REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

Have you ever wanted to control a property and make serious money from it WITHOUT putting up the cash or taking on any debt to buy it yourself?

It can be done through the use of an Option.

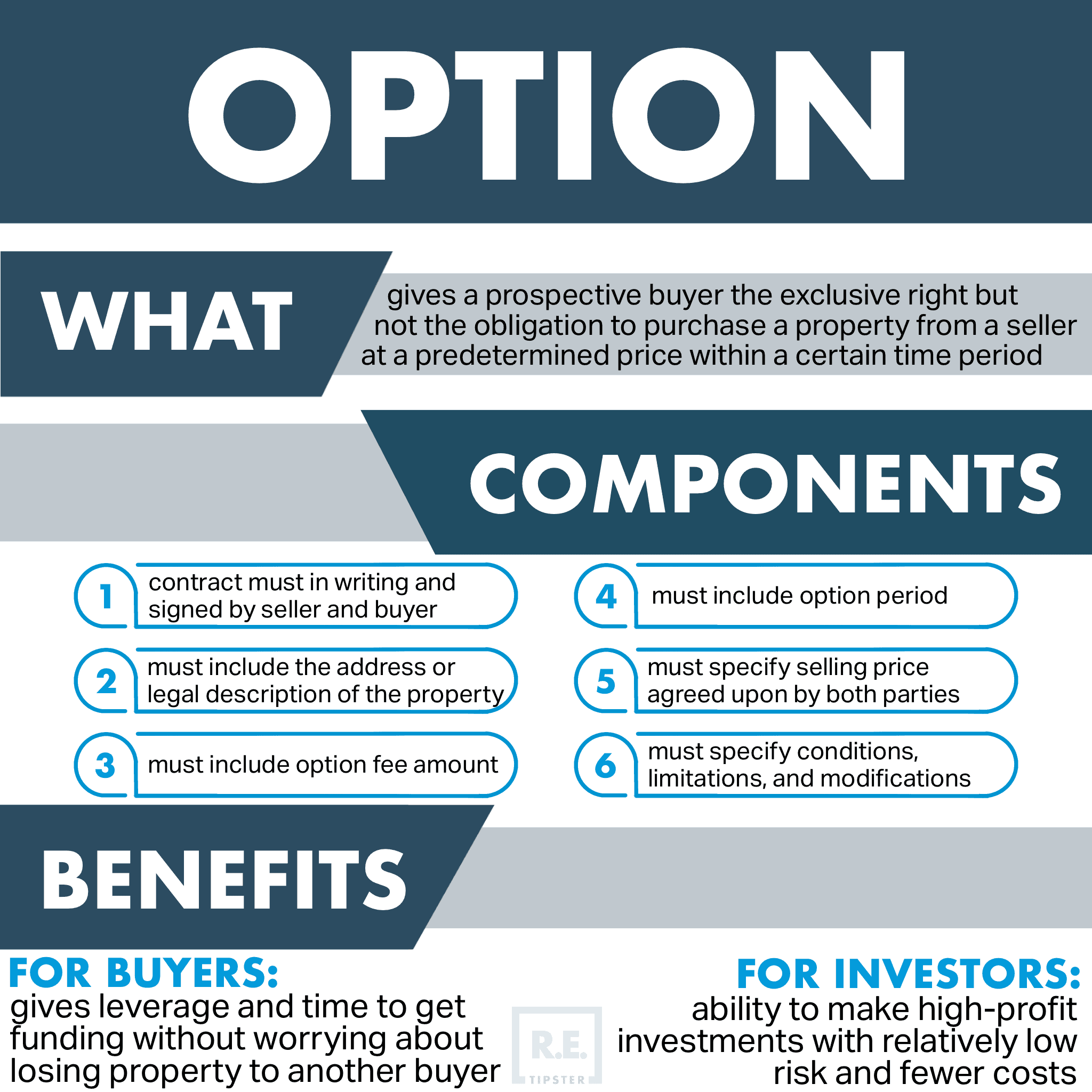

What Is An Option?

An “Option” is a formal agreement that gives a prospective buyer (Optionee) the exclusive right but not the obligation to purchase a property from a seller (Optionor) at a pre-determined price within a certain period of time.

