What Is Commercial Real Estate?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Benefits of Investing in Commercial Real Estate

Commercial properties are typically leased to businesses. Compared to residential real estate, commercial properties often offer investors a much wider range of investment opportunities[1].

Here are some of their advantages in detail.

Investment Yields Higher Returns

Investors find the returns in commercial real estate far more attractive than investments in residential real estate[2]. Industrial buildings tend to have more square footage and offer more units. More rental space means more tenants can be admitted, which can improve cash flow.

Tenants Typically Maintain the Property

Commercial tenants generally follow the rules and respect their space because their financial success is tied to the rental. As a result, CRE tenants are more likely to take on the responsibility of maintenance and upkeep.

Commercial Property Can Have a Triple Net Lease

With a triple net lease, the tenant or lessee handles the property expenses. The investor typically avoids maintenance costs as the lessee takes care of it, particularly if they want the place to look and feel in line with their style and branding. The property owner only needs to pay the mortgage, holding the asset while the occupant covers taxes, insurance, and maintenance (hence triple net).

Triple net leases only benefit commercial properties[3].

Leases Have Longer Terms

While a residential property lease can range from six months to a year, many commercial property leases can last five to 10 years[4]. This is one of the top draws of commercial real estate, as investors do not have to deal with high turnover costs and long vacancies. This allows property owners to generate reliable income without committing too much time to oversight.

Easier to Scale

While a residential real estate investor typically has to deal with comparable properties to determine market value, a commercial real estate investor can determine the property’s value based on its revenue. The higher the property’s earnings, the higher its worth[5]. This means investors are likely to see value increases at a much faster rate when compared to residential property.

Ways to Invest in Commercial Real Estate

There are several ways to invest in commercial real estate, but they can be either passive or active. The following are the most common.

Commercial Real Estate Crowdfunding

Real estate crowdfunding is one of the more popular financing options for accredited investors. First, an investor joins crowdfunding platforms, pairing the investor with third-party investors or developers that need funding for an investment opportunity.

Investing in crowdfunding for real estate properties can cost anywhere between several thousand and several hundred thousand dollars. Those who invest in commercial real estate crowdfunding usually get higher returns. Still, they should be ready to take on more risk with less liquidity, as opportunities can have a minimum of five-year maturities[5].

