What Is Residential Real Estate?

An Overview of Residential Real Estate

Residential real estate often refers to single- and multi-family homes, but other residential property types also belong to the residential real estate category.

For example, single-family homes and residential rentals with up to four units, including condominiums, duplexes, and quadruplexes are residential real estate, whether owned or rented.

Residential real estate includes the land, resources, and buildings on a given lot. The residential property is meant to be occupied as a personal dwelling, so local zoning ordinances do not allow residential real estate to be used for commercial and industrial functions.

In some states, places or property not typically used as residences, such as houseboats, may be considered residential real estate[1].

While most people who own residential real estate simply live on their property, some invest in residential real estate to make a profit, either by selling or renting out the property to tenants[2]. As an investment market, residential real estate demands a more active role from investors than owning and leasing a commercial property[3].

Residential vs. Commercial Real Estate

Residential real estate is limited to property used as a dwelling and is often owned by or leased to individuals or families.

Meanwhile, commercial real estate includes property used primarily for commercial (i.e., income-earning) purposes, such as hotels, offices, retail businesses, grocery stores, and special-purpose buildings.

Apartment complexes and multi-family homes with more than four units are also classified as commercial real estate[4].

What Are the Benefits of Investing in Residential Real Estate?

Several benefits come with investing in residential real estate, including the following:

Investment Cost Is Often Lower

If an investor is only starting in real estate, the cost of entry into residential real estate is often significantly less than the cost of commercial real estate[5]. It is often more straightforward to develop the funds needed for investing in a residential property.

As the necessary amount is typically smaller, a lender is more likely to approve an investor’s application if they seek to invest in residential properties. The cash flow needed to secure a commercial investment property loan is typically much greater than what lenders require for a single-family home.

Tenants Are Long-Term

For those willing to invest in residential real estate to rent out the property, it is possible to find tenants looking for a long-term lease. Properly vetted, these long-term renters are also more likely to care for the property as if they owned it.

In addition, the decreased tenant turnover means the investor does not have to deal with the task of looking for and vetting new tenants often. This leads to more financial security and less work.

Easier to Deal With Zoning Laws

Compared to zoning laws governing commercial real estate, zoning ordinances involving residential real estate property are more lenient[6]. As a result, a residential real estate investor has to deal with less red tape to start leasing the property to individuals or families.

Huge Market for Tenants and Buyers

Residential real estate has a much bigger market than others. More people are looking to rent or buy a place to live in than those seeking opportunities to start a business in a commercial space.

Safer During Economic Crises

While the residential real estate market is in no way immune to economic downturns, it is still less susceptible than commercial real estate property[7]. If the economy is floundering, it is often harder for a commercial real estate investor to find tenants or buyers. Small businesses leasing real estate may also go under if the economic climate remains challenging, forcing the property owner to look for new commercial tenants once the previous business folds.

On the other hand, people always need homes, so residential real estate properties are much more likely to stay in demand than commercial properties.

BY THE NUMBERS: Over 45% of Americans pay rent equal to 30% or more of their gross income.

Source: Pew Research Center

How to Invest in Residential Real Estate

There are several ways an investor can start investing in real estate.