This agreement creates a one-way street where the seller is obligated to sell, but the buyer is not obligated to buy. This means the buyer (Optionee) can control a property, without owning it, for the duration of that contract.

Why Use An Option?

Options are a great tool to use when you find a property you might want to buy, but there are some specific and important questions you haven't been able to answer yet.

For example, when buying a parcel of vacant land, it's not uncommon to have some uncertainties about the deal. Some common questions might be:

- “Will I be able to find a buyer who will pay a higher price for this property in the future?”

- “Is this property even worth the value I think it is?”

- “Will the local officials approve my request for a zoning change?”

- “Can I get the approvals I need to subdivide?”

- “Will the property pass all the inspections needed to build?”

- “Does this property have any hidden problems requiring more investigation time?”

An Option is an effective way to take a property off the market for a limited time, so the Buyer/Optionee (that's you) can answer these questions and figure out how to make money from the deal before the Option expires.

Ideally, the Optionee will be able to get answers to their questions during this period and solidify their decision to buy the property or walk away from the deal.

Example 1: The Developer

Suppose a big developer wants to combine several adjoining parcels from different landowners to build a mall.

Since they will have to negotiate with several different owners, it wouldn't be wise to commit to buying all the parcels before they know everyone will sell at a reasonable price.

The only practical way to pursue multiple properties like this is to sign an Option with each property owner. Once the developer controls every property needed for the development, they can exercise all of the Options at once, close on each property and proceed with the next stages of development.

In this kind of all-or-nothing scenario, if one property owner says “no,” it will kill the whole deal because the developer wouldn't want to be locked into buying all the other parcels for a project that isn't feasible anymore.

Example 2: The Wholesaler

Suppose a real estate wholesaler finds a good property, but the most they can offer is 50% of the property's market value, while the seller wants 70%.

It's still a good deal at 70% of market value, but it's more than the wholesaler is willing to pay. If that wholesaler has another buyer lined up, ready to pay 90% or more of market value, it could be a deal, but not until they find that person.

An Option can bridge the gap between the wholesaler's uncertainty and the seller's needs because it buys the wholesaler time to find that new buyer to step in and close (similar to how an assignment works).

And with an Option, if the wholesaler can't find another buyer, they can just walk away from the deal without sinking their limited resources into a deal that wouldn't be profitable.

Example 3: The Home Buyer

Let's say a homebuyer finds a $2 million house, and the seller is willing to sell the property for $1 million.

It's a great deal, but the homebuyer doesn't have $1 million cash. They need time to get approved for the financing and do thorough due diligence on the property, and with a larger purchase price like this, it wouldn't be uncommon for the process to take longer than 30 days.

One solution would be to ask the seller to sign an Option for 90-days.

If the seller is willing to do this, it will give the homebuyer the extra time they need to ensure all the boxes are checked and they have the funding to close.

Example 4: The Speculative Investor

Perhaps there's an area of town where you've heard rumors of a BIG new development (like a new Costco or sports stadium being built). The land in the surrounding area will skyrocket in value, but only if the development actually happens.

One way to play this would be to lock up a property with an Option for three years. This would give you enough time to wait and see if the development comes to fruition.

If it does, you can exercise the Option and purchase. If it doesn't, you can walk from the deal without wasting money on a speculative investment that doesn't pan out.

Options Buy You Time

One of the biggest challenges with buying an investment property is that we don't know the future.

We can make educated guesses all day long, but what if our guesses aren't very educated yet?

What if there are HUGE consequences for making the wrong assumptions?

What if we just need more time to put the pieces together?

This is where Options shine. For a significantly lower cost, you can take the same property off the market for a limited time while you work to solve problems and answer questions that will allow you to move forward with confidence.

How Long Should an Option Last?

The “term” or time length of an Option depends on the proposed buyer's needs and how motivated the seller is to sell their property.

A relatively short Option term would be 30 – 90 days and would make sense for a buyer who just needs more time to secure financing before closing.

An Option term of 120 – 180 days would often make sense for a wholesaler trying to find a buyer to step in and do an assignment or double closing.

A longer Option term could be anywhere from 180 days – 5 years, which would make sense for a speculative buyer who needs to wait and see if growth continues in the area or for a developer who is working to secure Options with several other property owners before buying all the land together simultaneously.

