REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

The first time I ever used my Self-Directed Roth IRA to invest in real estate, I was able to buy a property for $4,587, and I sold it about a year later for $20,000.

It was a decent deal with an ROI of approximately 300%. Certainly on the better side of ordinary, but nothing I hadn’t seen before.

A lot of people would look at an ROI of 300% and think, “Wow, that’s amazing” (and I suppose it is), but for the business model I work with, it’s not uncommon to double, triple, or even quadruple investment dollars like this (I’m not bragging, that’s just how it works).

But even beyond the numbers and logistics of how this deal got done, one thing made this transaction particularly exciting.

MY PROFITS WERE TAX FREE!

Rather than writing the IRS a massive check to reward them for nothing they did to help out, I decided not to take the usual punishment for my success. Instead, I chose to keep 100% of my money, and I did it all with the full blessing of the U.S. Government.

Granted, it did require a few extra steps along the way, but with a little education and a neat tool called a “Self-Directed Roth IRA,” it wasn’t hard to pull off, and I’m going to show you exactly how it works.

What is a Self-Directed Roth IRA?

To explain this adequately, I’ll start at the very beginning.

For most of the past century, most people in the U.S. relied heavily on a few standard retirement plans to finance their retirement (e.g., 401k, Traditional IRA, etc.).

These retirement plans allowed people (and/or their employers) to deposit their pre-tax income into an investment account. The money usually went into a mix of stocks and bonds and grew over time. As the decades went by, their retirement savings would multiply (at least, that was the idea), leaving them with more money than a simple savings account would have generated.

People invest in these accounts for several reasons. One of the reasons is that they don’t require much thought. You don’t need to be an expert in the stock market to invest in a 401k, you just give your money to a fund manager, and these “experts” will handle it for you.

One “catch” of investing this way is that when people deposit their money into these retirement accounts, they deposit it BEFORE paying their taxes. When the day finally comes for them to take their money out, they’ll have to pay their taxes at that point (when they have a lot more money to lose, and they may be in a higher tax bracket than when they first deposited the money).

For many years, this was the established norm.

One day, near the end of the 20th century, the U.S. Government enacted the Taxpayer Relief Act of 1997, and something called the Roth IRA was born.

The Roth IRA took a new approach to retirement savings. It allowed individuals to invest their after-tax income into their retirement account (when they would most likely be in a lower tax bracket) and then withdraw it in retirement tax-free (when they would most likely be in a higher tax bracket).

This was a big deal for a few reasons…

When people invested with a traditional 401K, their exponential investment growth (where the bulk of their money was made) would be saddled with a BIG, fat tax bill before they could use their money. When people invest with a Roth IRA, that same exponential growth had no taxes whatsoever.

Why? Because they already paid their taxes on the front end (when the tax bill was nominal) instead of on the back end (when the tax bill would be huge).

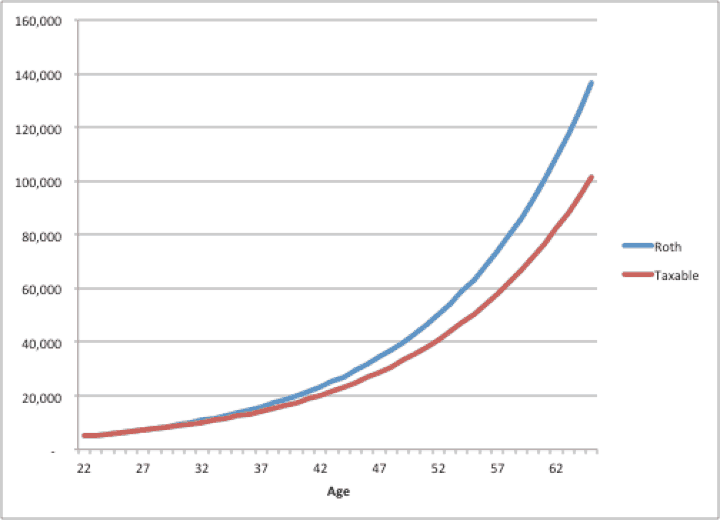

In the end, this can make a pretty dramatic difference. Here’s a basic illustration to give you an idea:

Image Source: nerdwallet.com

Of course, for those who are familiar with Roth IRAs, there are a few standard rules that always apply:

- The IRS has an annual limit on how much can be contributed to a Roth IRA each year. When the Roth IRA first hit the scene, that limit was $2,000 per year. As of 2020, that limit was $6,000 ($7,000 if age 50 or older), and it will presumably continue to grow in future years. (source)

- To withdraw tax-free earnings from a Roth IRA, the account owner must be at least 59.5 years old, and the account must be at least 5 years old. (source)

- You can withdraw the principal investment at any time without penalty, but not the earnings. (source)

- IRA funds can never be co-mingled with personal funds. (source)

With rules like this, the IRS allows people some tax advantages, but it certainly comes with its limits.

