REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

When I got into the niche of land investing, I was pleasantly surprised to find that when I looked in the right places and talked to the right people, it wasn't difficult to buy properties for pennies on the dollar.

To my surprise, selling my properties was a bigger challenge than buying them in the first place.

Part of the problem is that I'm not the most patient person. When I list a property for sale, I want it sold today.

Not next week. Not next month. Not next year.

NOW.

In some cases, I got lucky, and my properties actually did sell in a matter of days, but more often than not, it took at least a few months to move my inventory, and every once in a while, I found myself stuck with a property that just wouldn't freaking sell.

Whenever I was dealing with one of these stubborn properties (i.e., listings that sat on the market for more than three months), I always remembered what my dad used to say…

“There's more than one way to skin a cat.”

Have you ever heard that before? Its meaning is simple…

Even though we may have a preconceived idea about how something is supposed to be done, there's often an alternative way that will accomplish the same goal.

Granted, sometimes the alternative is more difficult…

Sometimes the alternative is more complicated (hence why nobody does it)…

But every once in a while, the alternative is easier than the conventional method we're all accustomed to. The only reason nobody does it is that it's not obvious.

My First Tax Hack Lesson

Let's look at a real scenario I dealt with in my first year as a land investor.

Back in 2009, I bought this vacant lot for $4,000:

I'll be honest with you… I overpaid for the thing, BIG TIME.

The county assessor had given this property an assessed value of $5,000, which meant that by their standards, the property was worth $10,000 (each state handles assessed values differently – but in my state, assessed values are approximately 50% of a property's supposed market value).

At the time, I didn't realize that most county offices are renowned for over-shooting on these property values.

Why? Because when they value properties higher, they can also charge more in property taxes each year. Think about it… when you have the power to establish values AND handle the taxation on each property, wouldn't you be more inclined to air on the higher side too?

At the time, I figured this assessed value was reliable (a big mistake), so I offered 40% of this value (which is on the higher side of my equation).

About four months later (which seemed like an eternity at the time), I found a buyer who paid me $4,900 for it. Given how much money and time I had sunk into this property, how hard I worked to sell it, and how small my payday was in the end, I wasn't thrilled with the results on this deal. Had I been more patient, I probably could have done better, but I was so paranoid and eager to sell it that I let my impatience get the best of me.

At the time, I didn’t know that I could just as well have donated this property to an eligible non-profit organization and treated it as a tax write-off, which would have effectively given me a lot more “after-tax income” in the end. As long as the tax prep system you use is up to date, it should be set up to account for this.

Donating Land? Seriously?

The idea might sound ridiculous at first glance, but it's not that different from what many of us do all the time with other things we own.

Have you ever donated old clothes, toys, or furniture to a second-hand store? Ever given a tithe for a church offering? Perhaps you've felt moved to sponsor a child in need or give canned goods to a homeless shelter. Some people donate their old cars, boats, and equipment and receive tax deductions.

You can follow the same strategy with real estate; in some cases, you could come out even further ahead if you give your properties away than if you sold them the conventional way!

As long as you can document the transaction and verify the numbers in sufficient detail, you can donate your properties and receive credit for their FULL market value (regardless of how little you paid for it).

This is a big deal, and when you can buy properties for pennies on the dollar, this little-known strategy can go a long way toward reducing your tax bill (or even eliminating it). In the same way, you can supercharge your retirement savings tax-free; you can create some HUGE tax write-offs by selectively donating properties instead of selling them for cash.

How to Donate Real Estate

I had heard about this strategy years ago but was a little foggy about how it works.

I decided to talk with three different CPAs in my area and three licensed real estate appraisers to get the low-down on what procedures need to be followed to do this right.

Disclaimer: I'm not a CPA or an appraiser, so I'm not qualified to give you any deal-specific tax advice. I know nothing about your financial situation, I'm not familiar with the local laws in your area, and I have no idea what kinds of properties you're working with… so before you move forward with the steps outlined below, do us both a favor and cross-check these procedures with a tax pro in your area.

Step 1: Find an eligible non-profit organization willing to accept your property.

There are millions of organizations out there that carry “non-profit” status. Still, only certain types of non-profits can accept contributions that will qualify as a legitimate tax write-off for the donor (i.e., you).

Generally speaking, you'll want to find a 501(c)(3) or a 501(c)(13) non-profit organization. In English, this means you'll want to target one of the following types of organizations:

- Religious (churches, mosques, synagogues)

- Educational (schools, colleges)

- Scientific (research facilities)

- Charitable (homeless shelters, child sponsorship)

- Literary (libraries)

- Public Safety (community improvement)

- Prevention of Cruelty to Children or Animals

As you'll see from the massive non-profit directory on Guidestar.org, there is no shortage of eligible non-profits. You'll probably want to start your search locally. Still, as long as the recipient non-profit is willing to accept your donation and they can give you all the verifying paperwork to document your donation properly, you should be clear to move forward.

2. Verify and Document the Fair Market Value of Your Real Estate

When you donate any non-cash asset to an eligible non-profit, you need to substantiate what the item(s) is/are worth. Take this excerpt from Charity Navigator,

When you give used clothes or other items to charity, the Internal Revenue Service will allow you to deduct the fair market value of the items on your income tax return. The IRS isn't in the appraisal business, so it can't tell you exactly how much each item you donate is worth.

