What Is a Comparable Sales Approach in Appraisal?

Shortcuts

- The comparable sales approach is an appraisal method that estimates a property’s value by analyzing recent sales of similar properties.

- An appraiser identifies comparable properties (comps) that are alike in location, size, condition, etc. and have sold recently.

- Sale prices of comps are adjusted to account for differences compared to the subject property.

- Adjusted prices of comps are compared and analyzed to estimate the subject property’s market value.

- The approach appeals to buyer motivations but requires sufficient recent sales of similar properties.

How the Comparable Sales Approach Works

The comparable approach appraisal works by comparing the subject property to similar properties that have recently sold or are currently for sale in the same area.

Also known as the sales comparison approach, it’s one of the three standard methods used by real estate appraisers to determine the fair market value of a property. The other two are the income approach and the cost approach.

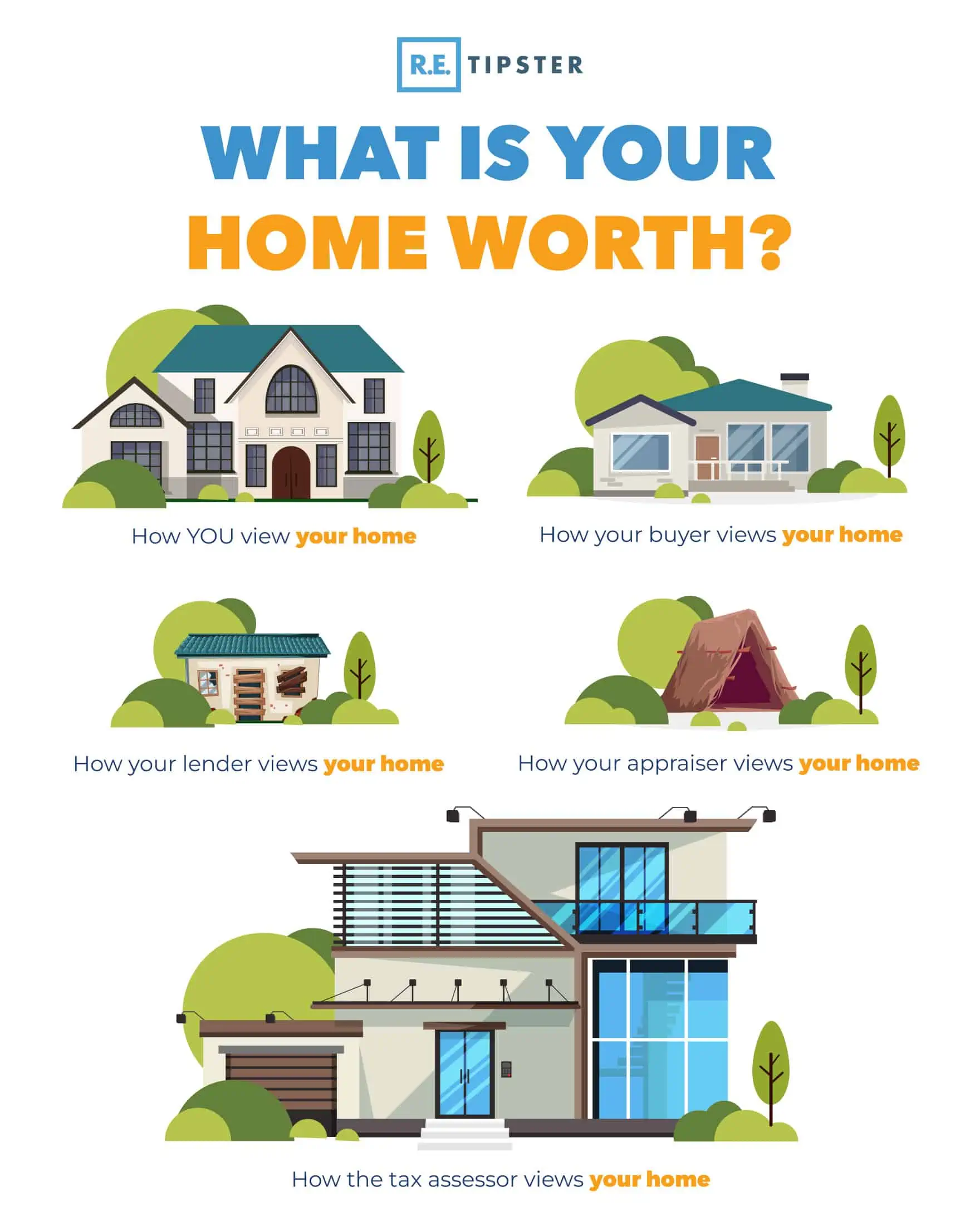

The principle behind the comparable sales approach is that an informed buyer would not pay more for a property than what other similar properties are selling for on the open market. Essentially, appraisers utilize the comparable approach to estimate what price a typical buyer would be willing to pay for the subject property on the open market by analyzing closed sales of similar homes.

An Overview of the Comparable Sales Approach Process

When using the comparable approach, an appraiser collects information on recently sold, listed, or pending sale properties similar to the subject property in terms of location, physical characteristics, and amenities.