Enter the Self-Directed Roth IRA

A Self-Directed Roth IRA is an individual retirement account that allows people to pursue alternative investments for their retirement savings. Rather than handing money over to a fund manager, the owner of a Self-Directed Roth IRA can make these decisions for themselves by investing in things like:

- real estate

- private company stock

- oil and gas LPs

- precious metals

- intellectual property

- tax liens and tax deeds

And when we refer to “real estate” as an alternative investment above, this is defined as things like:

- residential and commercial properties

- home flipping

- farmland

- residential lots

- new construction

- property renovation

- development

- passive rental income

With a self-directed IRA, it’s up to the individual investor to choose the assets they will buy. However, they need to use a trustee or custodian to ensure their self-directed individual investment account does not lose its tax-advantaged status. The custodian’s task is to issue all necessary tax statements and ensure that the account adheres to IRS tax guidelines.

It is wise to seek a custodian before opening a Self-Directed IRA account. In different types of IRAs, brokerage firms serve as custodians. However, many big brokerage firms do not accommodate Self-Directed Roth IRAs; some trust companies or banks specialize in handling such accounts. Some of the well-known IRA custodians are:

That said, not all self-directed IRA custodians offer relevant services to the types of assets in a certain account. A good custodian provides services to manage the specific asset/s that can be invested in. In addition, they should have years of experience handling self-directed IRAs and understand the IRS rules governing self-directed individual retirement accounts.

Supercharging Your Retirement

Most people are stuck with the erroneous notion that the path to retirement has to be long, slow, and boring (and when an 8% – 12% ROI is considered a “good return”, it’s not hard to understand why).

The beauty of a Self-Directed Roth IRA is that you’re not just stuck with stocks and bonds. You can invest your retirement funds in all kinds of things, even real estate! And given how quickly we can multiply our money with real estate, this is a pretty big deal.

As I mentioned earlier, a typical land deal can earn a 300% ROI… and if you could get even half that much regularly (which is absolutely achievable with our land investing model), you would be doing A LOT better than the “great returns” of 8% – 12% the stock market will bring you.

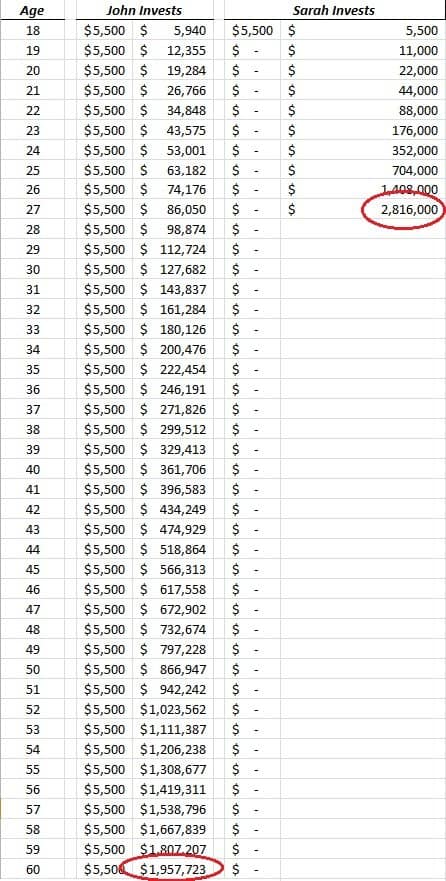

To put this in perspective, let’s take a look at a comparison of two retirement savings models. The table below shows two prospective retirees, John and Sarah.

John is investing in a standard Mutual Fund.

He invests $5,500 of new money every year while reinvesting his returns, which average 8% annually. He continues to do so until he reaches $2,000,000.

Sarah is investing in real estate with her Self-Directed Roth IRA.

Using the land flipping business model, she invests $5,500 once and is regularly able to find properties at a fraction of market value and sell them within 12 months. She reinvests her returns, which average 200% annually, and she continues to do so until she reaches $2,000,000.

(note: most of my properties have sold in less than 6 months for a return of anywhere from 100% – 300%, so this is a fairly reasonable assumption for someone who is taking the business seriously)

As the chart shows, Sarah’s path to retirement only took her until age 27, when she blew past her goal by over $800,000.

John’s path to retirement took him until age 60; even then, he still hadn’t reached his goal.

