What Is Escrow?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

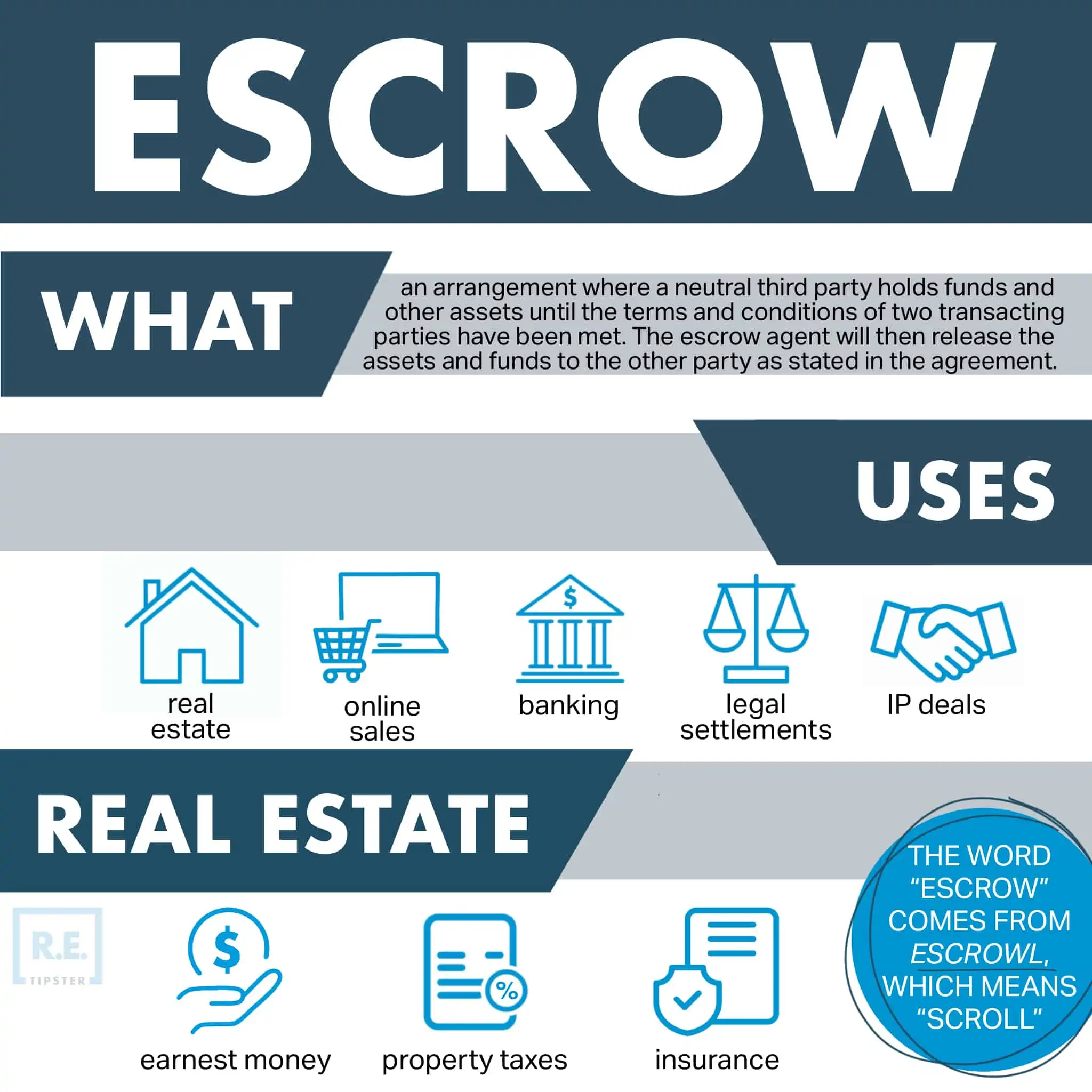

How Does an Escrow Work?

In general, an escrow company is used when there is a degree of uncertainty in a transaction. In international e-commerce, for example, the buyer needs a guarantee that the goods they have purchased from the seller, who is in another country, will arrive as ordered. Similarly, the seller requires a guarantee that they will receive payment when the buyer gets the goods. In this case, a buyer may place the funds in escrow, instructing a neutral third party (the escrow company) to release the funds to the seller when they have received what they purchased.

Many transactions across different practices involve escrow arrangements, including real estate.

For example, many real estate lenders will set up an escrow account to assist their borrowers in paying their annual property insurance and property taxes. In doing this, the borrower will make one monthly payment to their lender, and a portion of this monthly payment will be set aside in an escrow account until it is time to pay these related expenses that only come up once each year when the escrow company will pay these bills directly.

Escrow companies are also commonly used when buying and selling real estate. When a buyer puts down an earnest money deposit, an escrow company can hold this money and provide evidence to the seller that the money has been committed by the buyer in accordance with the terms of the purchase agreement.

