REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

One of the most important questions you'll have to answer as a land investor is:

“How much should I offer for this property?”

It's a crucial question because your offer price has everything to do with your ability (or inability) to make money on each deal.

With this in mind, I'd like to explain the basic math I'm using to make offers on vacant land properties.

The Challenges of Pricing Offers

For land investors, there are several challenges with formulating offer prices.

Even if we assume we've made a perfect valuation (which is rarely the case because valuing land is often tricky and subjective), our offer price may go higher or lower based on a few things.

- The desirability and uses of the property.

- The market demand and speed of selling where the property is located.

- If we're willing to make any improvements or changes to force appreciation, the property's value will go even higher than it's currently worth.

If the market is hot and/or the property is highly desirable with several potential uses, we will have a reason to offer more money.

On the other hand, if the market is slow, if the uses are limited, and if we're not planning to make any changes or improvements to the property, we'll want to stay more conservative with our offer price.

The Difference Between Hot and Cold Markets

Another challenge with pricing offers is that the market is always changing.

When I started investing in land in 2009, the market was very slow. I could offer absurdly low prices and get plenty of offers accepted.

However, as the years have passed, property values and the demand for land have increased, and the land-flipping industry has become more competitive. Making absurdly low offers doesn't work as well as it once did. If I wanted this business to keep working, I had to offer more and work with thinner margins.

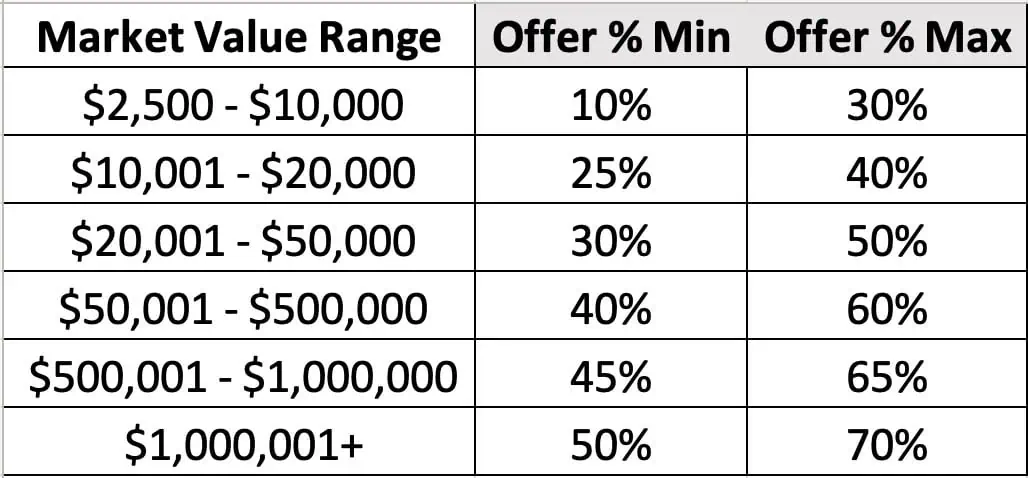

Depending on how I determine a property's market value, I'll typically adjust my offers up or down as a percentage of what I think it's worth.

The Sliding Scale Offer

Depending on the competitiveness of the market where I work, the highest and best use of the property, and how quickly I think it will sell, I use varying sliding scales to determine offer prices. The offer ranges will change based on what I believe a property is worth.

For example, if I'm working in a market where land isn't selling quickly, the subject property isn't particularly unique or special, and/or there is no real competition from other land investors, my offer prices will be less.

On the other hand, if I'm competing with other land investors for a highly desirable property in a market where properties are selling quickly, and if I'm confident about the property's true market value, my offer prices will be higher.

Want to run the calculations yourself? You can do it with the calculator below!

Note that I don't make offers on anything with a market value below $2,500. When a property is this cheap, any profit I make can quickly be eaten up by closing costs or property taxes. Ultimately, the juice just isn't worth the squeeze.

Also, keep in mind that I don't stick to this chart with militant perfection.

If I'm dealing with a property that is unique in some way (e.g., if a seller is unusually motivated, the property has a peculiar problem, the property has a special selling point, etc.), I may deviate from this to some degree, but these charts give me a point of reference I can use, depending on whether I'm working in a hot or cold market.

If the seller appears highly motivated or apathetic about their property, my offer will be on the lower end of the range I've set for myself. If I think they'll need a higher offer, I'll lean towards the higher end (but I rarely exceed it).

Of course, there's nothing magic about this set of numbers. Yours could be different and move at different intervals, and it could work out just as well (maybe even better, depending on who your seller is and what markets you're working in). This is just a basic guide I put together for myself, so maybe you'll find it helpful, too.

The Importance Of Price

Your offer prices will play a major role in the overall scope of your transaction. With the right number, you'll have a grand slam deal. With the wrong number, you can lose a lot of money very quickly (or lose a deal altogether)

There's a saying a lot of real estate investors like to throw around:

“The money is made when you buy.”

It's true. If you make the right assumptions about a property's market value and have an accurate idea of what your holding costs, closing costs, and improvement costs (if any) are going to be along the way, you can essentially write yourself a paycheck, simply by choosing an offer price that will allow the necessary room for your profit margin, however big or small you'd like it to be.

Base Your Offers On Math, Not Emotion

What I love about this calculator is that it tells me in very plain terms what the consequences of my numbers will be, for better or worse.

If I stick to my business model and keep my emotions out of the equation, I need to ensure my Net Profit and ROI are in line. This all starts with finding a reasonably accurate market value for the property and keeping the offer price within an acceptable range.

This approach helps keep my emotions in check so I can decide based on what the data says.

Am I going to miss out on some opportunities because my offer prices are too low? Absolutely.

Am I willing to compromise my business model because a seller might not accept my offer? Absolutely not.

YES, I have to play the numbers game and make a lot of offers. Do I hear “No” much more than “Yes”? Of course!

But what do I get in return? I get peace of mind.

When someone does accept my offer, I can be 1,000% sure I'm holding the deal of a lifetime in my hands.

And it's worth the effort! We can reap huge benefits when we stick to our guns and make data-driven decisions. If there's anything I've learned about real estate investing, it is that data-driven decisions beat emotional decisions every time.