What Is Bitcoin?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Shortcuts

- Bitcoin is a type of cryptocurrency and the first of its kind, peer-to-peer, decentralized digital currency.

- Bitcoin allows individuals to send and receive payments directly to and from one another without an intermediary such as a traditional banking system.

- Each Bitcoin transaction is recorded in the Bitcoin blockchain, a digital ledger secured by cryptographic rules.

- Bitcoin is scarce, divisible, countable, and fungible enough to be used as a good unit of account, medium of exchange, and store of value.

- Bitcoin is not fully immune to hacking, but its blockchain is extremely difficult to corrupt because of its proof-of-work consensus mechanism and massive miner network.

How Does Bitcoin Work?

Like many cryptocurrencies (popularly known as “crypto”), Bitcoin allows individuals to send and receive payments directly to each other without an intermediary (such as a bank)[1].

In other words, users can transfer Bitcoin to and from their electronic wallets, like email (as opposed to regular payments, which usually go through a bank or some other form of middleman to approve the process). A Bitcoin wallet can only send and receive Bitcoins.

When a user sends Bitcoins, this action is broadcast to a network of “Bitcoin miners” that process the data. This network validates the transaction using a distributed consensus (i.e., unanimously) and, when validated by Bitcoin protocol, encodes them into a decentralized ledger called a blockchain.

True to its name, each block in the Bitcoin blockchain contains a number of transactions. Each transaction contains details of the sender and recipient and the amount of Bitcoin being transferred.

Finally, the entire system is secured by cryptographic rules. The mining network enforces the transaction to be encoded chronologically and enforces strict cryptography. Using this method, consumers in the Bitcoin network cannot modify blockchain data once encoded, because it will invalidate the rest of the previous transactions and blocks in the chain.

This, among other rules, make Bitcoin—or any cryptocurrency based on blockchain—difficult to hack and manipulate.

Is Bitcoin Real Money?

Bitcoin meets all of the traditional requirements of money:

- Countable, divisible, and fungible. These characteristics make Bitcoin a good unit of account (i.e., one can use it to value goods and record debts, payments, and other financial transactions).

- Medium of exchange. One can send it to another party through its decentralized network of independent miners that own and maintain the machines necessary to validate and confirm transactions.

- Store of value. Its price has increased substantially since it was first mined in 2009[2]. As long as the growth of its value outpaces the inflation rate, it can preserve one’s purchasing power[3].

Even during times of uncertainty with Bitcoin and other cryptocurrencies, the Bitcoin price has remained high due to the law of supply and demand[4]. Moreover, its adoption rate rises as it matures as a technology and asset[5].

As its demand increases, its remaining supply continuously decreases due to its fixed quantity of 21 million[6]. Of these 21 million finite Bitcoins, Satoshi Nakamoto holds 750,000 to 1.1 million[7].

Bitcoin’s minting schedule[8] is also widely publicized as a matter of public information, making its circulation predictable.

Bitcoin vs. Fiat Money

Unlike fiat money backed by a central bank or government, Bitcoin relies only on the market to determine its value.

Based on a broad definition, Bitcoin is a type of commodity money, which is money with an intrinsic value based on the commodity it represents (such as gold or silver). On the other hand, Fiat money has no such value, but its value is based on the trust and faith of the people using it as legal tender.

Can Bitcoin Be Used as Legal Tender?

The idea of embracing Bitcoin as legal tender is attractive in developing countries[9]. Some reasons cited for this move include the ability to trace every unit of currency spent, reduce instances of money laundering, and fairer taxation. In addition, a decentralized cryptocurrency can also eliminate many of the transaction fees assessed by traditional brick-and-mortar banks.

Legal tender means currency recognized by a government or legal system as a valid form of payment for debts, taxes, and other financial obligations.

Examples of countries that have adopted Bitcoin as legal tender include El Salvador (the first country to do so) and the Central African Republic. Because of this status, anyone in these nations can accept Bitcoin to settle any financial obligation without being denied.

However, developed nations whose fiat currencies are in-demand and stable[10] are more immune to this domino effect. Their governments are not keen on giving up control over monetary policy[11].

Can Bitcoin Be Hacked?

