REtipster features products and services we find useful. If you buy something through the links below, we may receive a referral fee, which helps support our work. Learn more.

Imagine running your business smoothly, focusing on growth and innovation, while someone else handles all your bookkeeping and tax filings.

Sounds too good to be true, right?

This is the dream for most business owners because many of us are not strong in bookkeeping and accounting, and it's not always easy to know where or how to find the right person for this job without costing an arm and a leg.

Well, that's exactly what Doola promises to deliver.

With renowned investors like Graham Stephan, Alex Lieberman, and Codie Sanchez backing and promoting it, Doola isn't just another financial management service—it's a huge game-changer you need to know about!

In the next few minutes, we'll dive into what makes Doola stand out and how it can simplify your business finances, no matter where you are in the world.

What Is Doola?

Doola serves customers in over 160 different countries who need to file taxes in the United States on an ongoing basis.

When we think about bookkeeping and tax preparation, we think of software like Quickbooks or TurboTax, but Doola is much different.

With software like Quickbooks, you need to know how to do it and use their software to implement it, but with Doola, you can upload your bank statements to your appointed CPA through Doola's secure portal, and they will review everything and file your taxes.

In some cases, they may need additional information, like financial statements, business expenditures made from your personal bank, and the address details of the US company's owners. Your Doola-appointed CPA will contact you for any information or clarification they may need, but for the most part, they take control and lead the tax filing process.

The idea behind Doola is that you won't need to find and hire a local CPA—your Doola-appointed CPA will handle it all at a much lower cost and more conveniently. You just send them your bank statements and any supplemental info they request, and they handle the rest.

If you want to use Doola to file your taxes, they will migrate all your data (including your registered agent, if you have one) over to Doola. They also give you tax filings and a dedicated account manager.

Communicating With Your Doola CPA

When I first learned about how Doola works, one of my questions was,

How often do I have phone or email contact with my CPA? Are they available on-demand? Am I limited to a once-a-year phone call, or is it strictly limited to email?

I wanted to get a feel for how this relationship would compare to the CPA I've worked with for years, whom I can call anytime and answer my questions for a hefty fee.

With Doola, the process starts with a CPA call to initiate the tax filing process, and from then on, communication through email is sufficient for most people. Due to the high volume of tax returns they process, they are not available on demand, so if you want help or have questions, you'll have to schedule an appointment with them, which is usually available the next day.