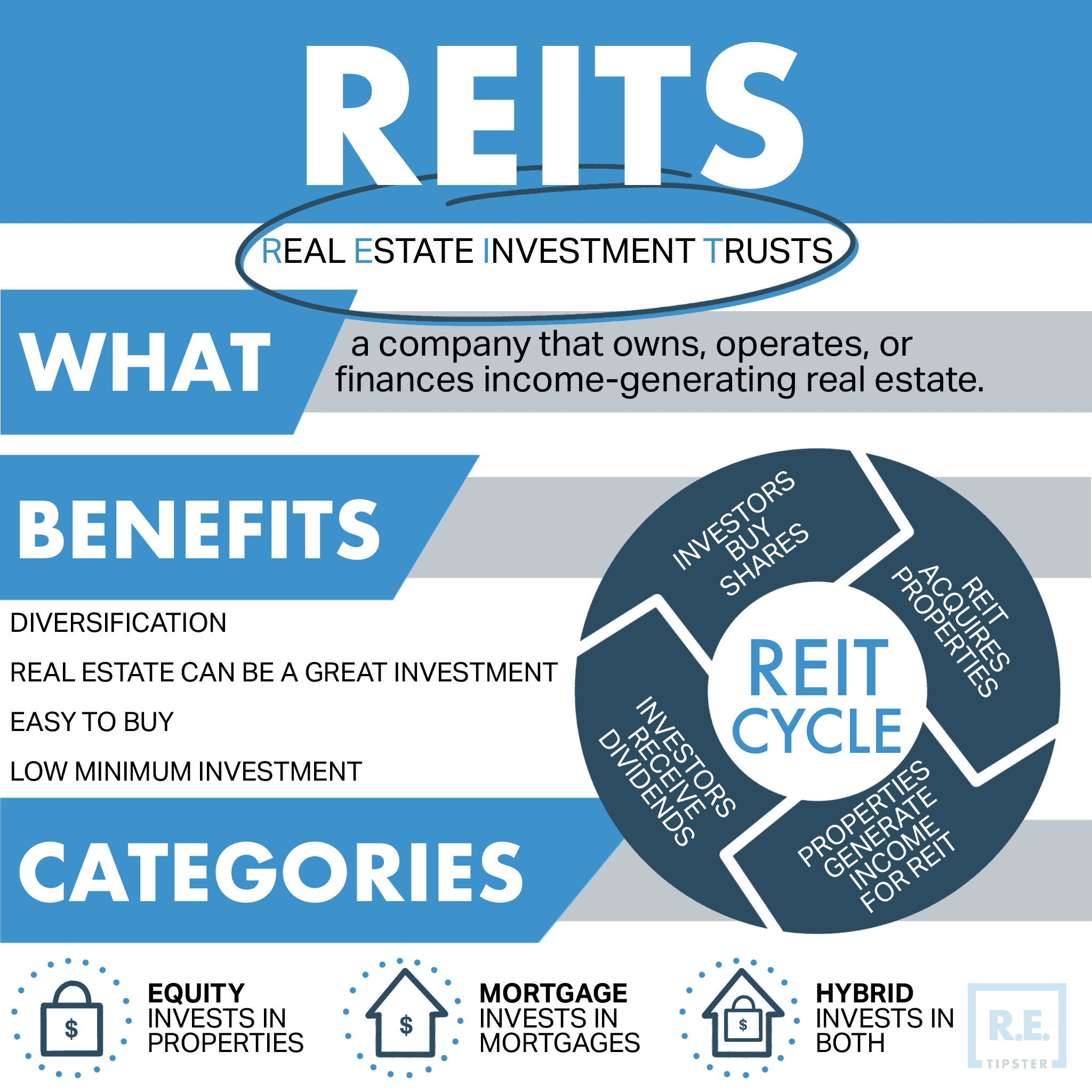

Real Estate Investment Trusts (REITs)

A real estate investment trust is often compared to another type of investment vehicle, mutual funds[8]. REITs allow investors to put money into real estate without acquiring physical real estate property.

Companies own REITs and often include a combination of residential, commercial, and industrial real estate properties. This is a popular form of real estate investing because REITs often yield high investment dividends. Retirees like REITs as a form of investment because they do not require much work and they still generate revenue.

Not all REITs are the same, so it is important to understand the kinds of REITs one is looking at before putting any money into them.

Online Investment Platform

Many investment opportunities are available online, including real estate. Some investors are willing to finance real estate transactions through equity or debt. Investing in these real estate platforms means absorbing risks and expecting monthly or quarterly distributions.

To do this, however, an investor has to be accredited[9], which means an investor needs to have a high net worth. A company looking at this type of real estate investing should also have the funds and experience with riskier, private investments.

