What Is Real Estate?

Shortcuts

- Real estate refers to land and anything natural or artificial attached to that land.

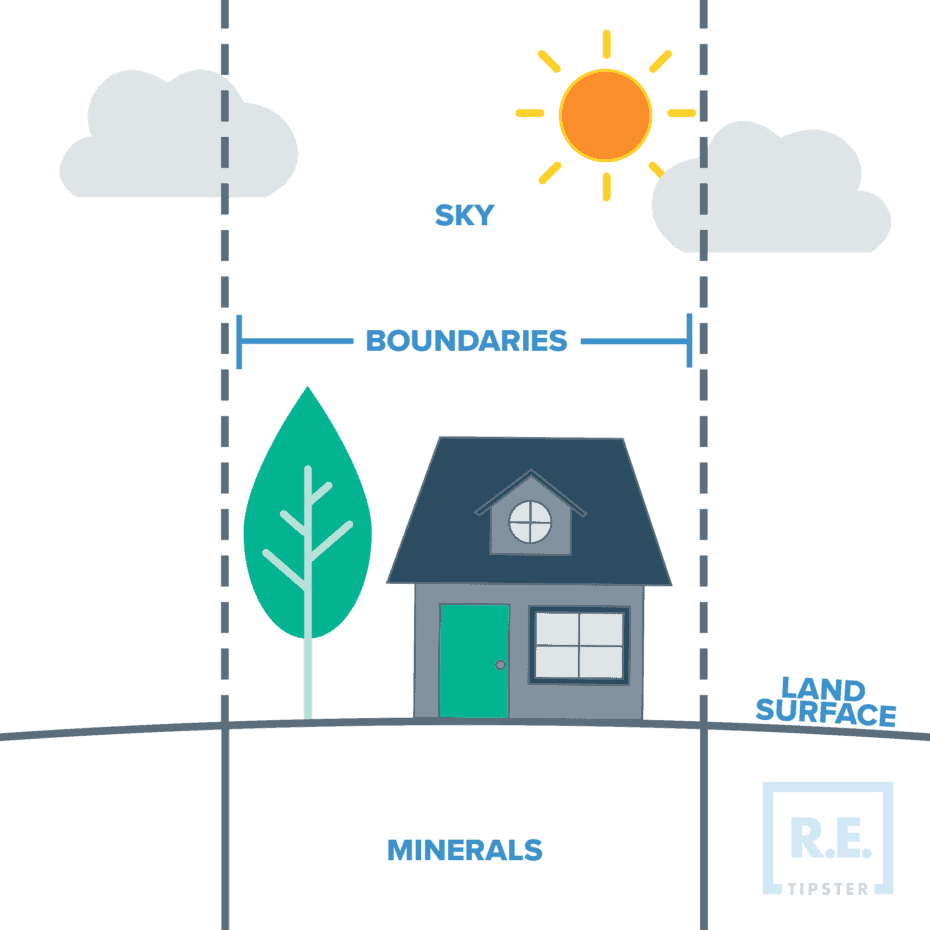

- It includes everything beneath the land down to the center of the earth and above it to the skies.

- It is distinct to real property, which can be defined as the rights and ownership to that piece of real estate.

- Real estate can be classified into how it is used, of which there are six: residential, commercial, industrial, agricultural, raw land, or special purpose.

- An individual or a firm can invest directly (such as homeownership, house flipping, and rental property ownership) or indirectly (such as purchasing shares in REITs or private equity funds) in real estate.

Real Estate vs. Real Property

In some cases, “real estate” and “real property” are used interchangeably. However, they have a subtle and important distinction.

Real estate refers to the earth’s surface, extending down to its center, and upward to the airspace above. This includes any bodies of water, trees, minerals, and other naturally occurring or artificial attachments on the surface of the land, as well as the sky and infinity above it. Artificial attachments include houses, buildings, sewer systems, and many others.

