REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

If you've ever dreamed about investing in real estate but had no idea where to start (or whether you wanted to deal with all the headaches that come with the trade), you owe it to yourself to get educated about real estate crowdfunding.

In recent years, several new crowdfunding and peer-to-peer lending platforms have popped up online, offering fascinating new ways for investors to diversify their retirement savings by putting their money to work in real estate.

Considering the advantages that real estate offers (e.g., income, appreciation, and tax benefits, to name a few), this may be worth a closer look at.

To most people, crowdfunding as an investment strategy is still relatively new.

Back in mid-2012, the JOBS Act was signed into law with bipartisan support, which opened the door for broad solicitation of private investments, which is why all of these crowdfunding websites started popping up around this period.

With the passing of the JOBS Act, “accredited investors” (individuals with a net worth exceeding $1 million or more OR an annual income exceeding $200K for at least two years) are now able to invest in smaller portions of real estate deals through crowdfunding and peer-to-peer lending.

What Is Real Estate Crowdfunding?

The problem with real estate investing is, most conventional properties require hundreds of thousands (if not millions) to acquire and/or develop.

Even if you're a multi-millionaire, unless you're getting a truly remarkable deal, it usually isn't pragmatic to acquire an entire property (and all the debt associated with it) all on your own. Taking on a massive project like this by yourself requires a lot of work, due diligence, debt, risk and hassle – and most people aren't cut out for it.

This is where the beauty of crowdfunding comes into play.

By participating in a real estate project financed through crowdfunding, you can be one of MANY different financiers or equity holders to invest a small portion into the overall project.

Rather than putting down ALL the cash it would take to acquire a $1 million building, you can invest in smaller “chunks” of the project – like $5K, $10K or $20K (depending on the project and which website you're working with).

The projected returns on these types of deals can vary quite a bit. Still, from what I've seen in the various sites I've explored, the numbers tend to range from 8% (at the lower end) to as high as 14%, and they fluctuate based on the level of risk associated with the deal, and the type of project it is.

Project Types: Debt vs. Equity

Debt Deals

These projects are being financed with at least one (and sometimes multiple) loans, and a portion of the overall loan proceeds are coming from the money you invest. Your funds are essentially being borrowed by a real estate investor/developer, and assuming all goes as planned, you and all the other investors will eventually get paid back by the borrower with interest.

Most (though not all) of the debt deals I've seen tend to have an earlier maturity date (e.g. – 12 – 24 months), allowing the investors to pull their money back out in a shorter period of time. A maturity timeline of 1 – 2 years is fairly common, but with the faster turnaround, the return is usually along the lower end of the spectrum.

Equity Deals

Equity investments put investors in an indirect ownership position, which allows them to participate in the property’s excess cash flow AND any appreciation that happens when the property is eventually sold. These investments are usually for longer periods of time (3 – 5 years), because these projects typically involve extensive renovations to the property or other “value-add” efforts by the borrower. These investments typically involve quarterly cash flow distributions and have certain tax advantages.

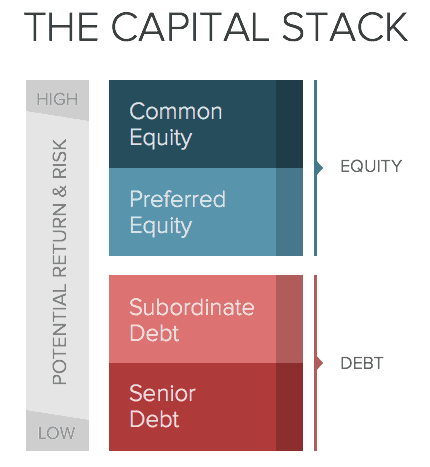

There are actually some different types of “equity” available with these types of projects, often referred to as “common equity” and “preferred equity”.

Common Equity

In terms of risk – common equity investors are the most vulnerable to loss if a deal falls apart, making this one of the riskiest investments among the different product types. If the property’s value fails to appreciate or generate sufficient cash flow to cover the debt and preferred equity hurdle rates, the common equity investors get hit first and could experience a negative return. On the same coin, common equity deals typically involve a “preferred return” (often 7-10%), payable to investors quarterly. These investors also get to share in any appreciation (or depreciation) upon the sale of the property – which generally causes equity investments to have the highest potential return among the various investment types.