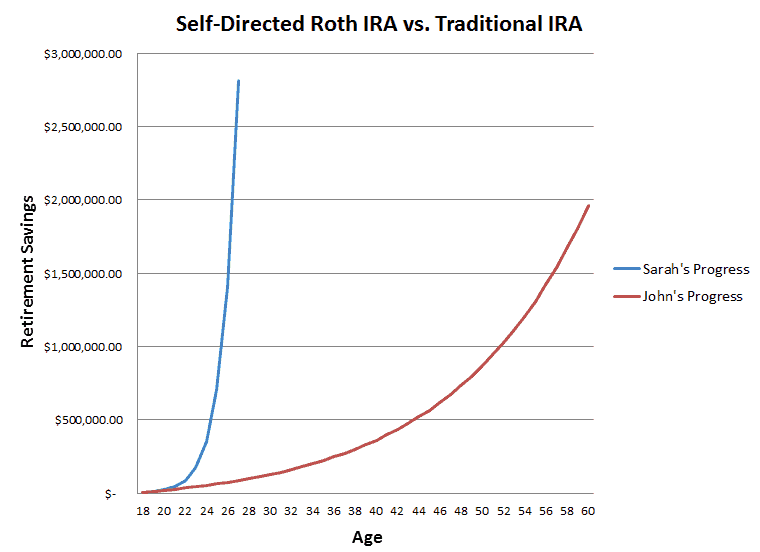

Just to put this in another perspective, this is what the comparison looks like on a line chart:

Of course, when we’re projecting paths to retirement like this, we must make some pretty broad assumptions. Just like John’s return on his mutual fund isn’t always going to be 8%, Sarah’s return on her real estate investments won’t always be 200%, and she won’t always sell them in exactly 12 months.

Sometimes John will see returns of up to 20% when times are great, and sometimes his investment will go backward when the economy is terrible.

Likewise, Sarah’s returns may dip down to 100% on some of her “sub-par” deals, and sometimes they’ll spike up to 400% or higher when the stars align and everything goes as planned. It’s also worth noting that sometimes her properties may take more than 12 months to sell (just like my recent example did), and sometimes they’ll sell in a matter of days.

The point here is that a Self-Directed Roth IRA will allow you to supercharge your retirement savings. Whether you’re 20 years old or 70 years old, if you’re using the right business model and consistently pursuing it year after year, it won’t take long to inject mutant-like powers into your retirement account and blast your savings into the stratosphere, with the kind of numbers that are impossible in the stock market.

My Real-Life Example

So, how complicated is it to buy and sell a property using a Self-Directed Roth IRA? What extra steps are required along the way?

I will admit that with the deals I've done using my IRA, the process worked a bit differently than I was used to – primarily because I couldn’t sign any documents on behalf of my Self-Directed Roth IRA. Instead, I had to have my custodian to do all the signing for me. This took a few additional steps, but it wasn’t difficult.

Disclaimer: Before we get into this, let me reiterate that I am not a tax accountant or attorney. The information I’m showing you is specific to my situation, and I acted on the advice of my tax professionals. Your situation may differ, so don’t misconstrue this information as tax or legal advice. Talk to your accountant or attorney before taking action.

Step 1: Finding the Deal

I found this deal the way I usually do. After some back and forth with a seller via email, the opportunity finally arose for me to buy this property at a small fraction of market value. I estimated the property to be worth anywhere from $20K – $40K and I got it under contract for less than $5K.

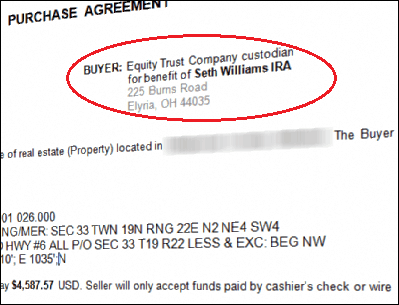

Step 2: Signing the Purchase Agreement

Once we settled on the price, the Seller and I signed my standard purchase agreement. The only notable difference was that since I was buying the property in the name of my Self-Directed Roth IRA (and at the time, Equity Trust was acting as my custodian), my name had to appear slightly different as the “Buyer” of the property:

Note: It was extremely helpful to work with Equity Trust on this transaction because they were able to coach me every step of the way – informing me of what is and isn’t allowed, how my documentation had to look, and what steps I had to go through to get the deal done. If I didn’t have their help, I probably never would’ve gotten through the process.

Step 3: Closing the Transaction

When buying and selling real estate with a Self-Directed Roth IRA, you must use a third-party closing agent (i.e. – title company or attorney). Contrary to how I handle some of the cheaper deals, you cannot close these kinds of transactions in-house… so don’t think about it.