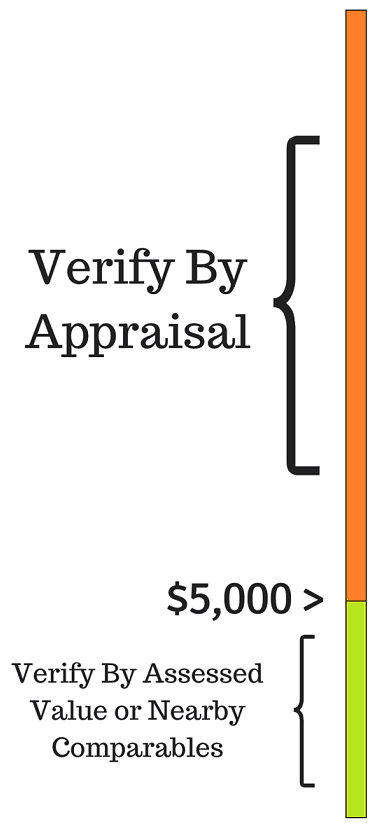

When valuing real estate, it will depend on how much you claim the property is worth.

Note: In my conversations with three local appraisers in my area (both commercial and residential), the cost of most residential appraisals will be somewhere in the neighborhood of $500, and the cost of most commercial appraisals will start at $1,500, and go up from there (depending on the complexity of their report). Given this – you'll want to factor this additional cost into the overall equation if you're hoping to get credit for a donation of $5,000 or higher (i.e., sometimes you'll be able to justify the extra cost, sometimes you won't).

On the flip side, if you're claiming a tax deduction of less than $5,000, you can be less “scientific” and use the same valuation method as your local assessor. As I mentioned earlier – in my home state, property assessors give each parcel a “SEV” (State Equalized Value) of 50% of the property's market value (and from what I've gathered, this number is derived from whatever their gut feeling was at the time). Nevertheless, if you're claiming a value that is LESS than $5,000, you won't need to go much further than this. It should work if you have something beyond your personal opinion to support your assumption. Another slightly less concrete (but potentially useful) way to verify this method would be to simply attach recent comparable sales from sites like Zillow or Redfin.

3. Retain copies of the closing documentation as evidence of your donation.

In most cases, the documentation doesn't need to be complicated. A simple copy of the Purchase Agreement (confirming that both parties agreed to donate/receive the property for no monetary value), a copy of the Deed (again, listing a transfer value of $0.00), and if it's available, a copy of the Closing Statement (verifying that no funds were received for the transfer of the property).

When Should You Donate Real Estate?

It should go without saying that donating real estate isn't always the answer to your problems. However, it CAN be very beneficial if the numbers make sense.

To make the right decision for your situation, you'll have to weigh a few things regarding the deal itself:

- What is your total investment in the property?

- What is the high-end value of this property?

- i.e., What does the county assessor think this property is worth?

- What is the low-end value of this property?

- i.e., What kind of low-ball offers are you likely to get when selling?

If the deal seems to make sense on its merit, you'll also want to look at the bigger picture of your current financial situation:

- How much money will you make in the current fiscal year?

- How much will you have to pay in taxes for the current fiscal year?

- What other tax write-offs do you already have working in your favor for the current fiscal year?

- How much cash/liquidity do you currently have available

- i.e., Are you in desperate need of cash right now, or are you in a good position as-is?

The right answer depends on several variables.

Suppose you've got a deal with a healthy profit margin (simply looking at the amount you paid vs. the documented appraised value), AND you're facing a tax liability larger than the deduction you'd get from donating the property. In that case, YES, it probably makes sense to donate it!

If you've got a deal with a weak or questionable profit margin (amount paid vs. value) OR your tax liability will already be less than the credit you'd get from donating the property, then NO, it probably doesn't make sense to donate it.

The point to remember is that the decision to donate your real estate shouldn't be driven solely by your inability to sell a property. I understand it can be frustrating when a property sits on the market for months, but if the math doesn't come out with a better result in the donation scenario, don't sell yourself short!

As a general rule, I wouldn't recommend buying any property solely to donate it. Instead, I would look at real estate donations as a “Plan B” that, in some situations, may have the potential to turn out even better than your “Plan A” (but even so… don't pursue anything with the intent of going after Plan B first).

A tax deduction is only useful to the extent that you have a large enough tax obligation to deduct it from… so it should go without saying, this is only a strategy to pursue when your cash position is already healthy enough and when you have a large enough tax burden to hedge it against.

Additional Resources

As I mentioned earlier, I'm not a CPA or tax professional, so before you follow through with this action plan – be sure to get educated about the specifics of how this process works in your area because these details can change based on a variety of factors, like:

- The type of property you're donating.

- Which non-profit you're donating it to.

- What tax bracket you fall into.

- The type of documentation you're able to provide.

As Amanda mentioned in the comments section below,

“There are some very specific rules when writing off donations regarding whether you can take fair market value -OR- your actual basis in the donated property, and sometimes the difference is dependent on what type of entity you’re donating to. There may be times, though, when even your basis in the property is worth the write-off. Especially if it’ll *just* squeak you into a lower tax bracket.”

If you're interested in learning more, check out Publication 526 from the IRS website (note: this publication gets updated every year – so be sure you're working with current information), and once you've got a handle on what you're doing, be sure to call your tax professional.

RELATED: Finding The Right Accountant For Your Real Estate Business

You can also check out this site or this site to explore additional information that isn't covered above.