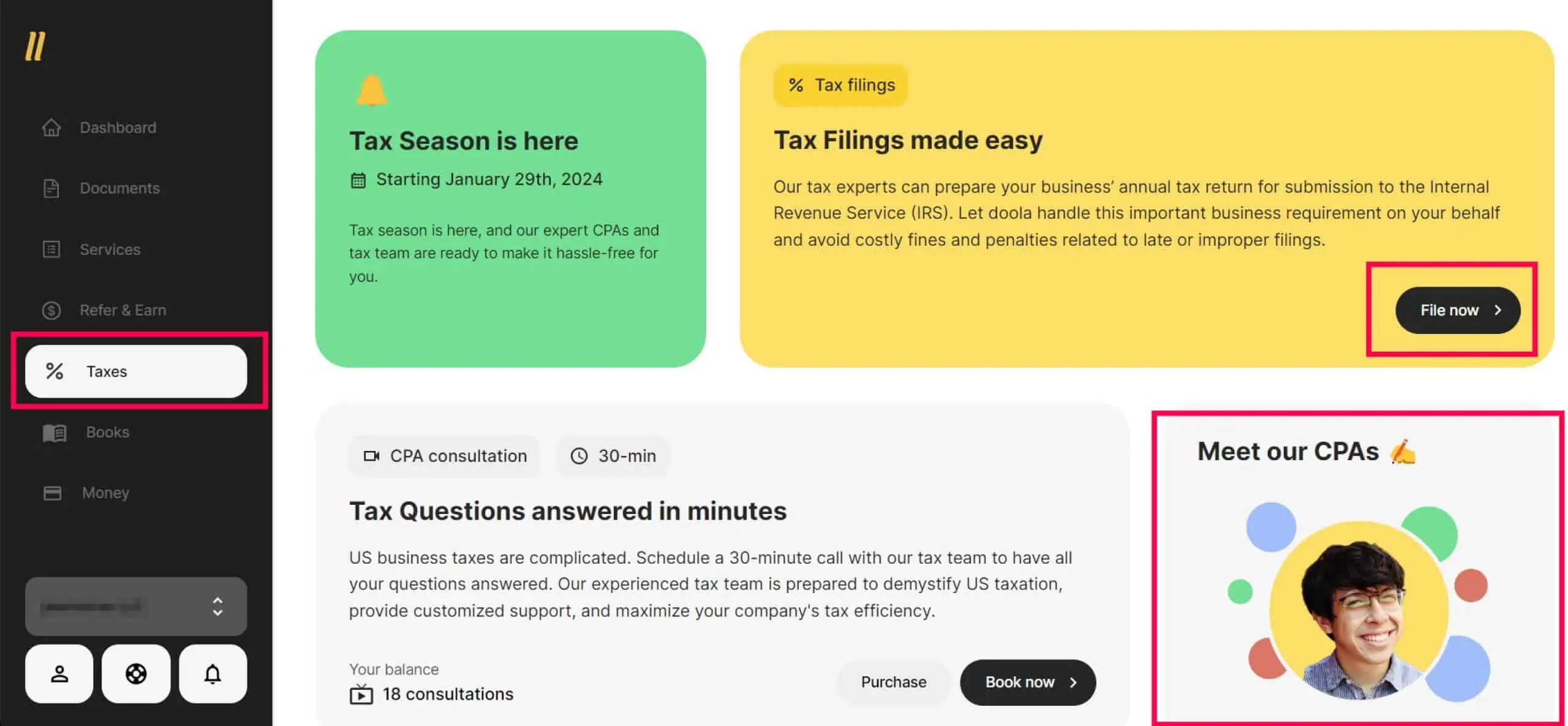

They don't have any mandatory once-a-year phone calls. Instead, they offer a one-on-one, 30-minute CPA consulting where you can meet with your CPA and discuss your tax questions at length.

Tax Strategy and Investment Advice?

I get a good amount of investment advice, tax strategy, and ideas on minimizing my annual tax burden from my current CPA every year.

Doola CPAs can offer tax strategy advice, but they cannot provide investment advice.

As long as the CPA has a brief on your situation, they can come to the meeting well-researched and address all your questions. Doola handles the bookkeeping and tax filings, of course. The CPA can look at each situation individually and offer specialized, applicable advice. You can come to the table with well-thought-out and well-articulated questions on where you need help.

What About Personal Tax Returns?

Currently, Doola does not offer any help with personal tax returns. Their primary objective is to prepare business tax returns.

I've been told they have this on their product roadmap, but they do not have a timeline for when it will be available.

Any Discounts On Multiple Entities?

If you have multiple LLCs or business entities, Doola offers a discount.