A longer period will be more advantageous for the buyer, and a shorter period will be more advantageous for the seller.

If a buyer needs more time than a seller is willing to give, one way to accommodate the seller for a longer term is to pay them a higher Option Fee to compensate them for the time they will have to wait.

An Option can also be written with a clause that allows the agreement to be extended for more time if necessary, but again, this depends on the seller's willingness to include this in the list of provisions in the agreement.

Generally, there is no time limit for how long an Option can last. For example, it could last for successive ten-year periods. However, there must be some kind of stated timeline. If the term is indefinite, a court will imply a reasonable time. A “reasonable” time depends on the parties' intent and the Option's purpose.

How Much Does An Option Cost?

When an Option is signed by both parties, the prospective buyer typically pays an Option Fee or “consideration” to the prospective seller.

Most Option Fees are a flat amount or a small percentage of the sale price to enter into the Option contract.

There is no specific standard for how much this fee needs to be, but there are a couple of factors to consider:

- The Optionor is taking the property off the market for the Option term, so the longer the term, the higher the Option Fee will be.

- The Option Fee is often based on the fair market value of the real estate. The higher the value of the property, the greater the amount of the option fee. For example, an option fee on a property valued at $1,000,000 could be $25,000 or more.

But, with all that said, there is no hard and fast “rule” about the fee amount. If the seller is willing to accept $100, $10, or $1, it could be this low. An Option is not enforceable if there is no Option Fee, and this fee needs to be distinguished from the purchase price.

At least part of the Option Fee should be paid when the Option is signed, even if it is a small amount. The Option could provide that the rest of the Option Fee shall be paid when the Option is exercised. From a legal perspective, the Option Fee must be paid before obtaining the Option. If the Option Fee isn’t paid when the Option is executed, the Optionee hasn’t paid any consideration to receive an Option. Therefore, the Option would fail for lack of consideration.

Does the Option Fee Get Applied to the Purchase Price?

Depending on how the Option Agreement is worded, the Option Fee may or may not be applied to the final purchase price if/when the buyer (Optionee) exercises their right to purchase.

In my agreement template, I have it worded so that the Option Fee will be applied to the purchase price, but (unlike an earnest money deposit for a purchase agreement), this is not a hard and fast rule for whether Option Fees get applied to the eventual purchase price.

Right to Rescind Language

In most Option Agreements, if the Option's term expires before the buyer exercises their right to purchase, the Option Fee will go ‘hard,' and the money is non-refundable. Even though an Option costs significantly less than buying the property outright, there is still a cost.

However, it is possible to include a “Right to Rescind” in the original Option Agreement. With this language, if the contingencies are not satisfied, the Optionee (Buyer) may have a right to notify the Optionor (Seller) that the Option is being canceled and the Option Fee is to be returned to the Optionee. Here's an example of how that language might look, if you choose to include it:

RIGHT TO RESCIND: The Optionee shall have the right to terminate this Option at any time and without any further obligation of any kind whatsoever by giving written notice to the Optionor. Upon receipt of written notice from the Optionee, the Optionor shall promptly refund the Option Fee in full to the Optionee.

It's a similar concept to getting a refund of an earnest money deposit if contingencies are not satisfied. If the buyer provides written notice to the seller before the contract's expiration, 100% of that money is refundable.

However, keep in mind, when paying the Option Fee, this money is usually held by the Optionor, not a title company, as it would be for an earnest deposit.

Unlike an earnest deposit for a normal Purchase Agreement (normally paid to a title company or closing agent), an Option Fee is not held by a title company because it is unknown whether the option will ever be exercised. Since the Optionor is holding this money, you would need to consider how realistic it will be to get his money back, even if the correct language is included in your contract.

Recording an Option Memorandum

While not required, one action the Optinee can do to protect their interests is to prepare and record a Memorandum of Option with the county.

This will notify subsequent buyers and sellers that the property is subject to an option (effectively, it will be much harder for the Optionor to sell the property to someone else while your Option is in effect).

Exercising the Option

If and when the day comes that you're ready to exercise your Option and proceed with closing, this can be done by completing an Exercise of Option form and sending it to the Optionor (Seller).