Rental Property

Many novice investors can start by purchasing a rental property. The investor can live in the property to save money, rent out the other units to tenants, or even perform house hacking.

In this style of investing, however, the property owner becomes the landlord, which means they are also responsible for the upkeep of the property. Investors can hire a property manager if they do not want to receive calls every time a faucet breaks or a lightbulb is busted.

Airbnb Arbitrage

Investors who own a house can put up a spare room on sites like Airbnb. They can also do this for extra properties, such as a condo in which the investor does not live.

An Airbnb rental is usually occupied by short-term tenants, such as tourists[10]. The investor does not have to deal with long-term tenants’ woes, Airbnb provides some prescreening and also some protection against damage.

Flipping or Rehabbing

While this is not as easy as renting out a room one already owns, it is one of the most popular ways to invest in residential real estate. An investor looks to purchase a low-priced property that needs a little renovation, renovates it as inexpensively as possible, and sells it.

As inexperienced investors run a high risk of underestimating and miscalculating the necessary renovation costs, it is a good idea to partner up with a more experienced house flipper before purchasing a property[11].

BY THE NUMBERS: Over 58% of home flips are purchased with cash.

Source: UpNest

Takeaways

- Residential real estate refers to all single-family homes, as well as residential rentals with one to four units, including condominiums, duplexes, and quadruplexes, which are typically leased to individuals or families.

- Investing in residential real estate has several benefits, including lower entry costs, more stability in finding tenants, more relaxed zoning laws, and a large market of renters and buyers.

- Investors looking to enter the residential real estate market can start with real estate investment trusts (REITs), online investment platforms, purchasing rental property, renting out a room through online apps like Airbnb, and house flipping.

Sources

- Holmes, J. (n.d.) Is A Houseboat Real Property? Crow Survival. Retrieved from https://crowsurvival.com/is-a-houseboat-real-property/

- Taylor, M. (2022, October 20.) What Is Residential Real Estate? Bankrate. Retrieved from https://www.bankrate.com/glossary/r/residential-real-estate/

- Esajian, J. (n.d.) Commercial Real Estate Vs Residential Real Estate Investing: Which Strategy Is Right For You? Fortune Builders. Retrieved from https://www.fortunebuilders.com/commercial-vs-residential-real-estate/

- Multifamily vs Commercial Real Estate. (2022, June 8.) LoanBoss. Retrieved from https://www.loanboss.com/blog/multifamily-vs-cre

- Ahlquist, T. (2022, September 20.) Commercial Real Estate vs. Residential Real Estate. Ball Ventures Ahlquist. Retrieved from https://www.bvadev.com/post/commercial-real-estate-vs-residential-real-estate

- Sapio, A. (2022, June 10.) Where to Invest: Residential vs. Commercial Real Estate. The Motley Fool. Retrieved from https://www.fool.com/investing/stock-market/market-sectors/real-estate-investing/commercial-real-estate/residential-vs-commercial/

- RESIDENTIAL VS. COMMERCIAL REAL ESTATE INVESTING. (2022, September 21.) Zommick Mcmahon. Retrieved from https://zmcre.com/commercial-vs-residential-investing/

- Hayes, A. (2022, May 23.) REIT vs. Real Estate Fund: What’s the Difference? Investopedia. Retrieved from https://www.investopedia.com/ask/answers/012015/what-difference-between-reit-and-real-estate-fund.asp

- Accredited Investor. (n.d.) Securities and Exchange Commission. Retrieved from https://www.sec.gov/education/capitalraising/building-blocks/accredited-investor

- Meyer, S. (2023, January 2.) Airbnb statistics and host insight. The Zebra. Retrieved from https://www.thezebra.com/resources/home/airbnb-statistics/

- O’Shea, A. (2022, September 14.) How to Invest in Real Estate: 5 Ways to Get Started. NerdWallet. Retrieved from https://www.nerdwallet.com/article/investing/5-ways-to-invest-in-real-estate