What Is a Letter of Intent (LOI)?

REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

How Does a Letter of Intent Work?

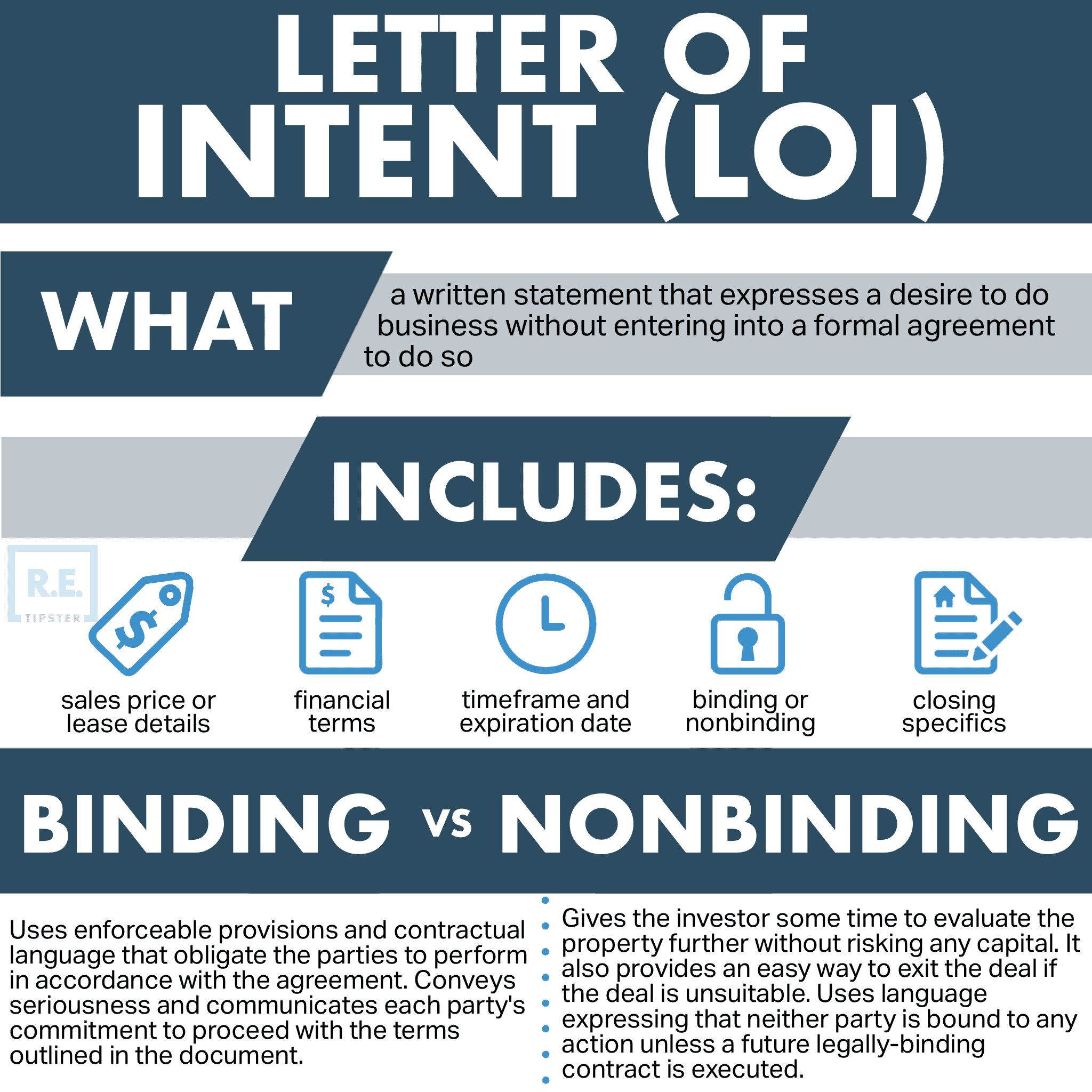

A letter of intent, or LOI, is a document used to indicate a preliminary commitment between two parties to do business. The LOI is typically used as an instrument to open negotiations for a future agreement.

A letter of intent can be binding or non-binding. If the two parties agree to make the letter legally binding, it should include language that clearly spells that out. Without specific language that the LOI is lawfully binding, it is almost impossible to enforce in court if it becomes necessary.

When Is a Letter of Intent Used?

There are many different situations where real estate investors and businesses use a letter of intent. For example, in a business deal, Company A’s legal department can draft an LOI detailing a broad outline of an agreement for review by the legal department of Company B. This way, letters of intent are often used in the early stages of forming a joint venture.

