What Is Liquidity?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

What Does Liquidity Mean in Business?

Liquidity is the ease at which an asset or security can be bought or sold in the market at or near its fair market value. It also refers to the degree to which an asset or security is used in transactions.

Simply speaking, cash or currency is the most liquid of all assets because it has an objective value and it is a medium commonly used in the exchange of goods and services. Currency has a value that is recognized by all parties that function within that same monetary system.

At the same time, certain types of assets do not have this same objective value (such as a house, a car, or jewelry). In order for these assets to be converted to cash and “liquidated,” they must be sold to another party who is willing to pay for the asset’s value. It can take an unpredictable amount of time to find this type of buyer and as such, these assets are not considered liquid.

Is Real Estate Liquid?

Real estate is considered to be illiquid (the opposite of liquid) because it does not have an objective value that every buyer will agree with. In normal market conditions, the owner will have to list the property for sale, find the right buyer, negotiate and agree on a price, carry out property inspections, and close on a sale. This entire process may take months, sometimes even years for the seller to receive their sale proceeds.

In real estate, it is difficult to predict when and how properties will sell. In some cases, properties may even depreciate in value, and the property owner may have to sell the property at a lower price than when it was purchased[2].

Despite the disadvantage of low liquidity, real estate offers other benefits to investors that are not available with any other type of investment. The opportunity to leverage other people’s money (OPM) allows an investor to own, control, and monetize 100% of property while investing a much smaller portion of their own money.

Real estate also offers significant tax write-offs through depreciation and other maneuvers like the 1031 exchange. Since real estate does not have an objective value, it presents an opportunity for investors to buy properties below market value and adding sweat equity to increase the property’s value, so they can resell for a significant profit in the future. These characteristics can help investors by acting as a hedge against inflation[3], effectively diversifying their portfolios.

In addition, property appreciation[4] and cash flow from rentals are well-known strategies to earn income from real estate. In some markets, investment properties can appreciate by as much as 10%[5].

Finally, real estate investment trusts (REITs) are liquid real estate investments[6]. Most REITs are publicly traded and can be bought and sold just like stocks. The disadvantage is that the investor has no physical ownership of the property.

BY THE NUMBERS: National appreciation values average around 3.5% to 3.8% per year.

Source: Ownerly

Factors That Determine Real Estate Liquidity

Different factors influence how quickly and easily a property may sell in the market.

Some properties are more liquid than others. For example, residential properties often sell faster because there are more buyers in the market looking for homes, whereas commercial real estate is much more expensive and there are far fewer buyers in the market for these properties at any given time. Homes (particularly single-family units) also require less due diligence and lower transaction costs. However, the property’s condition is also a big factor; freshly renovated properties are generally more liquid, for instance.

Properties in a convenient and prime location appeal most to buyers[7]. A rental property located in popular districts with easy access to great schools, public transportation, parks, groceries, and malls sells quickly. Safety, utility, and developer brand recall may also improve the liquidity of a property.

The time it takes to close a deal and the overall costs of the transaction also affect the liquidity of the property[8]. This includes the time to finalize the paperwork and all legal obligations and the total costs of the taxes, broker’s fees, registration fees, and other maintenance costs. The smoother and the fewer overhead costs there are, the more liquid the property is.

Finally, the market dictates the general liquidity of real estate. Like any other investment, there are good and bad times to sell depending on how “hot” the market is. The hotter the market, the more liquid real estate is; the colder the market, the more illiquid[9]. Real estate investors often call a hot market a seller’s market and a cold market a buyer’s market.