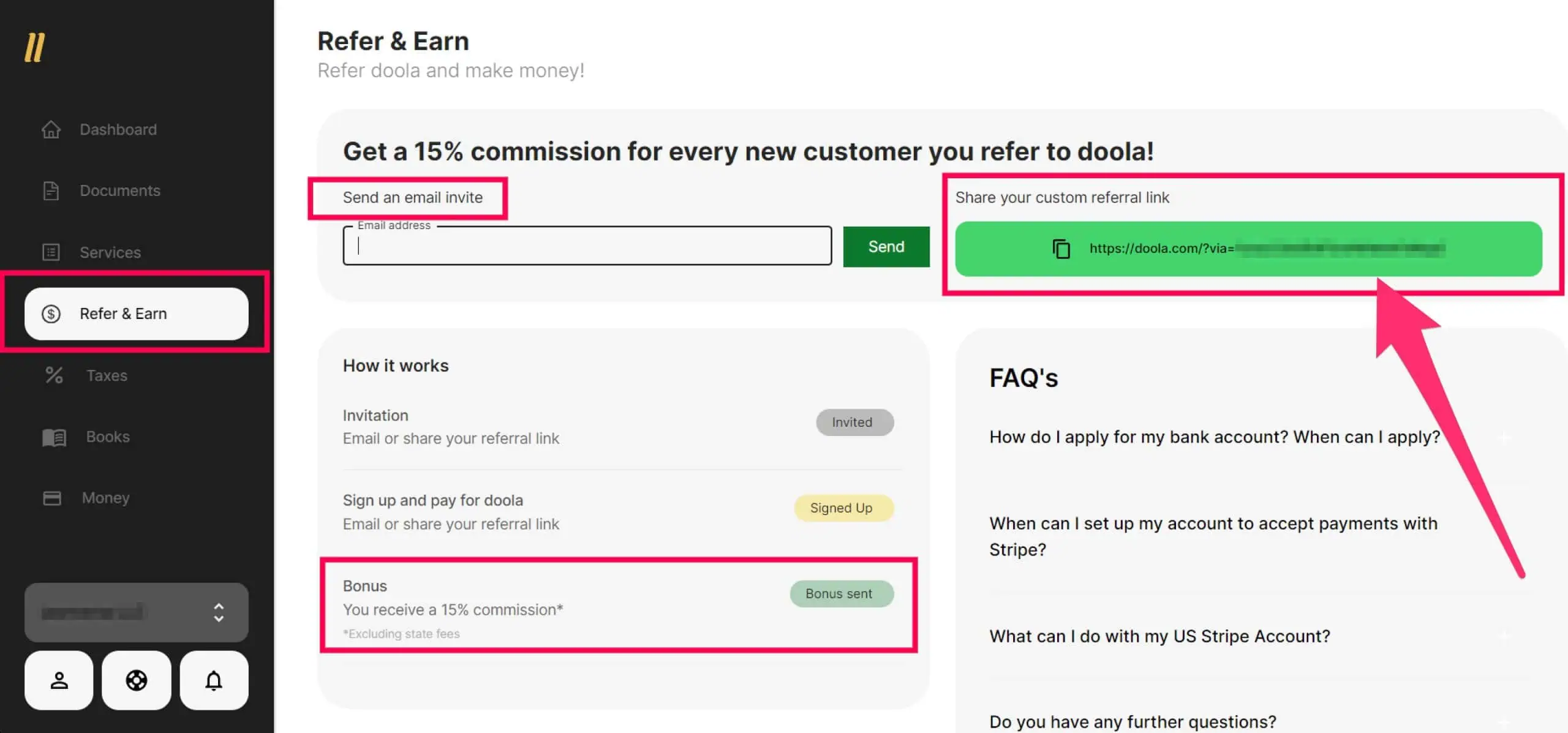

Once you sign up for your first entity, you can access your own Doola referral link right on the Doola dashboard.

Doola offers a 15% commission on their fees for all future entities signed up using your referral link. The 15% commission is paid to you after 30 days. You can invite folks directly from the Doola dashboard itself.

Who Is Doola For?

At this time, about half of Doola's customers are international (outside the U.S.).

International business owners have much to gain from this kind of service. Since they're living outside the U.S., they have to maintain a “virtual” relationship with their CPA anyway. Doola allows them to get most of the same benefits but at a significantly lower price than hiring a conventional CPA in the United States.

Doola also has proprietary software designed specifically to help business owners upload their documents securely. Depending on which CPA you work with, even the more expensive, conventional ones in the States often don't make it as easy and streamlined to upload this financial information securely.

How Much Does Doola Cost?

