What is an Accredited Investor?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

How is an Accredited Investor Defined?

The Securities and Exchange Commission (SEC) establishes the criteria to be designated as an accredited investor (also known as a qualified investor).

According to Rule 501 of Section D of the Securities Act of 1933, the SEC’s definition of an accredited investor is:

- A person with an annual income of at least $200,000 in each of the last two years (or exceeding $300,000 jointly with a spouse), with the expectation of earning the same or greater income in the current year and

- An individual or joint net worth exceeding $1 million excluding the primary residence

- Is currently in good standing with a Series 7, 65, or 82 license.

Other categories of accredited investors may also be relevant:

- A trust with total assets of $5 million or higher, not formed specifically to purchase the subject securities, whose purchase is directed by a sophisticated person, OR

- A certain entity with total investments in excess of $5 million, not formed to specifically purchase the subject securities, OR

- Any entity in which all of the equity owners are accredited investors. (source)

The Dodd-Frank Act in 2010 eliminated the primary residence from the net worth calculations, but on the flip side, it also removed any mortgage on the primary residence, up to fair market value, from the calculations.

The provisions for being an accredited investor are different for partnerships, corporations, trusts, and charitable organizations, but each can become accredited investors under SEC rules.

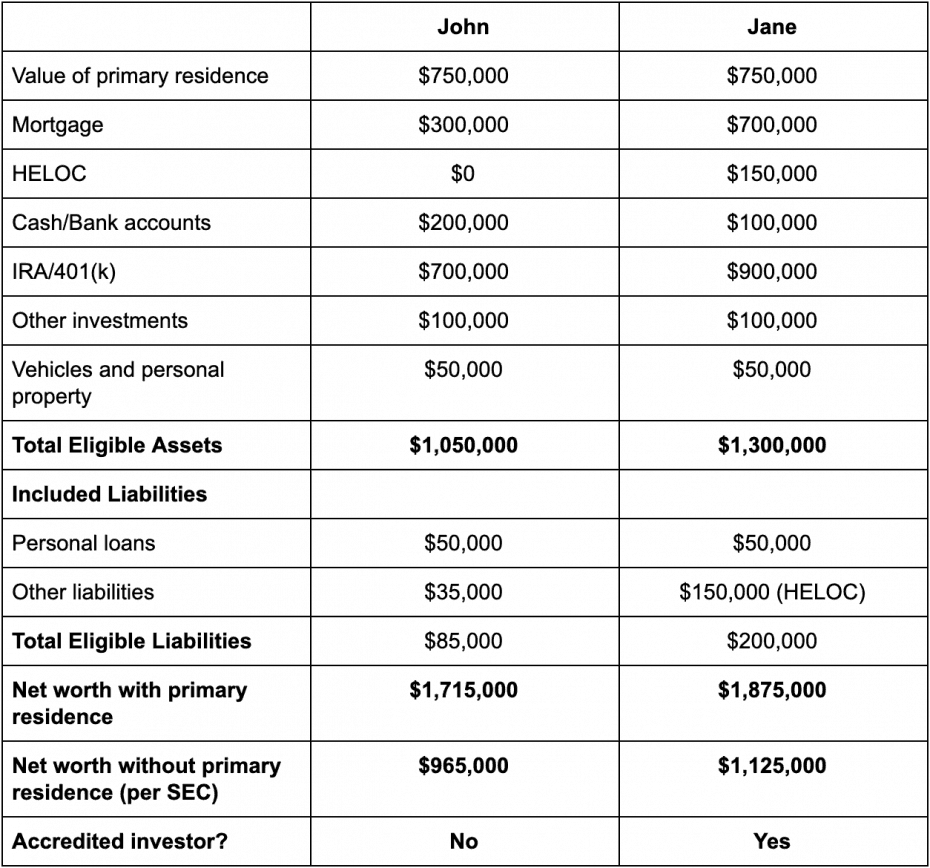

The table below shows how the SEC calculates net worth for the purpose of becoming an accredited investor:

As you can see, Jane qualifies to be an accredited investor, despite having a lot of mortgages and unsecured debt.

John, on the other hand, doesn’t qualify, despite having just $385,000 in debt compared to Jane’s $900,000 in debt. Jane’s home is actually underwater; it contributes nothing to her net worth. Nearly half of John’s net worth is tied up in his home, disqualifying him for accredited investor status.

What's so special about an Accredited Investor?

Accredited investors have opportunities to put money in lucrative investments that aren’t available to the general public. Private equity, hedge funds, real estate crowdfunding and debt syndication are just a few avenues open to an accredited investor.

It’s not just the accredited investor who benefits from this exalted status; it benefits entities that need to raise capital, too. The SEC requires organizations to register any securities they plan to sell to the public. It’s an expensive and time-consuming process for businesses. But if they sell only to accredited investors, they can skip the registration process.

You don’t have to be an accredited investor to invest in real estate; there are private REITs open to non-accredited investors as well. However, if you don’t have the time or know-how to fix and flip properties, you can get into some of the more profitable real estate opportunities by becoming an accredited investor.

How to become an Accredited Investor

Even though the SEC sets the guidelines for becoming an accredited investor, it doesn’t actually handle the qualification process. In fact, there is no “official” process or universal certification you can use with every fund or organization.

That said, individuals can’t simply check a box or self-certify that they are accredited investors. This was allowed until 2013, but the SEC changed the rules so that any organization seeking funds from accredited investors had to implement a process to verify potential investors meet the accreditation standards.

In order to participate in real estate or other investments open only to accredited investors, an investor will need to contact the organization and ask them what they need to see. The accreditation process varies, but will likely include some or all of the following:

- Complete a financial questionnaire

- Submit bank and financial statements

- Submit tax returns and/or W-2 forms

- Review of your (and your spouse’s, if joint) credit report

- Provide letters from your CPA, attorney, broker, and/or financial advisor

You’ll have to repeat this process for each organization, but once an investor is accredited with a fund, they can participate in any available opportunities within that particular organization.

What if an investor doesn't qualify as an Accredited Investor?

Getting accredited isn’t a one-time-only deal. If a person’s net worth or income isn’t what it needs to be this year, they can try again and again in the subsequent years. If their assets increase in value so that their net worth hits the required $1 million mark later in the year, they can reapply for accreditation.

An investor isn’t locked out of real estate investment opportunities if they aren’t accredited. While there are many private crowdfunding opportunities and REITs, there are several that are open to anyone who wants to invest.

REtipster features products and services we find useful. If you buy something through the links below, we may receive a referral fee, which helps support our work. Learn more.

For example:

- Fundrise offers eREITs and e-funds in commercial real estate. Investors can get in for as little as $500.

- Realty Mogul opened up its MogulREIT I and MogulREIT II funds to general investors; they also have private funds for accredited investors.

- Rich Uncles is aimed at Gen Y and Gen Z and operates a REIT that collects rent and pays it out to shareholders in the form of monthly dividends. It is open to all investors.

Accredited investors have access to private investment opportunities average investors don’t, but that doesn’t guarantee market-beating performance. Whether you qualify as an accredited investor or not, you can still find real estate investment opportunities to meet your wealth-building goals.