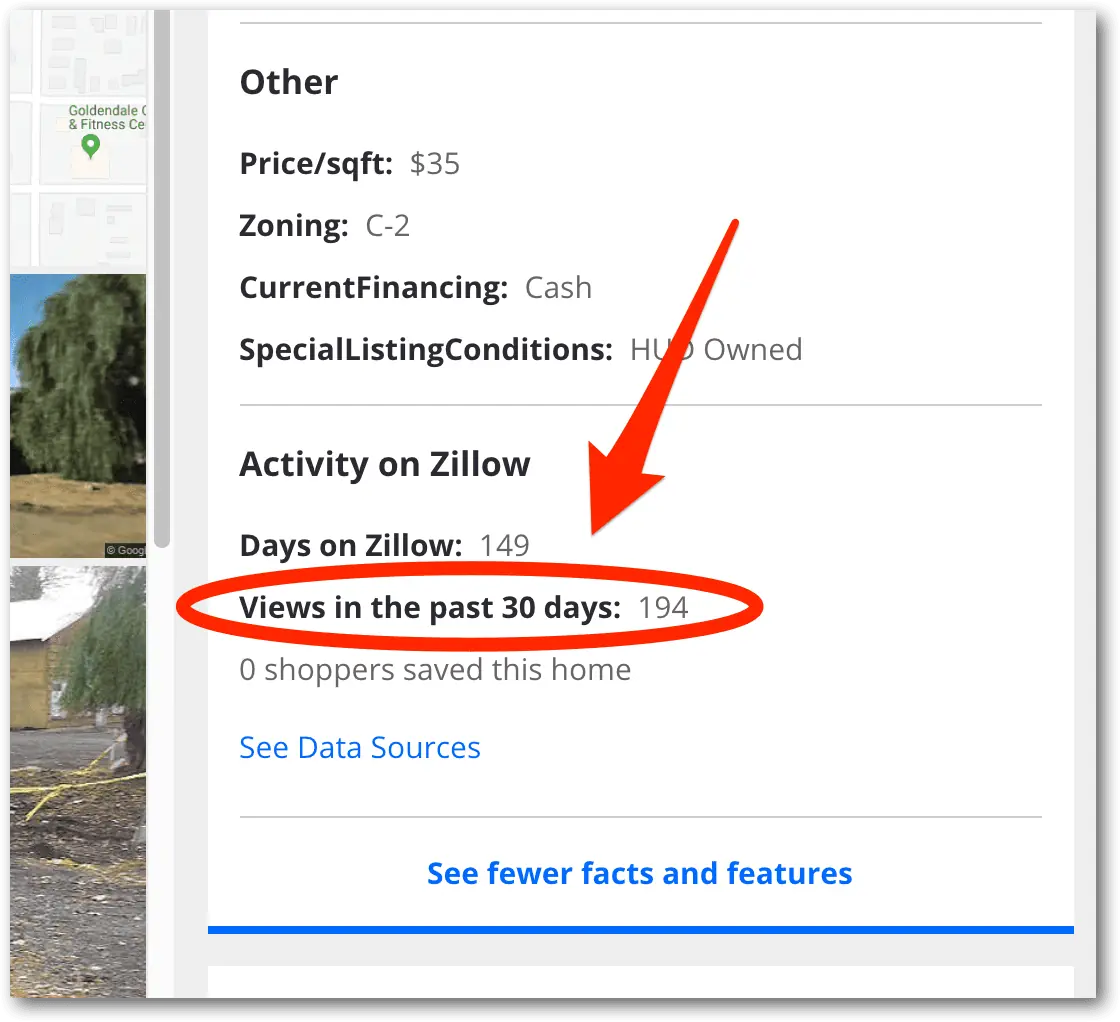

This will pop open a new box with a lot of information, and if you scroll to the bottom, you'll see an interesting piece of information.

This doesn't just tell you how long it's been listed; it tells you how many views the listing has gotten in the past 30 days.

When you understand what this means, it's quite useful.