Since this document will trigger the wheels to start moving toward closing, you'll want to know when it was delivered to the Optionor/Seller. You can do this by mailing it to the Optionor with delivery confirmation AND emailing it to them with email tracking, so you can verify when your email was seen by the recipient.

Once this is received by the Optionor, the Option Agreement effectively becomes your Purchase Agreement, and you can proceed with closing, following the terms written in your Option (no need to fill out any additional paperwork).

The notice must be sent before the Option's expiration and exercised on the exact terms and conditions as in the Option Agreement. In other words, don't put extraneous information in the exercise notice that may be interpreted as creating additional terms and conditions.

What If the Optionor Ghosts Me?

If you have a big Option Fee on the line and you're worried about the Optionor not following through, you can have the fee held by a title company. This isn't necessarily the norm for how all Options work, but it can be one way to give yourself some security if the Optionor decides to leave you out in the cold.

You can also add a paragraph to your Option stating that the prevailing party can get reimbursed for legal fees.

How to Make Money With Options

There are a few key ways to make money with an Option Agreement.

1. Assign the Option to Another Buyer

Are you familiar with how assignments work? Well, the same concept applies here!

The only difference is that instead of assigning a Purchase Agreement, you can assign your Option to another buyer, provided the correct language is included in your Option Agreement.

Note: You'll find this language included if you use my templates at the bottom of this blog post.

The only technical difference is that when you assign an Option, you're assigning a non-committal contract instead of a document that implies your commitment to close (a Purchase Agreement).

Keep in mind that if you intend to assign your Option, it's important to be very clear with the original seller (Optionor) and the new prospective buyer (Optionee) when you sign your agreements with them. You want to eliminate any confusion about who will be stepping into the deal and who will be stepping out.

See this blog post for an example of how you can explain this to both parties.

You should also communicate with both parties until the closing process is finished to ensure the deal gets done. Don't just abandon the deal once you have your money.

Provide a good experience for both parties and stay in communication with them (and their title company) to ensure the deal still moves through the closing process.

2. Exercise the Option to Buy

If you intend to buy the property, either to develop it or just to lock up a good deal, you will need to exercise your option to buy before the term of the Option expires.

Why would you exercise the Option and buy it yourself?

There are many potential reasons to start with an Option before you make a final decision to buy. Here are just a few examples:

- You have another buyer lined up but need time to close, and your Option is about to expire, and the seller isn't willing to renew or extend the Option's term. If you don't buy it now, you and your future buyer will lose the deal.

- You're confident you'll be able to sell the property at a higher price eventually, and you're okay with taking on the “risk” of sinking your cash into the deal while you wait for the right buyer to come along.

- You have a plan to develop the property and need extra time to get your approvals or entitlements. The Option will give you time to check all the necessary boxes until you're ready to purchase the property and proceed with your plans.

The biggest underlying benefit an Option gives you is time, so you can obtain whatever certainty you need before closing instead of rolling the dice on a speculative purchase.

How to Exercise and Close an Option

If you decide to exercise an Option, the next step is to prepare a second document called the Notice of Exercise of Option to Purchase. This simple, 1-page document informs the seller (Optionee) that you're ready to close and what/when/where the next steps will be.

If you assigned your Option to another party (or if the Option was assigned to you), then this new party (the Assignee) would need to exercise the Option and proceed through the closing process.

When exercising an Option, the next step is to bring it to your title company. You'll want to be sure you're working with a title company that understands how to close these transactions (especially if an assignment is involved). There are a few different scenarios for how an Option can be closed.

Straight Purchase

If you are the Optionor and you're planning to buy the property yourself, it's pretty simple. You can exercise the Option and sign documents with the title company.

Assignment

Sometimes, you may want to assign your rights in the Option to another party. This process is very similar to assigning a Purchase Agreement.

In this scenario, you are selling (aka – assigning) a piece of paper (the Option) to another party and collecting an assignment fee. This other party (the Assignee) can then step into your shoes and exercise the Option and close if they choose, abiding by all the terms of the original Option Agreement.

Double Closing

In other cases, you may want to do a double closing instead of an assignment. This is a slightly more complex closing maneuver, and the main reason behind this strategy is to keep your profit hidden from the original seller and your end buyer.