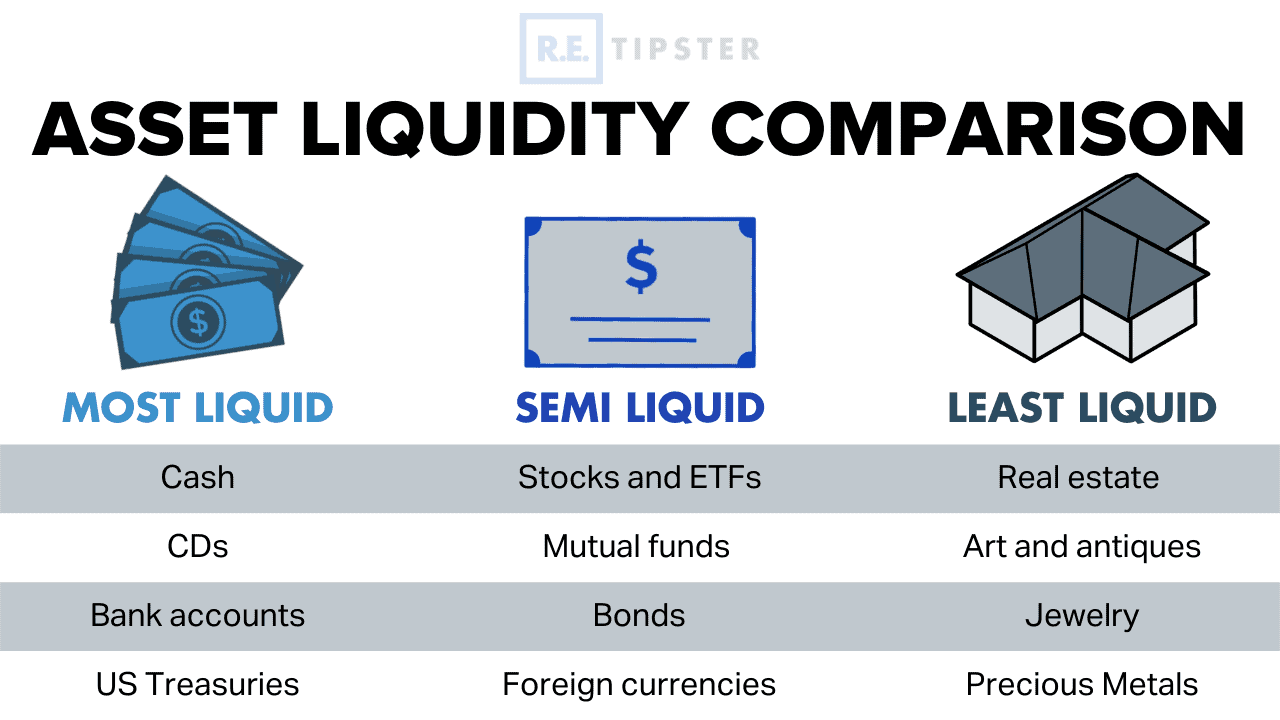

This table explains the correlation between liquidity and other factors in the market[10]:

| Hot (Seller’s Market) | Cold (Buyer’s Market) | |

| Liquidity | High | Low |

| Inventory | Low | High |

| Price | Higher than listing | Lower than listing |

Is There Liquidity Risk in Real Estate?

Certain types of real estate may also suffer from liquidity risk, which describes properties that are more difficult or take longer to sell.

Various factors contribute to the liquidity risk of a specific property, such as high carrying costs, undesirable locations, or the general state of the market. If the investor needs to raise the money immediately, they will be forced to sell the property for less than its fair value.

However, there are ways to capitalize on liquidity risk[11]. Investing in a property with a long time horizon may bypass volatility and changes in the market. Doing so may allow the property to be sold later when the investor feels it can sell; for example when the neighborhood is gentrified, or development has begun to ease access to the property.

Investors, however, must consider that market conditions will not always be favorable. In some cases, there will be no “favorable” times at all. When the opportunity presents itself, they should take the chance and sell the high-risk property instead of missing the only window they could sell it.

Takeaways

- Liquidity is the speed and efficiency at which an asset or security can be traded at or near its market value.

- Cash is the most liquid because it has an objective value and it is the most commonly used medium of exchange.

- Real estate is highly illiquid. However, real estate has a low or negative correlation with other asset classes, making it a good hedge against inflation due to its appreciation and cash flow potential.

- Factors that determine the liquidity of a property include location, condition of the property, transaction costs, and the state of the local market. Some properties have inherently high liquidity risk, however.

Sources

- Nicolas, S. (2021.) What Investments Are Considered Liquid Assets? Investopedia. Retrieved from https://www.investopedia.com/ask/answers/032715/what-items-are-considered-liquid-assets.asp

- Seal, J. (n.d.) What Makes Property Values Go Down? SFGATE. Retrieved from https://homeguides.sfgate.com/property-values-down-52344.html

- Brady, T. (2021.) What investors need to know about real estate and inflation. Mynd. Retrieved from https://www.mynd.co/knowledge-center/what-investors-need-to-know-about-real-estate-and-inflation

- Corporate Finance Institute. (n.d.) What is Price Appreciation (Real Estate Investments)? Retrieved from https://corporatefinanceinstitute.com/resources/knowledge/valuation/price-appreciation/

- Yale, A. (2021.) What Is Real Estate Appreciation? Millionacres. Retrieved from https://www.millionacres.com/real-estate-market/what-is-real-estate-appreciation/

- Bechard, M. (2017.) How do REITs Work? Nareit. Retrieved from https://www.reit.com/news/videos/how-do-reits-work

- Mburugu, C. (2019.) 10 FACTORS THAT AFFECT PROPERTY VALUE. Mashvisor. Retrieved from https://www.mashvisor.com/blog/factors-that-affect-property-value/

- Schmidt, C. (2020.) Is Real Estate A Liquid Investment? Realized. Retrieved from https://www.realized1031.com/blog/is-real-estate-a-liquid-investment

- Lucro. (n.d.) What is Liquidity and How Does it Impact the CRE Market? Retrieved from http://getlucro.com/knowledge-base/2018/04/what-is-liquidity-and-how-does-it-impact-the-cre-market/

- Weintraub, E. (2021.) Buyer’s vs. Seller’s Real Estate Markets. The Balance. Retrieved from https://www.thebalance.com/hot-cold-and-neutral-real-estate-markets-1798785

- REStrats. (n.d.) Best Way To Use Real Estate Liquidity Risk To Your Advantage. Retrieved from https://realestatestrats.com/real-estate-liquidity-risk/