In some counties, most listings will have only a handful of monthly views (anywhere from 0 – 20).

In other counties, you'll find that some listings have well over 1,000 views. The market is very interested in these properties!

Like the “Days on Zillow,” finding this number for ONE property isn't enough information to draw any real conclusions, but when you look at 10, 20, 30, or more and keep track of how many views each of these listings is getting, this is another helpful clue that tells us how many people are interested in these properties.

And if people are interested in these listings, some will go so far as to save the listing (an even stronger indication of engaged buyers in the area).

All of this data is free and easily accessible all over the United States, so before you start working in a new county, make sure you spend some time getting a good understanding of how much activity there is in the market.

5. Value and Desirability

Before you sink your investment dollars into any property, always ask yourself…

What is the highest and best use for this property?

Is this the type of property a lot of people would want to own?

If a property can be used for it's highest and best use, are there any secondary uses that are still valuable?

To answer this question, we must ask ourselves,

What makes a property valuable and desirable in the first place?

Most people could guess that it has to do with the property's geographic location, but it also helps if you sell real estate in an area where people want to be.

For example, let's consider the places people choose to go on vacation.

- Warm places (Southern States)

- Areas near large bodies of water (West Coast, East Coast, Great Lakes, Islands & Peninsulas)

- Areas with mountains and geographic beauty (the Rocky Mountains, Smoky Mountains, Grand Canyon, California Coast, etc.)

- Areas near big national parks (California, Washington, Texas, Montana, Wyoming)

- Areas with things to do (hunting, fishing, hiking, skiing, snowmobiling, camping, horseback riding, theme parks, etc.)

It's never quite as simple as labeling an entire state as “good” or “bad,” you need to evaluate the specifics of each county and city to get an accurate picture of what an area has to offer.

Every state has counties that are great for land investing and others that are pretty lousy to work in… so before you say,

“The state of ________ is perfect for land investors.”

Make sure you understand what each specific COUNTY offers before jumping in.

6. Property Types

There's a reason we DON'T want to work in densely populated counties.

When you think about all the vacant land that's available in a big city, it almost always falls into one of two categories:

Category A: Extremely valuable parcels in high-traffic areas.

Category B: Dumpy parcels in terrible parts of town.

When you come across those “Category A” parcels, it is highly unlikely that you'll get them for a low price. It's not impossible (I've done it before), but it's kind of like winning the lottery; the odds are not in your favor, and it's not something you should plan your entire business model around.

When you come across those “Category B” parcels, and the seller accepts your low-ball offer, these properties are usually not the kind you (or anyone else) will want to buy. Trust me.

In my first year of land investing, I almost made the mistake of buying this half-acre lot in the inner city of a dumpy town.

It looked fine from the satellite pictures, but when I drove to the property and saw it with my own eyes (and the surrounding neighborhood), my common sense kicked in, and I ran away before it was too late.

The problem with vacant lots in big cities is that, for the most part, they only have a couple of practical uses:

- Building a new structure (like a house or garage).

- Adding to the footprint of someone's existing yard.

If a vacant lot is situated in a thriving, upscale neighborhood in the city – you're golden! These are the neighborhoods where people want to be, and it's not difficult to sell vacant lots in these neighborhoods for either purpose.

However, if a vacant lot is situated in a dilapidated, trashed-out, war zone neighborhood, selling for a profit will be much harder. Simply owning them could be way more trouble than they're worth.

The problem with most densely populated counties is that when you find vacant land deals, many will be situated precisely in the parts of town where you DON'T want to buy.

When you're looking at a property with only one feasible use: building a new home, and that property is located in the nastiest, decaying part of the city, do the math. Will someone spend top dollar building a new home in the ghetto? Rarely. I won't say never, but it's not very common.

So… there are certainly some vacant land opportunities in densely populated counties, but your chances of finding great opportunities are less likely compared to what you'll find in most rural areas.

7. Property Values

Something most people don't realize is that it's fairly easy to figure out how much a hypothetical property will sell for in any given market.