Preferred Equity

Preferred equity deals share some similarities with both debt deals and common equity deals. With this type of investment, the investor has an indirect ownership stake in the property, but since it's preferred equity – these investors will also be in better position in any bankruptcy scenario. Similar to debt deals, preferred equity involves fixed terms and regular payments (typically monthly) and it is treated like debt for tax purposes.

In terms of risk – preferred equity deals are somewhere in the middle, between debt deals and common equity deals. In the event of default, preferred equity holders get paid before the common equity owners, but after the debt holders. Preferred equity projects typically have a payback term of around 2 – 3 years, which is longer than most debt deals, but shorter than most equity deals.

This diagram from RealtyShares gives a good visual portrayal of the risk and reward outlook from each type of investment product…

The critical point to remember is there is always a risk of loss in a crowdfunded real estate deal. Like any real estate investment, there are no guarantees that the projected numbers will pan out exactly as planned.

This is part of the value proposition that crowdfunding brings to the table. With the ability to invest smaller portions of money in multiple projects, it becomes much easier to mitigate your overall risk. If a $5,000 investment goes sideways, it won't be nearly as catastrophic to a single investor as a $1,000,000 investment going sideways.

You can use crowdfunding to spread out your investing activity, which makes it ideal if you have no experience in real estate OR if you're already running a profitable real estate investing business. In either case, it's an investment strategy that allows you to pay the cash and let someone else do all the number-crunching and grunt work for you.

Which Websites Are Worth Investigating?

As I've been keeping my eye on this space over the past couple of years, I've looked into several different websites that are doing some pretty cool, innovative things for this emerging industry. The ones I'll be talking about here certainly are NOT the only ones out there, but from what I've seen, they've all generated a fair amount of buzz and interest in the industry.

It's also worth noting that I have invested with some of these platforms but not all. I can't offer much feedback on how their deals are vetted or how my returns have panned out with each one, but I can give a fairly decent overview of how each website is laid out and how easy it is to get started with each one.

REtipster features products and services we find useful. If you buy something through the links below, we may receive a referral fee, which helps support our work. Learn more.

Fundrise

Fundrise has earned a massive following since it was founded in 2010. This site makes it very easy to choose from dozens of eREIT funds to invest in, which can help to diversify anyone's investment portfolio. Here's a video tour of how their system works…

Disclosure: I’ve been investing with Fundrise since 2017. When you sign up with my link, I earn a commission. All opinions are my own.

Here are some quick stats on the company:

- Fundrise was founded in 2010.

- Since inception, Fundrise has originated more than $250 million in both equity and debt investments deployed across more than approximately $1.4 billion of real estate property.

- As of July 24, 2017, their equity and debt originations have been deployed across approximately 110 real estate transactions.

- Fundrise has over 150,000 users on their platform. Accreditation is not a requirement to invest in the eREITs or eFunds, as their mission is to democratize access to high-quality private real estate investments.

Fundrise is a bit different from the other websites listed here because the investors don't invest in one specific property. Instead, their funds are invested into a pool of properties, from which they earn a return (with a maturity date of approximately 5 years).

What I like about Fundrise is that they don't require their investors to be accredited (i.e. – you don't have to already be filthy rich or make tons of money to get involved). I was able to invest as little as $1,000 on the site earlier this year and to date, the funds have earned an approximately 8% return (of course, that's just my experience – yours will probably vary to some degree – but that's what I've seen so far).

RealtyMogul

RealtyMogul is similar to Fundrise in that, this platform has pivoted towards offering funds that combine multiple real estate properties into a single investment product, a similar concept to the real estate investment trusts (REITs) that existed since long before the JOBS Act.

These REITs offer built-in diversification, which may make sense for investors that lack the time, knowledge, or means to spread their investment dollars across specific properties and markets. On the other hand, some investors may be turned off by the lack of transparency. These platforms typically make more sense for non-accredited investors looking for built-in diversification at a very low minimum.

This video from RealtyMogul explains their REIT product a bit more…

The company also offers some investment opportunities for individual properties (for accredited investors), in addition to the REIT funds they have available (for non-accredited investors).

Here are some quick stats on this company…

- RealtyMogul began operating in 2013.

- More than $300 million has been invested through the RealtyMogul platform since its inception

- RealtyMogul has over 140,000 total investors registered with its platform.

At the time of this writing, RealtyMogul has multiple REIT products available – and you don't need to be an accredited investor to participate. However, the minimum investment amounts range from $5,000 – $10,000, so you'll have to commit at least this much in order to start investing with them.