Despite being based on blockchain technology and secured by cryptography, Bitcoin is not completely immune to hacking or other bad actors.

Simply put, hacking Bitcoin involves altering the records in its blockchain[12] through proof-of-work[13]. This works by changing the contents in a block and modifying those in the block following it to avoid suspicion[14].

On top of this, one must also win the right to produce as many succeeding blocks as possible. This is the best way to convince the rest of the network that the fraudulent chain is valid[15].

Theoretically, pulling off this series of events is only feasible by carrying out a successful “51% attack,” where the attacker must gain control of at least 51% (hence the majority) of the mining power in the network.

However, doing so costs a staggering amount of money and resources, equivalent to about $10 billion[16]. This malicious party needs a fleet of state-of-the-art Bitcoin mining equipment and considerable energy to power the machines.

Therefore, considering these demanding requirements, blockchain networks as large as Bitcoin’s are unlikely to fall victim to 51% attacks. In addition, it is improbable to accumulate more computing power than the entire Bitcoin mining council and hide it simultaneously.

Ultimately, the prohibitive cost of hacking the Bitcoin network diminishes any incentive to launch a 51% attack. Any party that can afford to do so may find legally mining Bitcoin more economically viable and practical.

Investing in Bitcoin

Bitcoin (and, in a broader sense, crypto) investing can be an excellent way to diversify, but with significant risk.

Bitcoin prices are infamous for being wildly volatile. For example, it has crashed by at least 80% multiple times throughout its history[17]. In fact, in 2012, the Bitcoin Foundation was created to help repair an increasingly negative perception of Bitcoin in the wake of price drops and scandals.

However, its volatility period has slightly lengthened, meaning the Bitcoin price takes more time to crash[18]. The period between crashes may allow new investors to react to crashes in a more timely manner.

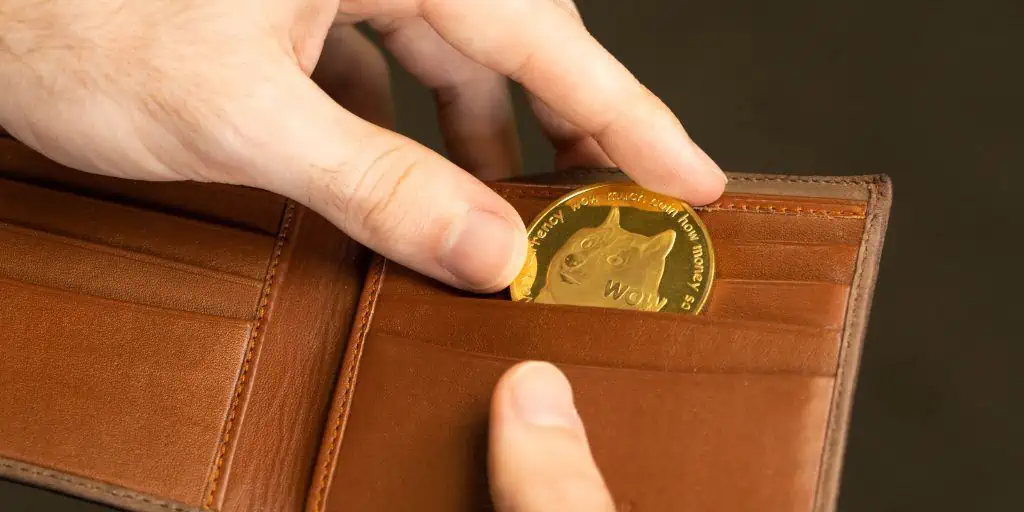

Fortunately, Bitcoin has always bounced back[19]. Unfortunately, the same cannot be said for other, less stable cryptocurrencies, particularly the so-called “meme coins,” which are subject to extreme changes and volatility, even more so than regular crypto.

Dogecoin, a popular meme coin (image by CryptoWallet.com Images, CC BY 2.0, via Wikimedia Commons)

Many cryptocurrency exchanges allow investors to buy Bitcoin and other digital assets. The average investor doesn’t have to engage in crypto mining to access a blockchain ledger; one can buy and sell Bitcoin using an app or service connected to their bank account.