Most areas within these systems make it easy to find sales data going back three years or more on almost any property. This can be done on Zillow, Redfin, Realtor.com, Land.com, and any other major land listing website.

In this video, I'll show you one way to do it with Redfin…

When you have this information, there's no reason to wonder how valuable properties will be in your target market because you can see exactly what they've been selling for (and what they're currently listed for) over the past few months or years.

If you're unsure what kind of market you're getting into and whether the price ranges will be in the right place relative to your budget, some sales comp research will quickly get you up to speed!

8. County Resources

When you start working with these county workers and their systems, you'll learn quickly that some counties are fantastic, and others are an absolute nightmare.

It’s not easy to call county after county and meet CONSTANT resistance to your requests, poor communication on the phone, and ridiculous costs for access to things that ought to be freely available online.

How easy is the county's website to work with?

Depending on what markets you're working in, the county website can be a very helpful place to find the information you're looking for.

Start by googling “County Name, State Name” of the area you'd like to work in. Click on the county website and poke around for a while.

- Can you find the Treasurer's, Assessor's, Equalizer's & Recorder's information?

- Can you find the county's GIS mapping system (i.e., does it even exist)?

- Can you find the current and prior ownership information of any property? Sales prices? Legal descriptions? Parcel numbers?

- Can you find current tax information on each parcel (taxes owed, tax paid, etc)?

In my experience, no two counties ever use the same system. Often, the information is there, but it isn't easy to find (and/or it isn't user-friendly) – which can make things a bit more tricky. Nevertheless, if you're serious about working in any particular county, it's worth your time and effort to learn the county's website and figure out what kind of information you do (and don't) have at your disposal.

How easy is the county to communicate with?

This essentially boils down to “human relations” – but it does count for something. Most of the time, you'll get a feel for this if/when you call the County Treasurer (aka – Tax Collector) to order a tax delinquent list.

As you're talking to them on the phone, take note of a few things:

- Do these people sound competent?

- Do they seem to know what they're talking about?

- Are they able to legitimately help you with your request?

- Do they understand what you're asking for, or do they act clueless?

- Do they show a willingness and desire to help you or are they unwilling to give you the time of day?

You'll find the full range of attitudes in the various counties you talk to. It isn't necessarily a “deal killer” when people are difficult to work with, but it can enhance the experience when you're dealing with people who are nice to work with.

When you're just starting out, finding counties that will make things easy can be one of the most difficult obstacles to overcome (and many people quit before they ever get past this initial phase). Sometimes you can get lucky and find a great county on your first try, but many times – you'll have to try at least a few (perhaps several) before you find one that will help you connect the dots.

I hear from many people who encounter SERIOUS fatigue as they try to find the right counties. When you're starting from scratch, it can take a lot of work to figure this out – and the only way to get there is to start trying and keep trying. As you go through this process, remember that with every contact you make, you are learning crucial information about which counties WILL and WON'T be sustainable markets to work in… and the only way to learn this information is to start exploring what's out there and take good notes about which counties make the process easy and which counties make it WAY harder than it needs to be.

9. Data Availability

This information is extremely helpful (some might even say it's crucial) when pulling your marketing lists and/or doing property research.

Unfortunately, some counties do an awful job (sometimes even a non-existent job) of making this information available to the general public.

GIS mapping data, delinquent tax data, property ownership information, assessed values, prior sale prices, and comparable values in the surrounding area… it's all part of the overall need for public data. When you can get it, your job as a land investor will be MUCH easier… but when you can't get it (i.e., if one or more of these components is either missing or extremely inconvenient to obtain), your job will become much more difficult.

Now, if you can't get 100% of the data you need, I wouldn't necessarily say a county is a “lost cause”, but at some point, it will get VERY difficult to work in some markets when you can't get easy access to the information you need.

Poor access to data doesn't mean there are no opportunities (if anything, there may be even more opportunities in these areas because the lack of data makes it harder for everyone else to work there), but most of us have to draw the line somewhere and decide how much B.S. we're willing to tolerate in the running of our business. If a county makes the data-gathering process difficult, this is an issue you'll want to factor into your decision.

