What Is the Debt-to-Equity Ratio?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Why the D/E Ratio Matters

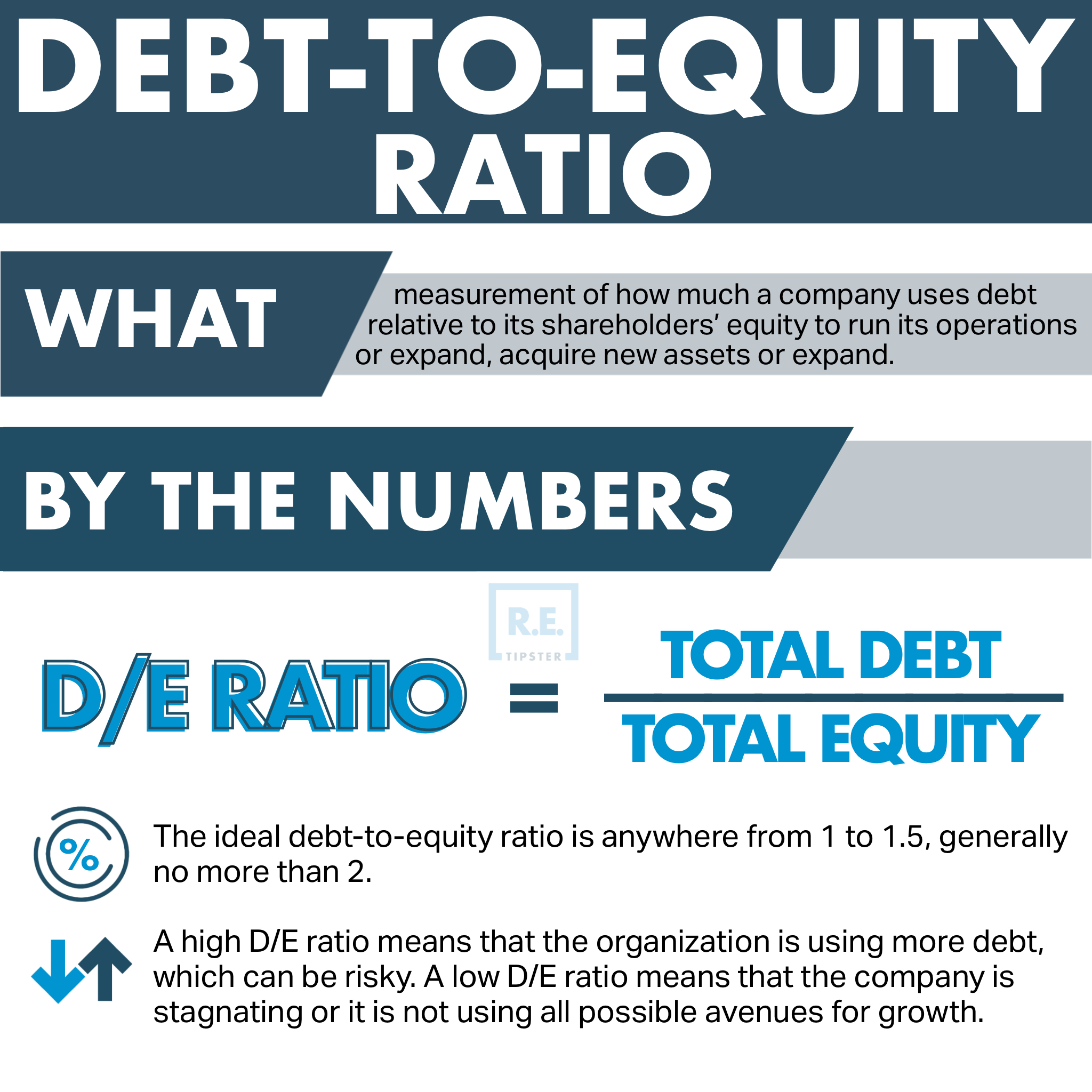

The Debt-to-Equity (D/E) ratio is important because it measures an entity’s financial leverage. Lenders and investors look closely at this ratio to assess each borrower’s financial strength and risk profile.

This ratio is derived by dividing the organization’s debt by its shareholders’ equity[1]. In simpler terms, the D/E ratio measures how much an organization relies on debt to finance its growth[2]. Lenders and investors assess D/E ratios from similar entities or those in the same industry and evaluate their risk based on the organization’s market.

A company with a high D/E ratio is risky for lenders and investors because it may default on its debts. On the other hand, a low D/E ratio may indicate that the company is not expanding as well as it should. Low D/E means the company is stagnating or its creditworthiness is suspect. In addition, a company with an abysmal debt-to-equity ratio exposes itself to the risk of a leveraged buyout[3].

Companies also track D/E ratios to comply with certain loan agreements[4]. Some agreements include requirements to maintain a certain financial ratio level, including a reasonable D/E ratio.

Ideal D/E Ratio

The ideal debt-to-equity ratio is anywhere from 1 to 1.5, generally no more than 2[5].