Meanwhile, real property refers to the benefits, interests, and rights included in real estate ownership. In other words, real property includes real estate and all the rights associated with owning that particular piece of real estate.

When there are man-made objects attached to the land, the land is called “improved,” and those objects are called “improvements.” Improvements include vegetation that requires routine labor, such as crops[1]. If it is just vacant land, this type of real estate is called “unimproved” or “raw land.”

Real Property vs. Personal Property

While real property is a term that covers objects considered permanently attached to the land (thus “immobile”), “personal property” covers movable objects. Cars, equipment, furniture, computers, appliances, and even portable housing are considered personal property because they are not affixed to the ground and can be moved from one location to another easily.

Characteristics of Real Estate

Given that real estate involves land, its physical characteristics are different from other asset classes. Real estate has three physical characteristics:

- Immobility. The topography (how natural and artificial physical features are arranged) of land can be changed, and some of its parts can be removed, but the location is permanent forever.

- Indestructibility. Land is permanent and durable. Anything attached to it can ultimately be removed or changed, but the land will always remain.

- Uniqueness. While similarities may be found between two different parcels of land, those parcels of land can never be exactly the same. Their geographic locations will always be different.

Types of Real Estate

There are six major types of real estate:

- Residential Real Estate. These are properties primarily used as residences, whether as a resale or new construction. Single-family homes are the most common category of residential real estate. Multifamily homes up to five housing units, townhouses, high-value homes, condominiums, co-ops, vacation homes, and multigenerational homes are considered residential real estate.

- Commercial Real Estate. Commercial real estate is used exclusively for business-related purposes or to provide a workspace rather than as a living space[2]. Strip malls, shopping centers, office buildings, hotels, and schools are common examples of commercial real estate. Though apartment buildings are used for residences, they are often considered commercial buildings because such buildings generate income. Multifamily properties with more than five housing units are classified as commercial real estate[3].

- Industrial Real Estate. Spaces and land improvements used for the manufacture and storage of goods are called industrial real estate. Other facilities that fall under this category are those used for production, research, and the distribution of goods. Industrial real estate has different zoning restrictions, construction laws, and sales than other commercial real estate types.

- Agricultural Real Estate. Land and buildings dedicated to the growth and production of food, agricultural commodities, and products are agricultural real estate. They are often used to grow crops, raise livestock, and develop ancillary uses in the farming industry.

- Raw Land. Raw land is purchased for “future” rights on natural resources, such as water or minerals. Taxes on raw, undeveloped land are minimal due to the absence of improvements on it.

- Special Use Land. Also known as “special purpose real estate” or “purpose-built real estate.” Publicly used properties often fall under special purpose, including public libraries, parks, cemeteries, places of worship, government buildings, public schools, and mass transit stations. Mixed-use real estate is also considered special-use real estate.

How Do You Invest in Real Estate?

An individual or a company can invest in real estate either directly or indirectly.

1. Direct Investment

Some of the most common ways to directly invest in real estate include homeownership, house flipping, and rental property ownership.

There are a few common ways to make money by investing in real estate:

- Buying a property at a discount and proactively making improvements to increase its value (“sweat equity”) and then selling it at a higher price to make a profit.

- Buying a property and waiting for the value of real estate to appreciate as the market naturally brings property values higher and then selling it for a profit.

- Buying a property and renting or leasing it to a tenant to generate a recurring stream of rental income.

The value of any property is affected by a number of factors, particularly its location. Prospective buyers and renters often think about:

- The state of the local economy, including employment availability.

- Transportation and logistics in the area, including traffic.

- The quality of education in local schools.

- Security (crime rates).

- Safety (e.g., how near to or far from a faultline, flood plain, hurricane/tornado belt).

- Municipal services.

- The rate of property taxes.

Pros and Cons of Direct Investment

Like any other investment, directly investing in real estate has its advantages and disadvantages.

Advantages:

- Real property ownership can provide steady income, as in renting out an apartment building.

- Real estate offers capital appreciation.

