REtipster features products and services we find useful. If you buy something through the links below, we may receive a referral fee, which helps support our work. Learn more.

As a business owner, you know the importance of keeping your personal and business finances separate. But finding the right banking solution for your company can be a challenge.

Traditional banks often fall short when it comes to meeting the unique needs of small businesses and startups.

That's where Bluevine comes in. Founded in 2013, Bluevine is shaking up the business banking world with its innovative approach to financial management. But is it the right choice for your business? Let's dive in and find out.

What is Bluevine?

While it's not a traditional bank, Bluevine partners with Coastal Community Bank, Member FDIC, to provide banking services.

Bluevine Review

Summary

Bluevine offers an impressive array of features tailored for modern businesses, including quick account setup, multiple sub-accounts, and innovative tools like auto transfer rules. While it excels in many areas, minor limitations in international services and cash handling prevent it from achieving a perfect score.

Pros

- Quick and easy account setup process.

- Up to 5 sub-accounts with unique routing numbers.

- Automated transfer rules for efficient cash management.

- 1.5% cash back credit card for account holders.

- High FDIC insurance limit of $3,000,000.

Cons

- Limited options for cash deposits.

- Small fees for wire transfers.

This means your funds are FDIC insured up to a whopping $3,000,000 per depositor—12 times the standard FDIC insurance limit!

Bluevine has been around since 2013, so they didn't just start operating last week. This banking platform has been around for a while, and they've ironed out a lot of the wrinkles that other, newer banking platforms are still working through.

Getting Started with Bluevine

One of the most impressive aspects of Bluevine is how quick and easy it is to get started.

You can open an account in minutes, all from the comfort of your computer or mobile device. Visiting a physical branch or wading through mountains of paperwork is unnecessary.

Here's what you'll need to open an account:

- Your Business Information

- Your Employer Identification Number (EIN)

- Your Social Security Number (SSN)

It's worth noting that Bluevine requires both an EIN and SSN to open a business checking account. This means that non-U.S. citizens or those outside the U.S. might face some challenges in opening an account if they don't have a social security number.

Features That Set Bluevine Apart

Multiple Sub-Accounts

Bluevine allows you to create up to 5 additional sub-accounts within your main account. Each sub-account comes with its own unique account and routing number, making it easy to organize your finances for different aspects of your business.

Note: If creating and managing a large number of sub-accounts is the most important thing you need in your business, it's worth noting that other online banking platforms will allow for more if you want to investigate those options. Mercury allows up to 15, and Relay allows up to 20.

Automated Transfers

Bluevine offers what they call “auto-transfer rules.” These allow you to set up automatic transfers between your main account and sub-accounts based on your defined rules. For example, you could automatically transfer 10% of every incoming deposit to a specific sub-account for taxes or savings.

High-Yield Checking Accounts

Unlike most banks, which will give you practically no return on the cash you have parked in your accounts, Bluevine offers a pretty decent APY on your money. Depending on how much money you have in your account and/or what kind of plan you pay for, the return gets even better.

At the time of this writing, the Premier Plan offers up to 4.25% APY on balances up to $3 million (note: the Premier Plan costs $95/mo, but the fee can be waived if you have at least $100K in your accounts and spend at least $5K each billing period with their Bluevine debit card).

Otherwise, if you stick with the free Standard Plan, you can get 2.0% APY on balances up to $250K. It's not quite as impressive as the Premier Plan, but still, it's way better than most banks will offer.

Free Checkbooks

Most online-only banking platforms will allow you to generate checks that are sent to the recipient in the mail, but they don't make it easy to write or print checks off from your home or office. If you have a business that requires writing checks on a regular basis, this could be a problem.

Bluevine is a bit different. They will give you two free checkbooks per year, so if you need a checkbook on hand, you can have it!

Cash Back Credit Card

You can also securely issue physical and virtual cards to trusted team members—with multiple access levels and custom spend limits —so you can earn 1.5% cash back on all your team’s business purchases.

Integrations

Bluevine integrates with QuickBooks, making it easier to keep your accounting up-to-date and accurate.

No Physical Branches? No Problem!

While Bluevine doesn't have physical locations, they've partnered with MoneyPass® to offer free cash withdrawals at over 37,000 ATMs nationwide. You can see all MoneyPass locations here, if you want to find the nearest one to you.

Handling Cash Deposits

For businesses that deal with cash, Bluevine offers solutions through partnerships with Green Dot and Allpoint+. You can deposit cash at over 90,000 Green Dot retail locations or over 1,500 Allpoint+ ATMs. Keep in mind that these services have fees and limits.

Finer Details to Know About Bluevine

Aside from the usual perks of working with an online bank, there are some other unique things to know about how Bluevine works, which may be different from its competitors.

Fees for Sending Wires

Most online banks are fee-free, but you must pay fees when sending domestic or international wires, and Bluevine is no different.

- Outgoing wires are $15 on the standard plan, $12 on the plus plan, and $7.50 on the premier plan.

- Outgoing international wires in USD are $25 on the standard plan, $20 on the plus plan, and $12.50 on the premier plan.

For comparison, I pay $40 for international wires and $25 for domestic wires from my Chase Business bank account. So, even though Bluevine has fees, they're not as expensive as one of the bigger banks.