If you take this approach, it's very helpful if you can find a title company that can close the deal using single-source funding, which means they can use the end buyer's funds to fund both transactions (the A-to-B closing from the Seller to You, and the B-to-C closing from You to the End-Buyer).

Not all of them do, so you may need to shop in your local market to find one.

Why Don't We Always Use Options?

With all the flexibility afforded by Options, you may be wondering,

“Why don't we ALWAYS use Options instead of buying the property outright?”

It's a reasonable question. After all, if we could mitigate 99.9% of our risk, make higher offers, and NOT tie up our cash with a deal that might not work out, why wouldn't we always lead with this kind of offer?

You technically could, and some people do (hint: if you have little or no operating capital, this could be one way to get in the game without any cash), but most sellers want your commitment to buy now instead of maybe buying later.

Think about it from the seller's standpoint.

Suppose you own a $100,000 property that you're desperately trying to sell. All of a sudden, two offers come in on the same day:

- Option at $90,000 with a 180-day term

- Cash Offer at $70,000 with a 14-day closing deadline

If you're motivated to sell and need the money now, which would you take?

On the other hand, if you're not motivated to sell and you're fine with waiting for a higher price on a sale that may never close, you'd probably be more inclined to take the Option.

An Option is very non-committal on behalf of the buyer. It's great for the buyer because it gives them “options” (hence the name) while locking the seller into a certain price and period of time.

Since the prospective buyer (Optionee) is holding most of the cards in an Option Agreement, most sellers will only agree to an Option if:

- They need to sell ASAP, and they don't have any better offers.

- The purchase price in the Option is high enough that the seller is willing to take a chance on the deal because, if it does close, the seller will get paid enough to justify the long wait time and lack of guarantee.

Different Tools for Different Problems

You wouldn't use a hammer to pound a screw, right? Of course not!

You'd use a screwdriver on a screw!

A hammer certainly has uses, but you don't use it on every situation you encounter.

In the same way, every seller is different, and different tools are required to solve different problems.

If you try to use the same tool (like a low cash offer) to solve EVERY problem and satisfy EVERY seller you encounter, you'll miss a lot of opportunities!

If you find a seller who wants more than your low can offer, an Option may be the tool that can get the job done… but it can only work if you're aware of the tool and how to use it.

Want My Option Templates?

There are plenty of places online where you can find an existing Option Agreement template. The problem I found was that these templates are either,

- Way too long and complicated, written by attorneys who are paid to insert every possible scenario, most of which the average land investor will never encounter, OR

- They are written for certain types of buyers that don't apply to the uses above.

I spent a lot of time and money with my attorney to craft set templates that would be simple, easy to understand, and spell out only the issues that mattered to me.

We also came up with all the supplemental documents that often come into play (like the Assignment of Option Agreement, the Notice to Exercise, the Memorandum of Option, and a Cover Letter to help explain the offer and give some compelling reasons for a seller to enter into this type of transaction.

It cost me thousands to create these for myself, but you can get them at a small fraction of what I had to pay.

Here's What You'll Get

- Option Cover Letter

- Option Agreement (Version A)

- Option Agreement (Version B)

- Memorandum of Option

- Exercise of Option to Purchase

- Assignment of Option Agreement Agreement

- Video Tutorials Explaining Each Document

If you've scrolled this far, you probably know I care a lot about doing things right.

I've spent a lot of time and money working with different attorneys and investors to try and nail down the PERFECT set of Option Agreement templates.

After obsessing about this and going back and forth for many months, I think we finally landed on a solid set of documents.

If you want to use the templates I put together for myself, you can get them right here!

Additional Resources

I've explained all the basics of Options above, but sometimes it's helpful to hear the same thing explained differently. You can find those below if you're looking for ideas and examples from other industry experts.

Options | Creative Real Estate Investing for Beginners

Matt Theriault of Epic Real Estate does a great job cramming A LOT of information into 7 minutes above.

Real Estate Option Agreement Template

The templates I use are sufficient for most purposes, and I put them together with my attorney in a way that would make them short, simple, and easy to understand.

However, some Option templates are much longer and more detailed, which may be appropriate, depending on the specifics and complexities of the deal. For a detailed walkthrough of such a template, William Dolan from Dolan Law goes line-by-line through his document below.

Mitch Stephen from 1000houses.com gives a quick overview in this explanation below.