One thing that differentiates RealtyMogul from other REIT providers is the higher level of voluntary oversight and regulation than other companies with similar offerings. They physically walk every property, have a more conservative underwriting process, and evaluate every deal from scratch, regardless of what information has been pre-packaged for their underwriters.

EquityMultiple

EquityMultiple is one of the smaller, but quickly growing crowdfunding platforms on the market today. Here's another video overview I put together as I started exploring their site a bit more…

Here are some quick stats on the company:

- EquityMultiple began operating in 2015.

- More than $14 million has been invested through the EquityMultiple platform since its inception.

- More than 30 investments have been funded on the EquityMulptiple platform since its inception.

- EquityMultiple has a nationwide network of over 5,000 accredited investors that can evaluate projects.

- EquityMultiple averages around 30 investors per deal.

- The average investment size is $25,000 per investor.

- EquityMultiple has processed over 40 properties in 15 states.

Open an EquityMultiple Account

There are a few things about EquityMultiple that makes them unique…

- Institutional Focus: Their partnership with Mission Capital (an established real estate advisory firm in Manhattan) gives them access to larger, more exclusive commercial projects.

- Combination of Equity/Preferred Equity/Senior Debt: EquityMultiple is one of the few platforms that consistently offers all three, which gives investors a nice range of risk/return profiles and hold periods, which helps promote diversification.

- Debt Syndication: RealtyShares, for example, offers a debt product by acting as the lender. The EquityMultiple model is to work with established lenders to “syndicate” a preexisting loan. Since they do their own diligence on the lender, the borrower, and the project, they feel that this best protects investors by giving them an extra layer of underwriting. To my knowledge, PeerStreet is the only other platform that operates in this way, but they're focused exclusively on single-family fix-and-flips.

CrowdStreet

CrowdStreet is the nation's largest online private equity real estate investing platform.

Here are some quick stats on the company:

- CrowdStreet began operating in 2014 and is headquartered in Portland, OR.

- Over 540 commercial real estate offerings have been published by the company.

- More than 100,000 investors in the U.S. have invested with CrowdStreet.

- Investors with CrowdStreet must be accredited investors.

- For most of CrowdStreet's offerings, the investment minimum is $25,000.

Like with any investment, investing in a REIT with CrowdStreet is speculative and involves risk, including illiquidity and complete loss of invested capital and there are no guarantees of future success. Always conduct your own due diligence or discuss with a financial adviser before making any investment.

PeerStreet

PeerStreet is a platform with some similarities to RealtyShares and EquityMultiple in that, you need to qualify as an accredited investor in order to participate in their investment opportunities.

One nice aspect of the PeerStreet platform is that they have a minimum investment amount of $1,000 in order to open an account – so even though you may have money as an accredited investor, you don't necessarily need to commit such large amounts to each deal you invest in.

This video explains the process (which should look familiar by now)…

Here are some quick stats on the company:

- PeerStreet went live to all accredited investors in 2015

- More than $500 Million has been invested through the PeerStreet platform since its inception.

- More than 1,200 investments have been funded on the PeerStreet platform since its inception.

PeerStreet also has an interesting “Automated Investing” feature that allows investors to get allocated into loan investments automatically based on their investment criteria (and it's also a simple way to build up a portfolio of investments). When a loan investment becomes available that matches an investor's given criteria, they'll receive an allocation based on PeerStreet's prioritization algorithm.

To date, PeerStreet has focused 100% on first-position liens on real estate. In other words, money invested through PeerStreet goes into the safest place in the capital stack, because it's the first position to be paid back. Rather than sourcing loans from borrowers, they work with existing private lenders across the country who know each local real estate market. PeerStreet vets them and their loans, which helps them scale while maintaining quality.

An Emerging Industry

It's exciting to see how these online platforms are making the world of real estate investing more accessible to investors who otherwise wouldn't be able to play in this space. At the same time, there’s still plenty of reason for each individual investor to proceed with caution.

Above all, it’s important to note that not all platforms are created equal, and these real estate crowdfunding websites have separated into different investment product lines since the JOBS Act was passed.

No matter how offerings are structured, investors should carefully consider the relevant experience and expertise of the people behind the organization. Any real estate platform worthy of your investment dollars should be transparent, attentive, and able to declare a strong case for any particular offering.