Bluevine Loan Products

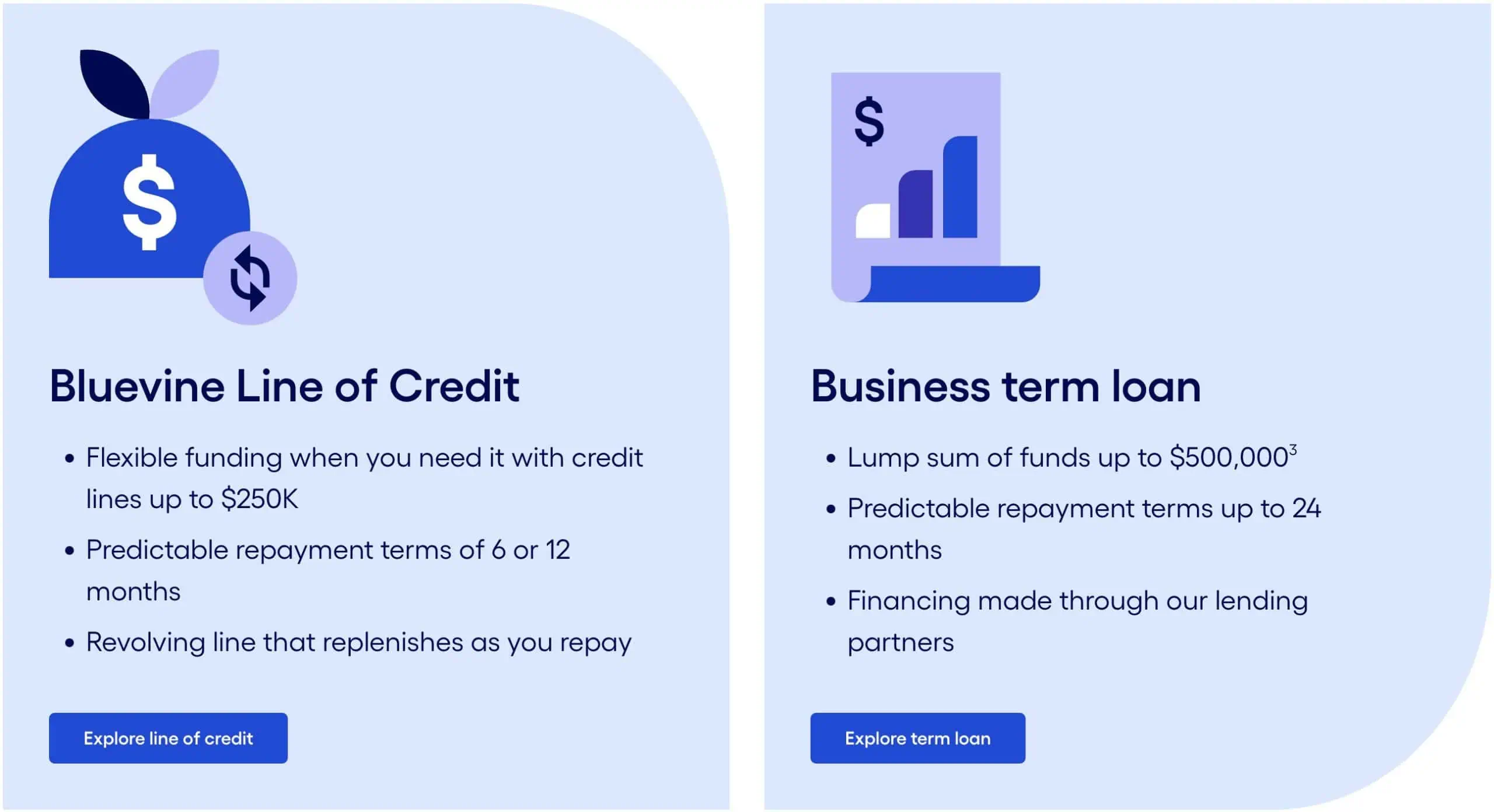

Unlike every other online banking platform I've reviewed, Bluevine is the only one that actually offers loans!

They currently offer a Business Line of Credit and a Term Loan.

Remember, if you're a land investor like me, you may not get approval for these types of loans, as our business model is somewhat unusual.

I've also heard from some colleagues who have gotten lines of credit from Bluevine that the interest rate is quite high.

Nevertheless, if you can get the LOC paid back quickly, it can be a great resource for fast cash if you need it.

The Drawbacks

While Bluevine offers some serious advantages, it's important to consider the potential drawbacks:

- Limited Sub-Accounts: While creating sub-accounts is easy, you're limited to 5 additional accounts. This might not be enough for businesses with complex financial structures.

- Wire Fees: Bluevine charges for outgoing wires, with fees varying based on your plan level.

- Cash Deposit Fees: While you can deposit cash, there are fees associated with this service.

- Limited International Services: Bluevine may not be the best choice for businesses with significant international operations.

- Checkbooks: Bluevine will print and mail checks for you, and you can get two free checkbooks a year. However, if your business frequently requires that you write checks from your account each day, Bluevine may not be the best fit for you.

Customer Support

If you need help, Bluevine offers customer support by phone Monday through Friday, 8 AM–8 PM ET, excluding Federal Reserve Bank holidays. They also provide email support for less urgent inquiries.

The Bottom Line

Bluevine offers a compelling package for many small businesses and startups. With its quick setup process, multiple sub-accounts, and innovative features like auto transfer rules, it addresses many pain points business owners face with traditional banks.

However, like all online-only banking platforms, it does not have any brick-and-mortar locations, so it may not be the best fit for businesses that deal heavily in cash, require extensive international banking services, or need more than five sub-accounts.

As with any financial decision, it's important to carefully consider your business's specific needs and compare multiple options before choosing. Bluevine's modern approach to business banking could be just what your company needs to streamline its financial management and focus on growth.

Remember, while Bluevine isn't a bank itself, your funds are FDIC insured through their partnership with Coastal Community Bank. This gives you the innovation of a fintech company with the security of a traditional bank – truly the best of both worlds.

Whether you're a tech startup, a small local business, or somewhere in between, Bluevine's business checking account is worth considering as you explore your banking options. It might just be the financial partner your business has been looking for.