These similar properties are known as “comparable properties” or “comps.”

Local real estate agents and Multiple Listing Services (MLS) provide the sales data needed. Appraisers may select at least three viable competitors, though some analyses call for additional sales comparisons.

The appraiser then adjusts the sale prices of comparable properties to account for differences between the comps and the subject property. They adjust for factors like lot size, number of bedrooms and bathrooms, age, condition, quality of construction, and amenities. Afterward, the appraiser uses these adjusted prices to estimate the value of the subject property through direct comparison or statistical analysis.

Key Elements of the Approach

There are four key elements involved in applying the comparable sales approach:

- Locating recently sold comparable properties.

- Verifying the validity of the comparables by confirming the sales details.

- Identifying similarities and differences between the comparables and subject property.

- Making adjustments to the comparable sales prices based on comparative analysis findings.

Below is a detailed description of each of the processes involved.

1. Finding Comparable Properties

To find comparable properties, appraisers search public records and real estate databases for properties near the subject property that sold within the past 6 to 12 months. Ideally, the comps will be in the same neighborhood as the subject property and on similar streets.

The appraiser looks for comps that are physically similar to the subject property in terms of lot size, square footage, number of bedrooms and bathrooms, quality of construction, age, condition, and amenities. Minor differences can be adjusted for, but major differences may disqualify a property from being used as a comp.

2. Verifying Sale Details

Before making comparisons, the appraiser verifies essential sale specifics by confirming the following:

- The properties were sold in arm’s-length transactions between unrelated parties without undue motivation.

- The sale dates and prices are accurate.

- Financing terms did not affect prices.

To be a valid comp, appraisers check the sale types to ensure they meet the definitional thresholds for market value. Things like foreclosure sales, property transfers between family members, or government transactions do not qualify.

3. Making Adjustments

Once comparable properties are selected, the appraiser analyzes the differences between each comp and the subject property to determine appropriate adjustments. Adjustments are made either on a dollar-per-unit or percentage basis.

Common adjustments include:

- Sale or Financing Conditions: Adjustments are made if a comp has favorable or unfavorable conditions, such as being in a short sale or foreclosure.

- Location: Properties in more desirable locations typically sell for more and receive positive adjustments, while those in less desirable areas receive negative adjustments.

- Site: Adjustments are made for differences in lot size, corner vs. interior lot location, views, and other site characteristics.

- Physical Characteristics: Bedrooms, bathrooms, square footage, quality of construction, age, condition, and amenities all require adjustments. Newer features receive positive adjustments while deficiencies receive negative adjustments.

- Date of Sale: Properties sold further from the appraisal date may require adjustments to account for changing market conditions over time.

4. Reconciling Adjusted Comparable Sales

Once the appraiser has adjusted all comparable sales, they analyze the adjusted values and determine if any comps should be given more weight due to their similarity to the subject property. They can also perform a statistical analysis to determine the indicated value.

The appraiser then reconciles all data and information to arrive at a final estimated value for the subject property. The comparable approach provides a reliable valuation when sufficient recent sales data is available for properties similar to the subject.

Pros and Cons of the Comparable Sales Approach

The comparable approach has distinct advantages:

- Relies on actual sale prices in the local market.

- Has moderate cost and time demands.

- Appeals directly to buyers’ purchase motivations.

Yet limitations exist too:

- Requires sufficient recent sales of similar properties.

- Inexact adjustment process relies on the appraiser’s judgment.

- Reflects past sales data, which may differ from current values.

Despite drawbacks, the approach strongly resonates with buying behaviors, so appraisers consider it very persuasive when applicable sales exist.

Key Applications of the Comparable Sales Approach

Appraisers commonly apply the comparable approach to valuing single-family homes as well as larger residential income properties like duplexes, triplexes, and small apartment buildings.

The method works best in standard housing markets containing an abundance of similar properties with frequent sales, such as:

- Typical suburban subdivisions featuring homes with comparable floor plans.

- Established urban neighborhoods with prevalent housing styles.

- Common condominium and townhome developments.

However, appraisers may not be able to use this method reliably in rural locations lacking adequate recent sales of similar dwellings or for atypical, custom residences.

Still, the comparative approach remains a primary method for developing residential appraisals, adeptly speaking to the motivations and perspectives home buyers use in making purchase decisions.

Frequently Asked Questions: Comparable Sales Approach

How many comparable properties are needed for an appraisal?

There is no minimum number for comparable appraisals. Most appraisals analyze between four to six comparable properties. More comparable sales provide more data points for the appraiser to analyze, but the quality of the comps is more important than the quantity alone.

How far back can comparable sales be?

While the most recent and similar sales provide the strongest evidence of value, appraisers generally use closed sales that occurred within the past 6 to 12 months. Sales older than 12 to 18 months may still be used but require larger adjustments and reduce the strength of the analysis. The appraiser must also account for market changes over time.

What if no comparable sales are available?

If insufficient comparable sales exist due to a lack of recent sales activity in the neighborhood, the appraiser may need to consider other means. This may include expanding the search area, looking further back in time, or using a different valuation approach, such as the income or cost approach. The appraiser will note any weaknesses in the analysis without truly comparable sales data.