Any legitimate title company or closing attorney should know how these transactions work. The main difference is that the communication will have to flow through three parties:

- You

- Your Closing Agent

- Your IRA Custodian

This works through a set of instructions called a “Direction of Investment” form. It’s a form you must fill out, instructing your custodian what to do on your behalf (e.g. – which documents they need to sign, how much money they need to send the title company, etc.).

To be completely honest, I found these forms rather confusing, and I probably would have messed them up if I hadn’t called Equity Trust and asked for help filling them out. With a little bit of hand-holding, I was able to get through it with no problems.

Once I notified Equity Trust of what they would need to sign for me, the closing agent mailed them the documents, a representative at Equity Trust signed where needed and then sent them back to the closing agent along with a cashier’s check from my account to pay for the property.

I’ll admit, on my first time through this process, it wasn’t always easy to keep track of things and make sense of the logistics, but now that I look back on it, it wasn’t all that bad. The closing agent and Equity Trust did the bulk of the heavy lifting. Once I submitted the direction of investment form, my work was finished.

Step 4: Selling the Property

In this deal, the selling process was by far the most time-consuming part. It took me an unusually long time to get this property sold, but I attribute most of this to the fact that I wasn’t marketing the property very hard.

I wasn’t overly concerned about finding a buyer because I knew the property would sell to the right person eventually. This particular property was big, valuable, and very inexpensive to hold (only $66 per year for property taxes – and that was it)… so the longer selling time never caused me any real anxiety.

Step 5: Finding the Buyer, Closing the Deal

When the right buyer finally came along, I knew I was working with “the one” because I didn’t have to bend over backward to contact them or get the deal closed. They were actively pursuing ME and were very easy to work with.

The closing process to sell this property worked similarly to the buying process. It was a matter of getting the list of documents that Equity Trust would have to sign on my behalf and then filling out a direction of investment form to send them.

After I sent these documents to Equity Trust, I got in touch with my representative and let them know that the closing agent was going to mail the following documents to them for their sign-off:

- Deed

- Settlement Statement

- Closing Acknowledgment

- Request for Settlement Protection Insurance

Once the documents were received and signed by Equity Trust, they were sent back to the closing agent to wrap up the deal. About one week later, the closing agent had mailed a cashier’s check to Equity Trust for the full purchase price, and I was $20,000 richer with no tax bill to show for it.

Any Down Sides to a Self-Directed Roth IRA?

As I’ve mentioned several times here, some MAJOR benefits come with investing in a Self-Directed Roth IRA.

The first and most obvious is your ability to buy and sell properties without paying taxes (and if you’ve ever had to pay a tax bill on a profit of $50,000 or more, you know it’s a very painful experience).

The second is the ability to supercharge your retirement savings. Rather than slogging away for years with the minimal returns that most people have resigned themselves to, a Self-Directed Roth IRA (coupled with the land investing model) has to power get you there at light-speed.

On the same coin, I’ve found that investing in a Self-Directed Roth IRA can be less than ideal in certain scenarios. For example…

1. It’s all good and fun to make tax-free money… but when your funds are tied up in a Roth IRA, and you can’t touch them until you’re 59.5 years old (and the account has been around for 5 years), it’s kind of a buzz kill. For some, it’s an automatic deal-killer – especially if you need immediate access to the money and don’t meet these two criteria.

2. If you invest with a Self-Directed Roth IRA, you need to be very careful about tracking your sources and uses of funds. Suppose you own a property in the name of your Self-Directed Roth IRA. In that case, you cannot use ANY of your personal or business funds to pay for property taxes, improvements, closing costs, or anything else related to the property's ongoing maintenance or holding costs. All the funds must come from the IRA that owns the property and nowhere else. If you co-mingle your IRA funds with any other person or entity (even if it’s by accident), you could be up against serious penalties from the IRS for breaking the rules – so don’t do it.

3. A Self-Directed Roth IRA may require a few more days to close each transaction (which is longer than some of us land investors are accustomed to waiting). Getting your IRA custodian and a third-party closing agent in the loop can slow down the process when multiple parties must approve and sign off on all the documentation. It’s not impossible (and to a lot of people, it’s just normal), but it does require a bit more time and patience – so be ready for this.

Lastly – I should reiterate that this blog post is not intended to be an all-inclusive explanation that outlines all the rules that pertain to Self-Directed Roth IRAs. If you aren’t sure what rules apply or what you’re allowed to do, you can do what I did and contact your IRA custodian for more information.