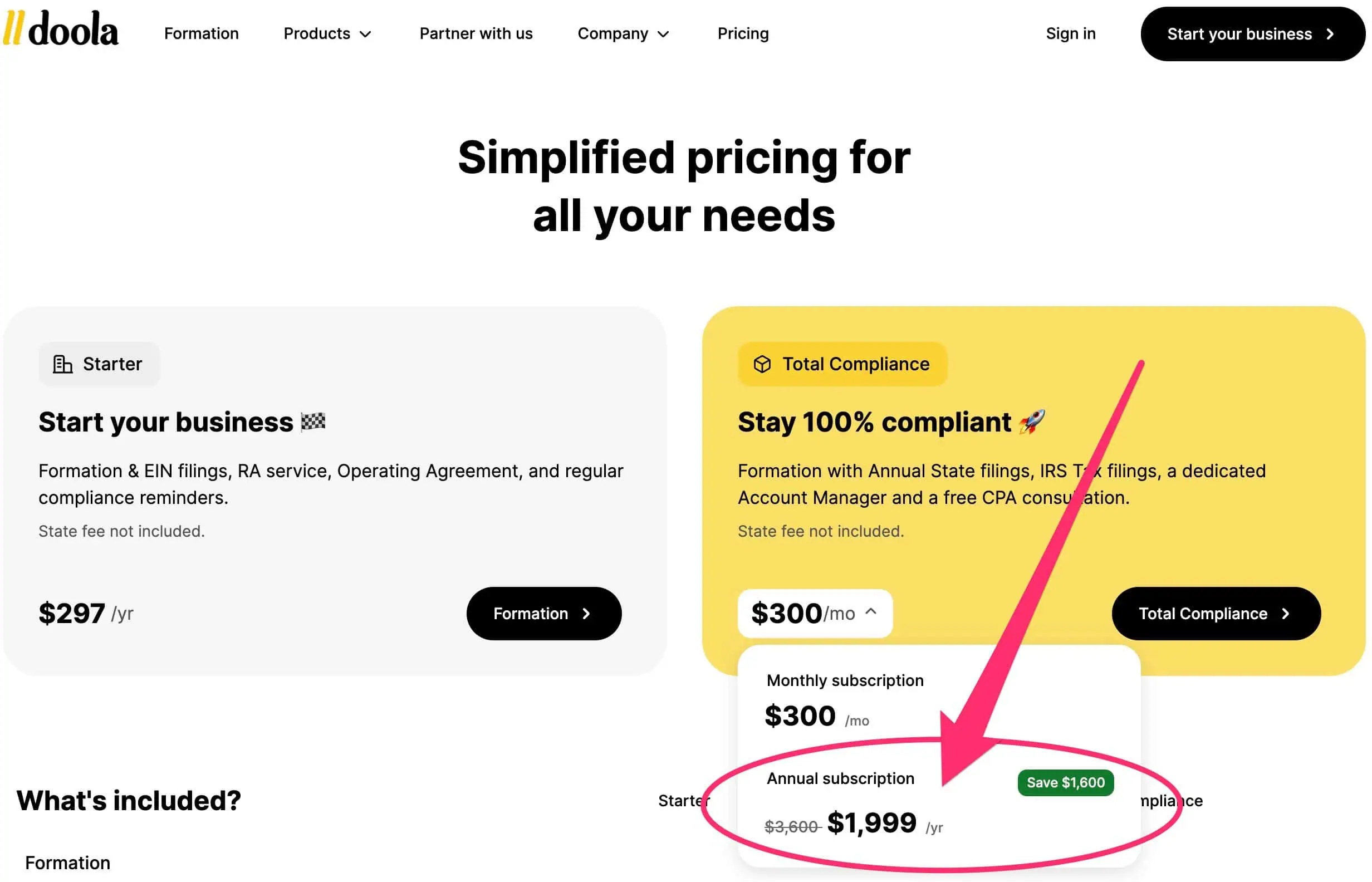

At the time of this writing, the cost of the annual plan with Doola is $1,999 per year or $300 per month for the monthly plan.

In my opinion, this is one of Doola's strongest selling points. I can't recall a year when I've paid less than $2K over 12 months for my CPA. I've spent well over $6,000 per year on it for the past few years.

Don't get me wrong, their help has been great, and I value their service, but it still gets a little pricey.

If you're in the early stages of your business or have a limited budget for what you can pay for this kind of help, Doola offers a good amount of value without breaking the bank.

Before you go…

Now that you've found a hassle-free way to handle your business bookkeeping and taxes with Doola, check out our guide on How to Start Your Corporation or LLC (It's Easier Than You Think!) next. This step-by-step tutorial covers everything you need to know to get your new business entity set up quickly and efficiently. Whether you're starting a new LLC or need help managing your finances, these resources can make the process much simpler.