However, the optimal D/E ratio varies depending on the industry, as some sectors depend more on debt financing than others. Examples are the construction, manufacturing, and finance industries. The companies in these sectors may post D/E ratios greater than 2 because of their extensive investments in operations and assets.

How to Compute the D/E Ratio

The computation of the debt-to-equity ratio is straightforward, as shown below.

- Derive the company’s total liabilities from its balance sheet.

- Also using the balance sheet, compute shareholders’ equity by subtracting the company’s liabilities from its assets.

- Divide total liabilities with shareholders’ equity for the D/E ratio.

For example, a company needs to calculate its debt-to-equity ratio and present it in its application for funding. Its total liabilities are $200,000, and shareholders’ equity is $100,000.

Debt-to-equity ratio = 200,000 ÷ 100,000

Debt-to-equity ratio = 2

This ratio can also be expressed as a percentage[6]. In the example above, the 2 D/E ratio also equals 200%. This shows that the company borrows twice as much debt for every unit of equity its shareholders own.

In other words, a D/E ratio of 2 means that the company is using debt to finance two-thirds of its expansion and the rest using equity.

Long-Term Debts and the D/E Formula

The D/E ratio calculation usually counts long-term debt[7], defined as debt with a maturity of over one year. It includes long-term leases, mortgages, and other long-term loans.

For example, Company A has a debt of $100,000, with $20,000 due this year. The $20,000 is taken as a current liability, and the remaining $80,000 is considered long-term debt or long-term liability. Therefore, the $80,000 is the numerator in the equation.

Calculating D/E may also exclude the liabilities unrelated to a company’s financing activities. Some examples are tax liabilities, trade payables, and accrued liabilities. These usually do not make a significant impact on the entity’s risk profile[8].

D/E Ratio in Real Estate

Homeowners who have taken out a mortgage may also use the D/E ratio to determine if they can leverage their equity[9], such as for refinancing or taking out a loan against it (e.g., a HELOC).

To calculate a homeowner’s D/E ratio, they must first establish their equity by subtracting their mortgage balance from its total value. Then, they can divide this equity by the mortgage balance to get the D/E ratio.

For example, a home valued at $300,000 with a mortgage balance of $100,000 results in a homeowners’ equity of $200,000. Divide the balance of 100,000 with the equity of 200,000, and it will yield a D/E ratio of 0.5.

In plain English, the homeowner owes only half a dollar for every $1 of equity they have built on the property. It suggests that the homeowner has already built significant home equity, making them unlikely to default on the mortgage.

As a result, lenders will be more confident in extending loan products to this homeowner. In turn, the homeowner can use this to negotiate better terms (such as a refinance) or take out a new loan for home improvements.

BY THE NUMBERS: The ideal timeframe for a home’s value to increase enough to make its sale profitable is 4 to 5 years.

Source: All Business

Takeaways

- Debt-to-equity ratio measures how much a company uses debt in relation to its shareholders’ equity to run its operations or expand.

- This metric is valuable for lenders and investors as it hints at the organization’s health.

- A high D/E ratio means that the organization is using more debt, which can be risky. On the other hand, a low D/E ratio means that the company is stagnating or it is not using all possible avenues for growth.

- Homeowners may also use the D/E ratio to see if they can leverage their property’s equity, such as for a loan or a refinance.

Sources

- Debt-to-Equity Ratio: Definition and How to Calculate It. (2022, June 20). Indeed. Retrieved from https://www.indeed.com/career-advice/career-development/debt-to-equity-ratio

- Gallo, A. (2015, July 30). A Refresher on Debt-to-Equity Ratio. Harvard Business Review. Retrieved from https://hbr.org/2015/07/a-refresher-on-debt-to-equity-ratio

- Why the Debt-to-Equity Ratio Matters in Capital Structure. (2022, July 29). Online Masters of Business Administration. Ohio University. Retrieved from https://onlinemasters.ohio.edu/blog/why-the-debt-to-equity-ratio-matters-in-capital-structure/

- Sherman, F. (n.d.) What Are the Disadvantages of a High Debt-to-Equity Ratio? Chron. Retrieved from https://smallbusiness.chron.com/business-risk-affect-decisions-capital-structure-45278.html

- Tyre, D. (2018, October). Debt to Equity Ratio Demystified. HubSpot. Retrieved from https://blog.hubspot.com/sales/debt-equity-ratio

- Debt-to-Equity Ratio. (n.d.) Business encyclopedia. Shopify. Retrieved from https://www.shopify.com.ph/encyclopedia/debt-to-equity-ratio

- Carlson R. (2020, January 26). Debt-to-Equity Ratio: Calculation and Measurement. The Balance. Retrieved from https://www.thebalancesmb.com/what-is-the-debt-to-equity-ratio-393194

- Ali, A. (n.d.) Debt-to-Equity Ratio. Accounting Simplified. Retrieved from https://accounting-simplified.com/financial/ratio-analysis/debt-to-equity/

- Di Jensen, E. (n.d.) Debt to Equity Ratio in Real Estate. SFGATE. Retrieved from https://homeguides.sfgate.com/debt-equity-ratio-real-estate-71462.html