In real estate, LOIs are common in commercial real estate deals. The purpose of the LOI is to alert the property owner that there is interest in buying or leasing the property. It serves as a formal first step in the negotiation process[1].

How to Use a Letter of Intent

Although the process may vary depending on market customs, the steps in a letter of intent negotiation generally look like this:

- The potential investor/buyer evaluates the property. This usually includes a thorough walk-through to test the heating, plumbing, and other fixtures to determine whether the property will meet the investor’s needs.

- The investor/buyer writes a letter of intent. If the property is satisfactory, the buyer drafts a letter of intent listing the desired price, terms, and closing date. In most cases, the two parties will enter a period of negotiation before an agreement is reached.

- The parties enter a binding contract. At this stage, a lease or purchase agreement is signed. Legal counsel, if not involved in the LOI stage, is usually brought in at this point to draft and/or review the contracts.

RELATED: Single, Double, and Triple Net Leases – What’s the Difference?

If the agreement involves purchasing the property as opposed to leasing, the next step is usually the inspection period. The agreement should spell out the inspection timeframe and include an out-clause if the property does not meet the buyer’s standards.

If everything appears in order, the parties will close the deal, and the seller transfers ownership.

What Is Included in a Letter of Intent?

The letter should cover the basics—buyer’s name or DBA, property address, type of property, and type of transactions (either buy or lease)—and then address the following specifics[2]:

- Sales price or proposed lease details.

- Financial terms, including payment method and whether or not the deal is contingent on financing.

- A timeframe for approval and expiration date if both parties did not agree on the terms.

- Whether the LOI is binding or nonbinding.

- Purchase or lease conditions, including inspections and disclosure reports.

- Closing specifics, including proposed closing date, closing costs, and date of possession.

Is a Letter of Intent Binding or Non-Binding?

There are obvious legal implications that come into play if an LOI is binding. A binding letter of intent will obligate the parties to pursue the agreement as outlined in the document[3].

If a company or individual wants their letter of intent to be non-binding, they should include language indicating that the terms in the document are non-committal and non-binding in nature. The wording included in (or excluded from) a letter of intent plays a pivotal role in the interpretation of the document.

If an investor wants to get a property off the market but does not want to offer up earnest money, a binding letter of intent compels the owner to break off all other potential negotiations on the property until either the letter’s expiration date or a purchase agreement or lease is signed. A binding letter of intent will often include contract words like, “offer,” “accept,” “agree,” “commit,” whereas a non-binding letter of intent will use words like, “presently intends,” “expects” or “may”[4].

A non-binding LOI will use terms that assert that the parties are not legally bound to any action unless a future legally-binding contract is executed.

A non-binding LOI gives the investor some time to evaluate the property further and explore funding sources without risking any capital. It also gives the investor an easy way to exit the deal if the property is ultimately unsuitable. Of course, the seller is not obligated to take the property off the market or stop other negotiations that may be in process.

Disadvantages to Using a Letter of Intent

Many commercial real estate transactions begin with a letter of intent. It spells out the primary terms and provides a road map for closing the deal.

The main disadvantage with a nonbinding LOI is that sellers can then shop the deal with other potential buyers to see if they can get a better price or terms. This may happen even if the letter includes language prohibiting the practice.

Finally, if the LOI is not carefully drafted to spell out the specific terms and whether or not the agreement is binding or nonbinding, it could lead to legal disputes and potential litigation.

Takeaways

A letter of intent is a preliminary commitment between two parties to do business together; it’s commonly used in commercial real estate transactions. LOIs are used for both purchase and lease agreements.

LOIs can be binding or nonbinding. While there are advantages to each depending on the situation, only a binding letter of intent can be enforced in court if necessary.

Sources

- Brumer, L. (2020). Letter of Intent in Commercial Real Estate. The Motley Fool. Retrieved from https://www.fool.com/millionacres/real-estate-investing/commercial-real-estate/letter-intent-commercial-real-estate/#

- Ramirez, A. (2018). Q&A: Letters of Intent. AR Legal Team. Retrieved from https://arlegalteam.com/letters-of-intent/

- McNally, S.F. (n.d.) Letters of Intent. CCIM Institute. Retrieved from https://www.ccim.com/cire-magazine/articles/letters-intent/

- Anderson, John A. Is Your Non-Binding Letter of Intent Actually Binding? Harter, Secret & Emery LLP. Retrieved from https://www.hselaw.com/news-and-information/in-the-news/1787-is-your-non-binding-letter-of-intent-actually-binding