- Investing in real estate is a good way to achieve portfolio diversification.

- Real estate property can be bought with leverage (debt).

Disadvantages:

- Real estate is not a liquid asset[4].

- Local factors have a huge influence on the property.

- The initial capital outlay is often substantial.

- Depending on the type of property, real estate may require some expertise and active management.

2. Indirect Investment

There are several ways to indirectly invest in real estate: syndication, private equity, exchange-traded funds (ETFs), mortgage-backed securities (MBS), and real estate investment trusts (REITs). Investors can also earn from indirectly investing in real estate through other means, such as interest or fees.

A real estate investment trust (REIT) is one of the most popular investment vehicles in indirect real estate investments. It is a body or group that holds a portfolio of real estate properties that produce income. Investors buy a share of the REIT and earn corresponding dividends.

A mortgage-backed security (MBS), meanwhile, is a bundle of mortgage loans, and an investor can earn money from the repayments made on those loans. Historically, they have represented a riskier type of investment than other types of indirect investments in real estate. They are believed to have played a major role in the 2007-2008 global financial crisis.

Pros and Cons of Indirect Investment

There are advantages and disadvantages to indirect investments.

Advantages:

- Indirect investments are generally more liquid.

- They can be used for portfolio diversification.

- The dividends are typically consistent.

- There are risk-adjusted returns.

Disadvantages:

- Capital appreciation and investment growth are typically low.

- They offer minimal tax advantages, if at all.

- Certain markets may present risks.

How Big Is the Real Estate Industry?

Real estate is a huge industry that involves many different sub-industries and specialties.

- Real Estate Development. A real estate developer earns income by purchasing land, rezoning, renovating an existing building or constructing a new one, and then promoting that new “product” to end-users to lease or sell the product. As such, a developer takes risks in financing such a project.

- Real Estate Lending. Lenders include entities such as banks, private lenders, and credit unions. Real estate lenders, which include government institutions through their First-Time Homebuyer Loans, Federal Housing Administration (FHA) Loans, refinancing loans, VA loans, and FHA 203(k) loans, are major players in the industry.

- Real Estate Brokerage. Many property buyers and sellers need the services of a real estate agent, Realtor, or broker to facilitate a transaction. Agents often work for a brokerage firm and can represent either a buyer or a seller, with the intention of purchasing or selling real estate property with the best possible terms for the person or entity they represent. Note that a Realtor, strictly speaking, refers to a real estate agent who is part of the National Association of REALTORS® (NAR).

- Property Management. Real estate owners can manage their rental properties themselves or employ a professional property manager. A property manager can be an individual or a firm. A property manager will perform administrative tasks for each property under management, including rent collection and tenant management. They can also show units to interested buyers or renters, fix any deficiencies, or perform necessary repairs on the units. Property managers charge the property owner a fee, usually a percentage of the rent or sales.

- Professional Services. Many professionals are involved in the real estate industry. Attorneys, accountants, general contractors, engineers, architects, construction workers, appraisers, surveyors, environmental professionals, and other tradespeople contribute to most real estate transactions in some capacity. Recently, software developers have also created applications that facilitate real estate research and transactions.

Sources

- Chorpenning, A. (2020.) Real Property vs. Personal Property: Why The Difference Matters. SmartAsset™. Retrieved from https://smartasset.com/financial-advisor/real-property-vs-personal-property

- Chen, J. (2020) Commercial Real Estate (CRE). Investopedia. Retrieved from https://www.investopedia.com/terms/c/commercialrealestate.asp

- Sturm, J. (n.d.) Single Family, 2-4 Unit Multifamily, or 5+ Unit Multifamily? Explore the Benefits of Each Here! BiggerPockets®. Retrieved from https://www.biggerpockets.com/blog/single-family-small-multi-or-large-multi

- Militana, T. (2019.) Is Real Estate a Liquid Investment? Realtyna®. Retrieved from https://realtyna.com/blog/real-estate-liquid-investment