RELATED: Will Growing Competition Ever Kill The Land Investing Business?

10. State Laws & Regulations

In some ways, these can be some of the trickiest issues to maneuver because even though most state laws are not detrimental to the land investing business, there can be some very random issues and nuances that arise in some parts of the country, and you'll want to steer clear of them. Here are just a few examples…

1. Tax Laws

Essentially, if you flip a parcel of vacant land in a shorter period than seven years, there is a massive tax penalty you'll have to pay. This is the kind of restrictive tax law that (although extremely unique and random) would make it extremely difficult to run a sustainable, profitable land business.

2. Seller Financing

This doesn't necessarily make it impossible to run your business there (because there are usually ways to mitigate these restrictive rules), but if you're planning to rely on seller financing as a big part of your business model, it can be a potential drawback to take into account if you're working in those areas, and you'll want to familiarize yourself with the specifics of how seller financing works in your state of choice.

3. Tax Sale Overages & Excess Proceeds

Unfortunately, nearly half the states in the U.S. don't allow for the collection of excess proceeds, so if you're planning to apply this strategy to collect an alternative source of income from your properties, this is something you'll want to be aware of, so you can stay OUT of the states where collecting overages isn't even allowed.

4. Title Agencies vs. Closing Attorneys

My title company in Michigan charges a standard closing fee of $500.

My closing attorney in Alabama charges a standard closing fee of $950.

They're both doing the same thing. The difference is that Michigan allows title agencies to close deals, whereas Alabama only allows real estate attorneys to handle closings.

Now, if you're closing on a $100,000 transaction, your profit margin will probably be big enough to cover the slightly higher closing fee – so in many instances, this isn't a deal-killer. However, if you're closing on a deal that costs $1,000… this 2x higher closing fee will become more problematic.

Identifying Issues

Most of the time, it's fairly easy to figure out which states will create obstacles and which won't, but every so often (like in the case of Vermont, mentioned above), identifying these problems isn't always straightforward. When you learn about these issues, take note of them and factor them into the overall viability of running your land investing business in that market.

Most issues won't mean you CAN'T do business, but if you keep encountering problems from several different angles… realize that these issues aren't likely to go away. In most cases, they will consistently be there, working against you and your goals… and if the situation is bad enough, it may be worth looking elsewhere.

RELATED: What Every Investor Needs To Know About Choosing The Right Real Estate Market

Putting it All Together

As you explore more and more counties across the country, you'll eventually learn that some markets are best to avoid. Not because they're impossible to work in, but simply because working in them requires more trouble than they're worth.

I've found that in the end, I don't really “need” more than 6 – 8 solid counties at my disposal. When I finally nailed down which counties would cover me from most (if not all) of the issues listed above, life got MUCH easier because I could continue to work and rework these counties repeatedly.

Keep searching until you find those counties.

In my home state alone, I've attempted to work in approximately 30 different counties. Of those 30 counties, no more than 10 of them were the kinds of counties I wanted to go back and do repeat business in. Granted, if my life depended on it… I could probably make it work in almost all of those 30 counties, but only 10 of them made the process easy and repeatable for me.

RELATED: The Real Estate Investor's Quick Start Action Guide

The Hidden Value of Inconvenience

Lastly, keep in mind – when a county appears to be “difficult” in some way (perhaps you can't get the list in the right format, or the county has a very poor GIS mapping system online)… while this does create some challenges for people like you and me, it creates the same challenges for every other competing real estate investor looking for deals in that market.

RELATED: The #1 Reason Land Investors Fail

Vacant land is known for its overall lack of competition compared to most other real estate investing niches – but when you can find a county that has virtually never been touched (because of its various barriers to entry), the results from even a mediocre marketing effort in these counties can be quite powerful.

Is it hard to work in inherently difficult counties? Of course… but some side benefits come with the territory when nobody else is willing to do the heavy lifting.