RELATED: HoneyBricks Review: Real Estate Syndications Traded by Token

Sources

- Bitcoin.org. (n.d.) How does Bitcoin work? Retrieved from https://bitcoin.org/en/how-it-works

- Phillips, D. (2021.) The Bitcoin Genesis Block: How It All Started. Decrypt. Retrieved from https://decrypt.co/56934/the-bitcoin-genesis-block-how-it-all-started

- Kolko, C. (2021.) Inflation and Why it Matters. The Summit Federal Credit Union. Retrieved from https://www.summitfcu.org/blog/how-does-inflation-affect-my-money/

- Asmundson, I. (2020.) Supply and Demand: Why Markets Tick. International Monetary Fund. Retrieved from https://www.imf.org/external/pubs/ft/fandd/basics/suppdem.htm

- Mail & Guardian. (2022.) Crypto in 2022: From crypto adoption outpacing the internet, to which sectors are worth watching out for, and everything in between. Retrieved from https://mg.co.za/special-reports/2022-01-25-crypto-in-2022-from-crypto-adoption-outpacing-the-internet-to-which-sectors-are-worth-watching-out-for-and-everything-in-between/

- River Financial. (n.d.) Can Bitcoin’s Hard Cap of 21 Million Be Changed? Retrieved from https://river.com/learn/can-bitcoins-hard-cap-of-21-million-be-changed/

- CNBC TV 18. (2021.) Satoshi Nakamoto’s Bitcoin holding: Here’s how much it is worth now? Retrieved from https://www.cnbctv18.com/cryptocurrency/satoshi-nakamotos-bitcoin-holding-heres-how-much-it-is-worth-now-11608832.htm

- Divine, J. & Reeth, M. (2021.) What Is Bitcoin Halving and Why Does It Matter? U.S. News. Retrieved from https://money.usnews.com/investing/investing-101/articles/bitcoin-halving-101-what-is-it-and-why-does-it-matter

- CoinMarketCap. (2022.) Countries Which Allow Cryptocurrency As Legal Tender. Retrieved from https://coinmarketcap.com/legal-tender-countries/

- CMC Markets. (2022.) What are the strongest currencies in the world? Retrieved from https://www.cmcmarkets.com/en/learn-forex/16-strongest-currencies-in-the-world

- O’Connell, B. (2022.) Monetary Policy: How Central Banks Regulate The Economy. Forbes Advisor. Retrieved from https://www.forbes.com/advisor/investing/monetary-policy/

- Bitcoin.com. (n.d.) How do Bitcoin transactions work? Retrieved from https://www.bitcoin.com/get-started/how-bitcoin-transactions-work/

- AAX Academy. (2022.) Consensus Mechanisms? How PoW, PoS, DPoS, and Other Blockchain Algorithms Work. Retrieved from https://academy.aax.com/en/consensus-mechanisms-how-pow-pos-dpos-and-other-blockchain-algorithms-work/

- Sahu, M. (2020.) What Makes a Blockchain Network Immutable? Immutability Explained. upGrad. Retrieved from https://www.upgrad.com/blog/what-makes-a-blockchain-network-immutable/

- Walker, G. (2020.) Longest Chain. Learnmeabitcoin.com. Retrieved from https://learnmeabitcoin.com/technical/longest-chain

- Coin Telegraph. (2022.) What is a 51% attack and how to detect it? Retrieved from https://cointelegraph.com/news/what-is-a-51-attack-and-how-to-detect-it

- Quast, J. (2021.) Crypto Crash 2021: 2 Lessons From Bitcoin’s History. The Motley Fool. Retrieved from https://www.fool.com/investing/2021/05/21/crypto-crash-2021-3-lessons-from-bitcoin-history/

- Zhang, J. (2022.) Has Bitcoin Become Less Volatile With Global Acceptance? Rebellion Research. Retrieved from https://www.rebellionresearch.com/has-bitcoin-become-less-volatile-with-global-acceptance

- Ozarowski, C. (2022.) Will Crypto Recover? Here’s What You Should Know. GoBankingRates. Retrieved from https://www.gobankingrates.com/investing/crypto/will-crypto-recover/