The same escrow company will typically stay involved until the transaction closes, at which point, they will be the neutral third party that facilitates the transfer of funds between the buyer, seller, and lender (if a lender is involved).

What Can Be Placed in Escrow?

An escrow is often used as a neutral “safe space” for money, but anything deemed valuable can be placed in escrow. Some of the more common assets are listed below, but this list is by no means exhaustive.

- Property (personal or real)

- Securities

- Checks

- Written instruments

- Promissory notes

- Deeds

- Bonds

- Licenses

- Mortgages

- Patents

What Makes an Escrow Valid?

For an escrow to be considered valid, it has to contain two essential elements. The first is the escrow instructions (also called escrow agreement), a binding contract between two principals in the transaction (the buyer and the seller). The second is an escrow agent.

The escrow agreement authorizes a third party’s involvement in the transaction. It more specifically lays out the terms and conditions of the disbursement of the assets in the escrow, each principal’s responsibility, and what can constitute a breach in escrow. Escrow instructions determine the scope and limitation of the escrow’s involvement in the transaction, as well as the duties, obligations, and funds that will be entrusted to an escrow.

An escrow agent is a third party that arranges the escrow. In a real estate transaction, an escrow agent can also be referred to as a “title agent[2],” as they are responsible for holding money, legal documents (such as the deed), and other instructions from both parties (the buyer and seller) as long as they are mutually consistent.

An agent’s role in an escrow is similar to a trustee, and they are required to follow escrow instructions, including the delivery of the assets held in escrow once conditions have been cleared[3]. An escrow agent must record all executed escrow instructions, note all transactions, and forward the necessary documents and reports to both parties.

Most of the time, other parties will choose the escrow agent, although some buyers can choose their own if they wish to. Note that an agent, representative, or attorney of the buyer or the seller naturally cannot be an escrow agent because of conflict of interest.

RELATED: The State-By-State Guide to Real Estate Closing Agents

How Is Escrow Used in Real Estate?

An escrow is ideal for complex, high-stakes transactions, especially those behind a huge volume of terms and conditions. While the general principle behind escrow remains the same across many industries, different businesses may use it in subtly different ways, including real estate.

How the Real Estate Escrow Process Works

When a buyer wants to purchase a house, they will usually put forward an earnest money deposit, which varies from 1% to 5% of the purchase price[4]. The seller may reject or accept the offer; if accepted, the money will be put in escrow, which will be used toward the down payment and closing costs.

A real estate escrow protects both the buyer and seller. If the buyer backs out of the transaction for any reason not indicated in the purchase agreement, the earnest money goes to the seller; if the seller backs out or if the buyer finds something wrong during the walk-through, the money in earnest money goes back to the buyer.

In cases where the transaction continues through the closing process, a buyer and/or their lender will eventually deposit the purchase proceeds into escrow, with instructions for the escrow agent to disburse the funds only when both parties’ conditions have been met. Meanwhile, the seller will sign the deed for their property transferring it to the buyer, and the deed is held in escrow until the seller’s requirements are satisfied, such as when the buyer deposits the purchase proceeds and the seller receives the payment. When each party has fulfilled their obligations, the deed is transferred to the buyer and the sale proceeds are transferred to the seller.

Another type of escrow account can be used by a lender to collect mortgage payments after a deal is closed. Not all lenders require this, but when they do, they will collect an additional amount each month in excess of the mortgage principal and interest. This additional amount is held in escrow to pay for the homeowner’s upcoming insurance and property taxes, which are typically billed once or twice each year. With this type of escrow account in place, the owner does not need to worry about paying these additional annual costs directly, because the escrow account should have collected enough money to pay for these expenses from the escrow account.

Takeaways

An escrow is an arrangement where a third party, neutral to the principals in a transaction, temporarily holds assets, funds, or other legal documents. When the terms and conditions of the escrow have been met, the escrow agent in charge of the escrow can disburse the assets according to the instructions both principals have agreed to.

Many kinds of assets can be placed in escrow, such as stock, securities, property, deeds, and most commonly, money. Many industries use escrow, especially in high-stakes transactions, and while the general concept of escrow remains the same across these sectors, they use escrow with a distinct difference. In real estate transactions, it can be used to hold the purchase price of a property until the buyer meets a seller’s requirements, and it can also be used by a lender to reserve payments for insurance and taxes.

Sources

- Nowacki, L. (2020.) Escrow: What Is It, And How Does It Work? Rocket Mortgage. Retrieved from https://www.rocketmortgage.com/learn/what-is-escrow

- Chen, J. (2020.) Escrow Agent. Investopedia. Retrieved from https://www.investopedia.com/terms/e/escrow_agent.asp

- Stimmel, Stimmel, & Roeser. (n.d.) The Basics of the Law and Practice of Escrow. Retrieved from https://www.stimmel-law.com/en/articles/basics-law-and-practice-escrow

- Ramsey, D. (2021.) What Is Earnest Money? Ramsey Solutions. Retrieved from https://www.daveramsey.com/blog/what-is-earnest-money