RELATED: Today’s Top Real Estate Crowdfunding Websites

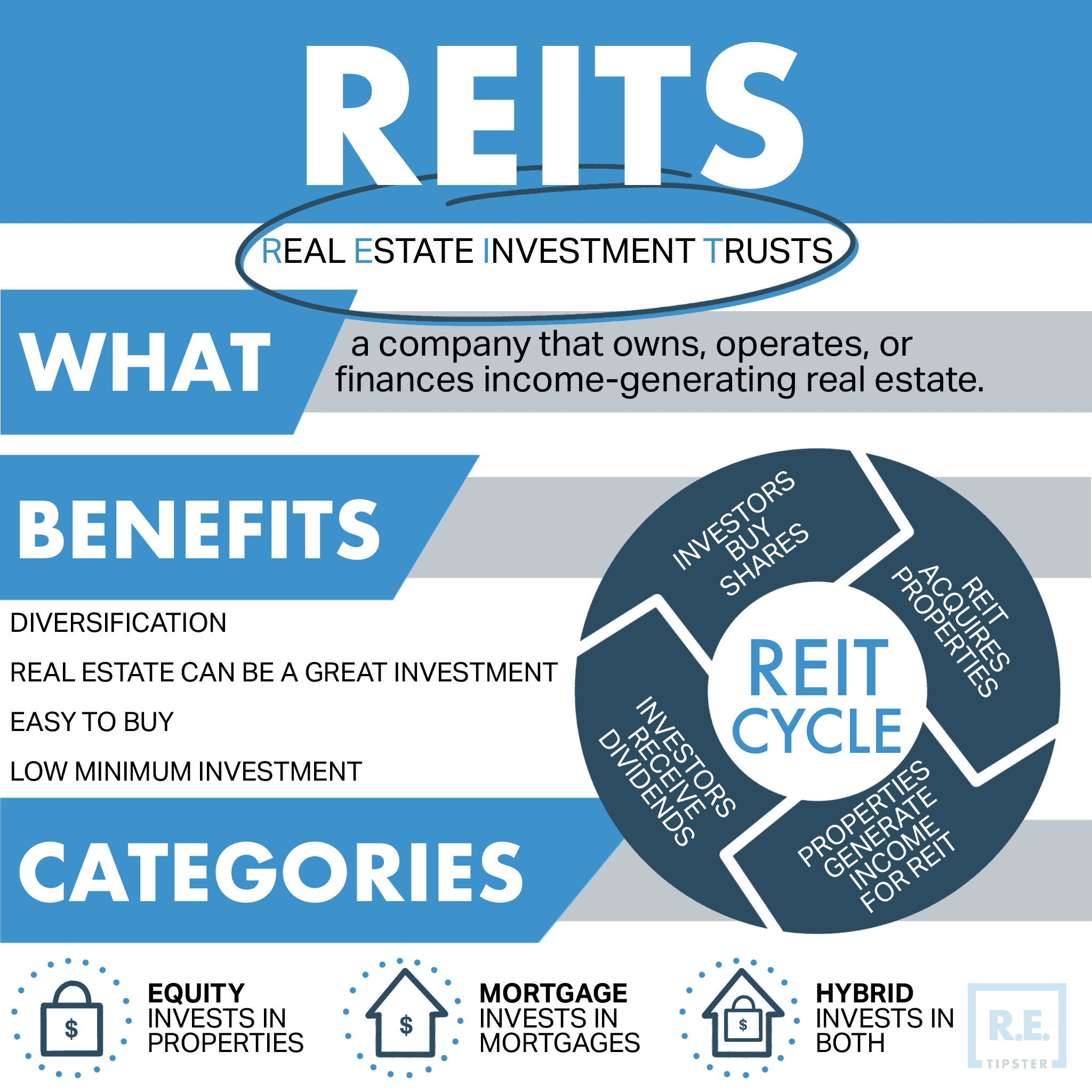

REITs

Real estate investment trusts or REITs are one of the easiest ways to do it for most investors just beginning to venture into commercial real estate. Companies own REITs, which pool money for buying and managing properties, often within the same industry. REIT investors receive dividends as payment.

REITs also get special tax benefits[6] as long as 90% of their income is paid as dividends to investors. This makes them reliable as sources of passive income for investors.

Investing in REITs does not have to be immediately expensive, as some publicly traded REITs are available for as little as a few hundred dollars, which is a good amount for investors still testing the waters in CRE investing.

Real Estate Exchange-Traded Funds (ETFs)

It is also possible for an investor to invest in multiple REITs through real estate exchange-traded funds.

Real estate ETFs are produced by fund managers who choose several real estate securities for investing in, usually by passively tracking an index that mirrors the real estate market[7]. As such, ETFs can include multiple REITs in different commercial sectors.

This option mitigates a measure of risk because investments in real estate ETFs are spread across different sectors and companies.

Funding Partner

Individuals can also invest in commercial real estate as limited partners. For example, if an investor does not have the financial leverage to become the direct owner of a building or lot, they can offer less capital by combining efforts with a CRE investment firm.

In this setup, the investor becomes a passive, silent partner who provides some funding for purchasing or putting the down payment on a property. In exchange for this portion of the funding, the investor can get a preferred return, an equity split, or both.

While this typically involves fewer partners, it often also entails higher risks. Beginner investors do not always qualify, either, because funding and equity partnership opportunities often result from relationships among already active investors.

Active CRE Investing

All the above examples are passive CRE investments, but there are also ways an investor can actively participate in commercial real estate.

In active commercial real estate investments, the investor owns at least a portion of the property and some of its risks and liabilities. Many investors prefer active investments in commercial real estate, however, because there is a higher likelihood of getting better returns when compared to passive investments.

Active investments typically earn income in two ways[8]:

- A buy-and-hold strategy entails buying the property, holding it for years, and forcing it to appreciate. This is a form of real estate speculation[9] but has a very long time horizon.

- Cash flow from rentals or leases. The yield may not be anything to write home about, but cash flow from commercial properties counts as regular income.

In both cases, an investor who chooses to invest this way has a hands-on approach to their commercial real estate investments.

Takeaways

- Commercial real estate (CRE) refers to properties whose purpose is to generate income, such as retail, office, hotel, special-purpose, and industrial buildings.

- Multi-unit residential properties with more than four units are also considered commercial real estate.

- Investing in commercial real estate includes higher returns, a better pool of tenants, triple net leases, long-term leases, more rent revenue, and the ease of raising the property’s value.

- Investors can invest in CRE either passively (such as by being a limited partner, through REITs, or ETFs) or actively, such as by real estate speculation, i.e., buy-and-hold.

Sources

- Esajian, J. (n.d.) Commercial Real Estate Vs Residential Real Estate Investing: Which Strategy Is Right For You? Fortune Builders. Retrieved from https://www.fortunebuilders.com/commercial-vs-residential-real-estate/

- Luthi, B. (2022, March 9.) Commercial vs. Residential Real Estate: Which Should You Choose? Experian. Retrieved from https://www.experian.com/blogs/ask-experian/commercial-vs-residential-real-estate-investing/

- Terry, T. (2019, September 17.) WHAT IS A TRIPLE NET LEASE? Voit Real Estate Services. Retrieved from https://voitco.com/what-is-a-triple-net-lease/

- The subtle difference between leasing and renting. (2022, February 1.) Bungalow. Retrieved from https://bungalow.com/articles/the-subtle-difference-between-leasing-and-renting

- Why Commercial Income Properties Scale Better Than Residential Properties. (2017, June 27.) Westwood Net Lease Advisors. Retrieved from https://westwoodnetlease.com/commercial-income-properties-scale-better-residential-properties/

- Reg D, A+, Or CF – Which Crowdfunding Approach Is Best For My Business? (2022, June 27.) Dalmore Group. Retrieved from https://dalmorefg.com/reg-d-a-or-cf-which-crowdfunding-approach-is-best-for-my-business/

- REIT Tax Advantages. (n.d.) Streitwise. Retrieved from https://streitwise.com/reit-tax-advantages/

- REITs vs. REIT ETFs: How They Compare. (2022, January 31.) Investopedia. Retrieved from https://www.investopedia.com/articles/investing/081415/reits-vs-reit-etfs-how-they-compare.asp

- Brumer-Smith, L. (2023, January 20). Commercial Real Estate Investing Basics. Million Acres. Retrieved from https://www.millionacres.com/real-estate-investing/commercial-real-estate/commercial-real-estate-guide/